CFP Board CEO To Step Down In Early 2026

Table of Contents

H2: Impact of the CEO's Departure on the CFP Board

The departure of the CFP Board CEO will undoubtedly create a period of transition for the organization. While change can bring challenges, it also presents opportunities for growth and adaptation. The current CEO's tenure has undoubtedly left its mark, with achievements that will be analyzed and built upon. However, the transition period itself will present inherent challenges. The Board of Directors will play a crucial role in navigating this phase effectively, ensuring continuity and maintaining the high professional standards the CFP designation represents.

- Analysis of the CEO's tenure and accomplishments: A thorough assessment of the outgoing CEO's successes will be vital in shaping the future vision of the CFP Board. This includes reviewing achievements in areas like expanding access to financial planning, enhancing CFP certification standards, and strengthening regulatory compliance.

- Discussion of potential challenges during the transition period: A smooth transition is paramount. Potential challenges include maintaining the momentum of ongoing initiatives, ensuring consistent communication with stakeholders, and minimizing any disruption to CFP certification processes.

- Speculation on the qualities and experience the Board will seek in a successor: The Board will likely prioritize candidates with proven leadership, a deep understanding of the financial planning landscape, and a commitment to upholding the integrity of the CFP certification. Strong regulatory knowledge and experience within the financial services industry will also be highly desirable.

- Potential impact on CFP certification standards and processes: While maintaining high standards is critical, the transition might necessitate a review of existing processes and potentially minor adjustments to optimize efficiency and effectiveness.

H2: The Search for a New CFP Board CEO

The process of finding a new CEO will be rigorous and thorough, likely involving a reputable executive search firm. The timeline, from initiating the search to appointing a new leader, is expected to be several months, providing ample opportunity for a comprehensive evaluation of candidates. The Board will undoubtedly prioritize candidates with a strong strategic vision for the future of the CFP Board.

- Details about the search process (e.g., internal vs. external search): The Board will carefully weigh the advantages of an internal search (promoting from within) against the fresh perspectives offered by an external candidate. A combination of both approaches is also possible.

- Discussion of the likely qualifications and experience the Board will prioritize in candidates (e.g., financial planning expertise, leadership experience, regulatory knowledge): Beyond extensive leadership experience, the ideal candidate will possess a deep understanding of financial planning, regulatory compliance, and the evolving needs of CFP professionals and consumers.

- Predictions regarding the timeline for the appointment of the new CEO: Given the importance of this decision, a thorough search will likely take several months, aiming for an appointment well before the CEO’s departure in early 2026.

H2: Implications for CFP Professionals and Consumers

The change in leadership at the CFP Board will have a ripple effect across the financial planning industry, impacting both CFP professionals and their clients. Maintaining consumer trust and protection remains a top priority, ensuring that the high standards associated with the CFP designation are not only maintained but strengthened.

- Discussion of the possible impact on CFP certification requirements: Any changes are likely to be incremental, focusing on maintaining the value and relevance of the CFP certification in a dynamically changing financial landscape.

- Analysis of the potential influence on the future direction of the financial planning profession: The new CEO's vision will heavily influence the future trajectory of the profession, potentially focusing on technology adoption, expanding access to financial advice, or enhancing professional development opportunities.

- Consideration of the implications for consumer trust and protection: The CFP Board's commitment to consumer protection is paramount. The leadership transition must ensure continued safeguards for consumers seeking competent and ethical financial advice.

H3: Looking Ahead: Future of the CFP Board

The future of the CFP Board under new leadership is promising. The financial planning profession faces exciting opportunities, driven by technological advancements, demographic shifts, and evolving consumer needs. The next CEO will need to navigate these changes strategically, ensuring the CFP Board remains relevant and impactful in the years to come. This includes embracing fintech innovations, addressing the growing demand for financial planning services, and fostering professional development for CFP professionals.

3. Conclusion:

The upcoming departure of the CFP Board CEO in early 2026 is a significant event for the financial planning profession. This leadership transition presents both challenges and opportunities, requiring careful planning and execution. The selection of a new CEO will be crucial in shaping the future direction of the CFP Board and the overall landscape of financial planning. The process will emphasize finding a leader with the experience, vision, and commitment to uphold the integrity and value of the CFP designation for both professionals and consumers. Stay tuned for updates on the CFP Board CEO transition and follow the CFP Board for news on the selection of their next CEO.

