China Diversifies LPG Imports: Middle East Replaces US Amid Tariffs

Table of Contents

The Impact of US Tariffs on China's LPG Imports

The imposition of US tariffs on various Chinese goods, including indirectly impacting LPG imports, significantly altered the cost landscape. These tariffs, implemented in a tit-for-tat trade war, dramatically increased the price of US-sourced LPG for Chinese importers. This resulted in a substantial decrease in LPG imports from the US to China.

- Tariff Percentage Increase: The tariffs imposed led to a [Insert Percentage]% increase in the cost of US LPG imports to China, making it significantly less competitive. (Source needed: Cite relevant data on tariff percentages).

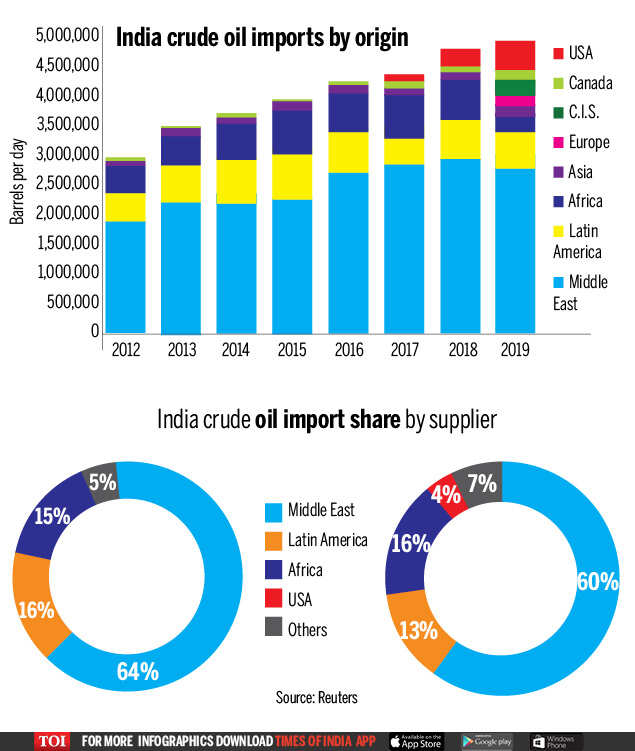

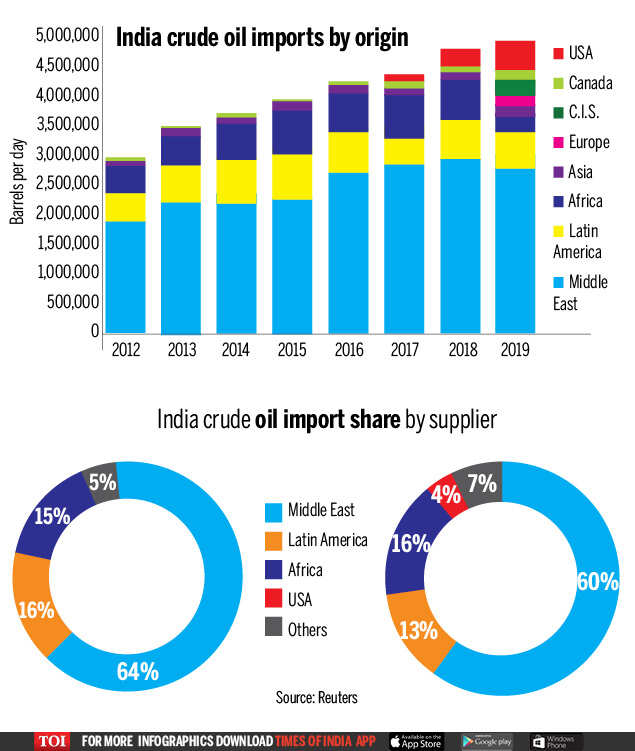

- Import Volume Comparison: [Insert Chart/Graph comparing US LPG import volumes to China before and after tariff implementation. Source needed]. The data clearly shows a sharp decline in imports following the tariff increases.

- Affected Companies and Industries: This price hike impacted numerous Chinese companies and industries relying on LPG, from petrochemical companies to residential consumers. Specific examples of affected businesses should be included here (Source needed).

