Canadian Housing Crisis: Posthaste Down Payments Price Out Buyers

Table of Contents

The Canadian dream of homeownership is increasingly out of reach for many, fueled by a severe housing crisis. Skyrocketing housing prices, combined with rapidly increasing down payment requirements, are effectively pricing first-time buyers out of the market. This article explores the multifaceted challenges contributing to this crisis and its impact on Canadians struggling with housing affordability. The high cost of homeownership is impacting the Canadian dream for many.

<h2>The Impact of Rising Housing Prices on Down Payments</h2>

<h3>Escalating Real Estate Costs in Major Cities</h3>

Exorbitant home prices in major Canadian cities like Toronto, Vancouver, and Montreal are a primary driver of the housing crisis. These cities consistently rank among the most expensive real estate markets globally, making homeownership a distant prospect for many.

- Average home prices: In 2023, average home prices in Toronto exceeded $1 million, while Vancouver and Montreal saw significantly elevated prices as well.

- Year-over-year price increases: Double-digit percentage increases in home prices have been common in recent years, making it incredibly difficult for buyers to keep pace.

- Impact on affordability: The sheer cost of entry into the market necessitates significantly larger down payments, pushing homeownership beyond the reach of many first-time buyers and even established families looking to upgrade.

<h3>The Minimum Down Payment Requirement and its Implications</h3>

The minimum down payment required significantly impacts affordability. The Canada Mortgage and Housing Corporation (CMHC) insures mortgages, but the required down payment percentage varies depending on the home's price.

- CMHC insured mortgages: These mortgages require a minimum down payment of 5% for homes priced under $500,000.

- Higher down payment requirements: For homes priced above $500,000, the down payment percentage increases, reaching 10% for homes between $500,000 and $1 million, and even higher for more expensive properties.

- Challenges for first-time buyers: Saving for a substantial down payment, especially in high-cost markets, represents a major hurdle for first-time buyers. Many struggle to save enough for a down payment while simultaneously managing other living expenses. This creates a significant barrier to entry into the housing market.

<h2>The Role of Interest Rates in Exacerbating the Crisis</h2>

<h3>The Impact of Rising Mortgage Rates on Monthly Payments</h3>

Higher interest rates dramatically increase monthly mortgage payments, making homeownership less attainable, even with a substantial down payment.

- Illustrative examples: A $500,000 mortgage at a 5% interest rate will have a significantly lower monthly payment than the same mortgage at a 7% interest rate. This difference can be substantial, impacting affordability significantly.

- Bank of Canada's monetary policy: The Bank of Canada's actions directly influence interest rates. Increases in the policy rate directly translate to higher borrowing costs for homebuyers.

<h3>The Difficulty in Securing a Mortgage with Higher Rates</h3>

Securing a mortgage becomes more challenging with higher interest rates, even with a large down payment.

- Stress test requirements: The stress test, implemented to ensure borrowers can handle potential interest rate increases, makes it harder to qualify for a mortgage.

- Tightening lending criteria: Financial institutions are tightening lending criteria, further reducing the number of individuals who can qualify for a mortgage.

<h2>Government Policies and Their Effectiveness in Addressing the Crisis</h2>

<h3>Analysis of Existing Federal and Provincial Housing Policies</h3>

Various federal and provincial government initiatives aim to improve housing affordability. However, their effectiveness remains a subject of debate.

- Examples of government programs: The First-Time Home Buyers' Incentive offers grants to help with down payments, but its impact is limited. Other initiatives focus on increasing the supply of affordable housing units.

- Pros and cons of each policy: While some programs offer limited relief, many critics argue they don't adequately address the core issues driving the housing crisis, such as supply constraints and speculative investment.

<h3>Suggestions for Improved Government Intervention</h3>

More robust government intervention is crucial to address the Canadian housing crisis.

- Increased funding for affordable housing: Significant increases in funding for the construction of affordable housing units are essential.

- Tax incentives: Targeted tax incentives for first-time homebuyers could lessen the financial burden of homeownership.

- Regulation of foreign investment: Stricter regulations on foreign investment in the Canadian real estate market could curb price inflation.

