Canadian Economy And Interest Rates: Analyzing The Effects Of Tariffs On Bank Of Canada Policy

Table of Contents

The Impact of Tariffs on Inflation in Canada

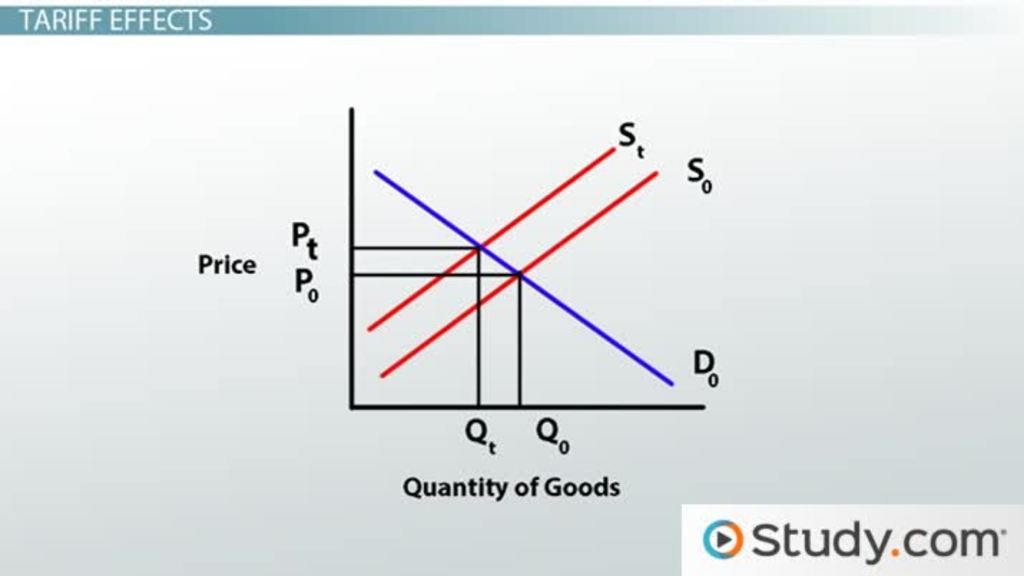

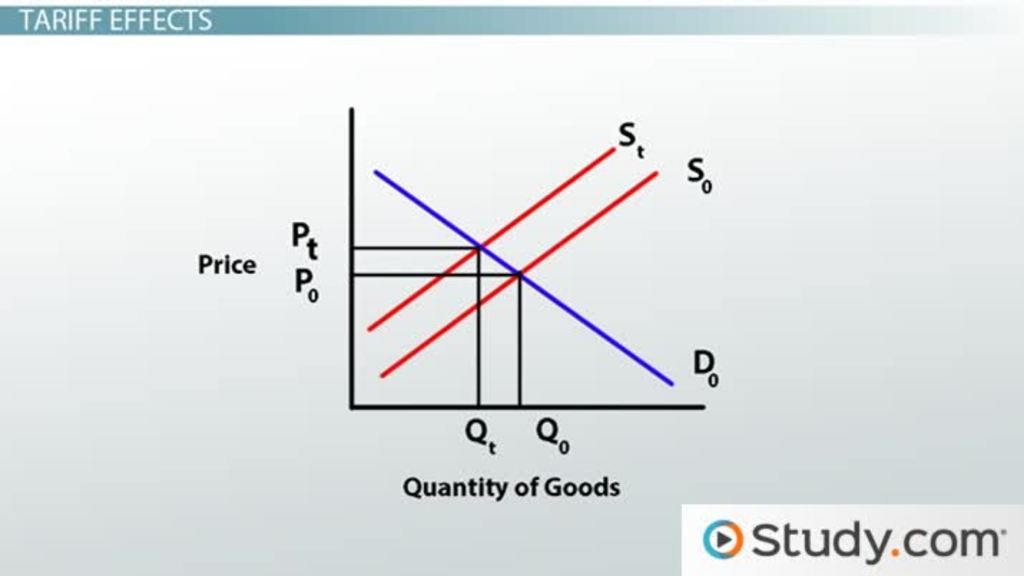

Tariffs, essentially taxes on imported goods, significantly influence inflation within the Canadian economy. This impact manifests in several key ways:

Increased Import Costs

Tariffs directly increase the price of imported goods. This leads to higher inflation because businesses pass these increased costs onto consumers.

- Increased prices for consumers: Higher prices for everyday goods, from clothing to electronics, reduce consumer purchasing power.

- Reduced purchasing power: Consumers have less disposable income, potentially leading to decreased spending and slower economic growth.

- Potential for decreased consumer spending: Reduced consumer confidence can lead to a decline in overall demand, impacting businesses reliant on consumer spending.

Supply Chain Disruptions

The imposition of tariffs can disrupt global supply chains. This disruption can lead to shortages of certain goods and further contribute to price increases.

- Increased uncertainty for businesses: Businesses face difficulties in forecasting costs and planning for production, leading to hesitancy in investment.

- Potential for decreased business investment: Uncertainty and higher costs deter businesses from investing in expansion or new projects.

- Ripple effects across various sectors: Supply chain disruptions in one sector can have cascading effects throughout the Canadian economy.

