Colgate Shares Fall As $200 Million Tariff Impact Hits Bottom Line

Table of Contents

The $200 Million Tariff Blow: A Detailed Breakdown

Colgate's recent financial woes stem directly from a confluence of tariffs imposed on both imported raw materials and finished goods. These increased costs significantly impacted the company's bottom line, resulting in a substantial reduction in profitability. The tariffs primarily affected Colgate's operations in several key regions.

- Specific examples of products affected by tariffs: Many Colgate products, including its flagship toothpastes, toothbrushes, and oral care products, were impacted. Certain specialized dental care items experienced particularly sharp price increases due to reliance on imported components.

- Percentage increase in costs due to tariffs: While the exact percentage increase varies depending on the specific product and its manufacturing process, estimates suggest a double-digit percentage increase in the cost of some key raw materials and finished goods. This directly translates to higher production costs.

- Geographic regions most impacted: The impact of tariffs wasn't evenly spread. Regions with a heavy reliance on imported components or those facing higher tariff rates experienced the most significant financial strain. This includes several key markets in Asia and Europe.

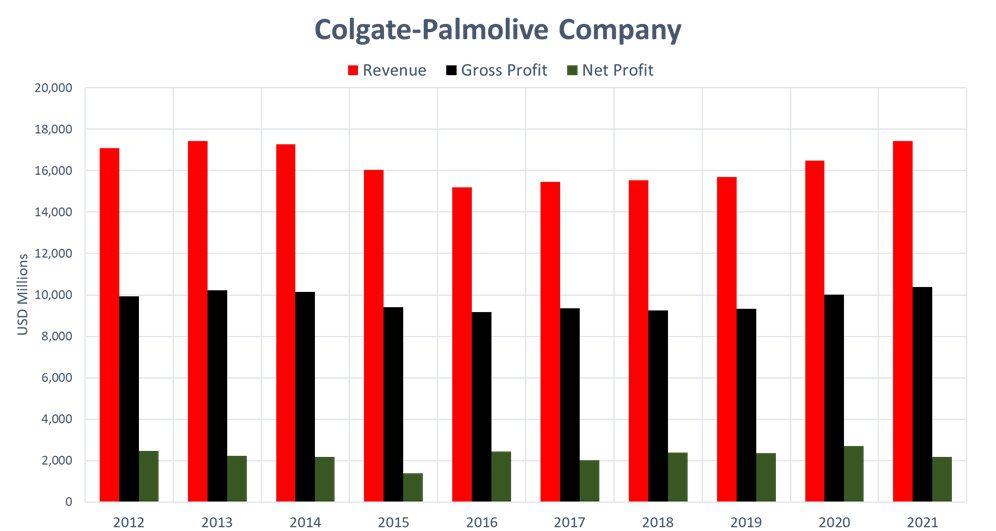

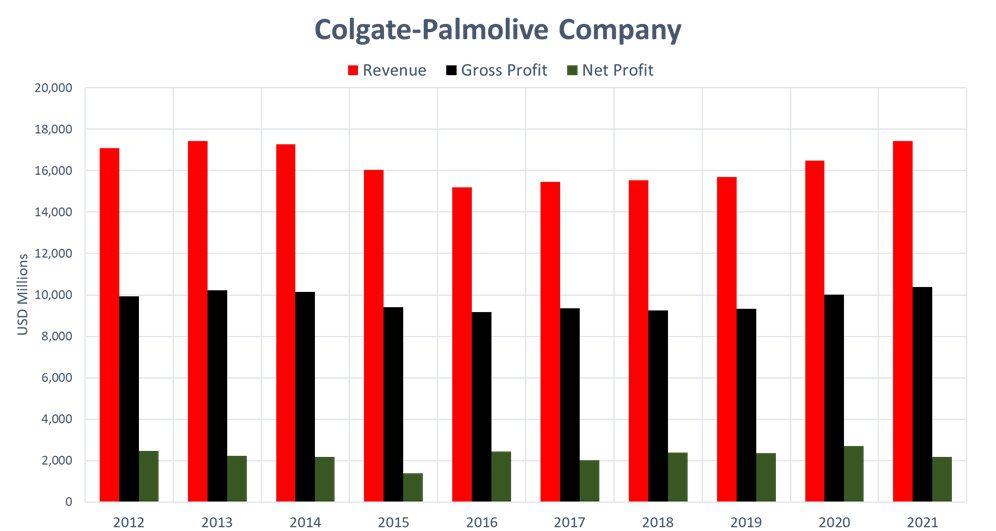

Impact on Colgate's Financial Performance and Stock Price

The $200 million loss attributed to tariffs significantly impacted Colgate's financial performance. This substantial hit resulted in reduced profit margins and a decline in earnings per share (EPS). The market reacted swiftly and negatively to this news.

