China's Lithium Restrictions: A Potential Boon For Eramet?

Table of Contents

China's Growing Influence on the Lithium Market

China's dominance in lithium processing and refining is undeniable. The country holds a significant share of the global lithium processing capacity, controlling key aspects of the supply chain from raw material sourcing to battery production. Recent government policies are further aimed at securing domestic lithium resources, prioritizing national interests. This concentrated control has significant implications for global lithium prices and availability.

- Significant share of global lithium processing capacity: China processes a large percentage of the world's lithium ore, transforming raw materials into battery-grade lithium chemicals.

- Control over key supply chains: This control extends throughout the supply chain, impacting the availability and cost of lithium for battery manufacturers globally.

- Recent government policies aimed at securing domestic lithium resources: China's government is actively investing in domestic lithium mining and processing to reduce its reliance on foreign sources.

- Impact on global lithium prices and availability: China's actions directly influence global lithium prices, creating potential for price volatility and supply chain disruptions.

These factors create significant uncertainty for global lithium producers. The potential for price volatility and supply chain disruptions is a major concern, making diversification of sourcing a critical strategy for many companies. The efficient and reliable supply of lithium refining and processing outside of China is becoming increasingly crucial. The complexity of the China lithium supply chain highlights the need for alternative, more robust sources.

Eramet's Strategic Positioning and Lithium Assets

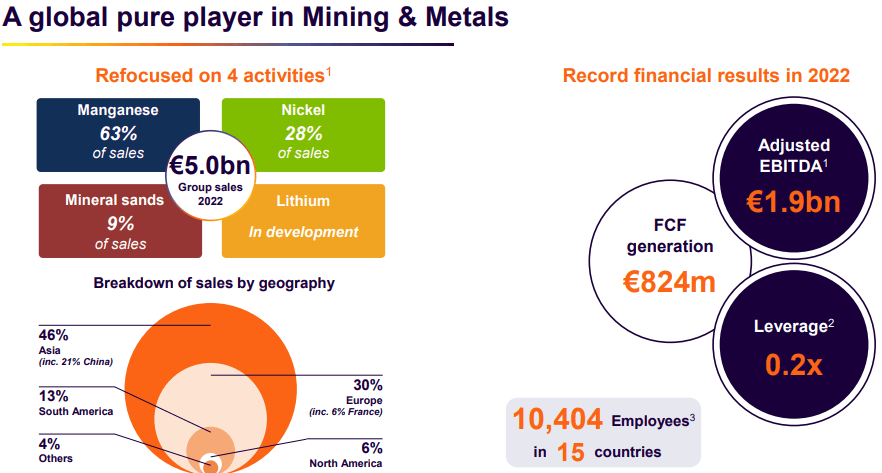

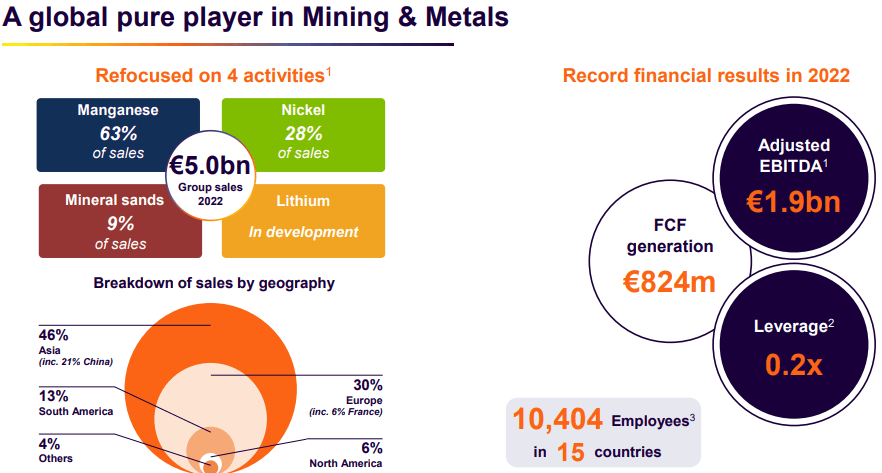

Eramet, a French mining and metallurgical group, is strategically positioned to benefit from the changing dynamics of the lithium market. The company possesses several key lithium projects and operations, characterized by geographic diversification and a focus on sustainable practices.

- Location of key lithium mines and projects: Eramet's projects are located in various regions globally, mitigating the risk associated with relying on a single source. This geographic diversification offers resilience against geopolitical risks and supply chain disruptions.

