Chime IPO: A Look At The Fintech Startup's Financial Performance

Table of Contents

Chime's Revenue Model and Growth

Chime's success hinges on its innovative approach to financial services, particularly its focus on serving the underbanked and underserved populations. This section examines the key drivers of Chime's revenue generation and its impressive user acquisition strategy.

Fee-Based Revenue Streams

Chime generates revenue primarily through various fee-based services. These include:

-

Overdraft Fees: While Chime promotes itself as a fee-free checking account, it does charge overdraft fees in certain situations, generating a significant portion of its revenue. The specific conditions and fee amounts are clearly outlined in Chime's terms and conditions.

-

Subscription Fees (Chime Plus): Chime Plus is a premium subscription service that offers enhanced features such as early direct deposit, increased overdraft protection, and other benefits. This subscription model adds a recurring revenue stream for Chime.

-

Interchange Fees: As with most financial institutions, Chime earns interchange fees from debit card transactions. These fees are paid by merchants each time a Chime debit card is used. The volume of transactions processed through Chime's platform is a key indicator of revenue growth in this area.

The chart below illustrates Chime's revenue growth from 2018 to 2022 (projected figures where available). A clear upward trend demonstrates strong revenue generation. (Insert chart here showing revenue growth)

Compared to competitors like Robinhood and Square, Chime's revenue model relies less on trading commissions and more on subscription and fee-based services, showcasing a distinct approach to monetization in the fintech sector.

User Growth and Acquisition Costs

Chime's remarkable growth in its user base is a testament to its effective marketing strategies and the appeal of its services to its target demographic.

-

Number of Users: Chime boasts millions of users, reflecting substantial market penetration. (Insert specific numbers here if available)

-

Growth Rate: The company has demonstrated impressive year-over-year growth rates in user acquisition. (Insert growth rate figures here if available)

-

Customer Acquisition Cost (CAC): Understanding Chime's CAC is crucial in assessing its efficiency in acquiring new customers. Lower CAC indicates better cost management. (Insert CAC data if available)

-

Customer Lifetime Value (CLTV): A high CLTV suggests that Chime effectively retains its customers over time, generating sustained revenue. (Insert CLTV data if available)

Chime's marketing focuses on digital channels, social media, and partnerships, targeting individuals seeking affordable and accessible financial services. A deep understanding of its target demographic's needs has fueled its success in acquiring customers.

Profitability and Financial Health

While specific financial details about Chime's profitability remain limited prior to its IPO, analyzing available data reveals key insights into its financial health.

Profitability Metrics

Evaluating Chime's profitability requires examining several crucial metrics:

-

Net Income: A positive net income indicates profitability after all expenses are considered. (Insert data if available)

-

Gross Margin: This metric reflects the profitability of Chime's core operations, excluding expenses like marketing and administration. (Insert data if available)

-

Operating Margin: Operating margin provides a clearer picture of the profitability of Chime's core business activities after deducting operating expenses. (Insert data if available)

-

EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization provides a measure of profitability before considering financing and accounting effects. (Insert data if available)

Chime's expense structure likely includes significant investments in technology, marketing, and customer service to maintain its rapid growth and user acquisition.

Comparing these metrics to industry benchmarks and competitors like PayPal and Square will further illuminate Chime's financial performance relative to its peers.

Financial Sustainability

The long-term financial sustainability of Chime's business model depends on several factors:

-

Cash Flow: Positive and consistent cash flow is crucial for long-term stability and expansion. (Insert data if available)

-

Debt Levels: Low debt levels indicate a healthier financial position, reducing financial risk. (Insert data if available)

-

Capital Expenditures: Wise investments in technology and infrastructure will be vital for continued growth. (Insert data if available)

Potential risks to Chime's financial stability include increased competition, changes in regulatory environments, and the ability to manage its rapidly growing user base efficiently. The Chime IPO will certainly provide more transparency into these areas.

Competitive Landscape and Future Outlook

Chime operates within a dynamic and competitive fintech landscape. This section analyses its competitive position and its future growth potential.

Key Competitors

Chime faces stiff competition from established players and emerging fintech startups. Key competitors include:

-

Robinhood: A popular trading platform offering commission-free stock trading.

-

Square: Provides payment processing services and financial tools for businesses and individuals.

-

PayPal: A dominant online payment platform with a broad range of financial services.

-

Other Neobanks: Many other neobanks compete directly with Chime by offering similar services and targeting similar customer segments.

Chime's competitive advantages lie in its focus on the underserved market, its simple and user-friendly interface, and its effective marketing strategies. However, competition is fierce, and Chime needs to continue innovating to maintain its market share.

