Comparing RIOT And COIN: A Stock Performance Comparison

Table of Contents

Investing in cryptocurrency mining stocks like Riot Platforms (RIOT) and Marathon Digital Holdings (COIN) can be a volatile but potentially rewarding venture. This article provides a detailed RIOT vs COIN stock comparison, examining their historical trends, financial health, and future prospects to help investors make informed decisions. We'll delve into key metrics to understand which stock might be a better fit for your portfolio. This in-depth analysis will cover key aspects of both companies to help you understand the nuances of a RIOT vs COIN investment.

H2: Historical Stock Performance Analysis of RIOT and COIN

H3: Analyzing RIOT Stock Performance:

Riot Platforms (RIOT) has experienced significant price fluctuations mirroring the volatility of the Bitcoin market.

- Historical Price Fluctuations: RIOT's stock price has shown strong correlation with Bitcoin's price, exhibiting sharp increases during bull markets and substantial declines during bear markets.

- Key Performance Indicators (KPIs): Tracking metrics like revenue growth, mining hash rate, and Bitcoin production are crucial for assessing RIOT's performance. Analyzing these KPIs over time provides a clearer picture of operational efficiency.

- Significant Events: Major events like regulatory changes, successful mining expansions, and significant Bitcoin price movements directly influence RIOT's stock valuation.

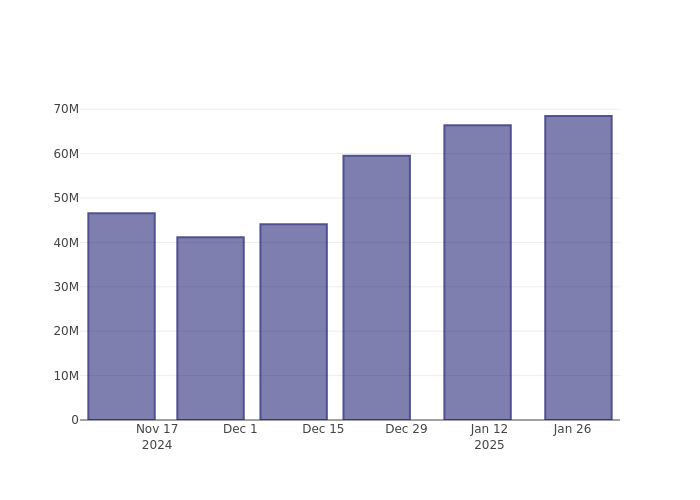

- Chart Visualization: (Insert chart visualizing RIOT's stock performance over 1-year and 5-year periods) This visual representation clearly shows the volatility and growth trajectory of RIOT. Analyzing the chart alongside Bitcoin's price fluctuations reveals a strong correlation.

- Return on Investment (ROI): (Insert ROI calculation if data available) This metric demonstrates the potential return on investment for RIOT stock over various periods.

H3: Analyzing COIN Stock Performance:

Marathon Digital Holdings (COIN) presents a similar investment profile to RIOT, but with distinct characteristics.

- Historical Price Fluctuations: Like RIOT, COIN's stock price is highly sensitive to Bitcoin's price movements. However, the magnitude and timing of price swings may differ.

- Key Performance Indicators (KPIs): Analyzing COIN's KPIs – including mining efficiency, operating costs, and Bitcoin holdings – allows for a direct comparison with RIOT.

- Significant Events: News related to COIN's mining operations, strategic partnerships, and Bitcoin price changes have significantly impacted its stock performance.

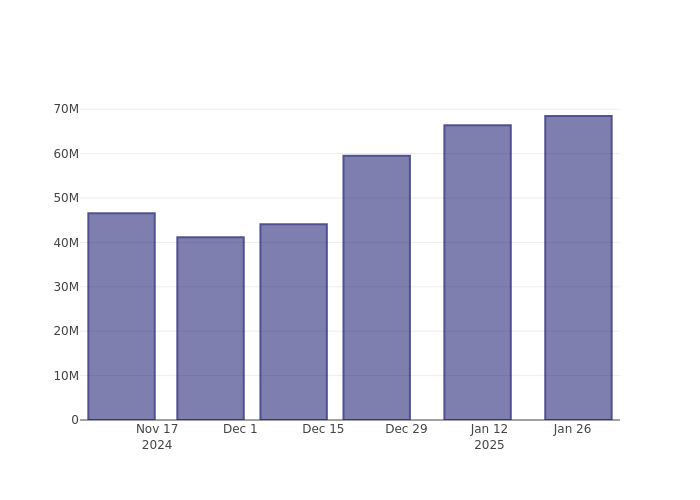

- Chart Visualization: (Insert chart visualizing COIN's stock performance over 1-year and 5-year periods) A comparison of this chart with RIOT's reveals potential similarities and differences in performance patterns.

- Comparative Performance: A direct comparison of RIOT and COIN charts highlights periods of outperformance and underperformance, helping investors identify potential investment opportunities.

H2: Financial Health and Fundamentals Comparison: RIOT vs COIN

H3: Key Financial Metrics for RIOT:

Assessing RIOT's financial health requires careful analysis of several key metrics.

