Canada's TSX Composite: Intraday Record And Market Outlook

Table of Contents

For those unfamiliar, the TSX Composite Index is a benchmark stock market index that tracks the performance of the largest companies listed on the Toronto Stock Exchange (TSX). It serves as a key indicator of the overall health and performance of the Canadian economy. Understanding its fluctuations is crucial for investors and economic analysts alike.

Analysis of the Intraday Record High

The recent intraday record high of the TSX Composite Index reflects a confluence of positive factors impacting the Canadian stock market. Several key elements contributed to this surge: strong commodity prices, particularly in the energy and materials sectors, positive economic data signaling robust growth, and a generally optimistic investor sentiment.

- Increased investor confidence: Positive economic indicators and government policies supporting growth boosted investor confidence, leading to increased investment in the Canadian market.

- Strong performance in energy and materials sectors: The rise in global oil prices and increased demand for raw materials significantly benefited these sectors, driving a substantial portion of the TSX Composite's gains. Companies like Suncor Energy and Barrick Gold saw considerable increases in their share prices.

- Positive global economic indicators: Positive economic news from other major economies, particularly the US, provided a spillover effect, further bolstering investor confidence in the Canadian market. This positive global sentiment reduced some of the risks typically associated with investing in the Canadian stock market.

- Impact of government policies: Supportive government policies aimed at stimulating economic growth, such as infrastructure spending and tax incentives, have played a role in the overall market positivity.

The TSX Composite experienced a [Insert Percentage]% increase in its intraday trading volume during the period leading up to the record high, further underscoring the heightened activity and investor interest.

Key Sectors Driving the TSX Composite's Performance

Several sectors significantly contributed to the TSX Composite's robust performance. The energy and materials sectors were the standouts, but other sectors also played a key role:

- Energy sector growth and its correlation with global oil prices: The energy sector's performance is closely linked to global oil prices. As oil prices rose, so did the share prices of major Canadian energy companies.

- Materials sector boom due to increased infrastructure spending: Increased global demand for raw materials, coupled with significant infrastructure investment, fuelled growth in the materials sector. This includes mining companies and related businesses.

- Financial sector performance influenced by interest rate changes: While interest rate changes can impact the financial sector, the current environment has, so far, been relatively positive, contributing to overall market strength.

- Technology sector trends and their impact on the TSX: While perhaps less dominant than energy and materials in this particular surge, the technology sector’s performance remains an important part of the overall TSX Composite health and continues to show potential for future growth.

[Insert chart/graph showcasing sector performance here]

Factors Influencing the Future Outlook of the TSX Composite

While the current outlook is positive, several factors could influence the future performance of the TSX Composite Index:

- Inflationary pressures and their impact on the stock market: Rising inflation could erode corporate profits and lead to interest rate hikes, potentially dampening investor enthusiasm. This is a key risk factor to monitor closely.

- Global economic slowdown and its potential effect on Canadian exports: A global economic slowdown could negatively impact Canadian exports, potentially impacting the performance of several key sectors within the TSX Composite.

- Opportunities in renewable energy and green technology: The shift towards sustainable energy presents significant growth opportunities for Canadian companies involved in renewable energy and green technology. This sector is expected to continue expanding.

- Potential for further growth in specific sectors: Despite potential headwinds, several sectors, including technology and healthcare, offer promising growth prospects.

Strategies for Investors

Given the current market dynamics, investors should adopt a diversified investment strategy, carefully managing their risk exposure. Those with higher risk tolerance might consider investing in sectors expected to experience significant growth, while more conservative investors might focus on established, stable companies. Asset allocation strategies should be tailored to individual circumstances and risk profiles. Seeking professional financial advice is always recommended.

Conclusion: Navigating the Future of Canada's TSX Composite

The recent intraday record high of the TSX Composite Index reflects a combination of positive economic factors and strong performance in key sectors like energy and materials. However, investors should remain aware of potential challenges, including inflation and global economic uncertainty. A balanced perspective, acknowledging both bullish and bearish scenarios, is crucial for informed decision-making. Stay informed about the latest developments in the TSX Composite Index to make informed investment choices. Monitor the TSX Composite Index’s performance for potential long-term investment strategies. Learn more about the TSX Composite and plan your investment strategy wisely. Remember to consult with a financial advisor before making any significant investment decisions.

