Canadian Tire-Hudson's Bay Combination: A Cautious Approach Needed

Table of Contents

Potential Synergies and Opportunities of the Canadian Tire-Hudson's Bay Combination

The combination of these two retail giants offers several avenues for growth and enhanced profitability. Careful execution will be key to realizing these opportunities.

Expanded Retail Footprint and Customer Reach

The merged entity will boast a dramatically expanded retail footprint, reaching a wider customer base than either company could achieve independently. This translates to:

- Increased brand visibility: More stores mean more opportunities to reach consumers across Canada.

- Broader product offerings: Canadian Tire's focus on automotive, home improvement, and sporting goods complements HBC's offerings in apparel, home furnishings, and luxury goods. This diversification reduces reliance on any single sector.

- Potential for cross-promotion: Marketing initiatives can leverage both brand strengths, creating synergistic campaigns that attract new customers to both product lines.

This expanded geographical reach allows targeting of diverse consumer segments, from urban shoppers drawn to HBC's offerings to suburban residents who frequent Canadian Tire. This strategic diversification mitigates risk associated with relying on a single market segment.

Enhanced Supply Chain and Logistics

Combining the supply chains of Canadian Tire and HBC presents significant opportunities for operational efficiency and cost savings. This includes:

- Reduced operational costs: Consolidating warehousing and distribution networks eliminates redundancies and improves logistics.

- Improved inventory management: Advanced data analytics can optimize inventory levels across the combined network, minimizing waste and maximizing sales.

- Faster delivery times: Streamlined processes will lead to quicker order fulfillment and improved customer satisfaction.

A unified, optimized supply chain will allow for better inventory management, reducing waste and boosting profitability. This is particularly crucial in today's competitive retail environment.

Leveraging Loyalty Programs and Data Analytics

Integrating loyalty programs and customer data is key to unlocking the full potential of this combination. This offers:

- Enhanced customer insights: Combining data from both programs provides a holistic view of customer preferences and purchasing habits.

- Improved marketing ROI: Targeted marketing campaigns based on detailed customer data will yield higher returns.

- Opportunities for customized offers: Personalized promotions and loyalty rewards will enhance customer engagement and loyalty.

The potential to create a unified loyalty program offering benefits across both brands represents a significant opportunity to reward customer loyalty and drive repeat business.

Potential Challenges and Risks Associated with the Canadian Tire-Hudson's Bay Combination

While the opportunities are considerable, the Canadian Tire-Hudson's Bay Combination also presents substantial challenges that require careful consideration.

Brand Identity and Customer Confusion

Maintaining the distinct brand identities of Canadian Tire and Hudson's Bay is crucial. A poorly executed integration could alienate existing customer bases:

- Maintaining separate brand identities: Careful marketing strategies are required to avoid diluting either brand's image.

- Integrating marketing strategies without confusion: A cohesive yet distinct approach to advertising is essential to avoid customer confusion.

- Potential for customer backlash: Negative reactions from loyal customers of either brand could impact sales and profitability.

Successful brand integrations, such as the LVMH acquisition of Tiffany & Co, demonstrate the importance of preserving brand heritage, while unsuccessful mergers highlight the risks of brand dilution.

Integration Difficulties and Operational Challenges

Merging two large organizations is a complex undertaking, fraught with potential pitfalls:

- Potential for system integration issues: Harmonizing IT systems, inventory management software, and point-of-sale systems requires careful planning and execution.

- Challenges in employee retention and training: Integrating two workforces requires a sensitive approach to retain talent and ensure effective training on new systems and processes.

- Risks of operational disruptions: Integration difficulties can lead to temporary store closures, supply chain disruptions, and reduced customer service.

The time and resources required for successful integration cannot be underestimated. Thorough planning and a phased approach are critical to mitigating potential disruptions.

Economic and Market Conditions

The current economic climate presents additional challenges:

- Consumer spending habits: Inflation and recessionary fears could impact consumer spending, affecting the profitability of the combined entity.

- Potential impact on profitability: Reduced consumer spending could necessitate price adjustments, impacting profit margins.

- Competitive landscape analysis: The retail sector is highly competitive, and the combined entity will need to navigate this landscape effectively.

Analyzing the overall retail market conditions is vital to anticipating and mitigating the potential impact on the combined entity's financial performance.

Conclusion: A Cautious Approach is Crucial for the Canadian Tire-Hudson's Bay Combination

The Canadian Tire-Hudson's Bay Combination presents a unique opportunity to create a dominant player in the Canadian retail market. However, the potential synergies must be carefully weighed against the significant challenges inherent in such a large-scale integration. A cautious and well-planned approach, emphasizing careful brand management, efficient operational integration, and awareness of prevailing market conditions, is absolutely crucial for the long-term success of this ambitious undertaking. We encourage you to continue following the developments of the "Canadian Tire-Hudson's Bay Combination" and share your thoughts and opinions on the potential outcomes. Let's discuss the long-term success of this merger – what are your predictions?

