Check Today's Personal Loan Interest Rates And Apply Now

Table of Contents

Understanding Personal Loan Interest Rates

Before diving into how to find the best personal loan interest rates, it's essential to understand the factors that influence them. Your interest rate determines the total cost of your loan, so understanding these factors is key to securing a favorable deal.

Factors Affecting Interest Rates

Several factors significantly affect the personal loan interest rates you'll be offered. These include:

- Credit Score: Your credit score is arguably the most critical factor. A higher credit score (generally above 700) typically leads to lower interest rates, reflecting your responsible borrowing history. A lower score indicates higher risk to lenders, resulting in higher rates.

- Loan Amount: Larger loan amounts often carry higher interest rates due to the increased risk for the lender.

- Loan Term: Shorter loan terms (e.g., 12 months) usually have higher interest rates but result in faster repayment and less total interest paid. Longer terms (e.g., 60 months) generally have lower monthly payments but result in significantly higher total interest paid.

- Income: Lenders assess your income to determine your ability to repay the loan. A stable, higher income often leads to better interest rates.

- Debt-to-Income Ratio (DTI): Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, indicates how much of your income is already allocated to debt repayment. A lower DTI suggests lower risk and can result in lower interest rates.

Types of Personal Loans and Their Rates

Personal loans come in various forms, each potentially impacting the interest rate:

- Secured Personal Loans: These loans require collateral (e.g., a car or savings account) to secure the loan. Because the lender has less risk, secured loans typically offer lower interest rates than unsecured loans.

- Unsecured Personal Loans: These loans don't require collateral. The higher risk to the lender often translates to higher interest rates.

- Fixed-Rate Personal Loans: The interest rate remains the same throughout the loan term, providing predictable monthly payments.

- Variable-Rate Personal Loans: The interest rate fluctuates based on market conditions, potentially leading to unpredictable monthly payments. These loans may start with lower rates but could increase over time.

The purpose of your loan can also influence the interest rate. For example, loans for debt consolidation might have slightly different rates than those for home improvements.

How to Check Today's Personal Loan Interest Rates

Now that you understand the factors influencing interest rates, let's explore how to check today's rates.

Online Loan Comparison Tools

Several online platforms allow you to compare personal loan rates from multiple lenders simultaneously:

- NerdWallet: Provides comprehensive comparisons, reviews, and educational resources on personal loans.

- Credible: Allows you to see pre-qualified offers from multiple lenders without impacting your credit score.

- Bankrate: Offers rate comparisons for various financial products, including personal loans.

- LendingTree: Connects borrowers with a network of lenders, enabling easy rate comparison.

- Experian: Offers a personal loan comparison tool on its website.

Remember to read reviews and carefully examine the features of any online tool before using it.

Contacting Lenders Directly

Contacting lenders directly is another effective way to determine current personal loan interest rates. When contacting lenders, be prepared to provide:

- Your desired loan amount.

- Your desired loan term.

- Your credit score (if known).

Ask lenders about their current interest rates, fees, and repayment terms. Compare offers from multiple lenders to secure the best deal.

Checking Your Credit Report

Before applying for a personal loan, review your credit report. Errors on your report can negatively impact your credit score and result in higher interest rates. You can access your free credit reports annually from AnnualCreditReport.com.

Applying for a Personal Loan with the Best Rate

Once you've researched today's personal loan interest rates and found a lender with a competitive offer, it’s time to apply.

Prepare Your Application

Gather the necessary documents before starting the application process:

- Proof of income (pay stubs, tax returns).

- Government-issued identification.

- Bank statements.

- Employment verification.

Having all your documentation readily available will streamline the application process.

Choosing the Right Lender

Consider these factors when selecting a lender:

- Interest Rate: Choose the lowest interest rate you qualify for.

- Fees: Be aware of origination fees, late payment fees, and other potential charges.

- Repayment Terms: Select a repayment plan that fits your budget.

- Customer Service: Read reviews to assess the lender's customer service reputation.

Always carefully review the loan agreement before signing.

Completing the Application Process

The application process typically involves completing an online form or applying in person. Ensure all the information you provide is accurate and complete to avoid delays.

Conclusion

Finding the best personal loan interest rates involves understanding the factors that influence rates, using online comparison tools, contacting lenders directly, and reviewing your credit report. By comparing offers from multiple lenders and carefully reviewing the terms and conditions, you can secure a personal loan with a competitive interest rate. Don't delay, check personal loan rates now and apply! Find the best personal loan interest rates today! Secure your low-interest personal loan today!

