Canadian Private Investment: CAAT Pension Plan's Focus

Table of Contents

CAAT Pension Plan's Investment Philosophy and Objectives

The CAAT Pension Plan's overarching investment goal is to secure the long-term retirement income of its members while achieving strong, risk-adjusted returns. This requires a sophisticated and diversified investment strategy. Specific objectives include:

- Securing long-term retirement income for members: This is the paramount objective, driving all investment decisions towards stability and consistent growth.

- Achieving strong, risk-adjusted returns: The plan aims for superior returns while carefully managing risk through diversification and robust risk management frameworks.

- Maintaining a diversified portfolio across asset classes: Diversification mitigates risk by spreading investments across various asset classes, including Canadian private investment, public equities, fixed income, and real estate.

- Supporting responsible and sustainable investment practices: CAAT is committed to Environmental, Social, and Governance (ESG) factors, integrating them into its investment due diligence and decision-making processes. This commitment aligns with growing investor demand for responsible investing and contributes to a more sustainable future.

The plan's commitment to ESG principles is not merely a matter of corporate social responsibility; it's integral to their long-term investment strategy. By investing in companies with strong ESG profiles, CAAT seeks to identify businesses with better long-term prospects and reduced risk. This proactive approach reflects a forward-looking CAAT Pension Plan investment strategy.

Focus Areas within Canadian Private Investment

CAAT Pension Plan's Canadian private investment strategy targets several key sectors offering significant growth potential and alignment with the plan's long-term objectives. These include:

-

Infrastructure: CAAT invests in various infrastructure projects, such as transportation networks, energy facilities, and telecommunications infrastructure. These investments offer stable, long-term cash flows and contribute to the development of essential Canadian infrastructure. For example, investments in renewable energy projects align with ESG goals and contribute to a sustainable energy future. However, large-scale infrastructure projects involve significant capital expenditures and are subject to regulatory risks.

-

Real Estate: The plan strategically invests in both direct real estate ownership and through real estate investment trusts (REITs). This sector offers diversification benefits and potential for long-term capital appreciation. Investments range from commercial properties in major Canadian cities to residential developments in growing urban areas. However, real estate investments are sensitive to interest rate fluctuations and local market conditions.

-

Private Equity: CAAT invests in various private equity funds that provide access to a diversified portfolio of private companies. This strategy offers exposure to high-growth companies with potentially significant returns. This approach allows them to participate in the growth of innovative Canadian businesses, but it also carries higher risk due to the illiquidity of private equity investments.

Geographic diversification within Canada is also a crucial aspect of the CAAT Pension Plan's strategy, minimizing regional risks and capitalizing on opportunities across the country.

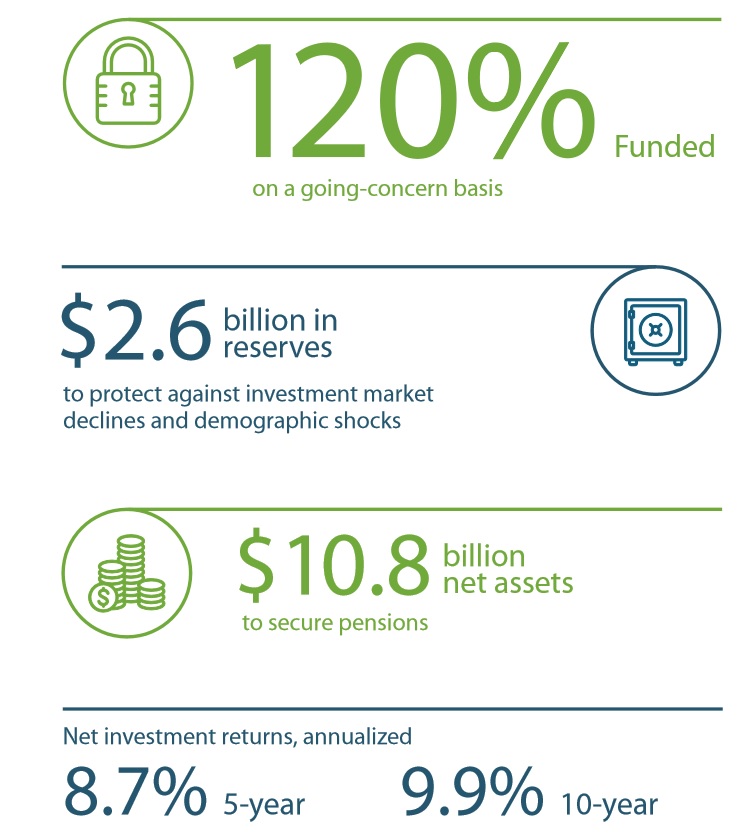

Performance and Impact of CAAT Pension Plan's Investments

Analyzing the historical performance of CAAT's private investment portfolio requires accessing their official reports, as detailed financial information is not always publicly available for private investments. However, publicly available information indicates a generally strong performance, contributing significantly to the overall plan's success. Their investments have demonstrably contributed to Canadian job creation and economic growth by providing capital to businesses and infrastructure projects. Specific success stories often highlight the plan's ability to identify high-growth opportunities and manage risks effectively. Challenges may include market downturns impacting certain sectors, but CAAT's diversified approach mitigates the impact of such events. A comprehensive comparison to benchmarks and other major pension plans requires accessing specialized financial data resources.

Transparency and Reporting

CAAT Pension Plan maintains a level of transparency concerning its investment activities, publishing annual reports and making certain information available to stakeholders. However, detailed breakdowns of individual private investments are often limited due to confidentiality agreements and the sensitive nature of the information. The level of transparency is generally considered adequate within the industry standard for private investment portfolios. Increased transparency is important to build trust with members and the public and to enhance the understanding of the investment strategy’s impact.

Conclusion

The CAAT Pension Plan's investment strategy demonstrates a thoughtful approach to Canadian private investment. Their focus on long-term growth, risk management, diversification, and ESG integration positions them effectively within the Canadian market. Their investments have a positive impact on the Canadian economy by fostering growth and creating jobs. While complete transparency is limited by the nature of private investments, CAAT provides sufficient information to inform stakeholders about its performance and strategy.

Understanding the CAAT Pension Plan Investment Strategy provides valuable insights into the dynamics of the Canadian private investment market. For more detailed information on CAAT Pension Plan investment strategy and its impact, refer to their official website and published reports. Further research into their portfolio will offer a richer understanding of current trends and opportunities within Canadian private investment.

Featured Posts

-

The Yankees Win A Team Performance Not A One Bat Show

Apr 23, 2025

The Yankees Win A Team Performance Not A One Bat Show

Apr 23, 2025 -

18h Eco Lundi 14 Avril Les Points Cles De L Emission

Apr 23, 2025

18h Eco Lundi 14 Avril Les Points Cles De L Emission

Apr 23, 2025 -

Byanat Asear Aldhhb Sbykt 10 Jramat Alathnyn 17 2 2025

Apr 23, 2025

Byanat Asear Aldhhb Sbykt 10 Jramat Alathnyn 17 2 2025

Apr 23, 2025 -

The Truth About Trumps Economic Policies What The Data Shows

Apr 23, 2025

The Truth About Trumps Economic Policies What The Data Shows

Apr 23, 2025 -

Go Ahead Entry At Target Field New Facial Recognition System Speeds Up Lines

Apr 23, 2025

Go Ahead Entry At Target Field New Facial Recognition System Speeds Up Lines

Apr 23, 2025