Chinese Stock Market Performance: Assessing The Effects Of US Negotiations And Economic Reports

Table of Contents

Impact of US-China Trade Negotiations on Chinese Stock Market Performance

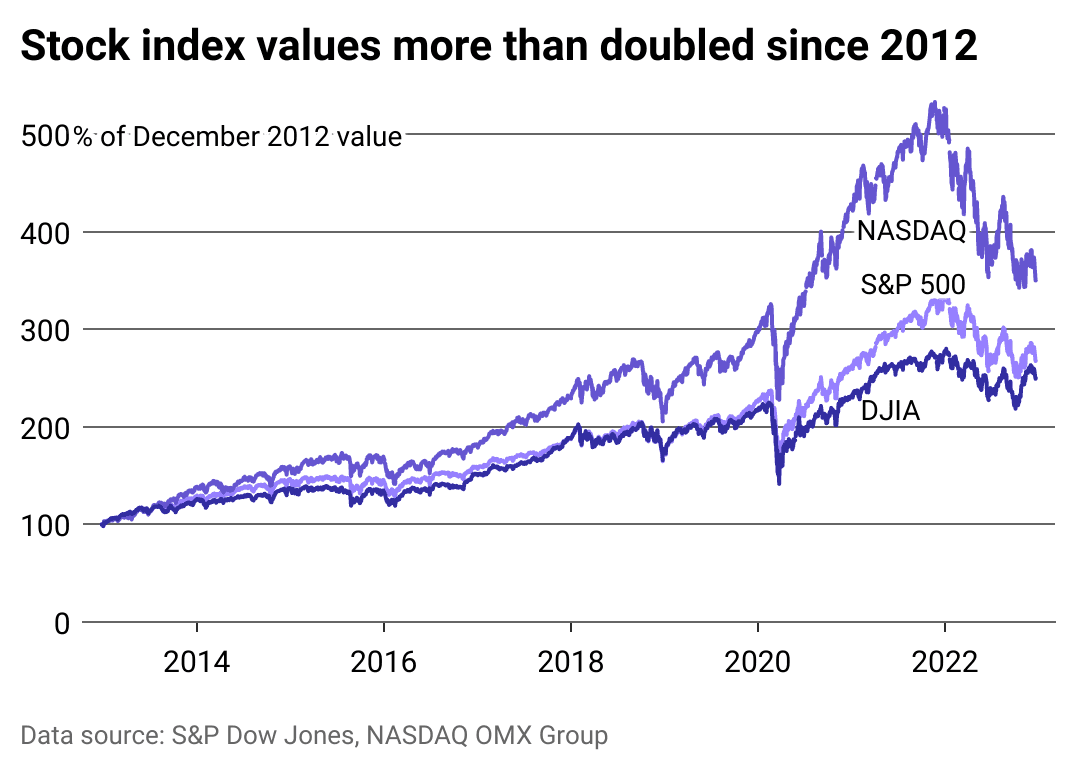

The historical relationship between US-China trade relations and Chinese stock market performance is undeniably intertwined. Periods of heightened trade tensions, often referred to as the US-China trade war, have consistently led to increased market volatility and uncertainty. Conversely, positive developments in negotiations usually result in market rallies and a boost in investor confidence.

- Escalation of trade disputes often leads to increased market volatility and sell-offs. Investors react to uncertainty by selling off assets, causing dips in indices like the Shanghai Composite Index and Shenzhen Component Index.

- Positive developments in negotiations typically result in market rallies and increased investor confidence. Announcements of trade agreements or de-escalation of tensions often trigger significant gains, reflecting a positive shift in investor sentiment.

- Specific examples of past trade agreements and their immediate effects on key indices (Shanghai Composite Index, Shenzhen Component Index, etc.). For instance, the "Phase One" trade deal in 2020 saw a temporary surge in Chinese stock markets, while subsequent escalations led to renewed volatility.

- Mention the impact on specific sectors (technology, manufacturing, etc.). Technology companies, often at the heart of trade disputes, experience particularly strong reactions. Manufacturing sectors heavily reliant on US exports also show significant sensitivity to trade tensions.

Influence of US Economic Reports on Chinese Stock Market Performance

Key US economic indicators significantly influence the Chinese stock market, even though they are geographically separate. The interconnected nature of the global economy means that a strong US economy typically benefits China, while a weak US economy can negatively impact Chinese growth.

- Strong US economic growth often leads to increased demand for Chinese goods, positively impacting related stocks. Higher US consumer spending translates into higher demand for Chinese exports, boosting related companies' share prices.

- Conversely, weak US economic data can negatively influence Chinese export-oriented companies. A slowdown in the US economy reduces demand for Chinese goods, leading to lower profits and potentially lower stock prices for these companies.

- Discuss the impact of US interest rate changes on Chinese capital flows and market valuations. Higher US interest rates can attract capital away from China, weakening the Chinese Yuan and impacting market valuations.

- Mention the correlation between the performance of the US dollar and the Chinese Yuan and its effects on the market. A strengthening US dollar relative to the Chinese Yuan can make Chinese exports less competitive, potentially hurting the stock market.

Analyzing Specific Economic Reports and Their Impact

Specific US economic reports, such as the Nonfarm Payroll report, Consumer Price Index (CPI), and Producer Price Index (PPI), provide crucial insights into the US economy and subsequently influence the Chinese stock market.

- Explain how each report influences investor expectations and market reactions. Strong Nonfarm Payroll numbers often indicate economic health, potentially positively impacting Chinese stocks. High inflation (CPI) can lead to interest rate hikes, potentially negatively affecting Chinese markets.