- Type of lithium produced: Eramet produces spodumene, a crucial lithium-bearing mineral, which can be further processed into lithium hydroxide, a key component in lithium-ion batteries.

- Current production capacity and future expansion plans: Eramet is actively investing in expanding its production capacity to meet the growing global demand for lithium. These expansion plans reflect a confidence in the company's long-term prospects.

- Technological advancements in lithium extraction and processing: Eramet is committed to sustainable and efficient lithium extraction and processing, incorporating technological advancements to minimize environmental impact.

Eramet's strengths lie in its geographic diversification, sustainable mining practices, and commitment to technological innovation, offering a compelling alternative to some of the less transparent practices found in some parts of the China lithium supply chain. These advantages position Eramet favorably compared to some Chinese competitors. "Eramet lithium projects" are rapidly gaining attention as a reliable and responsible source of this vital material.

The Impact of China's Restrictions on Global Lithium Supply

China's export limitations on lithium and related materials are causing significant ripples throughout the global market. The consequences are far-reaching and present both challenges and opportunities.

- Increased demand for lithium from outside China: The restrictions are forcing many countries and companies to seek alternative suppliers, driving up demand for lithium from non-Chinese producers.

- Potential price increases due to supply shortages: The reduced supply from China is likely to exacerbate existing price pressures and potentially lead to further increases.

- Incentive for diversification of lithium sourcing: Companies are actively diversifying their sourcing strategies to reduce their dependence on China.

- Opportunities for non-Chinese producers like Eramet: The increased demand and the need for diversification create significant opportunities for companies like Eramet, which are well-positioned to meet the growing demand.

The strategic partnerships and investments resulting from these restrictions further underscore the significance of this shift in the global lithium landscape. The "lithium supply chain disruption" caused by China's actions is driving innovation and reshaping the global market. Accurate "lithium price forecast" models are becoming increasingly vital for industry stakeholders.

Increased Demand for Western-Sourced Lithium

The growing demand for lithium from countries seeking to reduce their reliance on China is a key driver of this market shift. This demand is particularly strong in regions focused on developing domestic battery production.

- Growing electric vehicle (EV) market in Europe and North America: The rapid expansion of the EV market in these regions is fueling a significant increase in demand for battery materials.

- Government incentives for domestic battery production: Many governments are offering incentives to encourage domestic battery manufacturing, further boosting demand for domestically sourced or Western-sourced lithium.

- Focus on secure and sustainable lithium sourcing: There is a growing emphasis on securing reliable and sustainable sources of lithium, reducing reliance on single-source suppliers.

This increased demand for "European lithium demand" and a robust "North American lithium market" significantly benefits companies like Eramet, which are committed to providing ethically and sustainably sourced lithium. This trend is pivotal in building a truly "sustainable battery supply chain."

Conclusion

China's lithium restrictions create a significant opportunity for companies like Eramet to capitalize on increased global demand for ethically and sustainably sourced lithium. Eramet's strategic positioning, existing assets, and commitment to sustainable practices position it well to benefit from this shift in the global lithium market. The evolving dynamics demonstrate the importance of diversifying lithium sourcing and investing in companies committed to responsible and sustainable practices.

Call to action: Learn more about Eramet's commitment to securing the future of lithium production and its response to China's lithium restrictions. Stay informed about the evolving dynamics of the global lithium market and the strategic advantages for companies like Eramet. Explore the future of sustainable lithium sourcing and its impact on the global energy transition. Understanding "China's lithium restrictions" is key to navigating the future of the lithium market and appreciating the "Eramet lithium strategy" within the context of "sustainable lithium sourcing."

Featured Posts

-

Sanremo Concerto Musica E Pace Successo Per La Raccolta Fondi Al Fa Pp

May 14, 2025

Sanremo Concerto Musica E Pace Successo Per La Raccolta Fondi Al Fa Pp

May 14, 2025 -

Episode 58 Serbia Denmark Germany 2025 Trip Report

May 14, 2025

Episode 58 Serbia Denmark Germany 2025 Trip Report

May 14, 2025 -

Nottingham Forests Awoniyi An Fa Cup Start

May 14, 2025

Nottingham Forests Awoniyi An Fa Cup Start

May 14, 2025 -

E60m Transfer Liverpools All Out Bid For Key Player

May 14, 2025

E60m Transfer Liverpools All Out Bid For Key Player

May 14, 2025 -

Alexis Kohler Quitte L Elysee Un Depart Strategique Pour La Societe Generale

May 14, 2025

Alexis Kohler Quitte L Elysee Un Depart Strategique Pour La Societe Generale

May 14, 2025