Canadian Mortgage Terms: Understanding The Preference For Shorter-Term Loans

Table of Contents

The Allure of Shorter-Term Mortgages in Canada

Shorter-term mortgages, typically 5-year terms contrasted with a longer 25-year amortization, are gaining popularity. This means you'll renew your mortgage every five years, rather than committing to a single, longer-term rate.

- Lower interest rate potential over the short term: While not always guaranteed, shorter-term mortgages often come with lower initial interest rates compared to longer-term fixed rates. This is because lenders assess less risk over a shorter period.

- More frequent opportunities to refinance and potentially secure a better rate: The periodic renewal allows you to take advantage of potentially lower interest rates in the market. If rates drop, refinancing can significantly reduce your monthly payments and overall interest paid.

- Faster debt repayment, leading to potential long-term savings: Although you’ll pay the same overall amount (principal and interest) for the amortization period, a shorter term means you'll pay down your principal faster, reducing the total interest paid over the life of the mortgage.

- Increased financial flexibility: Shorter terms offer more control over your financial future. You can adapt to changing circumstances and financial goals more easily.

The impact on savings can be substantial. For example, a $500,000 mortgage amortized over 25 years with a 5% interest rate will result in significantly higher total interest paid compared to a similar mortgage renewed every 5 years, potentially benefitting from lower rates during those renewal periods. Carefully comparing interest rates on different terms, such as a 5-year fixed vs. a 1-year variable Canadian mortgage rate, is crucial for making an informed decision.

Factors Influencing the Choice of Shorter-Term Canadian Mortgages

Several factors contribute to the growing preference for shorter-term Canadian mortgages:

Interest Rate Volatility

- Impact on longer-term mortgages: Fluctuating interest rates pose a greater risk with longer-term mortgages, as your payments remain fixed, even if rates drop.

- Advantage of shorter terms: Shorter terms allow you to adjust to changes in interest rates. If rates fall, refinancing to a lower rate during renewal can save you a significant amount of money.

- Potential for refinancing: This flexibility mitigates the risk associated with long-term fixed-rate mortgages.

Financial Goals and Planning

- Alignment with financial goals: Shorter-term mortgages can align with specific financial goals like paying off your mortgage faster and building wealth. The quicker debt reduction can free up cash flow for other investments.

- Importance of financial planning: Careful financial planning and budgeting are essential for managing shorter-term mortgages. You need a plan to handle potential rate increases at renewal.

- Impact of unexpected life events: Unexpected events (job loss, illness) can significantly impact your ability to repay your mortgage. Having a financial buffer is crucial when opting for shorter terms.

Improved Financial Discipline

- Encouraging disciplined saving: Shorter terms encourage disciplined saving and budgeting. The knowledge that renewal is approaching motivates proactive financial management.

- Psychological benefits: Seeing quicker progress in debt reduction provides psychological satisfaction and reinforces responsible financial habits.

- Increased financial security: Faster debt reduction contributes to increased financial security and peace of mind.

Potential Drawbacks of Shorter-Term Canadian Mortgages

While shorter-term mortgages offer advantages, potential drawbacks should be considered:

The Burden of Refinancing

- Administrative and potential costs: Refinancing involves administrative work and potentially fees, adding to your overall costs.

- Risk of higher interest rates at renewal: Interest rates may rise at renewal, resulting in higher monthly payments. This risk needs careful consideration.

- Importance of financial planning: Thorough financial planning is crucial to mitigate the risks associated with refinancing and fluctuating rates.

Predictability and Stability

- Lack of long-term interest rate certainty: Shorter terms mean less certainty about future interest rates.

- Potential stress of repeated refinancing: The repeated refinancing process can be stressful, requiring careful monitoring of market rates and proactive planning.

- Weighing predictability versus flexibility: The predictability of long-term mortgages should be weighed against the flexibility and potential savings of shorter-term mortgages.

Conclusion

Choosing the right Canadian mortgage terms involves careful consideration of current interest rates, personal financial goals, and risk tolerance. While longer-term mortgages offer predictability, shorter-term mortgages provide flexibility and potential for savings. This article highlighted key aspects to consider when deciding between shorter and longer-term loans. By carefully weighing the benefits and drawbacks, you can make an informed decision that aligns with your circumstances. Remember to consult with a mortgage professional to discuss your options and find the best Canadian mortgage terms to suit your needs.

