Canadian Dollar Forecast: Minority Government's Impact

Table of Contents

Economic Policies and their Impact on the CAD

The Canadian dollar (CAD), like any currency, is highly sensitive to domestic economic policies. A minority government's inherent instability can significantly impact these policies and, consequently, the Canadian Dollar Forecast.

Fiscal Policy:

Government spending, taxation, and budget deficits significantly influence the CAD. A minority government's need for consensus often leads to protracted budget negotiations and compromises.

- Increased government spending: Could lead to inflation, potentially weakening the CAD. Increased demand without a corresponding increase in supply puts upward pressure on prices, making Canadian goods less competitive internationally.

- Tax increases: Could dampen economic growth, negatively impacting the CAD. Higher taxes reduce disposable income, leading to decreased consumer spending and potentially slowing economic expansion.

- Frequent budget negotiations: In a minority government setting, increase uncertainty, affecting investor confidence. The constant threat of political gridlock and potential snap elections creates an unstable environment that deters long-term investments.

Detail: Recent budget proposals focused on [mention specific examples, e.g., social programs, infrastructure spending] could influence interest rates. A significant increase in national debt, often a consequence of increased spending without corresponding revenue increases, can negatively impact the CAD's value by reducing investor confidence in the Canadian economy. The potential for increased national debt and its impact on the CAD's value needs close monitoring.

Monetary Policy:

The Bank of Canada's interest rate decisions are crucial for the CAD. Interest rate hikes generally strengthen the CAD by attracting foreign investment seeking higher returns. However, a minority government might exert subtle or overt pressure on the Bank of Canada.

- Interest rate hikes: Typically strengthen the CAD, attracting foreign investment.

- Minority government pressure: Might influence the Bank of Canada's independence, potentially leading to less effective monetary policy.

- Political instability: Could lead to unpredictable monetary policy decisions, impacting investor confidence and the CAD's stability.

Detail: The Bank of Canada's mandate is to maintain price stability and full employment. A minority government may prioritize short-term political gains over long-term economic stability, potentially creating conflicting policy goals and impacting the effectiveness of the Bank of Canada's actions. This conflict could lead to unpredictable interest rate changes and increased volatility in the CAD.

Political Risks and Uncertainty

The inherent fragility of a minority government is a key factor impacting the Canadian Dollar Forecast. Political instability creates uncertainty that negatively impacts investor confidence and economic planning.

Political Instability:

The precarious nature of a minority government creates significant uncertainty.

- Increased risk of snap elections: Impacts investor confidence, leading to a wait-and-see approach to investments.

- Frequent changes in government priorities: Can disrupt economic planning and long-term investment strategies.

- Potential for policy gridlock: Hinders effective economic management and creates uncertainty about the future economic direction.

Detail: Historically, minority governments in Canada have often resulted in periods of policy gridlock, hindering effective economic management and impacting the CAD. [cite specific historical examples, for instance, a particular period of minority government and its economic consequences].

Impact on International Trade and Investment:

Uncertainty deters foreign investment and complicates international trade.

- Reduced foreign direct investment: Can weaken the CAD as capital inflows decrease.

- Trade negotiations: Become more challenging and unpredictable, increasing transaction costs.

- Uncertainty creates hesitation: Among exporters and importers, leading to reduced trade volumes.

Detail: Canada's major trading partners, such as the US, are sensitive to political instability. Uncertainty surrounding trade policy could impact key export sectors like energy (oil and gas) and agriculture, weakening the CAD. This uncertainty needs to be carefully monitored within any Canadian Dollar Forecast.