Featured Posts

-

Padre Vs Cubs Series Key Takeaways And Analysis

May 28, 2025

Padre Vs Cubs Series Key Takeaways And Analysis

May 28, 2025 -

French Open 2024 Alcaraz Sinner And Swiateks Road To Success

May 28, 2025

French Open 2024 Alcaraz Sinner And Swiateks Road To Success

May 28, 2025 -

Nas Dem Bali Prioritaskan Kursi Senayan Program Kedai Kopi Ditangguhkan

May 28, 2025

Nas Dem Bali Prioritaskan Kursi Senayan Program Kedai Kopi Ditangguhkan

May 28, 2025 -

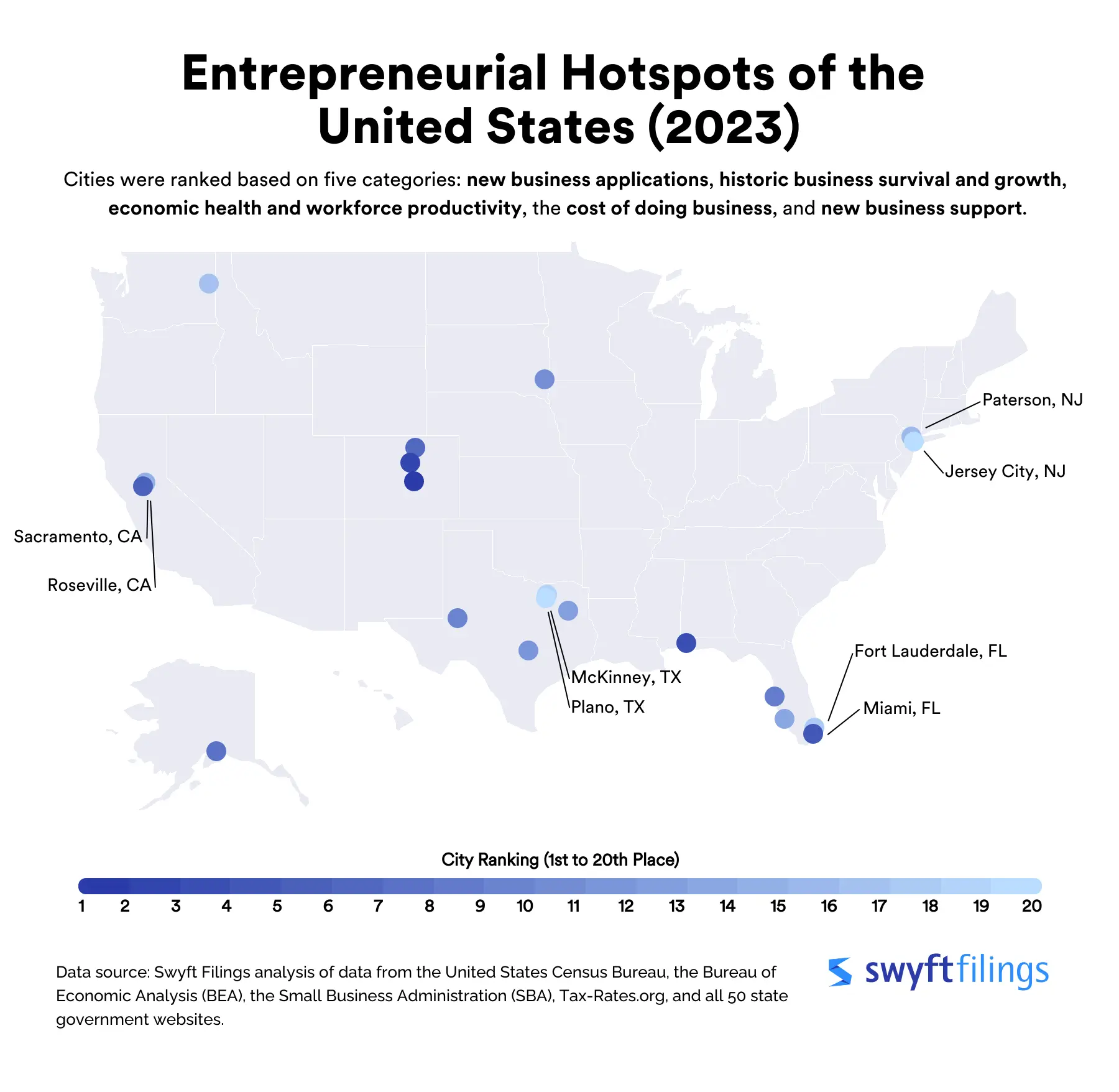

Mapping The Rise Of New Business Hotspots Across The Nation

May 28, 2025

Mapping The Rise Of New Business Hotspots Across The Nation

May 28, 2025 -

Investors Pile Into Etfs A Record Pace Despite Market Volatility

May 28, 2025

Investors Pile Into Etfs A Record Pace Despite Market Volatility

May 28, 2025