China Life Profitability: A Reflection Of Robust Investment Strategies

Table of Contents

Strategic Asset Allocation: The Cornerstone of China Life's Success

China Life's remarkable profitability is fundamentally rooted in its strategic asset allocation. This isn't a static approach; it's a dynamic process of careful planning and execution.

Diversification Across Asset Classes: A Multifaceted Approach

China Life avoids concentrating its investments in a single asset class. Instead, it employs a strategy of diversification, spreading risk across a variety of options:

-

Equities: A significant portion of their portfolio is invested in both domestic Chinese equities and international stocks, providing exposure to diverse growth opportunities and reducing reliance on any single market's performance. This includes investments in both large-cap and small-cap companies, further diversifying their equity holdings.

-

Fixed-Income Securities: Government bonds and corporate bonds form a crucial part of their portfolio, providing stability and predictable returns. This element offers a balance to the higher-risk, higher-reward nature of equity investments. Careful selection of bonds with varying maturities further enhances risk management.

-

Real Estate: Investment in real estate, both domestically and internationally, provides another avenue for diversification and long-term capital appreciation. This asset class offers a hedge against inflation and contributes to overall portfolio stability.

-

Alternative Investments: China Life also strategically allocates capital to alternative investments such as private equity and infrastructure projects. These investments offer potentially higher returns but also carry higher risk, requiring careful due diligence and robust risk management processes.

Geographic Diversification: Minimizing Regional Risk

Reducing vulnerability to regional economic shocks is a critical aspect of China Life's investment strategy. Geographic diversification minimizes the impact of economic downturns in any single region. By investing in multiple international markets, they effectively spread their risk and enhance portfolio resilience. This international approach is a hallmark of their long-term profitability.

Dynamic Asset Allocation: Adapting to Market Conditions

China Life doesn't adopt a "set it and forget it" approach to investment. Their asset allocation is dynamic, constantly adjusted based on prevailing market conditions and economic forecasts. This proactive approach uses sophisticated quantitative models and expert market analysis to identify optimal investment strategies. This responsiveness is crucial to their sustained profitability, allowing them to capitalize on opportunities and mitigate risks effectively.

Robust Risk Management Frameworks: Mitigating Potential Losses

China Life's success is not just about maximizing returns; it's equally about minimizing potential losses. Their robust risk management framework is a cornerstone of their overall profitability.

Stress Testing and Scenario Planning: Preparing for the Unexpected

Proactive risk management is a key element of China Life's strategy. They utilize rigorous stress testing and scenario planning to anticipate and prepare for potential market downturns. This foresight enables them to adjust their investment strategy to mitigate losses during periods of economic uncertainty, ensuring financial stability.

Sophisticated Risk Models: Quantifying and Managing Risk

China Life employs advanced quantitative models to identify and manage a wide range of risks, including:

- Market Risk: Fluctuations in market values.

- Credit Risk: The risk of borrowers defaulting on loans.

- Operational Risk: Risks stemming from internal processes and systems.

These models provide a quantitative assessment of risk, allowing for informed decision-making and proactive risk mitigation. The use of these models is directly linked to the company's overall stability and profitability.

Regulatory Compliance: Maintaining Stability and Trust

Strict adherence to regulatory guidelines is paramount for China Life. This commitment ensures stability, protects against unforeseen issues, and fosters trust among stakeholders. This commitment to responsible investment practices is integral to their long-term success.

Leveraging Market Opportunities: Capitalizing on Growth Potential

China Life’s success also stems from its ability to identify and capitalize on growth opportunities within the dynamic Chinese and global markets.

Understanding the Chinese Market: Intimate Market Knowledge

China Life possesses an unparalleled understanding of the Chinese economy's unique dynamics and its evolving regulatory landscape. This intimate knowledge allows for effective investment decisions, providing a competitive advantage in the market. This deep understanding informs their investment choices, giving them a strategic edge.

Strategic Partnerships: Expanding Opportunities

Strategic collaborations with other financial institutions and government bodies provide China Life with access to exclusive investment opportunities and strengthen their market position. These partnerships open doors to specialized investments and broaden their investment horizons.

Technological Innovation: Enhancing Efficiency and Performance

China Life proactively embraces technology to enhance efficiency, data analysis, and risk management. The adoption of AI-driven analysis and automated trading systems improves investment performance and boosts profitability. This technological edge allows them to make faster, more informed decisions.

Conclusion

China Life's exceptional profitability is not accidental; it's the direct result of carefully planned and executed investment strategies. Their success stems from a combination of strategic asset allocation, robust risk management, and a keen understanding of market opportunities. By diversifying their portfolio, proactively managing risks, and adapting to changing market conditions, China Life has become a leader in the insurance industry. To learn more about developing effective investment strategies and achieving similar success, study the investment strategies of other leading financial institutions and stay informed about global market trends. Understanding China Life’s profitability provides invaluable insights into the world of successful investment strategies. Analyzing China Life's investment strategies offers a valuable lesson in building a profitable investment portfolio.