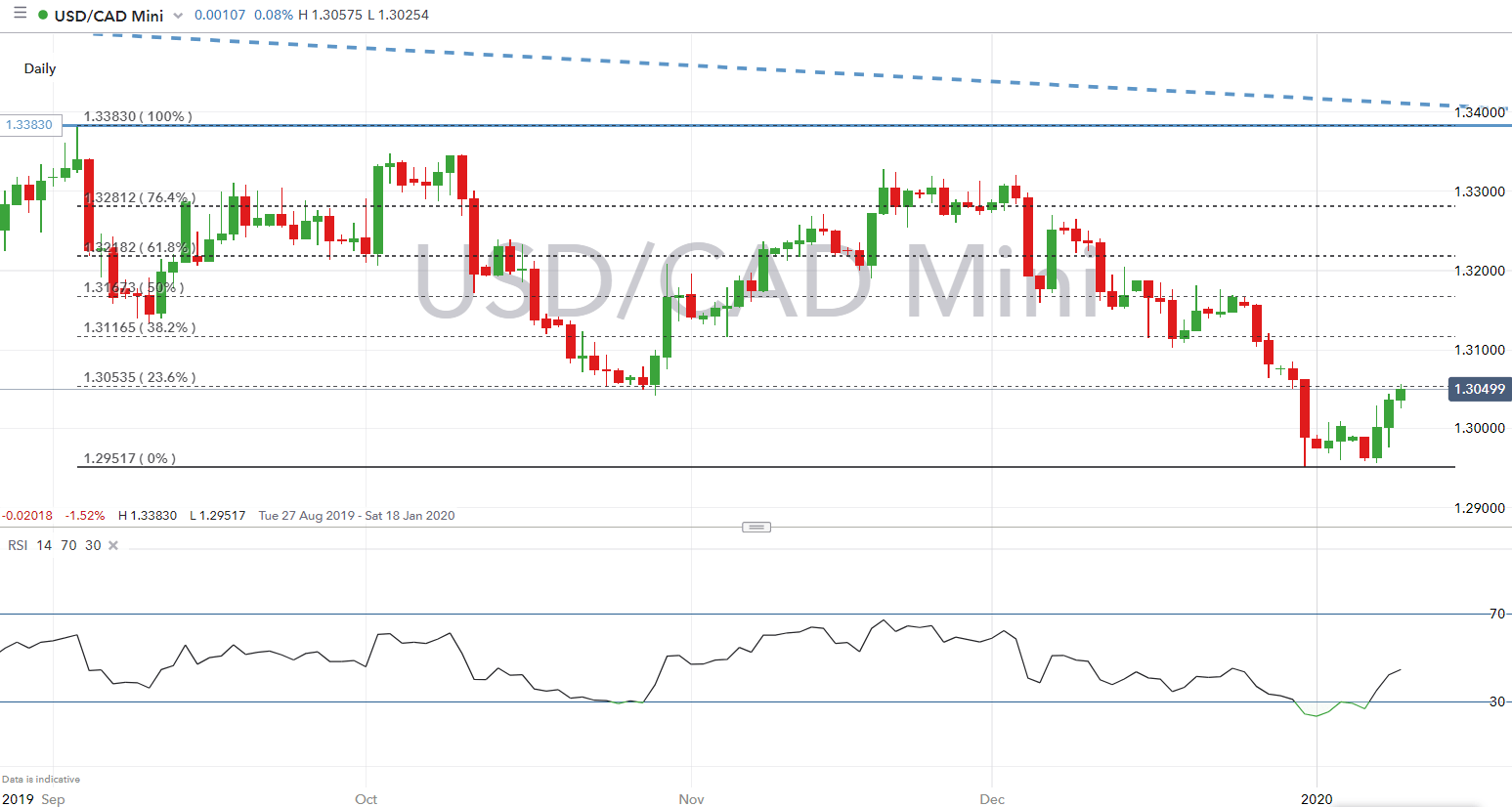

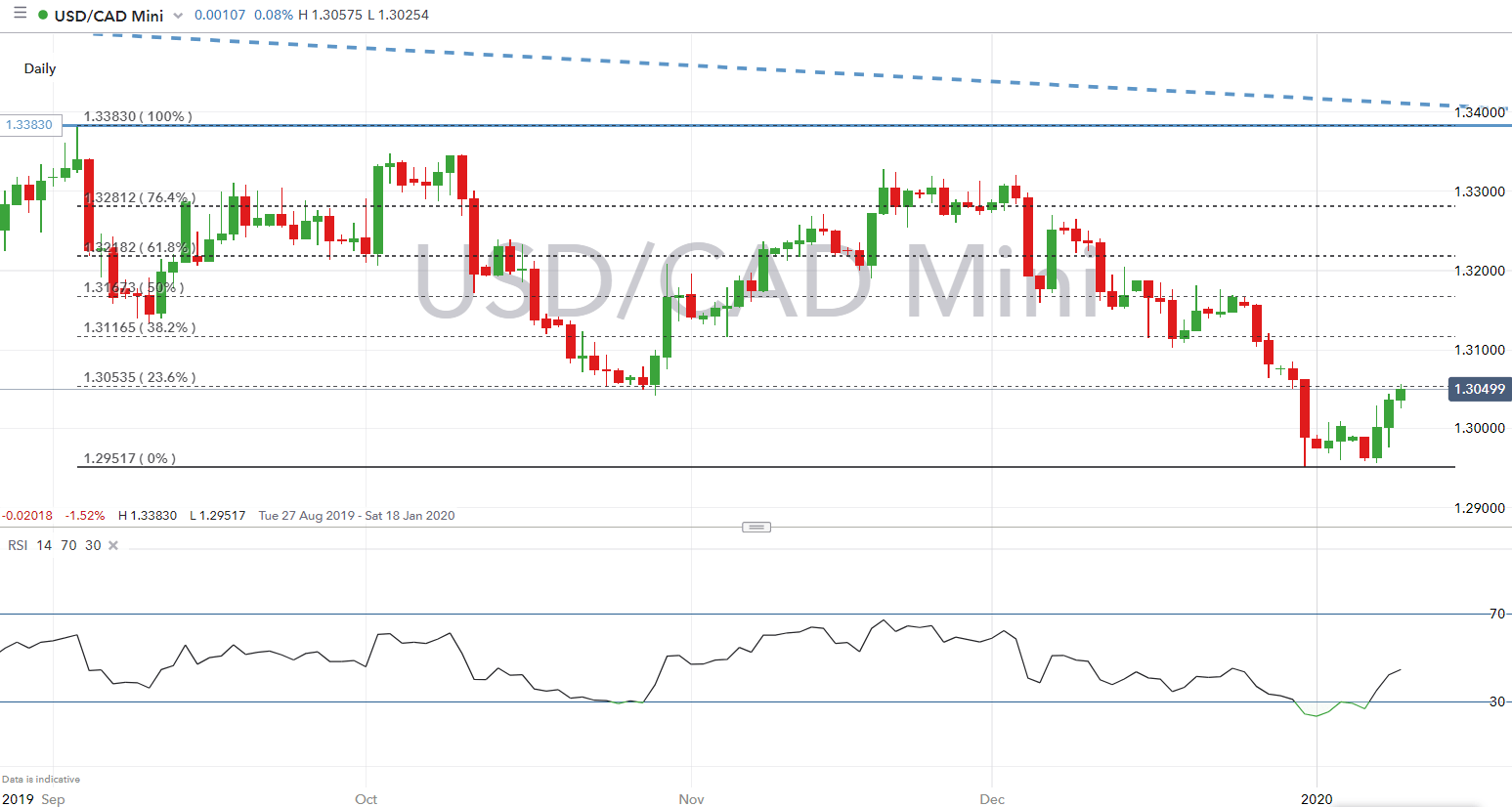

Key Economic Indicators to Watch

Several key economic indicators provide insights into the Canadian economy's health and its impact on the CAD. Understanding these indicators is crucial for a reliable Canadian Dollar Forecast.

GDP Growth: A strong GDP signals a healthy economy, supporting the CAD.

Inflation Rate: High inflation can weaken the CAD by eroding purchasing power and making Canadian exports less competitive.

Unemployment Rate: Low unemployment strengthens the economy and the CAD by signaling strong labor market conditions.

Commodity Prices: Canada's reliance on commodities (e.g., oil, lumber) makes their prices crucial for the CAD. Fluctuations in commodity prices directly impact Canada's export earnings and the value of the CAD.

Detail: Currently, [mention current GDP growth, inflation, unemployment rates, and key commodity prices]. Analyzing how these indicators are trending and how they are influenced by the minority government's policies provides crucial information for a precise Canadian Dollar Forecast.

Conclusion:

The Canadian Dollar Forecast under a minority government presents a complex picture. While the Bank of Canada's monetary policy and global economic trends remain significant factors, the inherent political instability and uncertainty significantly influence investor sentiment and consequently, the CAD's value. Monitoring key economic indicators, understanding the potential implications of government policies, and closely following political developments are crucial for navigating this uncertain environment. Staying informed about the Canadian Dollar Forecast is essential for anyone involved in international trade or investment in Canada. Regularly review reliable economic forecasts and analyses to make informed decisions regarding your Canadian dollar exposure.

