Chime Files For US IPO, Detailing Significant Revenue Increase

Table of Contents

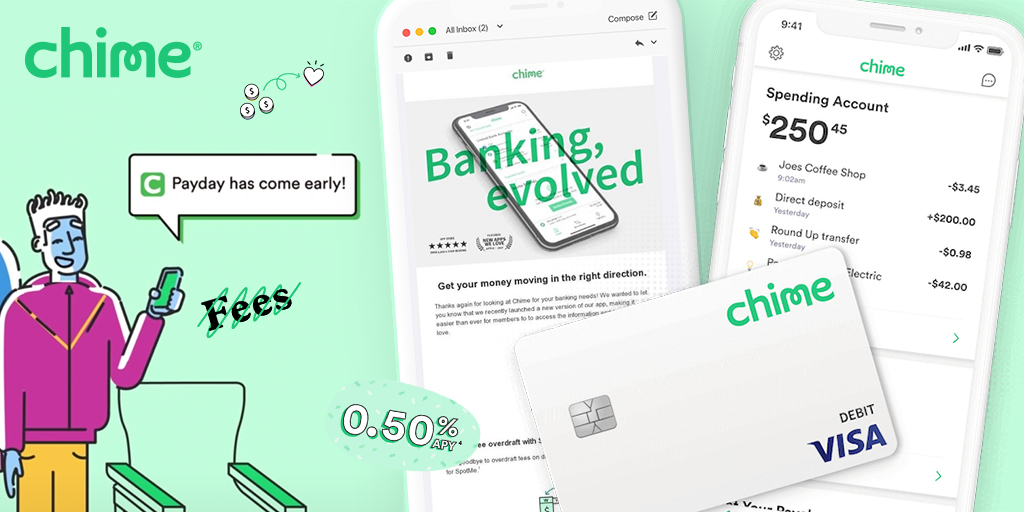

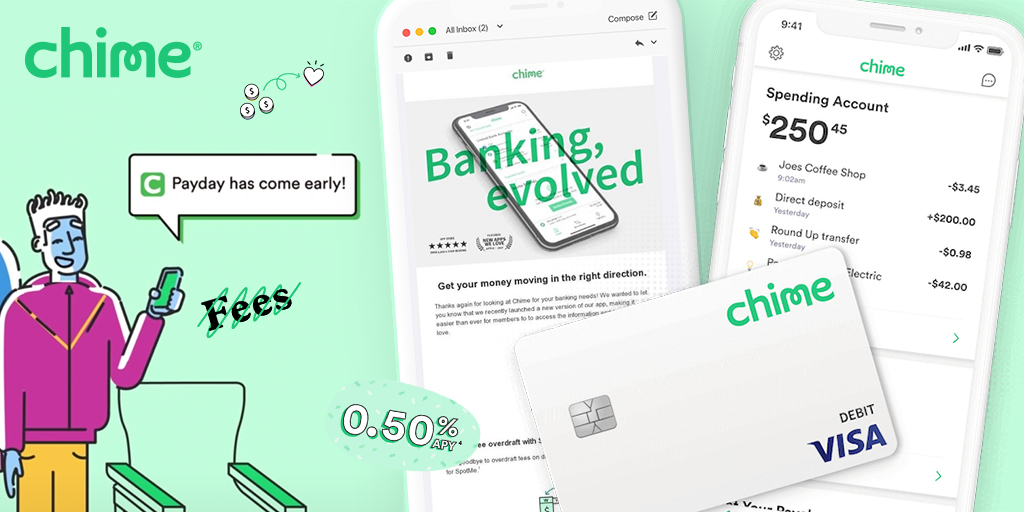

Chime, the leading digital banking platform, has officially filed for its highly anticipated US Initial Public Offering (IPO). The filing reveals impressive financial results, showcasing significant revenue increases and solidifying Chime's position as a major player in the rapidly growing fintech sector. This article delves into the key details unveiled in Chime's IPO filing, highlighting the factors contributing to its remarkable growth and what this means for the future of digital banking.

Chime's Impressive Revenue Growth

Keywords: Chime revenue growth, Chime financial performance, fintech revenue, digital banking revenue

Chime's IPO filing demonstrates explosive year-over-year revenue growth. While precise figures may vary depending on the specific reporting period detailed in the filing, analysts and early reports suggest a substantial percentage increase. This remarkable growth story is a testament to Chime's innovative approach to digital banking and its ability to capture a significant market share.

