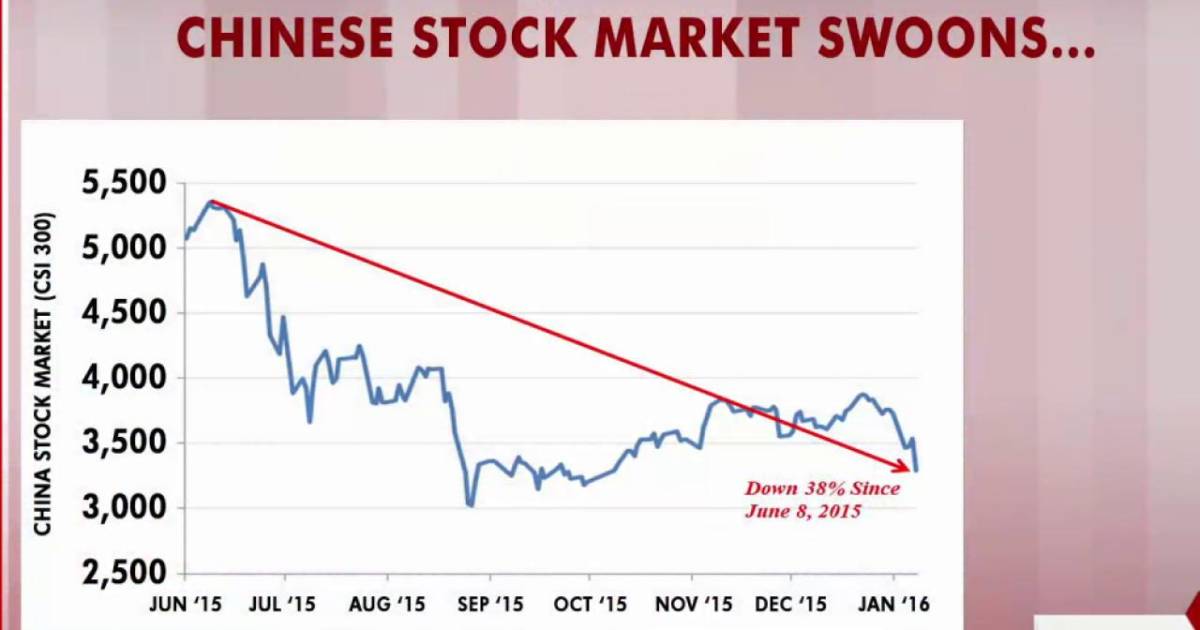

Chinese Stock Market Shows Growth Following Pause: Examining US Relations And Economic Indicators

Table of Contents

Improved US-China Relations: A Catalyst for Growth?

Easing trade tensions between the US and China have played a crucial role in bolstering investor confidence and contributing to the Chinese stock market growth. The renewed dialogue and efforts towards de-escalation have significantly reduced market uncertainty.

H3: Easing Trade Tensions:

- Reduced Tariffs: The partial rollback of tariffs on certain goods has eased the burden on Chinese businesses and improved their profit margins.

- Renewed Dialogue: High-level discussions and diplomatic efforts aimed at resolving trade disputes have fostered a more predictable and stable business environment.

- Potential Trade Agreements: The possibility of future trade agreements further enhances investor confidence, signaling a commitment to long-term cooperation.

Decreased uncertainty directly boosts foreign direct investment (FDI) into China. Multinational corporations are more likely to invest when they perceive a lower risk of trade disruptions. Simultaneously, improved sentiment among domestic investors leads to increased trading activity and higher stock valuations within the Chinese stock market.

H3: Technological Cooperation and its Influence:

The potential for enhanced technological collaboration between the US and China could be another significant driver of growth in the Chinese stock market.

- Semiconductor Collaboration: Potential easing of restrictions on the sale of advanced chip-making technology could significantly boost China's tech sector.

- Renewable Energy Partnerships: Joint ventures in renewable energy technologies could unlock substantial investment and innovation, impacting related stocks.

- Biotechnology Cooperation: Increased collaboration in the field of biotechnology could lead to breakthroughs and market expansion for relevant Chinese companies.

Increased collaboration fosters innovation, leading to the development of new technologies and products. This, in turn, drives economic growth and positively impacts the valuation of companies involved in these sectors within the Chinese stock market.

Positive Economic Indicators Fueling Market Confidence

Robust economic data from China further supports the recent growth in its stock market. Positive trends in several key indicators suggest a healthy and expanding economy, attracting both domestic and international investment.

H3: Robust Economic Data:

- GDP Growth: Sustained growth in China's Gross Domestic Product (GDP) demonstrates the economy's resilience and strength. (Include chart/graph if available showing GDP growth over the past few quarters).

- Industrial Production: Rising industrial production indicates increased manufacturing activity and economic expansion. (Include chart/graph if available).