<h2>Alternative Housing Solutions and Strategies for First-Time Buyers</h2>

<h3>Exploring Options like Condos and Townhouses</h3>

Smaller properties like condos and townhouses can represent a more attainable entry point into the housing market.

- Average prices: These properties generally have lower average prices than detached houses.

- Pros and cons: While smaller, they offer a pathway to homeownership, although they might lack the space of a detached house.

<h3>The Role of Rent-to-Own Programs</h3>

Rent-to-own programs provide an alternative path to homeownership, but potential buyers should carefully consider the risks involved.

- Advantages and disadvantages: Rent-to-own can allow buyers to gradually build equity, but it often involves higher overall costs and carries potential risks if the program isn't structured properly.

<h2>Conclusion</h2>

The Canadian housing crisis, characterized by soaring down payments and rapidly increasing prices, poses a significant barrier to homeownership for many Canadians, particularly first-time buyers. Rising interest rates further exacerbate the problem, making it crucial for both the government and individuals to explore innovative solutions. High down payment requirements are making it difficult to even consider homeownership.

Call to Action: Understanding the intricacies of the Canadian housing crisis and exploring all available options is the first step towards achieving the dream of homeownership. Continue researching strategies to navigate the challenges of securing a home in today's market and explore available resources to find the best solutions for your financial situation. Don't let the current challenges with high down payments deter you from pursuing your dream of homeownership. There are options available, and with thorough research and planning, you can navigate the Canadian housing market.

Featured Posts

-

Will Arsenal Win The Champions League Ferdinands Prediction And Analysis

May 09, 2025

Will Arsenal Win The Champions League Ferdinands Prediction And Analysis

May 09, 2025 -

Palantir Stock A Pre May 5th Investment Analysis Based On Wall Streets Opinion

May 09, 2025

Palantir Stock A Pre May 5th Investment Analysis Based On Wall Streets Opinion

May 09, 2025 -

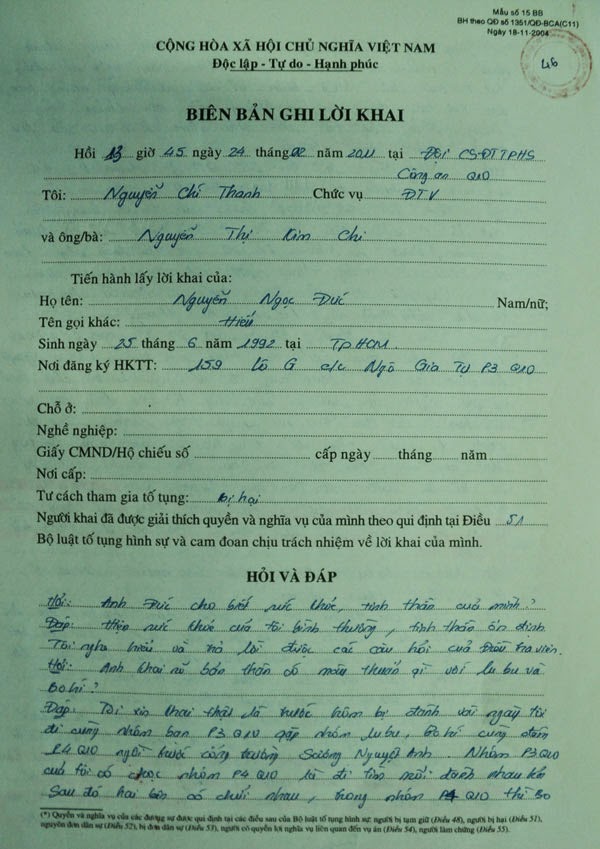

Loi Khai Gay Soc Bao Mau Tat Tre Toi Tap O Tien Giang

May 09, 2025

Loi Khai Gay Soc Bao Mau Tat Tre Toi Tap O Tien Giang

May 09, 2025 -

Tarlov And Pirro Clash Over Us Canada Trade Dispute

May 09, 2025

Tarlov And Pirro Clash Over Us Canada Trade Dispute

May 09, 2025 -

Sporedba Dali Neko Mu Parira Na Bekam

May 09, 2025

Sporedba Dali Neko Mu Parira Na Bekam

May 09, 2025