Featured Posts

-

Swiss Presidents Firm Commitment To Ukraines Cause

May 03, 2025

Swiss Presidents Firm Commitment To Ukraines Cause

May 03, 2025 -

Impact De La Reforme De La Loi Sur Les Partis Politiques Sur Le Pt Ffs Rcd Et Jil Jadid En Algerie

May 03, 2025

Impact De La Reforme De La Loi Sur Les Partis Politiques Sur Le Pt Ffs Rcd Et Jil Jadid En Algerie

May 03, 2025 -

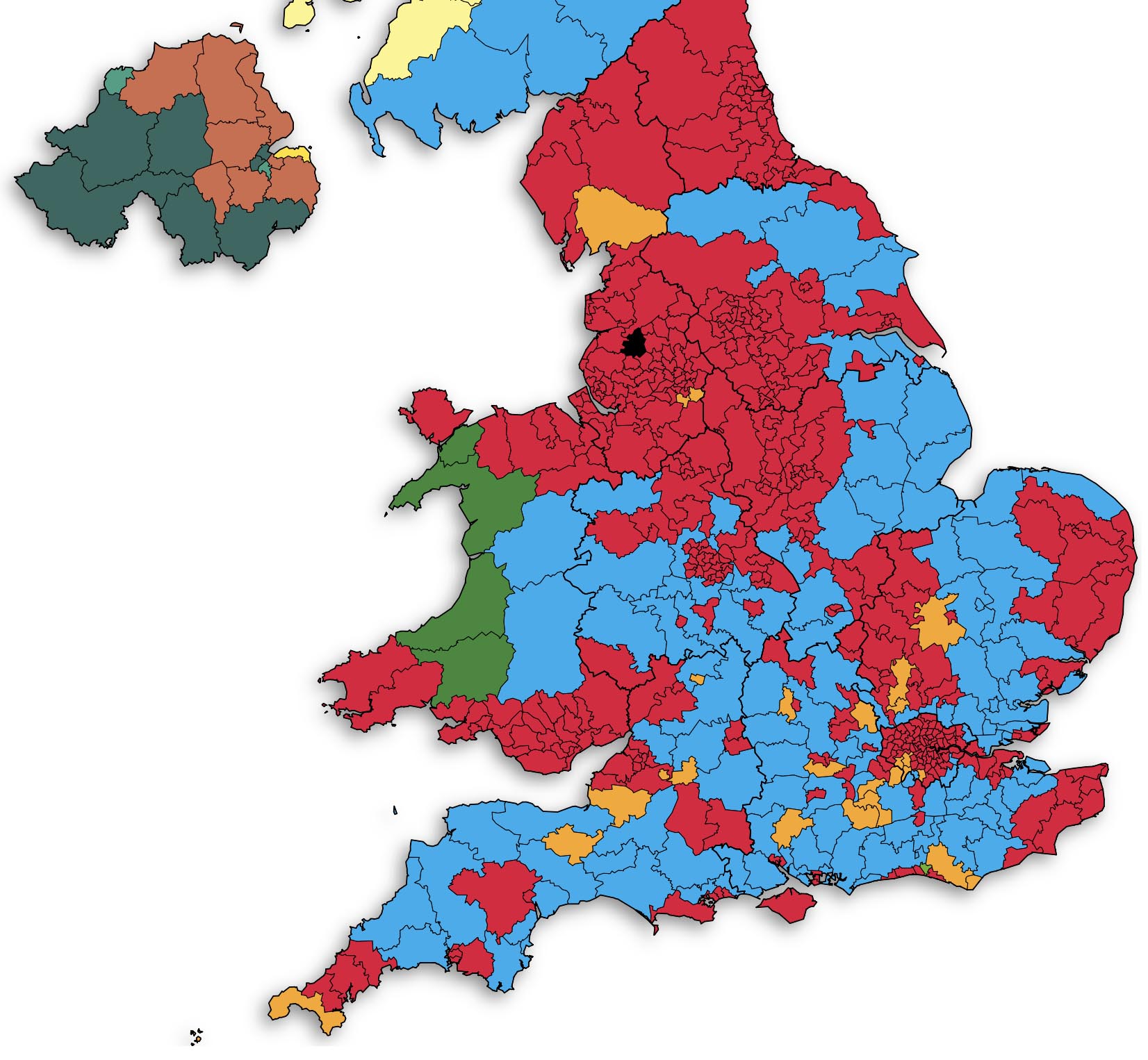

Reform Partys Local Election Performance A Key Indicator For Farage

May 03, 2025

Reform Partys Local Election Performance A Key Indicator For Farage

May 03, 2025 -

Loyle Carner Dublin 3 Arena Gig Announced

May 03, 2025

Loyle Carner Dublin 3 Arena Gig Announced

May 03, 2025 -

Hommage Dans Les Tuche 5 A Qui Est Il Rendu

May 03, 2025

Hommage Dans Les Tuche 5 A Qui Est Il Rendu

May 03, 2025