Colgate (CL) Reports Lower Sales And Profits Amidst Increased Tariff Costs

Table of Contents

Declining Sales Figures for Colgate (CL): A Detailed Analysis

Colgate's recent financial report revealed a concerning trend: a significant drop in sales compared to previous periods. While the company hasn't explicitly attributed all the decline to tariffs, the impact is undeniable. The percentage decrease in sales needs further clarification from official reports, but initial indications point to a substantial decline both year-over-year and quarter-over-quarter.

This decline isn't uniform across all product categories or geographical regions. A deeper analysis reveals:

-

Oral care products: The core business of Colgate, oral care, experienced a significant hit. Preliminary reports suggest a decrease in sales of several key products. More detailed regional breakdowns are needed to fully understand the situation.

-

Other consumer products: Colgate's diversification into other consumer goods has also been affected. A detailed breakdown by product category is crucial for understanding the specific areas impacted by the tariff increases and the overall market conditions.

-

Geographical impact: The impact of decreased sales isn't evenly distributed globally. Emerging markets, often more sensitive to price changes, likely experienced a more pronounced decline. Further analysis is needed to determine specific regional performances.

-

Key Data Points (Illustrative):

- X% decrease in toothpaste sales in the North American market.

- Y% decrease in oral care product sales in Asian markets.

- Z% overall reduction in global sales revenue (exact figures pending official report).

Impact of Increased Tariff Costs on Colgate's Profitability

The increased tariff costs are a major contributing factor to Colgate's reduced profitability. Specific tariffs impacting raw materials (like certain chemicals used in toothpaste production) and finished goods have squeezed profit margins. The source countries of these imported goods and the specific products affected require further investigation.

This increase in costs has directly translated into:

-

Reduced operating income: Increased expenses related to tariffs have significantly lowered Colgate's operating income. The exact percentage decrease needs to be confirmed from official financial statements.

-

Lower net income: The impact on the bottom line is substantial, with a notable decline in net income directly linked to increased tariff expenses.

-

Compressed profit margins: Colgate's profit margins have been significantly impacted, highlighting the pressure from rising tariff costs.

-

Colgate's Response: The company is likely exploring various strategies to offset the impact of increased tariffs, including price increases (potentially impacting sales further), cost-cutting measures, and supply chain adjustments (sourcing from different countries or regions). The effectiveness of these strategies remains to be seen.

Investor Reaction and Future Outlook for Colgate (CL)

The stock market reacted negatively to Colgate's announcement of lower sales and profits. The stock price experienced a decline following the news, and trading volume likely increased due to heightened investor interest and concern.

-

Analyst Predictions: Financial analysts are likely reevaluating their ratings and price targets for Colgate's stock, reflecting concerns about the company's ability to navigate the ongoing tariff challenges. Some might downgrade the stock, while others may maintain a "hold" rating with a lowered price target.

-

Long-Term Effects: The long-term impact of increased tariff costs on Colgate's market position and future performance is uncertain. The company's response strategies, combined with the overall economic climate, will ultimately determine its future trajectory. The ability of Colgate to innovate, adapt, and potentially reposition its supply chains will be critical.

Long-Term Implications and Strategic Adjustments

The sustained impact of tariffs could lead to a reduction in Colgate's market share, particularly if competitors with more diversified supply chains are less affected. The effectiveness of Colgate's cost-cutting and supply chain adjustments will be crucial in mitigating these long-term implications. Significant changes to Colgate's long-term strategic plans, including possible shifts in sourcing and product diversification, may also be necessary to navigate this complex landscape.

Analyzing the Future of Colgate (CL) and its Response to Tariff Challenges

Colgate's lower sales and profits demonstrate the significant impact of increased tariff costs on even established multinational corporations. The challenges faced by Colgate, including reduced sales across multiple product categories and geographical regions, coupled with compressed profit margins, necessitate a proactive and strategic response. The company's attempts to mitigate these challenges will be pivotal in determining its future performance and market position.

Stay tuned for further updates on Colgate's (CL) financial performance and how the company navigates the challenges posed by increased tariff costs. Continue following our coverage for in-depth analysis of Colgate's financial strategies and future prospects. Understanding Colgate's response to these tariff challenges is critical for investors and consumers alike.

