Cenovus CEO Downplays Merger Speculation, Prioritizes Internal Expansion

Table of Contents

Cenovus's Strategic Shift Towards Internal Expansion

Cenovus Energy's leadership has made it clear: the path to future success lies not in acquisitions, but in maximizing the potential of existing assets and strategically investing in future projects. This commitment to internal expansion is a cornerstone of their revised strategy.

Organic Growth Initiatives

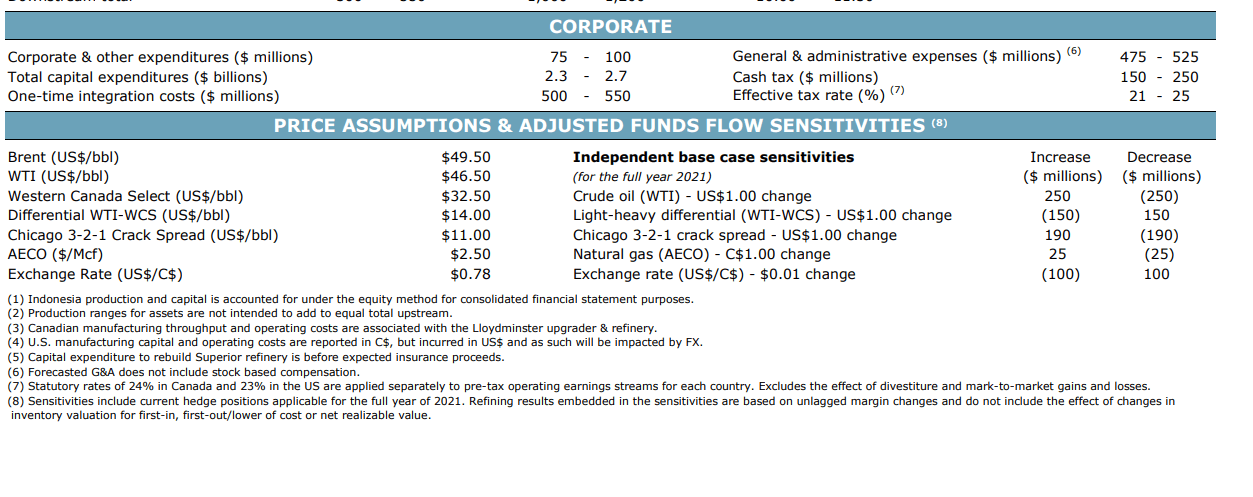

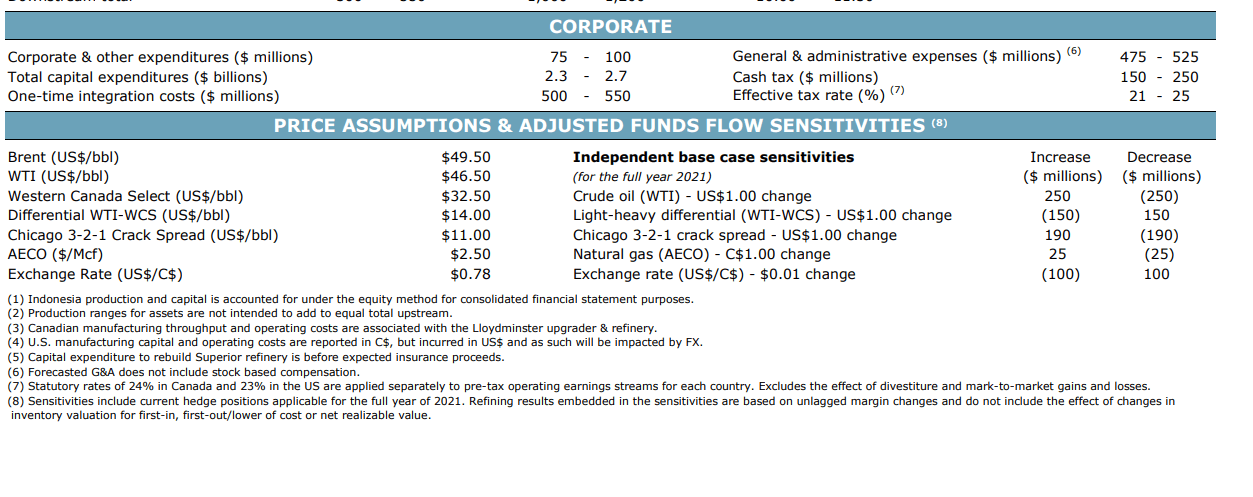

Cenovus is aggressively pursuing organic growth through significant investments in exploration and production. This involves substantial capital expenditure directed towards enhancing existing oil sands operations and developing new production capacities. Specific projects, such as those located in Alberta's oil sands region, are expected to significantly boost production volumes in the coming years.

- Technology Upgrades: Implementing advanced technologies to improve extraction efficiency and reduce operational costs.

- Efficiency Improvements: Streamlining processes and optimizing workflows across all operations.

- Operational Optimization: Focusing on data-driven decision-making to maximize output and minimize downtime.

- Strategic Partnerships: Collaborating with technology providers and other industry players to accelerate innovation and growth.

These initiatives, combined with ongoing exploration efforts, aim to solidify Cenovus's position as a major player in the North American energy market.

Financial Strategies for Internal Growth

Funding this ambitious internal expansion plan requires a robust financial strategy. Cenovus plans to leverage a combination of retained earnings and strategic debt financing to support its capital expenditure programs. The company's strong financial position, reflected in its healthy credit ratings and profitability projections, provides a solid foundation for this growth strategy.

