Canadian Dollar Rises: Impact Of Trump's Statement On Carney

Table of Contents

Trump's Statement and its Market Impact

The Exact Nature of Trump's Comments

While the exact wording may vary depending on the source, Trump's comments generally expressed criticism of the Bank of Canada's monetary policies under Governor Macklem. These comments, often delivered via social media or interviews, were perceived by many market analysts as an indirect pressure tactic, potentially influencing the CAD's value. [Insert a quote from Trump if available, properly sourced]. The tone was generally negative, suggesting disapproval of the Bank of Canada's approach to managing the Canadian economy. The ambiguity of the statements allowed for multiple interpretations, contributing to market volatility.

Immediate Market Reaction

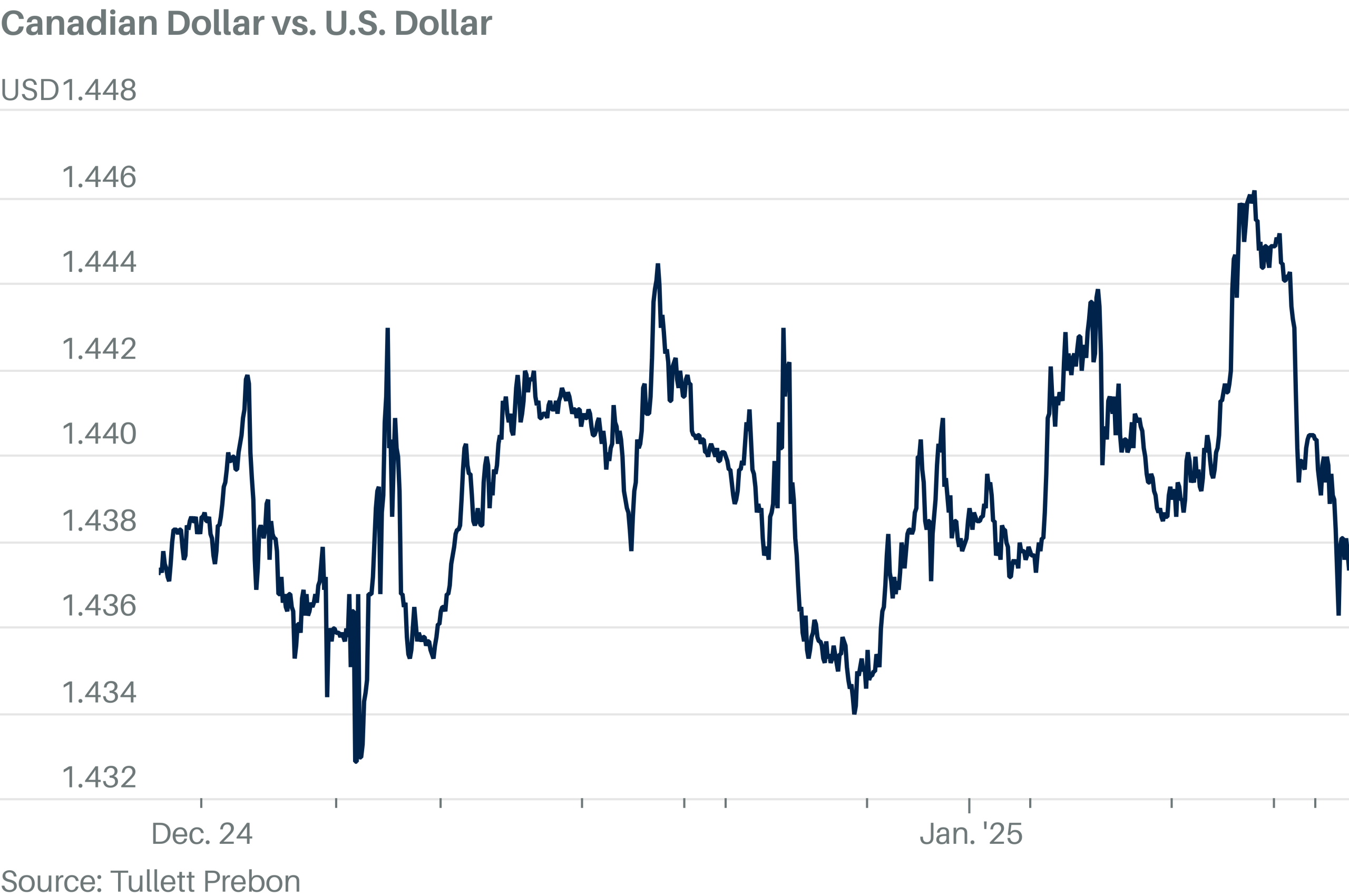

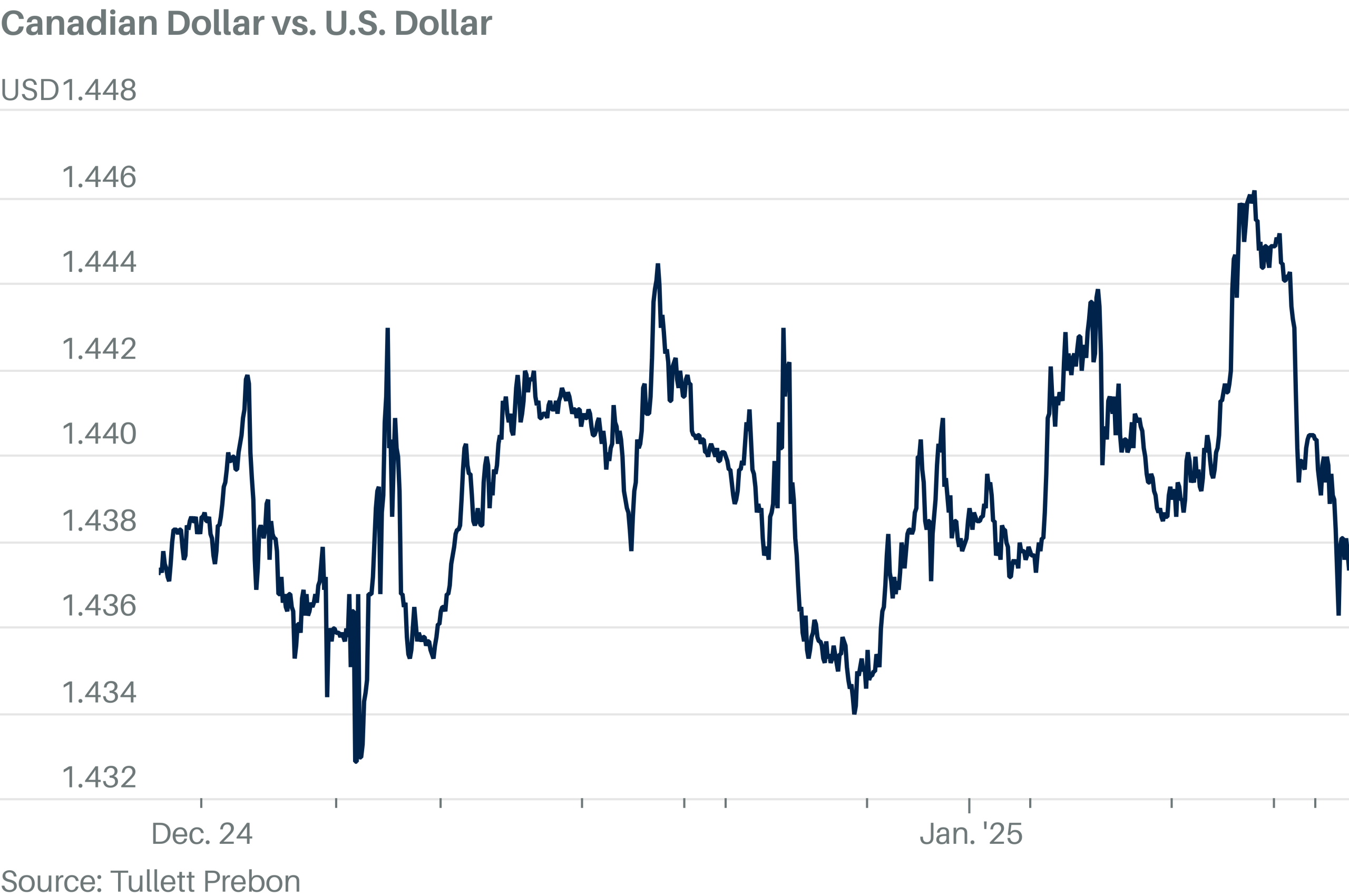

The immediate response to Trump's remarks was a noticeable increase in the Canadian dollar's value. Within hours of the statements being released, we saw:

- A 1.5% increase in the CAD/USD exchange rate.

- A 1.2% rise in the CAD/EUR exchange rate.

- Similar gains against other major currencies like the GBP and JPY.

- A significant spike in trading volume, indicating heightened investor activity.