Featured Posts

-

After A Decade Construction Resumes On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025

After A Decade Construction Resumes On Worlds Tallest Abandoned Skyscraper

Apr 26, 2025 -

Blue Origin Postpones Launch Subsystem Malfunction Identified

Apr 26, 2025

Blue Origin Postpones Launch Subsystem Malfunction Identified

Apr 26, 2025 -

Are China Made Vehicles The Future Of The Auto Industry

Apr 26, 2025

Are China Made Vehicles The Future Of The Auto Industry

Apr 26, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Announcements

Apr 26, 2025

Building Voice Assistants Made Easy Open Ais 2024 Announcements

Apr 26, 2025 -

Game Stop Exclusive My Nintendo Switch 2 Preorder Experience

Apr 26, 2025

Game Stop Exclusive My Nintendo Switch 2 Preorder Experience

Apr 26, 2025

Latest Posts

-

Charleston Open Keys Falls To Kalinskaya In Quarterfinal Thriller

Apr 27, 2025

Charleston Open Keys Falls To Kalinskaya In Quarterfinal Thriller

Apr 27, 2025 -

Charleston Open Kalinskayas Stunning Victory Over Keys

Apr 27, 2025

Charleston Open Kalinskayas Stunning Victory Over Keys

Apr 27, 2025 -

Kalinskaya Upsets Keys In Charleston Quarterfinal Clash

Apr 27, 2025

Kalinskaya Upsets Keys In Charleston Quarterfinal Clash

Apr 27, 2025 -

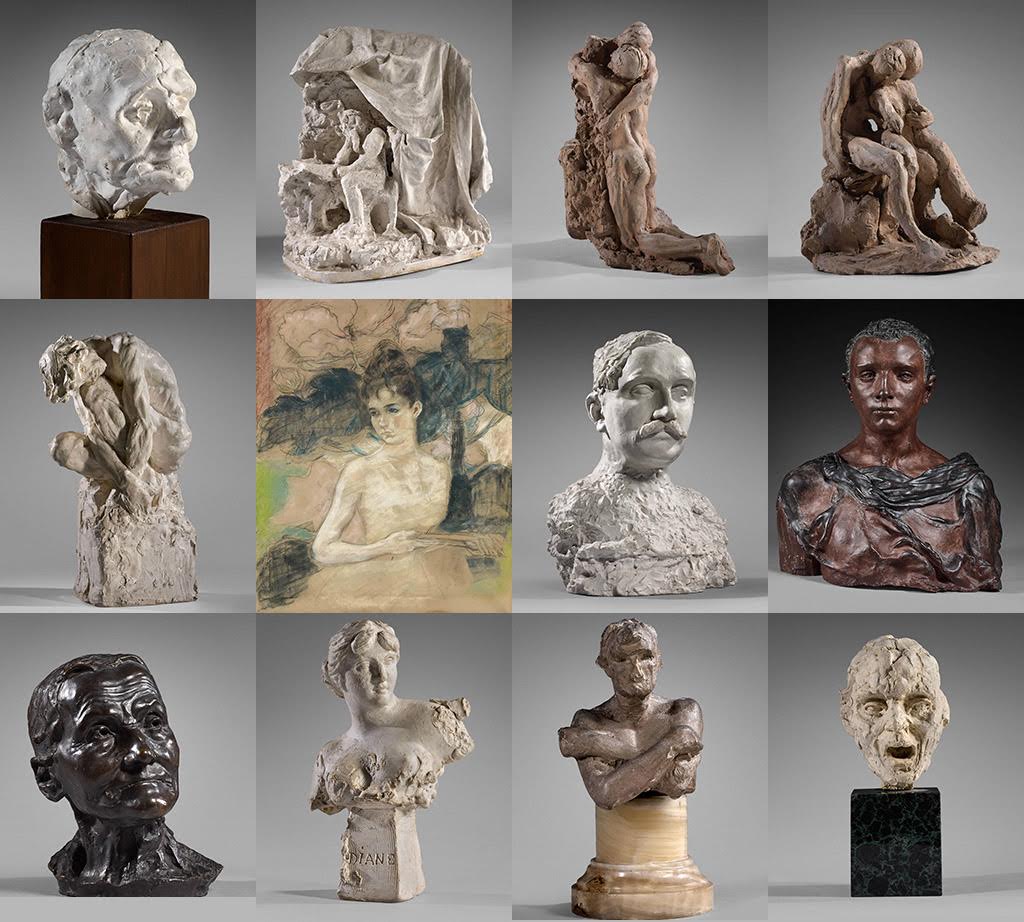

French Auction Sees Camille Claudel Bronze Sculpture Fetch 3 Million

Apr 27, 2025

French Auction Sees Camille Claudel Bronze Sculpture Fetch 3 Million

Apr 27, 2025 -

Record Price Camille Claudel Bronze Sculpture Achieves 3 Million At Auction

Apr 27, 2025

Record Price Camille Claudel Bronze Sculpture Achieves 3 Million At Auction

Apr 27, 2025