Featured Posts

-

Information Financiere Mercialys Document Amf 2025 E1022016

Apr 30, 2025

Information Financiere Mercialys Document Amf 2025 E1022016

Apr 30, 2025 -

The 2023 Canadian Election Poilievres Unexpected Defeat

Apr 30, 2025

The 2023 Canadian Election Poilievres Unexpected Defeat

Apr 30, 2025 -

Fotbolti I Dag Dagskra Bestu Deildarinnar Og Valurs Moeguleikar

Apr 30, 2025

Fotbolti I Dag Dagskra Bestu Deildarinnar Og Valurs Moeguleikar

Apr 30, 2025 -

Live Stock Market Updates Dow Futures Earnings And Market Commentary

Apr 30, 2025

Live Stock Market Updates Dow Futures Earnings And Market Commentary

Apr 30, 2025 -

Du An 500k V Mach 3 Ghi Dau An Cua Cong Nhan Dien Luc Mien Nam

Apr 30, 2025

Du An 500k V Mach 3 Ghi Dau An Cua Cong Nhan Dien Luc Mien Nam

Apr 30, 2025

Latest Posts

-

Gillian Anderson On Returning To The X Files A Look At Her Concerns

Apr 30, 2025

Gillian Anderson On Returning To The X Files A Look At Her Concerns

Apr 30, 2025 -

On Set Footage Ben Affleck And Gillian Anderson In A High Stakes Shootout Scene

Apr 30, 2025

On Set Footage Ben Affleck And Gillian Anderson In A High Stakes Shootout Scene

Apr 30, 2025 -

Tiesa Slypi Kazkur Anapus X Failu Zvaigzdziu Uzkulisiai

Apr 30, 2025

Tiesa Slypi Kazkur Anapus X Failu Zvaigzdziu Uzkulisiai

Apr 30, 2025 -

Ben Affleck And Gillian Anderson Film Dramatic Shootout Scene For Upcoming Movie

Apr 30, 2025

Ben Affleck And Gillian Anderson Film Dramatic Shootout Scene For Upcoming Movie

Apr 30, 2025 -

Building Resilience A Look At The New Boxing And Survival Training In Mathias Colomb Cree Nation

Apr 30, 2025

Building Resilience A Look At The New Boxing And Survival Training In Mathias Colomb Cree Nation

Apr 30, 2025