Chime's New $500 Instant Loans: A Direct Deposit Requirement

Table of Contents

Eligibility for Chime's $500 Instant Loans: What You Need to Know

To qualify for Chime's $500 instant loans, you need to meet specific eligibility requirements. A crucial element is consistent direct deposit into your Chime account.

Direct Deposit Requirement Explained

Consistent direct deposit is vital for eligibility. This demonstrates financial stability and helps Chime verify your identity and account activity. A qualifying direct deposit generally refers to regular, recurring deposits of a certain minimum amount.

-

Examples of qualifying direct deposits:

- Payroll deposits from your employer

- Government benefit payments (Social Security, unemployment benefits, etc.)

- Regular pension payments

-

Deposits that don't typically qualify:

- Peer-to-peer transfers (Venmo, Zelle, Cash App)

- Cash deposits made at a retail location

- One-time deposits

Chime uses its internal systems to verify your direct deposit history. This process assesses the frequency, amount, and consistency of your deposits over a specified period.

Other Eligibility Criteria

Besides direct deposit, other eligibility criteria may apply. These can include:

- Account Age: Your Chime account might need to be active for a minimum period.

- Credit Score: While not always explicitly stated, your creditworthiness might influence approval.

- Account History: Maintaining a positive account history with Chime, including on-time payments (if applicable on other Chime services) will improve your chances.

For the most up-to-date information on eligibility requirements, always refer to the official .

The Application Process for Chime's $500 Instant Loan

Applying for Chime's $500 instant loan is generally straightforward through the Chime mobile app.

Step-by-Step Guide

Follow these steps to apply:

- Step 1: Open the Chime mobile app on your smartphone.

- Step 2: Navigate to the "Loans" or "SpotMe" section (depending on how Chime offers the loans in your area).

- Step 3: Review the loan terms and conditions carefully.

- Step 4: If you agree to the terms, submit your application.

- Step 5: Chime will review your application, considering your eligibility based on your direct deposit history and other factors.

- Step 6: If approved, the funds will be deposited into your Chime Spending Account almost instantly.

(Note: Screenshots would be beneficial here if permitted by Chime's branding guidelines)

Required Documentation

During the application process, be prepared to provide accurate information, possibly including:

- Your government-issued ID

- Proof of income (pay stubs, bank statements, etc.)

Incomplete or inaccurate information can significantly delay the approval process, so ensure all details are correct.

Understanding the Repayment Terms of Chime's $500 Instant Loan

Understanding the repayment terms is crucial for responsible borrowing.

Repayment Schedule

Chime outlines the repayment schedule within the loan agreement, detailing:

- Repayment Timeframe: How long you have to repay the loan (typically a short-term repayment).

- Interest Rates (if any): Chime's $500 instant loan might or might not have interest. Clarify this within the application process.

- Fees: Check for any associated fees for late payments or other charges.

Failing to meet the repayment schedule can negatively impact your Chime account and potentially affect your credit score.

Managing Your Loan

Effective loan management is key:

- Set up automatic payments: This ensures timely repayments and avoids late fees.

- Create a budget: Allocate funds specifically for loan repayment to ensure you can comfortably meet your obligations.

For further guidance on budgeting and financial management, explore reputable resources like the .

Conclusion: Securing Your Finances with Chime's $500 Instant Loans

Chime's $500 instant loans offer a convenient solution for urgent financial needs. However, eligibility hinges on maintaining consistent direct deposits into your Chime account. Understanding the application process, required documentation, and repayment terms is essential for successful loan management. Remember to review the official Chime website for the most current information and to always borrow responsibly. Apply for Chime's $500 instant loan today! Learn more about Chime's fast and convenient loan options by visiting the .