Featured Posts

-

Fox News Faces Defamation Suit From Ray Epps Over January 6th Reporting

May 04, 2025

Fox News Faces Defamation Suit From Ray Epps Over January 6th Reporting

May 04, 2025 -

Thunderbolts A Deep Dive Into Marvels Latest Venture

May 04, 2025

Thunderbolts A Deep Dive Into Marvels Latest Venture

May 04, 2025 -

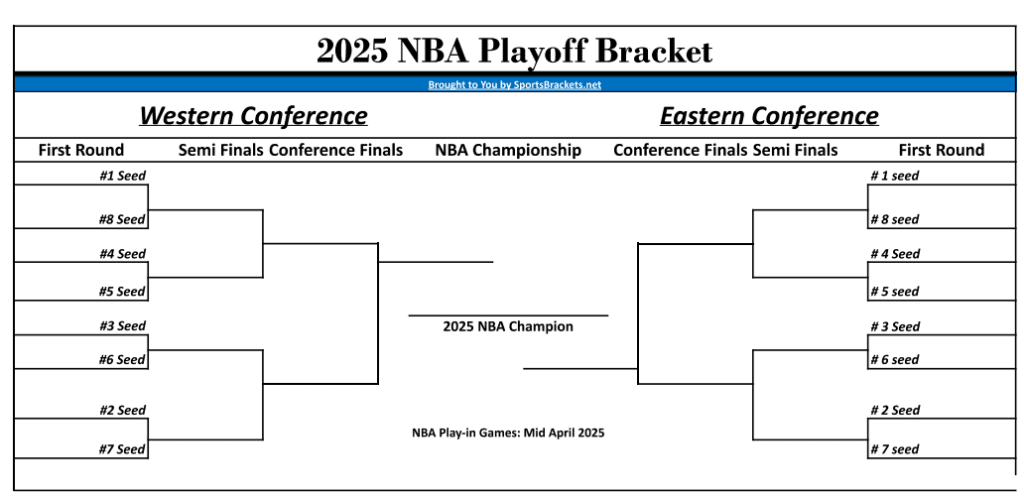

Charles Barkleys Nba Playoff Predictions Oilers And Leafs Make The Cut

May 04, 2025

Charles Barkleys Nba Playoff Predictions Oilers And Leafs Make The Cut

May 04, 2025 -

Solar Power And Lower Bills Dutch Utilities Innovative Tariff Trial

May 04, 2025

Solar Power And Lower Bills Dutch Utilities Innovative Tariff Trial

May 04, 2025 -

Ufc 314 Neal Vs Prates Cancellation Shakes Up Star Studded Card

May 04, 2025

Ufc 314 Neal Vs Prates Cancellation Shakes Up Star Studded Card

May 04, 2025

Latest Posts

-

Did Jean Silva Curse At Bryce Mitchell Ufc 314 Press Conference Fallout

May 04, 2025

Did Jean Silva Curse At Bryce Mitchell Ufc 314 Press Conference Fallout

May 04, 2025 -

Major Fight Cancellation Impacts Ufc 314s Star Studded Lineup

May 04, 2025

Major Fight Cancellation Impacts Ufc 314s Star Studded Lineup

May 04, 2025 -

Ufc 314 Mitchell And Silvas Heated Exchange At The Press Conference

May 04, 2025

Ufc 314 Mitchell And Silvas Heated Exchange At The Press Conference

May 04, 2025 -

Star Studded Ufc 314 Card Takes Hit Neal Vs Prates Fight Off

May 04, 2025

Star Studded Ufc 314 Card Takes Hit Neal Vs Prates Fight Off

May 04, 2025 -

Bryce Mitchell Accuses Jean Silva Of Using Foul Language At Ufc 314 Presser

May 04, 2025

Bryce Mitchell Accuses Jean Silva Of Using Foul Language At Ufc 314 Presser

May 04, 2025