- Comparison of Q[Quarter] earnings with previous quarters: A direct comparison between the impacted quarter and previous quarters reveals a steep decline in profitability, clearly illustrating the devastating effect of the tariffs. The numbers speak volumes.

- Analyst predictions and ratings post-announcement: Following the announcement, several financial analysts downgraded their predictions for Colgate's future performance, reflecting concerns about the long-term impact of trade tensions. Investor sentiment shifted considerably.

- Impact on Colgate's market capitalization: The drop in Colgate's share price directly translated into a significant reduction in its market capitalization, highlighting investor apprehension about the company's ability to navigate future trade uncertainties.

Colgate's Response and Mitigation Strategies

Facing this significant challenge, Colgate has initiated several strategic responses to mitigate the negative impact of tariffs. These efforts range from short-term adjustments to long-term strategic shifts in its supply chain and pricing.

- Specific examples of price adjustments: Colgate implemented selective price increases for certain products to offset the added costs from tariffs. This strategy aims to maintain profit margins but also carries risks regarding consumer demand elasticity.

- Exploration of alternative sourcing options: The company is actively exploring alternative sourcing options for raw materials, potentially shifting production to regions with more favorable trade policies or less reliance on imported components. This is a complex and time-consuming process.

- Planned investments in automation or efficiency improvements: Colgate is investing in automation and efficiency improvements to reduce operational costs and increase productivity. This is a longer-term strategy that aims to create more resilient supply chains.

Long-Term Implications for Colgate and the Consumer Goods Sector

The situation faced by Colgate underscores the vulnerability of companies heavily reliant on global supply chains within the consumer goods sector. The potential for future tariff increases or escalating trade wars poses a significant long-term risk to many companies.

- Examples of other companies facing similar challenges: Several other consumer goods companies, particularly those with global manufacturing and distribution networks, are facing similar challenges from tariffs and trade disputes.

- Predictions for future consumer goods pricing: The increased costs faced by companies like Colgate are likely to lead to further price increases for consumer goods, potentially impacting consumer purchasing power.

- Potential impact on consumer purchasing power: The combination of higher prices and potentially decreased disposable income due to economic uncertainty could lead to a shift in consumer behavior.

Conclusion

Colgate's $200 million loss due to tariffs highlights the significant risks associated with global trade uncertainties. The impact on their financial performance and stock price underscores the need for robust strategies to mitigate these risks. While Colgate is taking steps to adapt, the long-term implications for the company and the wider consumer goods sector remain a concern. Stay informed about the evolving landscape of global trade and its impact on major consumer goods companies like Colgate. Continue to follow our coverage for the latest updates on Colgate's response to tariffs and their effect on the Colgate shares price. Understanding the Colgate shares market and the impact of tariffs is crucial for informed investment decisions.

Featured Posts

-

Wildfires And Wagers Examining The La Fire Betting Phenomenon

Apr 26, 2025

Wildfires And Wagers Examining The La Fire Betting Phenomenon

Apr 26, 2025 -

A Conservative View How Harvard Can Reform Itself

Apr 26, 2025

A Conservative View How Harvard Can Reform Itself

Apr 26, 2025 -

Ukraines Nato Future Weighing Trumps Influence

Apr 26, 2025

Ukraines Nato Future Weighing Trumps Influence

Apr 26, 2025 -

Bmw Porsche And The Shifting Sands Of The Chinese Automotive Market

Apr 26, 2025

Bmw Porsche And The Shifting Sands Of The Chinese Automotive Market

Apr 26, 2025 -

A Strategic Military Base The Epicenter Of Us China Influence

Apr 26, 2025

A Strategic Military Base The Epicenter Of Us China Influence

Apr 26, 2025

Latest Posts

-

Juliette Binoche Cannes Film Festival Jury President 2025

Apr 27, 2025

Juliette Binoche Cannes Film Festival Jury President 2025

Apr 27, 2025 -

Binoche To Head Cannes Film Festival Jury

Apr 27, 2025

Binoche To Head Cannes Film Festival Jury

Apr 27, 2025 -

Juliette Binoche Appointed President Of The Cannes Jury

Apr 27, 2025

Juliette Binoche Appointed President Of The Cannes Jury

Apr 27, 2025 -

Juliette Binoche To Lead Cannes Film Festival Jury

Apr 27, 2025

Juliette Binoche To Lead Cannes Film Festival Jury

Apr 27, 2025 -

The Perfect Couple Season 2 A Look At The New Cast And Its Source Material

Apr 27, 2025

The Perfect Couple Season 2 A Look At The New Cast And Its Source Material

Apr 27, 2025