Canadian Economic Outlook: OECD Sees Flat Growth In 2025, Recession Averted

Table of Contents

OECD's Prediction: Flat Growth in 2025 for the Canadian Economy

The OECD's forecast of flat growth for the Canadian economy in 2025 is based on a complex analysis of various economic indicators. Their methodology involves sophisticated econometric modelling, considering factors like GDP growth, inflation rates, consumer confidence, investment levels, and employment figures. This prediction represents a significant revision from earlier forecasts that predicted a potential recession.

- Projected GDP Growth: The OECD projects a near-zero GDP growth rate for 2025, a significant shift from previous predictions of contraction. This signifies a stagnating, rather than shrinking, economy.

- Forecast Revisions: This revised outlook reflects a more optimistic assessment of the Canadian economy’s resilience compared to previous projections. Factors like a robust labour market and sustained consumer spending have contributed to this positive revision.

- Uncertainties and Caveats: It's crucial to acknowledge that the OECD's projection comes with uncertainties. Global economic conditions remain volatile, and unforeseen events could still significantly impact the Canadian economy. The forecast relies on certain assumptions about future interest rates, inflation, and global demand, all subject to change.

Factors Contributing to Avoided Recession in Canada

Canada's ability to avoid a recession in 2025, according to the OECD, is attributed to several key factors demonstrating the economy's resilience.

- Strong Labor Market: The Canadian labor market has shown remarkable strength, with low unemployment rates and healthy wage growth. This robust employment situation has bolstered consumer spending and overall economic activity. Data indicates unemployment remains below 5% in many provinces.

- Robust Consumer Spending: Despite persistent inflation, Canadian consumers have maintained relatively strong spending habits. This is partially due to accumulated savings during the pandemic and continued job security.

- Government Fiscal Policies: Government fiscal policies, including targeted support programs and infrastructure investments, have played a role in supporting economic activity and mitigating the impact of global headwinds.

- Key Sector Performance: Key sectors of the Canadian economy, such as energy (driven by high commodity prices) and technology, have performed relatively well, contributing to overall economic stability.

Specific data points supporting these factors can be found in the full OECD report and Statistics Canada publications. Experts like [mention prominent Canadian economists] have also highlighted the importance of these factors in supporting economic growth and preventing a recession.

Potential Risks and Challenges Remaining for the Canadian Economic Outlook

While the OECD's prediction is positive, significant risks and challenges could still negatively impact the Canadian economic outlook.