The Rise of the Middle East as a Key LPG Supplier to China

With US LPG becoming less attractive due to tariffs, China has turned to the Middle East, particularly Saudi Arabia and Qatar, to fill the gap. These countries offer several advantages:

- Increased Import Volumes: [Insert data on increased LPG import volumes from Saudi Arabia and Qatar to China. Source needed]. This demonstrates the significant shift in sourcing.

- Geographical Advantages: Middle Eastern LPG enjoys significantly shorter shipping routes to China compared to the US, leading to reduced transit times and lower transportation costs. [Insert comparison of shipping distances and costs. Source needed].

- Pricing Competitiveness: Post-tariffs, Middle Eastern LPG emerged as a more price-competitive option, further driving the shift in import sources. [Insert price fluctuation analysis comparing US and Middle Eastern LPG prices. Source needed].

China's Strategic Implications of Diversifying LPG Imports

This diversification strategy has significant implications for China:

-

Enhanced Energy Security: Reducing reliance on a single supplier like the US significantly strengthens China's energy security, mitigating risks associated with geopolitical instability or trade disputes.

-

Geopolitical Implications: The increased reliance on Middle Eastern LPG strengthens China's diplomatic and economic ties with these nations, creating new avenues for strategic partnerships.

-

Long-Term Energy Strategy: This shift underscores China's commitment to diversifying its energy sources and securing its energy independence in the long term.

-

Impact on US-China Relations: The shift in LPG imports reflects a broader strain on US-China trade relations and highlights the impact of trade protectionism on global energy markets.

-

China's Long-Term Energy Goals: This move aligns perfectly with China's broader energy diversification strategy, aimed at reducing reliance on any single supplier.

-

Future Energy Agreements: This shift will likely influence future energy agreements and collaborations, leading to new partnerships and potentially impacting global energy prices.

Challenges and Opportunities in the New LPG Trade Dynamics

While beneficial, this shift presents challenges and opportunities:

-

Logistical Issues and Infrastructure Needs: Increased LPG imports require significant investments in port infrastructure, storage facilities, and transportation networks in both China and the Middle East.

-

Price Volatility: The Middle Eastern LPG market is susceptible to price volatility due to various factors, including geopolitical events.

-

Further Diversification: China may seek to diversify its LPG imports even further, exploring sources beyond the Middle East to further mitigate risks.

-

Infrastructure Development: Both China and Middle Eastern nations need to invest in pipelines, storage tanks, and other infrastructure to facilitate the increased LPG trade.

-

Political Risks: Political instability in the Middle East remains a potential risk to the security of LPG supplies.

-

Joint Ventures and Collaboration: The increased trade volume presents opportunities for joint ventures and technological collaborations between Chinese and Middle Eastern companies.

Conclusion: China's Diversification of LPG Imports: A New Era in Energy Trade

The shift in China's LPG import sources, away from the US and towards the Middle East, represents a significant realignment of global energy trade. Driven primarily by US tariffs, this diversification strengthens China's energy security, diversifies its geopolitical relationships, and creates new economic opportunities. While challenges remain, including infrastructure development and price volatility, the long-term implications for both China and the Middle East are substantial. This dynamic situation underscores the importance of understanding China's diversification of LPG imports, China's energy security, and the implications for Middle East energy trade. We encourage further research into this evolving landscape and its impact on global energy markets.

Featured Posts

-

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience Video

Apr 24, 2025

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience Video

Apr 24, 2025 -

Investigation Reveals Lingering Toxic Chemicals In Buildings After Ohio Train Derailment

Apr 24, 2025

Investigation Reveals Lingering Toxic Chemicals In Buildings After Ohio Train Derailment

Apr 24, 2025 -

Utac Sale Chinese Buyout Firm Explores Options

Apr 24, 2025

Utac Sale Chinese Buyout Firm Explores Options

Apr 24, 2025 -

Whataburger Video Propels Hisd Mariachi To Uil State Competition

Apr 24, 2025

Whataburger Video Propels Hisd Mariachi To Uil State Competition

Apr 24, 2025 -

Market Rally Us Stock Futures Soar On Trumps Powell Statement

Apr 24, 2025

Market Rally Us Stock Futures Soar On Trumps Powell Statement

Apr 24, 2025