College Funding: Survey Reveals Changing Parental Attitudes And Loan Usage

Table of Contents

Decreased Parental Contributions to College Funding

Shifting Economic Realities

The impact of inflation, economic downturns, and job insecurity on parents' ability to save for college is undeniable. Many families are struggling to keep pace with the ever-increasing cost of living, leaving less money available for college savings.

- Increased cost of living: Housing, groceries, and healthcare costs are rising faster than wages in many areas, leaving less disposable income for saving.

- Stagnant wages: Despite economic growth in some sectors, wage stagnation for many workers means less money is available for long-term savings goals like college funding.

- Unexpected expenses: Unforeseen medical bills, car repairs, or home maintenance can significantly derail college savings plans, forcing families to re-prioritize.

Statistics from the [insert reputable source, e.g., Federal Reserve] show a decline in parental savings rates over the past [number] years, reflecting the challenges families face in saving for college amidst economic uncertainty. The Consumer Price Index (CPI) and other relevant economic indicators further illustrate the impact of inflation on family budgets and college savings capacity.

Changing Parental Expectations

There's a noticeable shift in parental expectations regarding children's contributions to college costs. Parents are increasingly emphasizing personal responsibility and expecting students to contribute through part-time jobs, summer employment, and active pursuit of scholarships.

- Increased emphasis on personal responsibility: Many parents believe that students should actively participate in financing their education, fostering a sense of ownership and accountability.

- Expectation of student employment: Working part-time during the academic year or full-time during summer breaks is becoming more common, as students contribute to their college expenses.

Survey data [cite survey data source] indicates that a growing percentage of parents expect their children to contribute [percentage] of their college expenses, reflecting a move towards shared responsibility models for college funding. Families are increasingly adopting strategies where students take on part-time jobs or secure scholarships to lessen the financial burden on their parents.

Increased Reliance on Student Loans for College Funding

Rising Tuition Costs and Loan Defaults

The soaring cost of tuition is directly correlated with the increased reliance on student loans. Many families find that even with parental contributions and student employment, they still need to borrow to cover the full cost of college. This rising debt is a significant concern, contributing to a growing number of loan defaults.

- Statistics on average student loan debt: The average student loan debt is [insert statistic] , reflecting the significant financial burden on recent graduates.

- Increase in loan defaults: The number of student loan defaults is [insert statistic], indicating the struggle many face in repaying their loans.

- Impact on post-graduation financial planning: High levels of student loan debt can significantly impact post-graduation financial planning, delaying major life milestones like homeownership and starting a family.

Data from the National Center for Education Statistics reveals a consistent upward trend in both tuition costs and student loan borrowing, highlighting the urgent need for alternative college funding strategies.

Understanding Loan Options and Repayment Strategies

Understanding the various types of student loans and effective repayment strategies is crucial. Federal loans offer several advantages, including income-driven repayment plans, but private loans may also be necessary to bridge the funding gap.

- Different types of federal student loans: Subsidized and unsubsidized federal loans, as well as PLUS loans for parents, offer varying terms and interest rates.

- Private loan options: Private student loans can supplement federal aid but often come with higher interest rates and less flexible repayment options.

- Strategies for repayment: Income-driven repayment plans, loan consolidation, and refinancing can help manage student loan debt.

Resources like the Federal Student Aid website ([insert link]) provide valuable information on student loan options and repayment strategies, empowering borrowers to make informed decisions.

The Rise of Alternative College Funding Strategies

Increased Importance of Scholarships and Grants

Securing scholarships and grants is becoming increasingly crucial for mitigating the high cost of college. Competition is fierce, making early planning and strategic application crucial.

- Importance of early planning: Starting the scholarship search early in high school is essential, allowing ample time to prepare applications and meet deadlines.

- Tips for finding and applying for scholarships: Utilize online scholarship databases, explore scholarships specific to academic interests or demographics, and craft compelling application materials.

- Types of grants available: Federal Pell Grants, state grants, and institutional grants provide need-based financial aid to students.

Websites like [insert links to scholarship search websites] offer resources to assist students in their search for scholarships and grants.

Exploring 529 Plans and Other Savings Vehicles

529 plans and other tax-advantaged savings options can significantly contribute to college funding. However, understanding their benefits and drawbacks is essential before investing.

- Advantages of 529 plans: Tax-deferred growth and tax-free withdrawals for qualified education expenses make 529 plans a powerful savings tool.

- Other savings vehicles: Education savings accounts (ESAs), Coverdell Education Savings Accounts, and traditional savings accounts can also be part of a comprehensive college savings strategy.

- Tax implications: Understanding the tax implications of each savings vehicle is crucial for maximizing returns and minimizing tax liabilities.

529 plans offer flexibility and tax advantages, allowing families to save for college more efficiently. Consider consulting a financial advisor to determine the best approach for your specific circumstances.

Conclusion

The survey results paint a clear picture: the landscape of college funding is undergoing a significant transformation. Parents are facing increasing financial pressures, leading to reduced contributions and a greater reliance on student loans. However, alternative strategies, such as aggressively pursuing scholarships and grants and utilizing savings vehicles like 529 plans, are becoming increasingly crucial for navigating the high cost of higher education. Understanding these shifting trends and proactively exploring diverse college funding options is essential for families planning for future educational expenses. Take control of your college funding strategy today – explore the available resources and start planning for a financially secure future for your child.