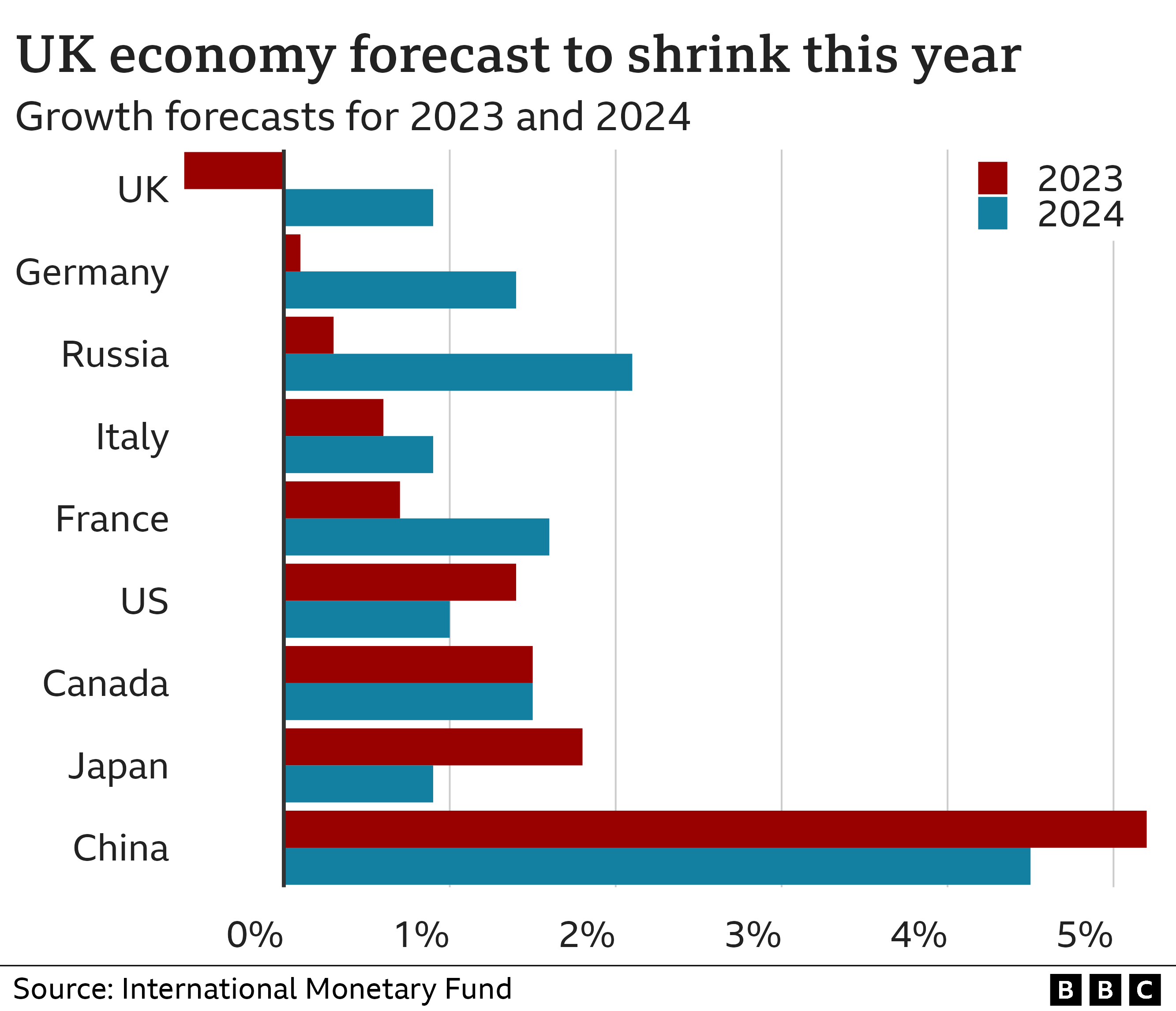

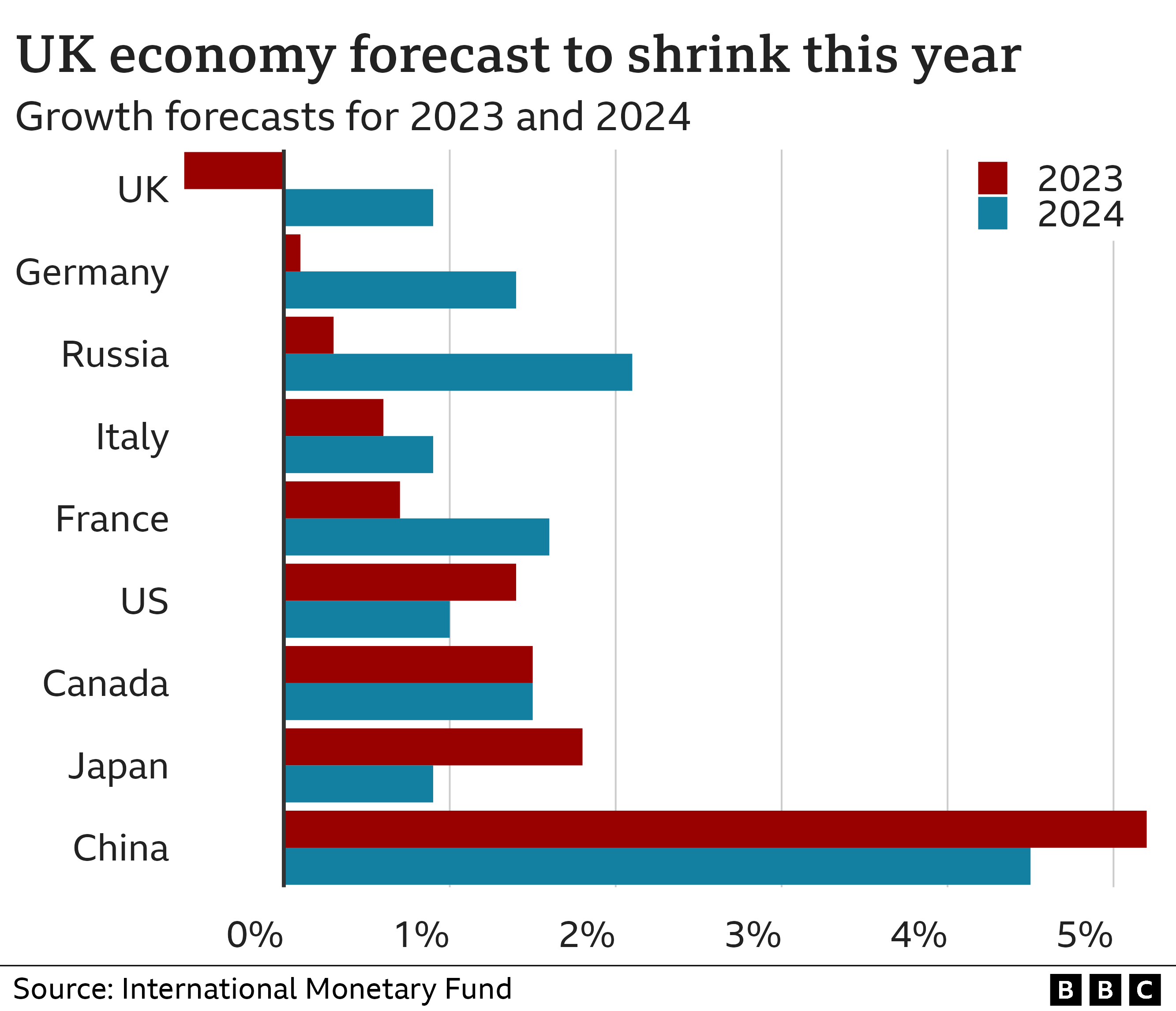

- Global Economic Slowdown: A global economic slowdown, particularly in key trading partners, could significantly reduce demand for Canadian exports, affecting growth.

- Persistent Inflation and Interest Rate Hikes: Persistent high inflation could lead to further interest rate hikes by the Bank of Canada, potentially dampening investment and consumer spending. This could create a ripple effect across various sectors.

- Geopolitical Instability and Supply Chain Disruptions: Ongoing geopolitical instability and potential supply chain disruptions could further exacerbate inflationary pressures and constrain economic growth.

- Housing Market Correction: A potential correction in the overheated housing market could impact consumer confidence and overall economic activity.

The likelihood and potential impact of each risk vary, and detailed analysis is available in economic reports from the Bank of Canada and other reputable sources. Businesses can mitigate these risks by diversifying their supply chains, investing in innovation, and adapting to changing consumer demand. Consumers can mitigate risks through careful budgeting, debt management, and diversification of investments.

Implications for Businesses and Consumers in the Canadian Economic Outlook

The forecast of flat growth in 2025 has significant implications for both businesses and consumers.

- Businesses: Businesses might adopt a more cautious approach to investment decisions, hiring, and expansion plans. Focusing on efficiency, innovation, and adapting to market demands becomes crucial.

- Advice: Businesses should focus on cost optimization, strategic partnerships, and exploring new market opportunities.