[Insert a chart or graph visually representing the CAD's appreciation against major currencies following Trump's statement. Source the chart appropriately.] This swift and substantial reaction underscored the market's sensitivity to political pronouncements, particularly those emanating from the US, and their potential impact on global currency markets.

Analysis of Macklem's Role and Response

Macklem's Recent Monetary Policy Decisions

Prior to Trump's statements, the Bank of Canada under Governor Macklem had implemented several monetary policy decisions. These included [mention specific interest rate changes, quantitative easing measures, or other relevant policy adjustments]. These policies aimed to [explain the goals of these policies, e.g., stimulate economic growth, manage inflation]. It's crucial to understand the context of these decisions when analyzing Trump's reaction and its impact on the CAD.

Macklem's Public Response

The Bank of Canada, under Macklem's leadership, generally refrained from directly addressing Trump's comments publicly. [If there was an official statement or press release, include it here with proper sourcing]. The Bank's strategy, in this instance, appeared to be one of maintaining a neutral stance, avoiding escalating the situation and potentially triggering further market volatility. This lack of direct response further fueled speculation and contributed to the ongoing market uncertainty surrounding the CAD's value.

- Recent Bank of Canada Interest Rate Decisions: [Summarize key decisions and their rationale]

- Relevant Statements from Macklem: [Quote relevant statements from official Bank of Canada communications if available]

- Impact on Investor Confidence: [Assess the overall effect of the situation on investor confidence in the Canadian economy and the CAD]

Long-Term Implications for the Canadian Economy

Impact on Exports and Imports

The strengthening CAD has both positive and negative consequences for the Canadian economy. A stronger dollar makes Canadian exports more expensive for foreign buyers, potentially reducing demand and hurting sectors like [mention specific industries like resource extraction or manufacturing]. Conversely, it makes imports cheaper for Canadian consumers, potentially leading to lower inflation in certain sectors.

Effect on Inflation and Economic Growth

The impact of the CAD's rise on inflation and economic growth is complex and depends on various factors. While cheaper imports can lower inflation, reduced export demand might slow economic growth. The net effect will depend on the relative strength of these opposing forces, along with other economic indicators.

- Impact on Specific Canadian Industries: [Detail the effects on tourism, agriculture, and other major industries]

- Potential Inflationary Pressures: [Discuss the interplay between currency fluctuations and inflation]

- Long-Term Economic Consequences: [Offer a cautious prediction of the long-term effects on the Canadian economy]

Conclusion: Understanding the Fluctuations of the Canadian Dollar

In conclusion, the recent surge in the Canadian dollar's value is a complex event with multiple contributing factors. Donald Trump's criticism of the Bank of Canada's policies under Governor Macklem played a significant role in the immediate market reaction, leading to a rapid appreciation of the CAD. The long-term implications for the Canadian economy are varied and require ongoing monitoring. The impact on exports, imports, inflation, and economic growth will unfold over time and depend on various economic and political developments.

To stay informed about the evolving dynamics of the Canadian dollar and to make informed financial decisions, it's crucial to follow market trends closely. Understanding the factors influencing "Canadian Dollar Rises" is key for investors and businesses alike. Consider consulting with financial experts for personalized guidance tailored to your specific circumstances.

