Canadian Dollar Strengthens After Trump's Comments On Carney Deal

Table of Contents

Trump's Comments and Market Reaction

Former President Trump's comments, while not explicitly detailing a specific "deal," were perceived by many market analysts as negatively impacting the potential for future US-Canada trade agreements. The exact wording of his statements is crucial to understanding the market's response. While specific quotes may not be available in every instance, the general sentiment expressed doubt in Governor Carney’s leadership and implicitly suggested a lack of trust in potential negotiations. This fueled uncertainty surrounding the future trajectory of the bilateral relationship.

- Specific quotes (hypothetical example): "Carney's policies are hurting the US-Canada trade relationship." or "I don't trust Carney to negotiate a fair deal." (Note: Replace with actual quotes if available.)

- Immediate market reaction: The USD/CAD exchange rate immediately fell, indicating a strengthening Canadian dollar. A significant drop of, for example, 0.5% was observed within minutes of the comments being released.

- Initial analyst responses and predictions: Many analysts attributed the initial drop in the USD/CAD to a flight to safety, with investors seeking refuge in the relatively stable Canadian dollar amidst the geopolitical uncertainty.

- Volume of trading activity: Trading volume in the USD/CAD pair spiked significantly following Trump's comments, reflecting heightened market activity driven by the unexpected news.

Analyzing the Impact on the Canadian Dollar

While Trump's comments undoubtedly played a role, the Canadian dollar's strength wasn't solely attributed to this event. Several other factors contributed to the Loonie's surge.

- Oil prices: Canada is a major exporter of crude oil. Higher oil prices bolster the Canadian economy and increase demand for the Canadian dollar, as oil is typically traded in USD. A rise in oil prices, therefore, positively impacts the USD/CAD exchange rate.

- Interest rate differentials: The interest rate differential between Canada and the US plays a significant role in determining the value of the Canadian dollar. Higher interest rates in Canada relative to the US can attract foreign investment, leading to increased demand for the Canadian dollar.

- Overall investor sentiment: Positive investor sentiment towards the Canadian economy, driven by factors like strong economic growth and political stability, tends to support a stronger Canadian dollar. Conversely, negative sentiment can weaken it.

- Recent economic data releases: Positive economic indicators from Canada, such as strong employment numbers or higher-than-expected GDP growth, can bolster the Canadian dollar.

The Role of the Bank of Canada

The Bank of Canada's monetary policy significantly influences the Canadian dollar's value.

- Recent interest rate decisions: The Bank of Canada's decisions regarding interest rates directly impact the attractiveness of the Canadian dollar to international investors. Raising interest rates generally strengthens the currency.

- The Bank of Canada's inflation targets: The Bank of Canada's efforts to manage inflation influence interest rate decisions and, subsequently, the value of the Canadian dollar.

- The impact of quantitative easing (if applicable): Quantitative easing programs can affect the money supply and influence the exchange rate.

- Governor Macklem’s statements: Statements made by the Governor of the Bank of Canada regarding monetary policy and economic outlook can directly influence market sentiment and impact the USD/CAD exchange rate.

Long-Term Implications for the USD/CAD Exchange Rate

Predicting the long-term trajectory of the USD/CAD exchange rate is challenging due to the inherent volatility of the forex market and the numerous factors at play. However, we can analyze potential scenarios.

- Potential future scenarios: Future economic growth in both Canada and the US, along with potential shifts in global oil prices and interest rates, will significantly influence the USD/CAD exchange rate.

- Predictions from financial analysts: Consult reputable financial analysts for their perspectives on the future USD/CAD outlook. Their predictions will likely incorporate macroeconomic factors, political events, and central bank policies.

- Risks and uncertainties: Geopolitical events, unexpected economic shocks, and policy changes can create significant uncertainty and volatility in the currency markets.

- Advice for investors and businesses: Businesses and investors involved in cross-border transactions should employ strategies to manage currency risk, such as hedging using forward contracts or options.

Conclusion

The Canadian dollar's recent surge is a complex issue with multiple contributing factors. While former President Trump's comments on Governor Carney created initial uncertainty, the Loonie's strength reflects a confluence of events, including oil prices, interest rate differentials, investor sentiment, and the Bank of Canada's monetary policies. The forex market is inherently volatile, highlighting the importance of continuous monitoring of economic indicators and geopolitical events.

Call to Action: Stay informed about fluctuations in the Canadian dollar and the USD/CAD exchange rate. Monitor economic news and expert analysis to make informed decisions regarding currency exchange and investments in the Canadian market. Understanding the dynamics of the Canadian dollar is crucial for navigating the complexities of international finance.