- Debt Levels: Maintaining responsible debt levels to ensure financial stability.

- Credit Ratings: Preserving strong credit ratings to access favorable financing terms.

- Profitability Projections: Demonstrating consistent profitability to support ongoing investments.

- Risk Management: Implementing rigorous risk management practices to mitigate potential financial challenges.

While the strategy involves inherent financial risks, Cenovus’s management team appears confident in their ability to navigate these challenges successfully.

Focus on Operational Excellence and Efficiency

A crucial element of Cenovus's internal expansion strategy is a relentless pursuit of operational excellence and cost efficiency. This involves implementing innovative technologies and refining existing processes to maximize productivity and minimize waste. The company also emphasizes sustainability initiatives, aiming to reduce its environmental footprint while enhancing efficiency.

- Automation: Implementing automation technologies to improve efficiency and reduce labor costs.

- Process Optimization: Streamlining workflows and eliminating redundancies to enhance productivity.

- Waste Reduction: Implementing strategies to reduce waste generation across all operations.

- Sustainable Practices: Investing in technologies and practices that minimize environmental impact.

These efforts are not only projected to boost profitability but also enhance Cenovus's long-term sustainability and competitiveness.

Dismissal of Merger Speculation and its Market Implications

The Cenovus CEO's firm rejection of merger speculation underscores the company's unwavering commitment to its internal growth strategy.

The CEO's Statement and Reasoning

The CEO's statement directly addressed the market rumors, emphasizing that Cenovus is not actively seeking a merger or acquisition. The rationale cited focuses on the belief that pursuing organic growth offers superior long-term value creation compared to the potential benefits of a merger.

- Strategic Fit: Concerns about the strategic fit and potential integration challenges associated with a merger.

- Valuation Concerns: Belief that current valuations do not adequately reflect the company's long-term potential.

- Focus on Core Business: Commitment to focusing resources on strengthening core operations and internal growth.

Market Reaction and Investor Sentiment

The market’s reaction to the CEO's announcement has been largely positive, with many analysts interpreting it as a sign of confidence in Cenovus’s future prospects. While initial stock price fluctuations occurred, investor sentiment generally reflects a belief in the company’s ability to execute its internal expansion strategy.

- Stock Price Fluctuations: Initial volatility followed by stabilization as investors processed the information.

- Analyst Comments: Mostly positive commentary reflecting confidence in Cenovus's strategic direction.

- Investor Reactions: A mix of reactions, but overall a positive shift in investor confidence.

Comparison to other Industry Mergers and Acquisitions

Recent mergers and acquisitions within the energy sector have been driven by a variety of factors, including consolidation, access to technology, and diversification. Cenovus's strategy represents a departure from this trend, prioritizing independent growth over external acquisitions. This unique approach contrasts with the more prevalent consolidation strategy seen amongst some competitors.

Conclusion: Cenovus's Commitment to Independent Growth

In conclusion, Cenovus CEO downplays merger speculation, firmly committing to an internal expansion strategy focused on organic growth and operational excellence. This strategic shift represents a bold departure from current industry trends, emphasizing long-term value creation through strategic investments and operational efficiency. The company’s strong financial position and commitment to sustainability underpin this ambitious plan. Stay updated on Cenovus Energy's progress as it implements its internal expansion strategy. Follow future developments regarding Cenovus's growth and its ongoing commitment to independent success. Learn more about Cenovus Energy's strategic plans and investment opportunities.

Featured Posts

-

A Fathers Determination Rowing Across Oceans For Sons 2 2 Million Medical Bill

May 25, 2025

A Fathers Determination Rowing Across Oceans For Sons 2 2 Million Medical Bill

May 25, 2025 -

Atletico Madrid In Geriden Gelislerinin Sirri

May 25, 2025

Atletico Madrid In Geriden Gelislerinin Sirri

May 25, 2025 -

Alcaraz And Sabalenkas Winning Debut At The Italian Open

May 25, 2025

Alcaraz And Sabalenkas Winning Debut At The Italian Open

May 25, 2025 -

Real Madrid De Bueyuek Sok Doert Yildiza Sorusturma

May 25, 2025

Real Madrid De Bueyuek Sok Doert Yildiza Sorusturma

May 25, 2025 -

Yuviley Naomi Kempbell Foto Zi Svyata 55 Richchya

May 25, 2025

Yuviley Naomi Kempbell Foto Zi Svyata 55 Richchya

May 25, 2025

Latest Posts

-

Melanie Thierry Et Raphael Differences D Age Et Parentalite Temoignage

May 25, 2025

Melanie Thierry Et Raphael Differences D Age Et Parentalite Temoignage

May 25, 2025 -

Elever Une Famille Nombreuse Le Parcours De Melanie Thierry Et Raphael

May 25, 2025

Elever Une Famille Nombreuse Le Parcours De Melanie Thierry Et Raphael

May 25, 2025 -

Parenthood Challenges Melanie Thierry Et Raphaels Experience With Three Children

May 25, 2025

Parenthood Challenges Melanie Thierry Et Raphaels Experience With Three Children

May 25, 2025 -

Melanie Thierry Et Raphael Les Defis De La Parentalite Avec Des Enfants De Plusieurs Ages

May 25, 2025

Melanie Thierry Et Raphael Les Defis De La Parentalite Avec Des Enfants De Plusieurs Ages

May 25, 2025 -

Melanie Thierry Et Raphael Elever Trois Enfants Avec Un Grand Ecart D Age

May 25, 2025

Melanie Thierry Et Raphael Elever Trois Enfants Avec Un Grand Ecart D Age

May 25, 2025