Featured Posts

-

Tout Savoir Sur Le Nombre De Droits De Vote Eramet

May 14, 2025

Tout Savoir Sur Le Nombre De Droits De Vote Eramet

May 14, 2025 -

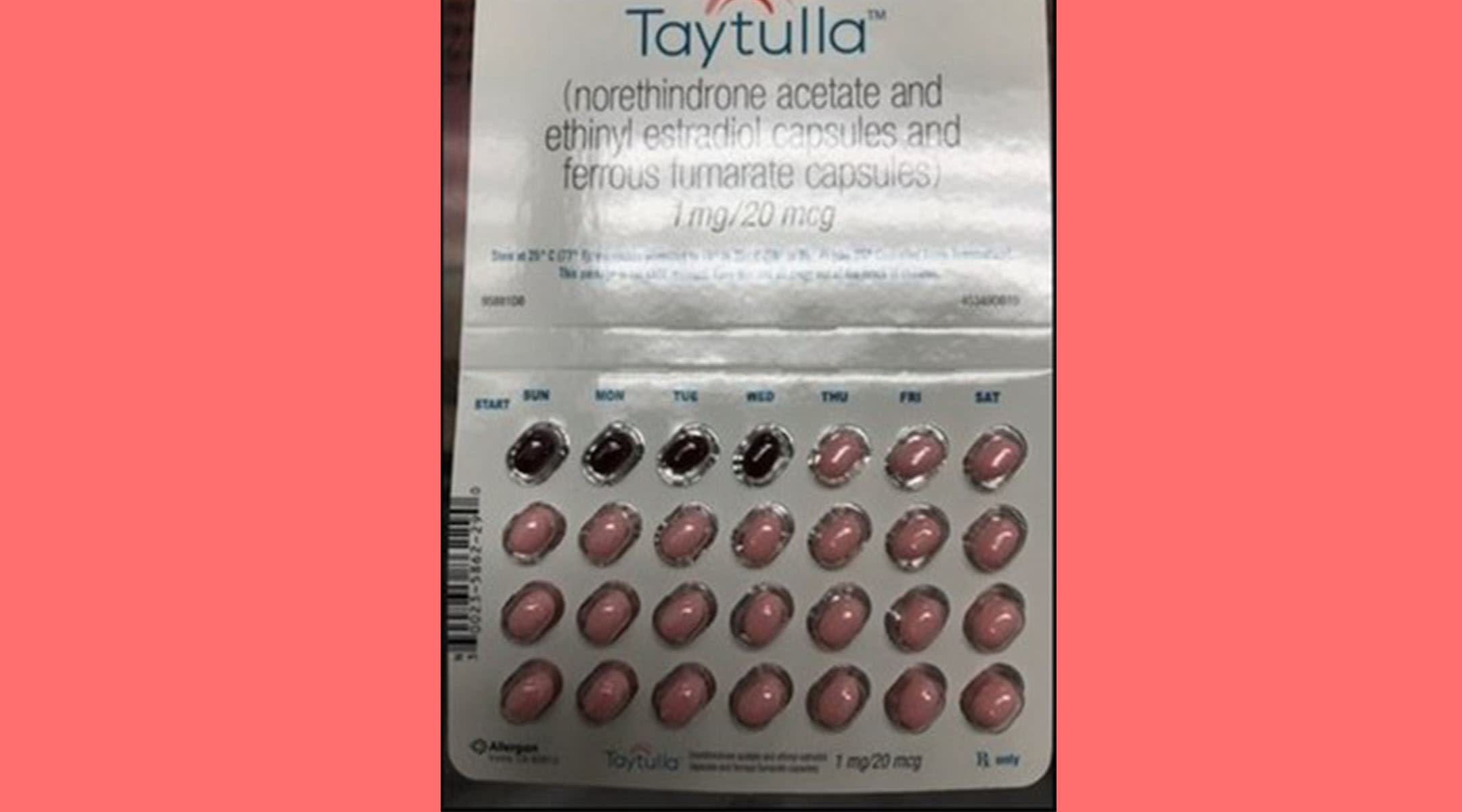

Government Recall Alert Check For Recalled Dressings And Birth Control Pills Ontario And Canada

May 14, 2025

Government Recall Alert Check For Recalled Dressings And Birth Control Pills Ontario And Canada