Featured Posts

-

Smart Shopping Getting High Quality On A Low Budget

May 17, 2025

Smart Shopping Getting High Quality On A Low Budget

May 17, 2025 -

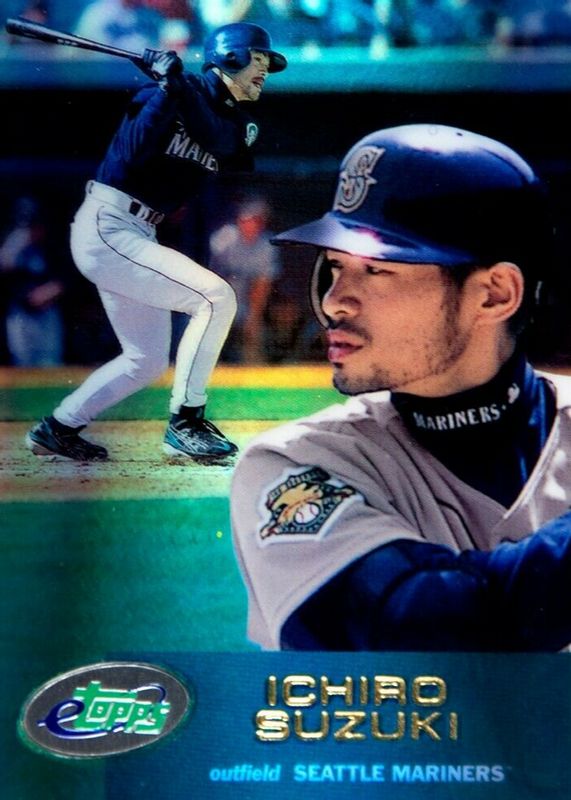

Ichiro Suzuki His Continued Relevance In Baseball Twenty Years On

May 17, 2025

Ichiro Suzuki His Continued Relevance In Baseball Twenty Years On

May 17, 2025 -

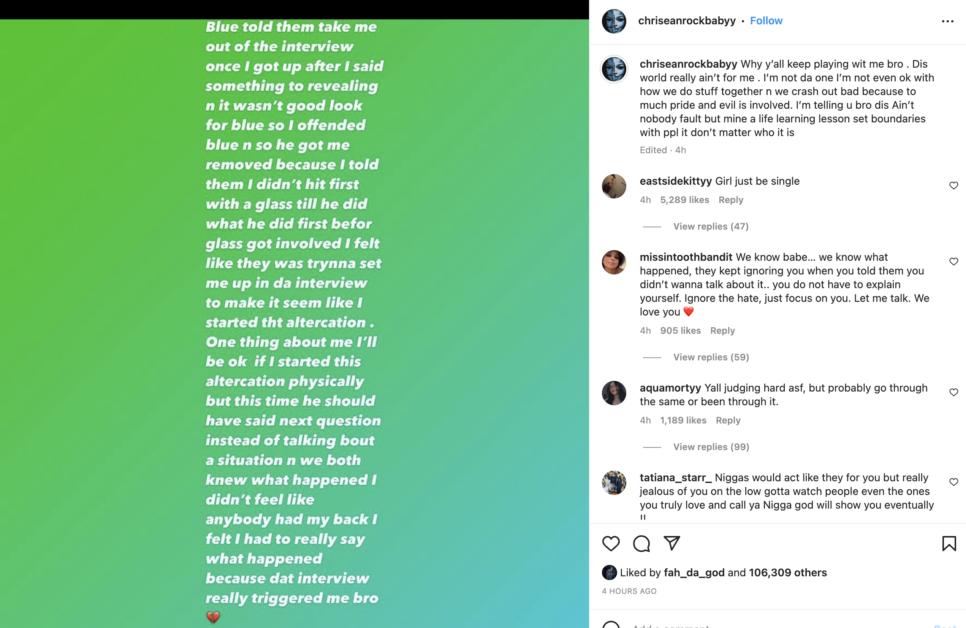

Angel Reese Responds To Backlash Over Chrisean Rock Interview

May 17, 2025

Angel Reese Responds To Backlash Over Chrisean Rock Interview

May 17, 2025 -

Trump Tariffs And The Price Of Phone Battery Replacements

May 17, 2025

Trump Tariffs And The Price Of Phone Battery Replacements

May 17, 2025 -

Energy Market Insights Oil Price Trends For May 16

May 17, 2025

Energy Market Insights Oil Price Trends For May 16

May 17, 2025

Latest Posts

-

Veteran Infielders Critique Of Seattle Mariners Quiet Winter

May 17, 2025

Veteran Infielders Critique Of Seattle Mariners Quiet Winter

May 17, 2025 -

Analysis Former Mariners Infielders Criticism Of Seattles Offseason

May 17, 2025

Analysis Former Mariners Infielders Criticism Of Seattles Offseason

May 17, 2025 -

Quiet Winter For Mariners Former Infielders Scathing Critique

May 17, 2025

Quiet Winter For Mariners Former Infielders Scathing Critique

May 17, 2025 -

Mariners Giants Injury Update Key Players Out For April 4 6 Series

May 17, 2025

Mariners Giants Injury Update Key Players Out For April 4 6 Series

May 17, 2025 -

Seattle Mariners Face Backlash For Quiet Winter Former Infielder Speaks Out

May 17, 2025

Seattle Mariners Face Backlash For Quiet Winter Former Infielder Speaks Out

May 17, 2025