- Provide examples of past instances where these reports significantly impacted the Chinese stock market. For instance, unexpectedly strong inflation data in the US could trigger a sell-off in Chinese stocks due to anticipated interest rate increases.

- Discuss the time lag between the report release and market response. The market's response is often immediate, but the full impact might not be visible for several days or weeks as investors digest the information.

Analyzing Domestic Chinese Economic Reports and their Combined Effect

To fully understand Chinese stock market performance, it's vital to consider both US and domestic economic factors. Chinese GDP growth, inflation, industrial production, and government policies all play a critical role.

- Explain the importance of considering both domestic and international factors for a comprehensive analysis. Ignoring either domestic or international factors will lead to an incomplete and potentially inaccurate assessment of market performance.

- Highlight the interplay between Chinese government policies and US economic indicators. Government stimulus packages in China can offset the negative impacts of weak US economic data, while restrictive policies might exacerbate negative trends.

- Provide examples where domestic strength mitigated negative impacts from US reports, or vice versa. Strong domestic consumption in China could offset the negative impacts of a weak US economy on export-oriented companies.

Conclusion

The Chinese stock market's performance is a complex function of both US negotiations and economic reports, alongside domestic economic data. Understanding the interplay of these factors is crucial for informed investment decisions. Staying informed about both US and Chinese economic indicators and US-China relations is paramount for effective navigation of this dynamic market. Regularly monitor key indices like the Shanghai Composite Index and Shenzhen Component Index, along with relevant economic reports, to make well-informed investment choices in this crucial market. Careful analysis of Chinese stock market performance requires a holistic view of international and domestic forces at play.

Featured Posts

-

John Wicks True Form One Appearance Across Four Films

May 07, 2025

John Wicks True Form One Appearance Across Four Films

May 07, 2025 -

From Scatological Documents To Podcast Gold An Ai Driven Solution

May 07, 2025

From Scatological Documents To Podcast Gold An Ai Driven Solution

May 07, 2025 -

E Bay Faces Legal Fallout Section 230 And The Sale Of Banned Chemicals

May 07, 2025

E Bay Faces Legal Fallout Section 230 And The Sale Of Banned Chemicals

May 07, 2025 -

1 6m Farmhouse Studio Proof Of Lewis Capaldis Imminent Musical Return

May 07, 2025

1 6m Farmhouse Studio Proof Of Lewis Capaldis Imminent Musical Return

May 07, 2025 -

Fantastic Four Vs Superman Pedro Pascal And Isabela Merceds Impact On Box Office Success

May 07, 2025

Fantastic Four Vs Superman Pedro Pascal And Isabela Merceds Impact On Box Office Success

May 07, 2025

Latest Posts

-

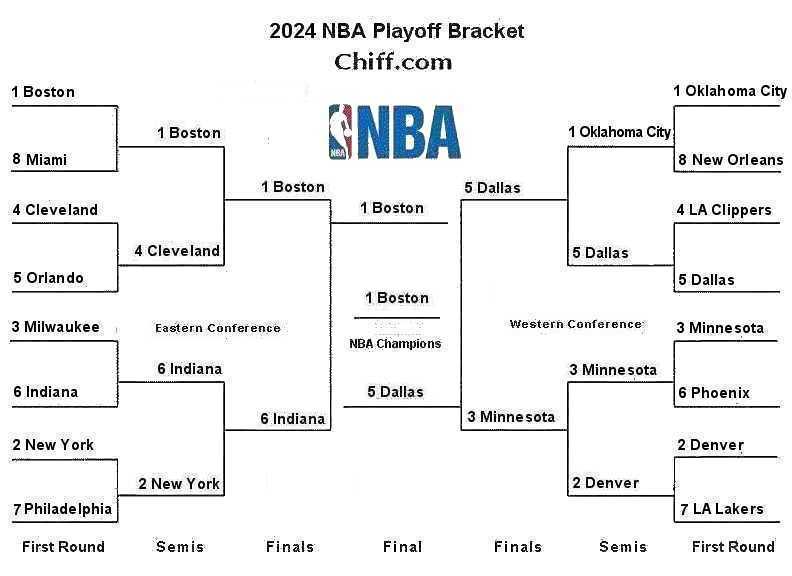

Nba Playoffs Game 2 Cavaliers Vs Heat Live Stream Tv Schedule And More

May 07, 2025

Nba Playoffs Game 2 Cavaliers Vs Heat Live Stream Tv Schedule And More

May 07, 2025 -

Nba Playoffs Game 1 Heat Vs Cavaliers Your Guide To Winning Bets And Predictions

May 07, 2025

Nba Playoffs Game 1 Heat Vs Cavaliers Your Guide To Winning Bets And Predictions

May 07, 2025 -

Nba Playoffs Heat Vs Cavaliers Predictions Picks And Best Bets For Game 1

May 07, 2025

Nba Playoffs Heat Vs Cavaliers Predictions Picks And Best Bets For Game 1

May 07, 2025 -

Heat Vs Cavaliers Game 1 Nba Playoffs Predictions And Betting Picks

May 07, 2025

Heat Vs Cavaliers Game 1 Nba Playoffs Predictions And Betting Picks

May 07, 2025 -

Nba Cavaliers Vs Pacers Prediction And Betting Preview For Tonight

May 07, 2025

Nba Cavaliers Vs Pacers Prediction And Betting Preview For Tonight

May 07, 2025