Featured Posts

-

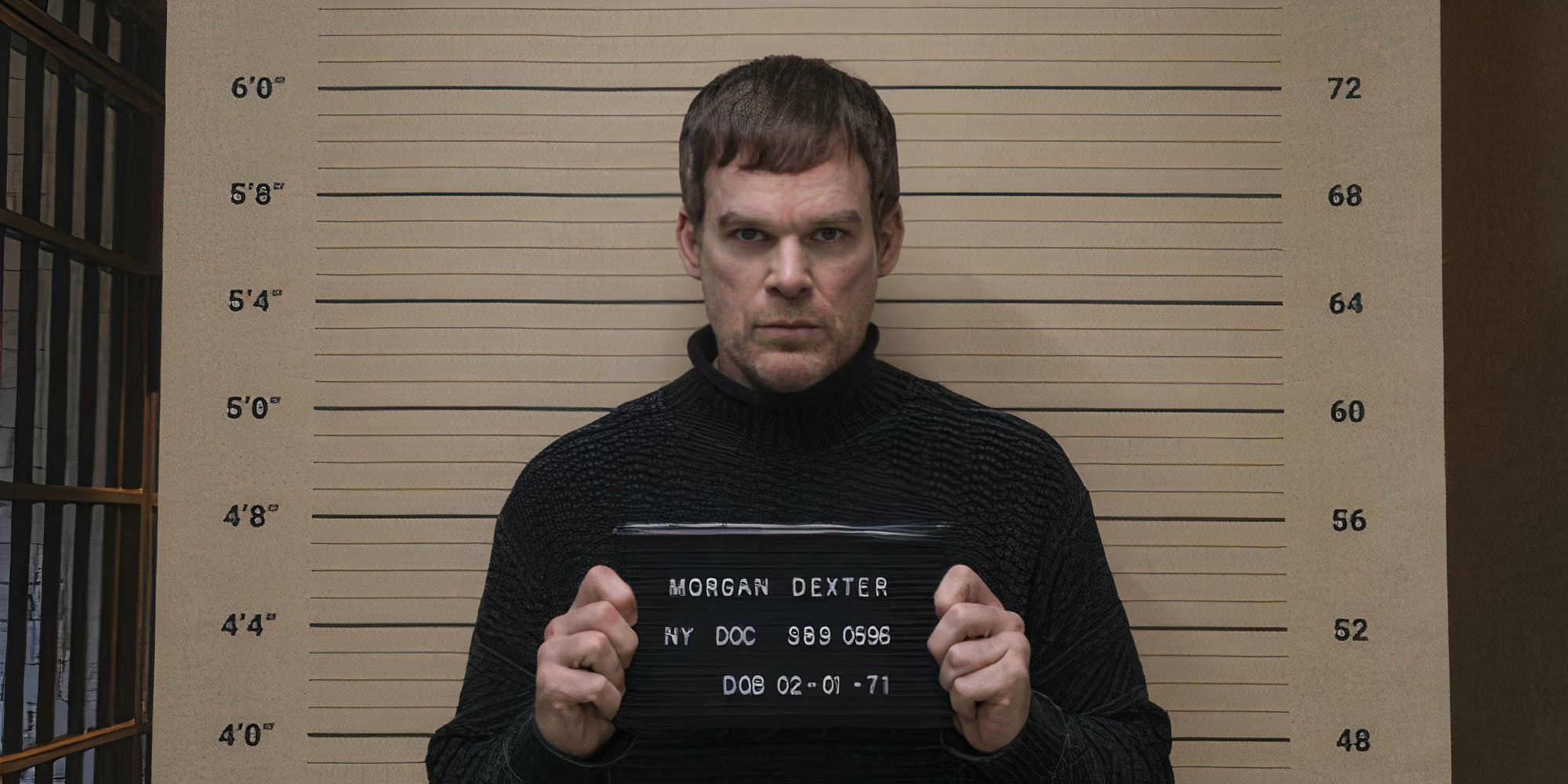

Dexter Resurrection Die Rueckkehr Der Kultfiguren

May 21, 2025

Dexter Resurrection Die Rueckkehr Der Kultfiguren

May 21, 2025 -

Councillors Wife To Challenge Jail Term After Migrant Social Media Rant

May 21, 2025

Councillors Wife To Challenge Jail Term After Migrant Social Media Rant

May 21, 2025 -

Giakoymakis Odigei Tin Kroyz Azoyl Ston Teliko Toy Champions League

May 21, 2025

Giakoymakis Odigei Tin Kroyz Azoyl Ston Teliko Toy Champions League

May 21, 2025 -

Building A Food Business In Louth Lessons From A Young Entrepreneur

May 21, 2025

Building A Food Business In Louth Lessons From A Young Entrepreneur

May 21, 2025 -

Trans Australia Run World Record On The Brink

May 21, 2025

Trans Australia Run World Record On The Brink

May 21, 2025

Latest Posts

-

Giakoymakis To Mls Perimenei Tin Epistrofi Toy

May 21, 2025

Giakoymakis To Mls Perimenei Tin Epistrofi Toy

May 21, 2025 -

T Helei O Giakoymakis Na Epistrepsei Sto Mls I Apopsi Ton Amerikanon

May 21, 2025

T Helei O Giakoymakis Na Epistrepsei Sto Mls I Apopsi Ton Amerikanon

May 21, 2025 -

Factors Affecting Giorgos Giakoumakis Transfer Value In The Mls

May 21, 2025

Factors Affecting Giorgos Giakoumakis Transfer Value In The Mls

May 21, 2025 -

I Epistrofi Toy Giakoymaki Sto Mls Pragmatikotita I Fantasia

May 21, 2025

I Epistrofi Toy Giakoymaki Sto Mls Pragmatikotita I Fantasia

May 21, 2025 -

Assessing Giorgos Giakoumakis Market Value Ahead Of A Potential Mls Transfer

May 21, 2025

Assessing Giorgos Giakoumakis Market Value Ahead Of A Potential Mls Transfer

May 21, 2025