- Consumer Spending: Strong consumer spending showcases robust domestic demand, a key indicator of a healthy economy. (Include chart/graph if available).

These positive economic indicators collectively signal a stable and growing economy, making the Chinese stock market more attractive to investors seeking strong returns.

H3: Inflation Management and Monetary Policy:

The Chinese government's effective management of inflation and its prudent monetary policies also contribute to investor confidence.

- Interest Rate Adjustments: Careful adjustments to interest rates help maintain price stability and support economic growth.

- Targeted Fiscal Stimulus: Government spending on infrastructure and other key sectors can stimulate economic activity and boost market sentiment.

- Currency Stability: Maintaining a relatively stable exchange rate for the Chinese Yuan (RMB) reduces currency risks for both domestic and foreign investors.

Effective inflation management and sound monetary policies create a stable macroeconomic environment, encouraging both short-term and long-term investment in the Chinese stock market.

Sector-Specific Growth Drivers within the Chinese Stock Market

Beyond the macroeconomic factors, specific sectors within the Chinese stock market are experiencing remarkable growth, further driving the overall market's positive trajectory.

H3: Technology Sector Boom:

China's technology sector is a significant contributor to the overall market growth.

- Artificial Intelligence (AI) Advancements: Significant investments in AI research and development are leading to innovation and market expansion.

- E-commerce Growth: The booming e-commerce sector, with giants like Alibaba and JD.com, continues to drive substantial economic activity.

- Cloud Computing Expansion: The rapid expansion of cloud computing infrastructure offers numerous growth opportunities for related companies.

Government support for technological innovation and increasing consumer demand are key factors driving the remarkable growth of the technology sector within the Chinese stock market.

H3: Renewable Energy and Infrastructure Investments:

Massive government investments in renewable energy and infrastructure projects are creating significant investment opportunities.

- Solar and Wind Energy Projects: Large-scale investments in solar and wind energy are driving growth in related companies.

- Electric Vehicle (EV) Production: Government support for the EV industry is fueling rapid expansion and attracting significant investment.

- High-Speed Rail Expansion: Continued development of China's high-speed rail network creates substantial demand for related materials and services.

These investments generate both short-term and long-term growth opportunities, attracting investors interested in the sustainable development aspects of the Chinese economy and its stock market.

Conclusion

The recent growth in the Chinese stock market is a result of a confluence of factors: improved US-China relations, robust economic indicators, and sector-specific growth drivers. Easing trade tensions, positive economic data, effective government policies, and the expansion of key sectors like technology and renewable energy have all contributed to this positive trend. The Chinese stock market's growth presents compelling investment opportunities. However, careful analysis of ongoing US-China relations and economic indicators remains crucial for informed decision-making. Stay informed on the latest developments in the Chinese stock market and consider exploring the potential benefits of diversified investments in this dynamic market. Further research into specific sectors and companies is advised before making any investment decisions.

Featured Posts

-

Golden State Warriors Target Kevon Looney In Nba Free Agency

May 07, 2025

Golden State Warriors Target Kevon Looney In Nba Free Agency

May 07, 2025 -

John Wicks Most Underrated Character A Long Awaited Return

May 07, 2025

John Wicks Most Underrated Character A Long Awaited Return

May 07, 2025 -

Ed Shiyrn I Riana Neochakvanata Vrzka V Muzikata

May 07, 2025

Ed Shiyrn I Riana Neochakvanata Vrzka V Muzikata

May 07, 2025 -

Lion Electrics Financial Troubles Liquidation A Real Possibility

May 07, 2025

Lion Electrics Financial Troubles Liquidation A Real Possibility

May 07, 2025 -

Incertidumbre Participara Simone Biles En Los Juegos Olimpicos De Los Angeles 2028

May 07, 2025

Incertidumbre Participara Simone Biles En Los Juegos Olimpicos De Los Angeles 2028

May 07, 2025

Latest Posts

-

Celtics Vs Cavaliers A Prediction For Game Game Number

May 07, 2025

Celtics Vs Cavaliers A Prediction For Game Game Number

May 07, 2025 -

Safeguarding Your Brand A Trademark Guide For March Madness

May 07, 2025

Safeguarding Your Brand A Trademark Guide For March Madness

May 07, 2025 -

Mitchells Dominance Cleveland Cavaliers Triumph Over Brooklyn Nets

May 07, 2025

Mitchells Dominance Cleveland Cavaliers Triumph Over Brooklyn Nets

May 07, 2025 -

Cavaliers Defeat Grizzlies Extend Win Streak To Franchise Record 16 Games With Mobleys Help

May 07, 2025

Cavaliers Defeat Grizzlies Extend Win Streak To Franchise Record 16 Games With Mobleys Help

May 07, 2025 -

Can The Celtics Defeat The Cavaliers At Home Prediction And Preview

May 07, 2025

Can The Celtics Defeat The Cavaliers At Home Prediction And Preview

May 07, 2025