- Revenue: RIOT's revenue is directly tied to Bitcoin mining and its selling strategy. Analyzing revenue growth trends provides insight into operational efficiency and market demand.

- Earnings Per Share (EPS): EPS helps determine the profitability of RIOT on a per-share basis, reflecting the return to shareholders.

- Debt-to-Equity Ratio: This metric highlights RIOT's financial leverage and risk profile. A higher ratio indicates greater reliance on debt.

- Bitcoin Holdings: The amount of Bitcoin held by RIOT influences its overall valuation and potential future income.

- Mining Operations: Analyzing RIOT's mining operations, including hash rate and energy consumption, provides a clearer picture of its production capacity.

H3: Key Financial Metrics for COIN:

A comparable analysis for COIN provides a direct basis for comparison.

- Revenue and EPS: Comparing COIN's revenue and EPS with RIOT's allows for a direct assessment of profitability and growth potential.

- Debt-to-Equity Ratio: A comparison of the debt-to-equity ratios reveals relative financial risk for both companies. For example: "COIN has a lower debt-to-equity ratio compared to RIOT, indicating lower financial risk."

- Bitcoin Holdings & Mining Operations: Similar analysis of COIN's Bitcoin holdings and mining operations allows for a side-by-side comparison of operational efficiency and profitability.

H2: Future Outlook and Growth Potential: RIOT and COIN

H3: RIOT's Future Prospects:

RIOT's future growth depends on several factors.

- Expansion Plans: Any planned expansion of mining operations, technological upgrades, or geographical diversification influence future growth.

- Technological Advancements: Adopting new and efficient mining technologies can improve RIOT's profitability and competitive advantage.

- Regulatory Landscape: Changes in regulatory environments affecting cryptocurrency mining can have a significant impact on RIOT's future.

- Bitcoin Price Projections: The predicted price of Bitcoin strongly influences the future valuation of RIOT.

H3: COIN's Future Prospects:

COIN's growth trajectory also hinges on several factors.

- Strategic Partnerships: Collaborations with other companies in the industry can enhance COIN's competitiveness and expansion opportunities.

- Market Position: COIN's position in the overall cryptocurrency mining market will affect its ability to capture market share and increase profitability.

- Technological Advantages: Any technological edge over competitors can significantly influence COIN's future growth and market share.

- Comparative Growth Potential: A direct comparison of RIOT and COIN's future prospects helps investors determine which company offers greater growth potential.

H2: Risk Assessment: Investing in RIOT and COIN

H3: Risks Associated with RIOT Investment:

Investing in RIOT involves inherent risks.

- Volatility: The cryptocurrency market's inherent volatility significantly impacts RIOT's stock price.

- Regulatory Risks: Changes in regulations concerning cryptocurrency mining can negatively affect RIOT's operations.

- Bitcoin Price Fluctuations: The price of Bitcoin directly influences RIOT's profitability and stock valuation.

- Operational Risks: Risks associated with mining operations, such as equipment failures or energy costs, can negatively impact profitability.

H3: Risks Associated with COIN Investment:

COIN also faces various risks.

- Competition: Intense competition in the cryptocurrency mining sector poses a challenge to COIN's growth.

- Energy Costs: High and fluctuating energy costs can significantly affect COIN's profitability.

- Comparative Risk Profiles: Comparing the risk profiles of RIOT and COIN helps investors assess which investment is more suitable for their risk tolerance.

Conclusion:

This RIOT vs COIN stock comparison offers valuable insights into the strengths and weaknesses of each investment. While both companies operate in the exciting but volatile cryptocurrency mining sector, their financial health, future prospects, and risk profiles differ significantly. By carefully considering the information presented, investors can make a more informed decision about which stock, RIOT or COIN, aligns better with their investment goals and risk tolerance. Remember to conduct thorough due diligence and consult with a financial advisor before making any investment decisions regarding RIOT vs COIN or other cryptocurrency mining stocks. Start your research today by analyzing the provided data and further investigating your chosen stock.

Featured Posts

-

Googles Future At Stake Sundar Pichai On The Dojs Antitrust Plan

May 03, 2025

Googles Future At Stake Sundar Pichai On The Dojs Antitrust Plan

May 03, 2025 -

Official Announcement Grant Assistance For Mauritius

May 03, 2025

Official Announcement Grant Assistance For Mauritius

May 03, 2025 -

L Intimite D Emmanuel Et Brigitte Macron Confidences Apres Des Annees De Mariage

May 03, 2025

L Intimite D Emmanuel Et Brigitte Macron Confidences Apres Des Annees De Mariage

May 03, 2025 -

Poslednie Novosti Kommentariy Zakharovoy O Makronakh

May 03, 2025

Poslednie Novosti Kommentariy Zakharovoy O Makronakh

May 03, 2025 -

Is A Boris Johnson Return The Answer For The Conservatives

May 03, 2025

Is A Boris Johnson Return The Answer For The Conservatives

May 03, 2025