Featured Posts

-

Tenis Yildizi Novak Djokovic 186 Milyon Dolarlik Gelirin Sirri

May 17, 2025

Tenis Yildizi Novak Djokovic 186 Milyon Dolarlik Gelirin Sirri

May 17, 2025 -

Yankees Vs Mariners Game Tonight Prediction Picks And Odds

May 17, 2025

Yankees Vs Mariners Game Tonight Prediction Picks And Odds

May 17, 2025 -

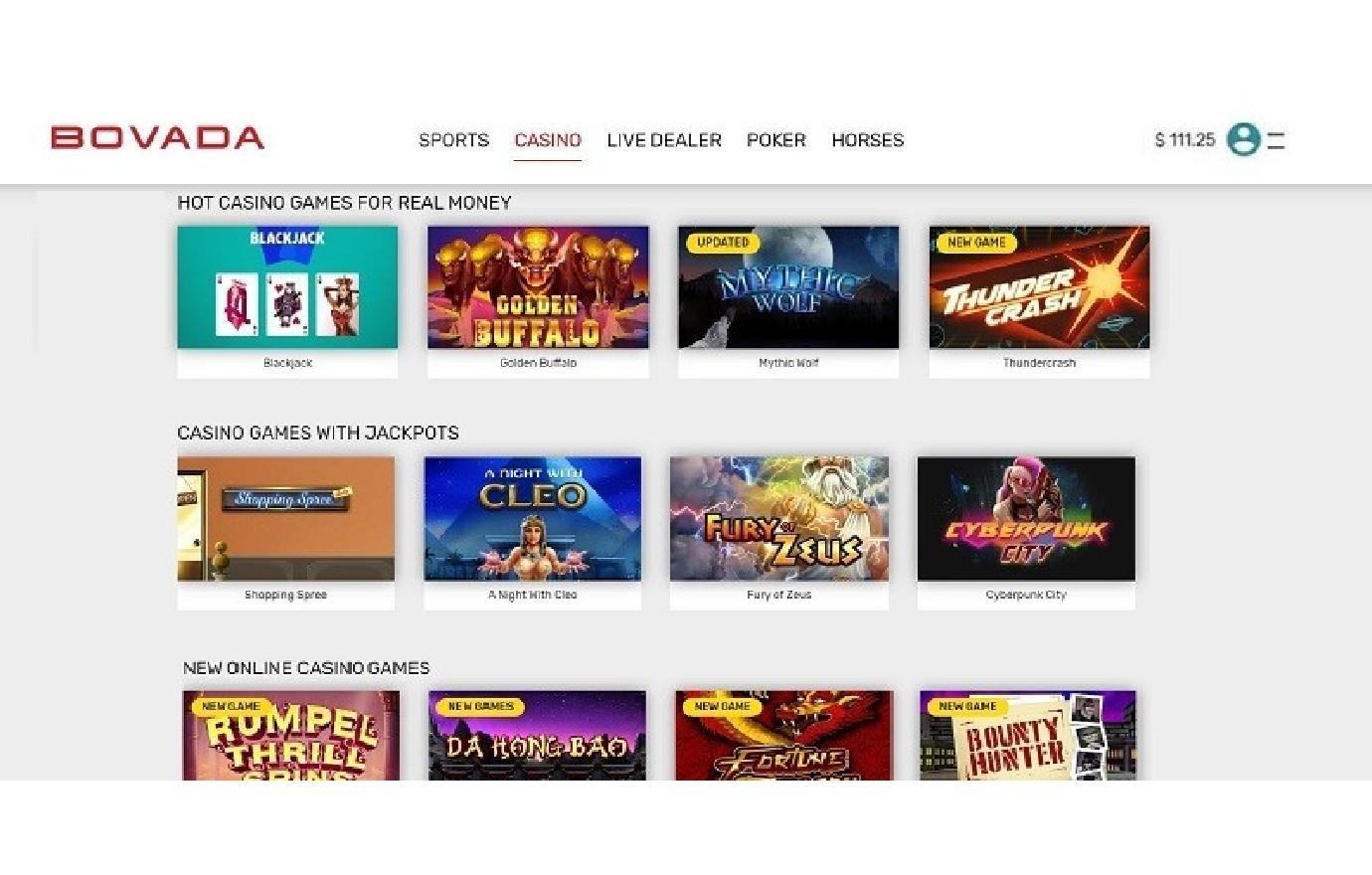

Choosing The Right Bitcoin And Crypto Casino In 2025

May 17, 2025

Choosing The Right Bitcoin And Crypto Casino In 2025

May 17, 2025 -

A Look At The Chances Of A Severance Season 3

May 17, 2025

A Look At The Chances Of A Severance Season 3

May 17, 2025 -

Alkuvuoden Tappiot Elaekeyhtioeiden Osakesijoituksissa

May 17, 2025

Alkuvuoden Tappiot Elaekeyhtioeiden Osakesijoituksissa

May 17, 2025

Latest Posts

-

Donald Trump Family Grows Tiffany And Michaels Son Alexander

May 17, 2025

Donald Trump Family Grows Tiffany And Michaels Son Alexander

May 17, 2025 -

Povredeni Alkaras Gubi Finale Barselone Protiv Runea

May 17, 2025

Povredeni Alkaras Gubi Finale Barselone Protiv Runea

May 17, 2025 -

Analiza Meca Rune Alkaras Finale Barselone

May 17, 2025

Analiza Meca Rune Alkaras Finale Barselone

May 17, 2025 -

Rune Osvaja Barselonu Alkarasova Povreda U Prvom Planu

May 17, 2025

Rune Osvaja Barselonu Alkarasova Povreda U Prvom Planu

May 17, 2025 -

Barselona Finale Rune Trijumfuje Nad Povredenim Alkarasom

May 17, 2025

Barselona Finale Rune Trijumfuje Nad Povredenim Alkarasom

May 17, 2025