May 14, 2025 -

Serbia Denmark And Germany 2025 Episode 58 Highlights

May 14, 2025

Serbia Denmark And Germany 2025 Episode 58 Highlights

May 14, 2025 -

Lindt Opens A Chocolate Paradise In Central London

May 14, 2025

Lindt Opens A Chocolate Paradise In Central London

May 14, 2025 -

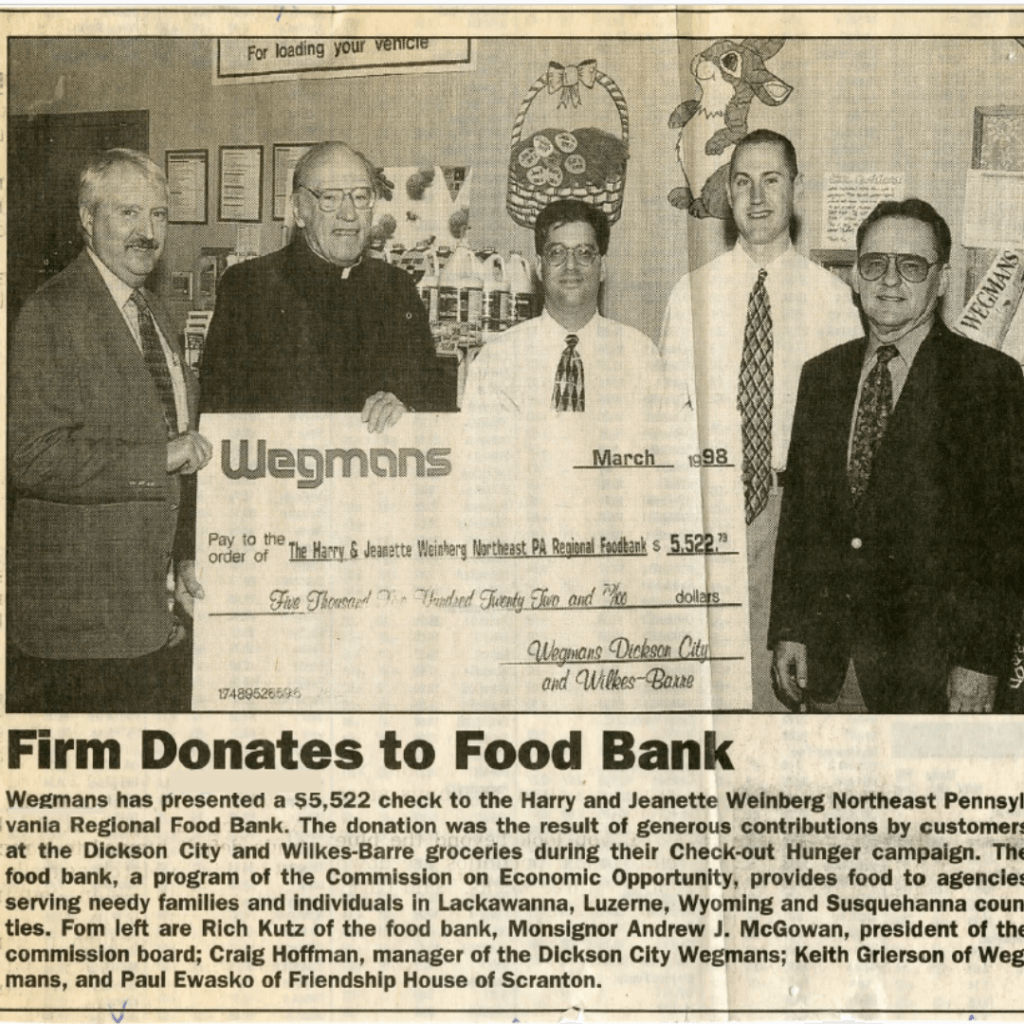

Braised Beef Recall At Wegmans Check Your Purchase

May 14, 2025

Braised Beef Recall At Wegmans Check Your Purchase

May 14, 2025