Featured Posts

-

Nrc Biedt Gratis Nyt Toegang Waarom Nu

May 01, 2025

Nrc Biedt Gratis Nyt Toegang Waarom Nu

May 01, 2025 -

Six Nations 2025 Frances Rugby Renaissance

May 01, 2025

Six Nations 2025 Frances Rugby Renaissance

May 01, 2025 -

Ripple Xrp News Sbi Holdings Xrp Shareholder Reward Program Details

May 01, 2025

Ripple Xrp News Sbi Holdings Xrp Shareholder Reward Program Details

May 01, 2025 -

Kshmyr Agha Syd Rwh Allh Mhdy Ky Bharty Palysy Pr Tnqyd

May 01, 2025

Kshmyr Agha Syd Rwh Allh Mhdy Ky Bharty Palysy Pr Tnqyd

May 01, 2025 -

Waarom Geeft Nrc Nu Gratis Toegang Tot The New York Times

May 01, 2025

Waarom Geeft Nrc Nu Gratis Toegang Tot The New York Times

May 01, 2025

Latest Posts

-

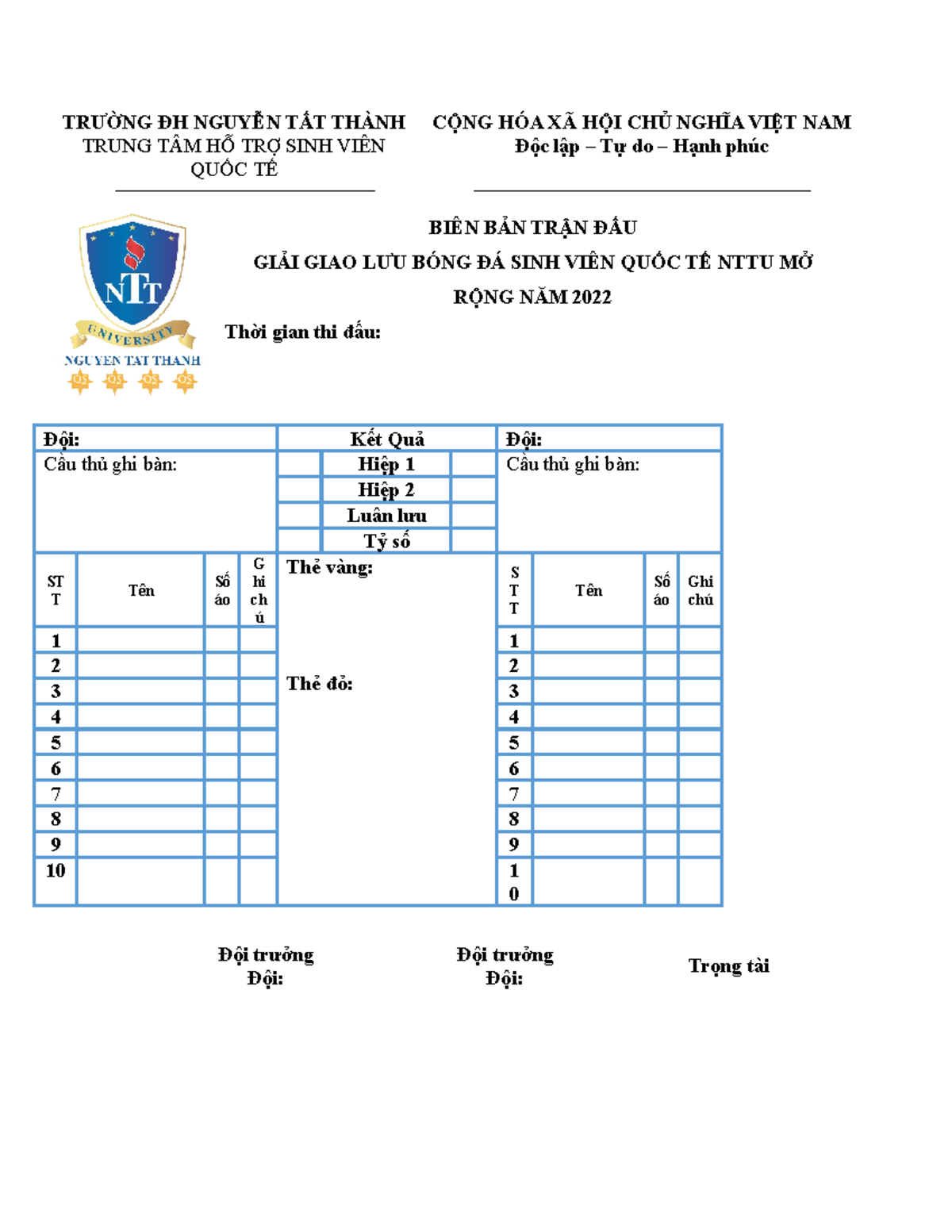

Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Lich Thi Dau Va Doi Hinh

May 01, 2025

Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Lich Thi Dau Va Doi Hinh

May 01, 2025 -

Luto En El Futbol Argentino Fallecimiento De Un Joven Referente De Afa

May 01, 2025

Luto En El Futbol Argentino Fallecimiento De Un Joven Referente De Afa

May 01, 2025 -

Khai Mac Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Thong Tin Chi Tiet

May 01, 2025

Khai Mac Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Thong Tin Chi Tiet

May 01, 2025 -

Americas Favorite Cruise Lines Reviews And Recommendations

May 01, 2025

Americas Favorite Cruise Lines Reviews And Recommendations

May 01, 2025 -

Than Trong Khi Rot Von Nhan Dien Va Tranh Rui Ro Dau Tu Vao Cong Ty Ma

May 01, 2025

Than Trong Khi Rot Von Nhan Dien Va Tranh Rui Ro Dau Tu Vao Cong Ty Ma

May 01, 2025