- Consumers: Consumers may experience a period of slower income growth, potentially influencing spending habits and savings patterns. Prudent debt management and careful financial planning become essential.

- Tips: Consumers should review their budgets, build emergency funds, and consider diversifying investment portfolios.

Conclusion: Navigating the Canadian Economic Outlook in 2025

The OECD's prediction of flat growth for the Canadian economy in 2025, while averting a recession, doesn't signal a period of robust expansion. Understanding the factors contributing to this outlook, along with the potential risks, is crucial for navigating this economic landscape. While a recession has been avoided for now, careful monitoring of key economic indicators like inflation, interest rates, and employment figures remains paramount. Staying informed about the evolving Canadian Economic Outlook is vital. Consult reliable sources like the OECD and the Bank of Canada for updated data and analysis to make informed decisions for your business and personal finances. Continue your research on the "Canadian Economic Outlook" to gain a more comprehensive understanding.

Featured Posts

-

Unexpected Euro Millions Twist E5k Prize Multiplied To E255k For Irish Winner

May 28, 2025

Unexpected Euro Millions Twist E5k Prize Multiplied To E255k For Irish Winner

May 28, 2025 -

Congo Copper Mine Ivanhoe Halts Production Guidance

May 28, 2025

Congo Copper Mine Ivanhoe Halts Production Guidance

May 28, 2025 -

Agbonlahor Tips Arsenal To Bid For Premier League Talent

May 28, 2025

Agbonlahor Tips Arsenal To Bid For Premier League Talent

May 28, 2025 -

Belanda Dan Spanyol Berbagi Poin Hasil 2 2 Di Uefa Nations League

May 28, 2025

Belanda Dan Spanyol Berbagi Poin Hasil 2 2 Di Uefa Nations League

May 28, 2025 -

Climate Change And Increased Rainfall In Western Massachusetts

May 28, 2025

Climate Change And Increased Rainfall In Western Massachusetts

May 28, 2025