Growth Potential and IPO Valuation

Chime's future growth potential is considerable. Factors influencing this potential include:

-

Market Projections: The continued growth of the fintech sector, coupled with an increasing demand for accessible financial services, bodes well for Chime. (Insert market projections if available)

-

Expansion into New Markets: Chime could expand its services geographically, targeting new customer segments.

-

Innovative Product Development: Continuously developing new and improved financial products will be crucial to maintaining a competitive edge.

The Chime IPO valuation will heavily depend on investor sentiment, market conditions, and the company's demonstrated ability to achieve consistent profitability and growth. (Insert predicted price range if available based on market analysis)

Conclusion

The Chime IPO represents a significant event in the fintech industry. This analysis of Chime's financial performance reveals a company with strong user growth, a potentially profitable revenue model, and significant growth potential. However, understanding the competitive landscape and potential risks is crucial. Further research and monitoring of the Chime IPO and its post-IPO performance will be essential to fully assess its long-term success. To stay informed about the latest developments regarding the Chime IPO and its financial performance, continue to follow reputable financial news sources and industry analyses. Understanding the intricacies of the Chime IPO is vital for anyone interested in investing in the fintech sector or simply following the evolution of this dynamic company.

Featured Posts

-

Great Value Recalls 14 Of The Biggest Walmart Product Withdrawals

May 14, 2025

Great Value Recalls 14 Of The Biggest Walmart Product Withdrawals

May 14, 2025 -

Tommy Fury Rejects Jake Pauls 3 Million Offer Feud Reignited

May 14, 2025

Tommy Fury Rejects Jake Pauls 3 Million Offer Feud Reignited

May 14, 2025 -

Guevenlik Krizi Ve Protestolar Haiti Nin Zor Guenleri

May 14, 2025

Guevenlik Krizi Ve Protestolar Haiti Nin Zor Guenleri

May 14, 2025 -

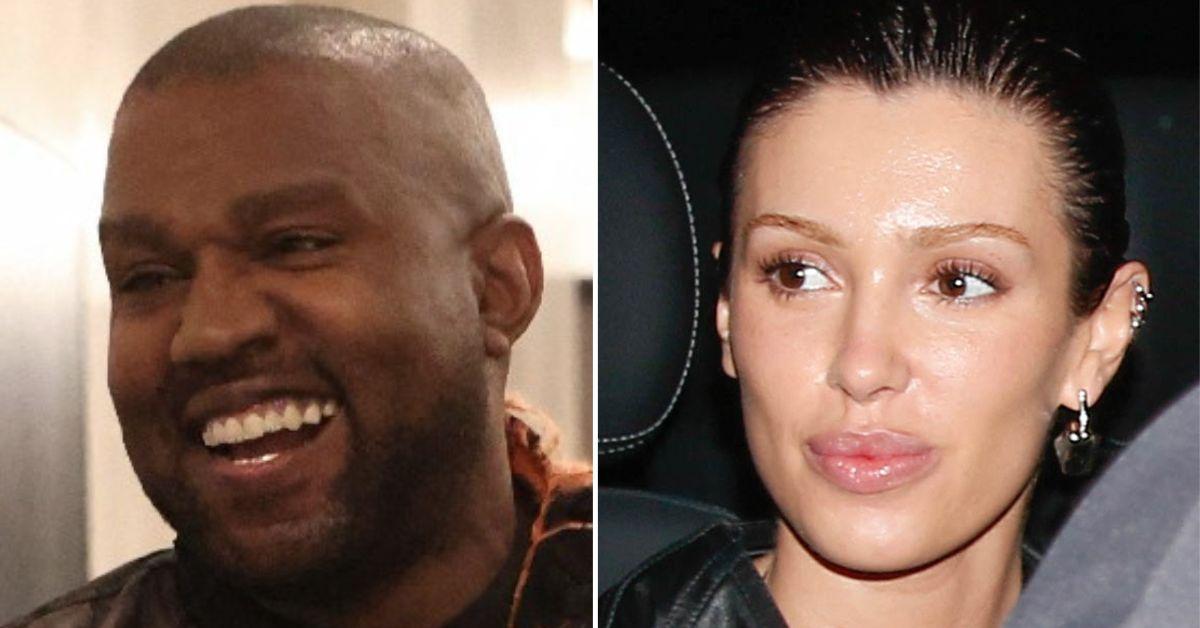

The Kanye West Bianca Censori Partnership An Examination Of Control And Consent

May 14, 2025

The Kanye West Bianca Censori Partnership An Examination Of Control And Consent

May 14, 2025 -

Tommy Fury Responds Jake Pauls Daddy Comment Explained

May 14, 2025

Tommy Fury Responds Jake Pauls Daddy Comment Explained

May 14, 2025