- Specific revenue figures for the past few years: (Insert specific figures from the Chime IPO filing once available. Example: Revenue increased from $X million in 2021 to $Y million in 2022, representing a Z% increase).

- Breakdown of revenue streams: Chime's revenue likely stems from multiple sources, including subscription fees for premium services, interchange fees from debit card transactions, and potentially revenue generated from partnerships and other financial products. A detailed breakdown will be crucial for investors assessing the sustainability of this growth.

- Comparison to competitors' revenue growth: Compared to other prominent players in the digital banking space, Chime's growth rate is expected to be significantly higher (Insert comparison data here once available, referencing competitors like Robinhood, Square, or other relevant fintech companies).

- Analysis of the factors driving this revenue growth: The rapid expansion of Chime’s user base and the introduction of new, in-demand financial products are major factors driving its revenue growth. This illustrates the market's strong demand for accessible and user-friendly digital banking solutions.

Key Financial Highlights from the Chime IPO Filing

Keywords: Chime IPO filing, Chime financials, Chime profitability, Chime valuation

Beyond the headline-grabbing revenue growth, Chime's IPO filing will provide a comprehensive picture of its financial health. Investors will be keenly interested in:

- Total number of users: The filing will undoubtedly highlight the impressive scale of Chime’s user base, a key indicator of market penetration and potential for future growth.

- Key financial ratios: Metrics such as profitability margins (both gross and net), debt-to-equity ratio, and return on equity will offer insights into Chime's operational efficiency and financial stability.

- Company valuation: The anticipated valuation based on the IPO filing will be a significant benchmark for the company's market position and investor confidence.

- Discussion of any significant expenses or liabilities: Transparency regarding operational expenses, research and development costs, and any potential liabilities will provide a complete financial picture.

Factors Contributing to Chime's Success and Future Outlook

Keywords: Chime success factors, Chime future growth, fintech industry trends, digital banking trends

Chime's success can be attributed to several key factors:

- Innovation in digital banking technology and services: Chime has consistently pushed the boundaries of digital banking, offering user-friendly interfaces and innovative features.

- Effective marketing and customer acquisition strategies: Their targeted marketing campaigns have resonated effectively with a large segment of the population.

- Strong brand recognition and customer loyalty: Chime has built a strong brand reputation for its ease of use and customer service.

- Opportunities for future growth within the expanding fintech market: The fintech sector is booming, presenting significant opportunities for expansion into new product offerings and geographic markets.

- Potential challenges and risks facing the company: Increased competition, regulatory changes, and economic downturns pose potential challenges to Chime’s future growth.

Competition within the Fintech Landscape

Keywords: Chime competitors, fintech competition, digital banking competition, neobanks

Chime faces competition from a range of established banks and emerging fintech players. Key competitors include other neobanks and digital-first financial institutions. However, Chime differentiates itself through its focus on user experience, accessible banking features, and targeted marketing toward underserved populations. The ability to maintain its competitive edge amidst a rapidly evolving market will be critical for Chime's long-term success.

Conclusion

Chime's US IPO filing reveals a compelling story of significant revenue increase and strong financial performance, cementing its position as a leader in the dynamic fintech industry. The impressive growth is fueled by innovation, effective marketing, and a loyal customer base. While challenges remain, Chime's prospects for future growth are substantial. Stay informed about the Chime IPO and the future of digital banking by following [link to relevant source/news] for updates. Learn more about the exciting developments in the Chime IPO and how it's shaping the future of finance. The Chime IPO is a pivotal moment for the digital banking landscape, and its success will likely have wide-reaching implications for the fintech industry.

Featured Posts

-

En Vivo Celta Vs Sevilla Partido De La Liga Espanola Fecha 35

May 14, 2025

En Vivo Celta Vs Sevilla Partido De La Liga Espanola Fecha 35

May 14, 2025 -

Debate Intensifies Icelands Call To Remove Israel From Eurovision For War Crimes

May 14, 2025

Debate Intensifies Icelands Call To Remove Israel From Eurovision For War Crimes

May 14, 2025 -

Lindts Central London Chocolate Paradise A Closer Look

May 14, 2025

Lindts Central London Chocolate Paradise A Closer Look

May 14, 2025 -

Jannik Sinner Vs Roger Federer A Branding Power Comparison

May 14, 2025

Jannik Sinner Vs Roger Federer A Branding Power Comparison

May 14, 2025 -

Captain America Brave New World Arrives On Disney May 28th

May 14, 2025

Captain America Brave New World Arrives On Disney May 28th

May 14, 2025