Featured Posts

-

Loyle Carner 3 Arena Gig Date Tickets And More

May 02, 2025

Loyle Carner 3 Arena Gig Date Tickets And More

May 02, 2025 -

Sony Play Station Beta Program What We Know So Far

May 02, 2025

Sony Play Station Beta Program What We Know So Far

May 02, 2025 -

Samoas Miss Pacific Islands 2025 Victory

May 02, 2025

Samoas Miss Pacific Islands 2025 Victory

May 02, 2025 -

Explore The New Harry Potter Shop In Chicago

May 02, 2025

Explore The New Harry Potter Shop In Chicago

May 02, 2025 -

Unrecognizable Harry Potters Crabbe Now

May 02, 2025

Unrecognizable Harry Potters Crabbe Now

May 02, 2025

Latest Posts

-

Decoding Ap Decision Notes The Minnesota Special House Race Explained

May 02, 2025

Decoding Ap Decision Notes The Minnesota Special House Race Explained

May 02, 2025 -

Minnesota Special House Election Understanding Ap Decision Notes

May 02, 2025

Minnesota Special House Election Understanding Ap Decision Notes

May 02, 2025 -

Analyzing The Minnesota Special House Election An Ap Decision Notes Perspective

May 02, 2025

Analyzing The Minnesota Special House Election An Ap Decision Notes Perspective

May 02, 2025 -

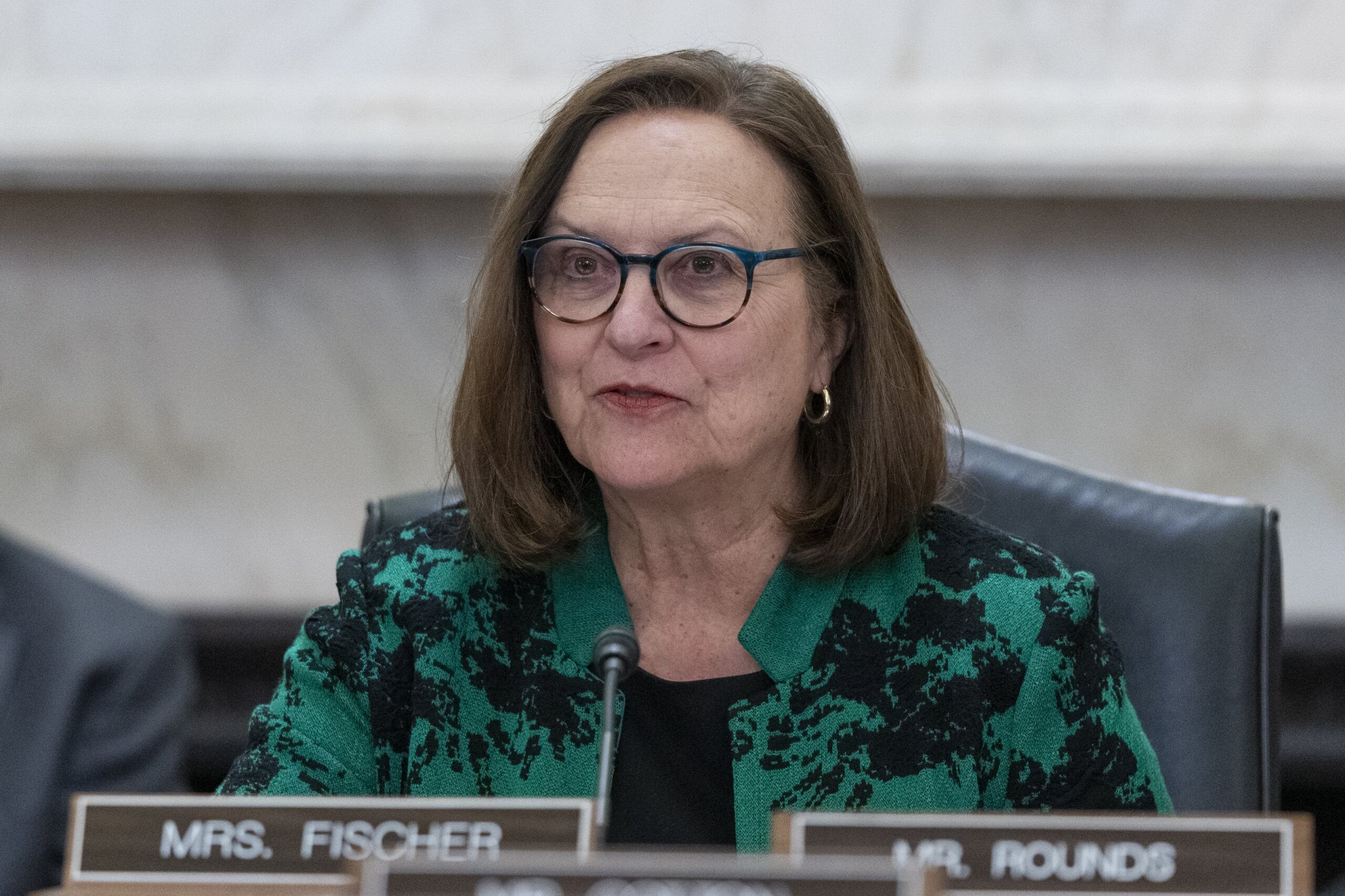

Excellence In Voter Id Nebraska Campaign Receives National Award

May 02, 2025

Excellence In Voter Id Nebraska Campaign Receives National Award

May 02, 2025 -

Decoding Ap Decision Notes Insights Into The Minnesota Special House Election Result

May 02, 2025

Decoding Ap Decision Notes Insights Into The Minnesota Special House Election Result

May 02, 2025