Impact on the Consumer Price Index (CPI)

The Consumer Price Index (CPI) is a key metric used to measure inflation. Tariffs directly impact the CPI by increasing the cost of imported goods and services included in the index.

- Analysis of historical data correlating tariffs and CPI increases: Examining past instances of tariff implementation reveals a clear correlation between increased tariffs and subsequent rises in the CPI.

- Predictive modelling of future inflation based on tariff implementation: Economic models can forecast the potential inflationary pressure based on the magnitude and scope of newly implemented tariffs. This allows for proactive policy adjustments.

Bank of Canada's Response to Tariff-Induced Inflation

The Bank of Canada, as the central bank of Canada, is responsible for maintaining price stability and full employment. In response to tariff-induced inflation, it typically employs several strategies:

Interest Rate Adjustments

The most common tool used by the Bank of Canada to combat inflation is adjusting interest rates. When inflation rises, the Bank typically raises interest rates.

- Mechanism of interest rate hikes to curb inflation: Higher interest rates make borrowing more expensive, reducing consumer spending and business investment, thus cooling down the economy and curbing inflationary pressures.

- Considerations of the Bank of Canada's mandate – price stability and full employment: The Bank must balance its mandate to control inflation with its aim of maintaining full employment; raising interest rates too aggressively can lead to a recession.

- Potential for a recessionary effect with aggressive interest rate increases: While necessary to control inflation, aggressive interest rate hikes can stifle economic growth and potentially lead to job losses.

Quantitative Tightening (QT)

Quantitative tightening (QT) is another tool the Bank of Canada might use to combat inflation. It involves reducing the money supply by selling government bonds.

- Explanation of quantitative tightening and its impact on the money supply: By selling bonds, the Bank reduces the amount of money circulating in the economy, thus dampening demand and inflationary pressures.

- Comparison of QT's effectiveness versus interest rate adjustments: QT is a less direct method than interest rate adjustments, and its effectiveness can be debated.

- Potential risks and unintended consequences of QT: QT can have unintended consequences, such as impacting credit markets and financial stability.

Balancing Economic Growth and Inflation Control

The Bank of Canada faces a delicate balancing act: controlling inflation without triggering a recession. This is particularly challenging when inflation is driven by external factors like tariffs.

- Analysis of the Bank of Canada's policy statements and communications: Studying the Bank's public statements reveals its approach to navigating this challenge.

- Discussion of the economic forecasting models used by the central bank: The Bank utilizes sophisticated economic models to forecast inflation and the impact of its policy decisions.

Sectoral Impacts of Tariffs and Interest Rate Changes

The impact of tariffs and subsequent interest rate changes is not uniform across all sectors of the Canadian economy.

Manufacturing and Export-Oriented Industries

These sectors are particularly vulnerable to tariffs and interest rate hikes.

- Increased costs of production and reduced competitiveness: Higher input costs due to tariffs reduce competitiveness in global markets.

- Potential job losses and reduced investment: Businesses might cut back on production, leading to job losses and decreased investment.

Import-Dependent Industries

Industries heavily reliant on imported goods are significantly affected by higher import prices and interest rates.

- Increased costs for businesses and potential price increases for consumers: Businesses face higher input costs, forcing them to increase prices, impacting consumers.

- Potential for business closures and job losses: Businesses struggling with increased costs might be forced to close, leading to job losses.

Conclusion

The interplay between tariffs, the Canadian economy, and interest rates set by the Bank of Canada is a complex and dynamic relationship. Tariffs can significantly influence inflation, forcing the Bank of Canada to adjust its monetary policy, including raising interest rates to manage inflation, potentially impacting various sectors of the economy differently. Understanding these intricate effects is crucial for navigating the evolving Canadian economic landscape. Staying informed on the Bank of Canada's actions and their potential repercussions on Canadian economy and interest rates is vital for making informed financial decisions. Further research into the specific impacts of various tariff implementations and their influence on the Canadian economy and interest rates is encouraged.

Featured Posts

-

Le Depart D Alexis Kohler Quelles Consequences Pour Emmanuel Macron

May 14, 2025

Le Depart D Alexis Kohler Quelles Consequences Pour Emmanuel Macron

May 14, 2025 -

Safety Alert Walmart Recalls Unstable Dressers And Other Baby Products

May 14, 2025

Safety Alert Walmart Recalls Unstable Dressers And Other Baby Products

May 14, 2025 -

Muere Jose Pepe Mujica Expresidente De Uruguay A Los 89 Anos

May 14, 2025

Muere Jose Pepe Mujica Expresidente De Uruguay A Los 89 Anos

May 14, 2025 -

Eurojackpot Am Freitag Die Gewinnzahlen Des 09 Mai 2025

May 14, 2025

Eurojackpot Am Freitag Die Gewinnzahlen Des 09 Mai 2025

May 14, 2025 -

Orari Di Passaggio Milano Sanremo 2025 E Sanremo Women In Provincia Di Imperia

May 14, 2025

Orari Di Passaggio Milano Sanremo 2025 E Sanremo Women In Provincia Di Imperia

May 14, 2025