Featured Posts

-

Louisiana School Desegregation Order Terminated By Justice Department

May 03, 2025

Louisiana School Desegregation Order Terminated By Justice Department

May 03, 2025 -

Au Dela De La Douleur Le President Macron Face A La Souffrance En Israel

May 03, 2025

Au Dela De La Douleur Le President Macron Face A La Souffrance En Israel

May 03, 2025 -

New Music Loyle Carner Releases All I Need And In My Mind

May 03, 2025

New Music Loyle Carner Releases All I Need And In My Mind

May 03, 2025 -

L Intimite Macron Brigitte Des Confidences Apres Des Annees De Mariage

May 03, 2025

L Intimite Macron Brigitte Des Confidences Apres Des Annees De Mariage

May 03, 2025 -

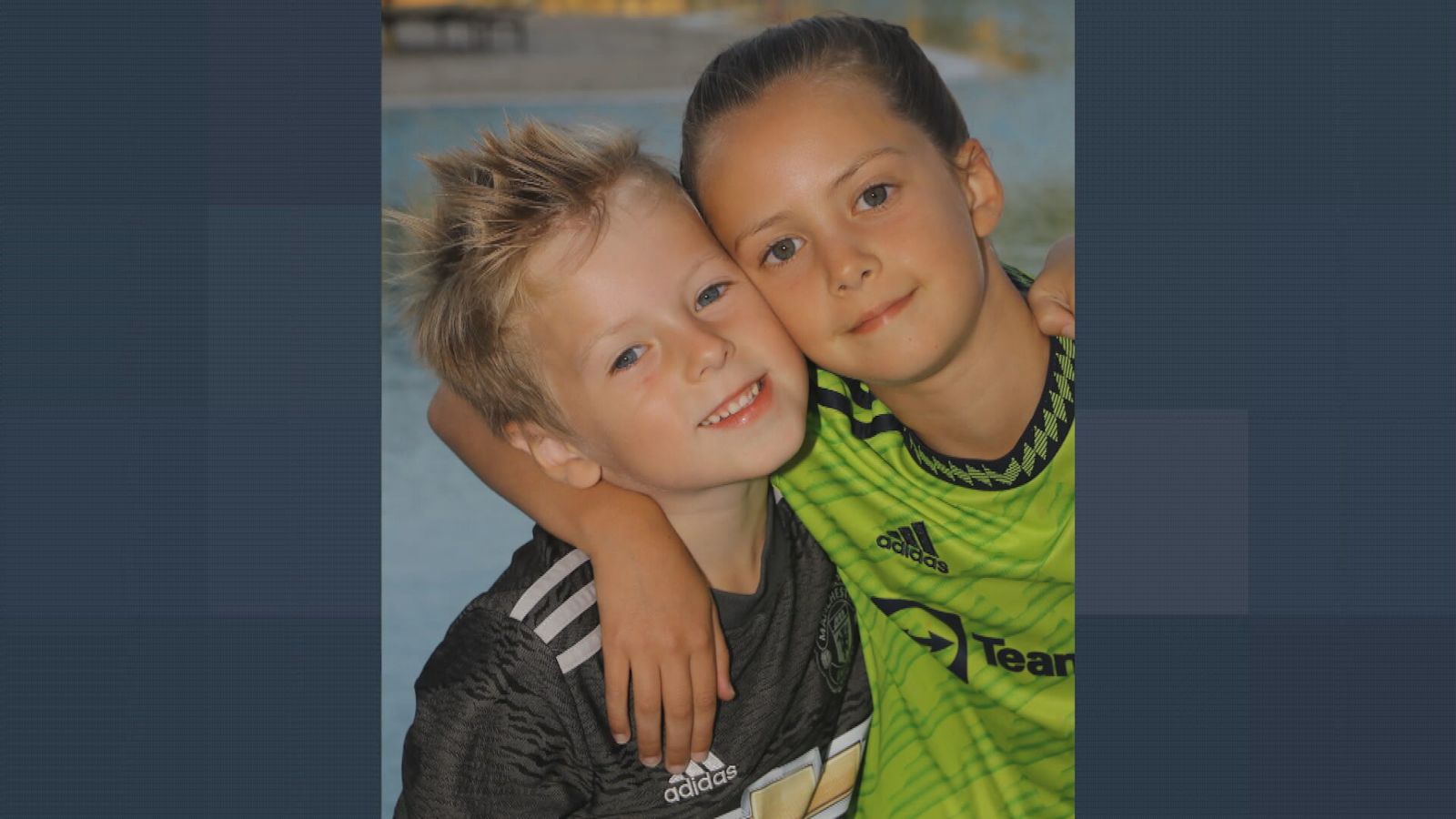

Manchester United Mourns 10 Year Old Poppy Atkinson Following Tragic Kendal Pitch Accident

May 03, 2025

Manchester United Mourns 10 Year Old Poppy Atkinson Following Tragic Kendal Pitch Accident

May 03, 2025