Canada's Housing Market: Signs Of A Price Correction

Table of Contents

Rising Interest Rates and Their Impact

The Bank of Canada's aggressive interest rate hikes are significantly impacting the Canadian housing market. These increases directly affect mortgage affordability and are a primary driver of the potential price correction.

The Bank of Canada's Aggressive Rate Hikes

The Bank of Canada has implemented a series of interest rate increases throughout 2022 and 2023 in an effort to combat inflation. These hikes have dramatically altered the mortgage landscape.

- Increased Mortgage Payments: Higher interest rates translate to significantly higher monthly mortgage payments for both new and existing homeowners. This reduces the purchasing power of potential buyers and increases the financial burden on current homeowners.

- Reduced Borrowing Power for Buyers: Lenders are now approving smaller mortgages due to increased interest rates, meaning potential buyers can afford less expensive homes. This directly reduces demand.

- Impact on Variable-Rate Mortgages: Homeowners with variable-rate mortgages are immediately affected by interest rate increases, facing potentially substantial increases in their monthly payments.

The Bank of Canada's key interest rate increased from 0.25% in early 2022 to 5% by late 2023, representing a significant and rapid shift in monetary policy. This rapid increase has had a profound and widespread impact on the housing market.

The Ripple Effect on the Housing Market

The higher interest rates are creating a ripple effect throughout the housing market, leading to several observable changes.

- Decreased Bidding Wars: The days of fierce bidding wars and offers significantly over asking price are becoming less frequent, particularly in areas already showing signs of cooling.

- Longer Homes on the Market: Properties are staying on the market for longer periods, indicating reduced buyer demand and a shift away from the seller's market that characterized recent years.

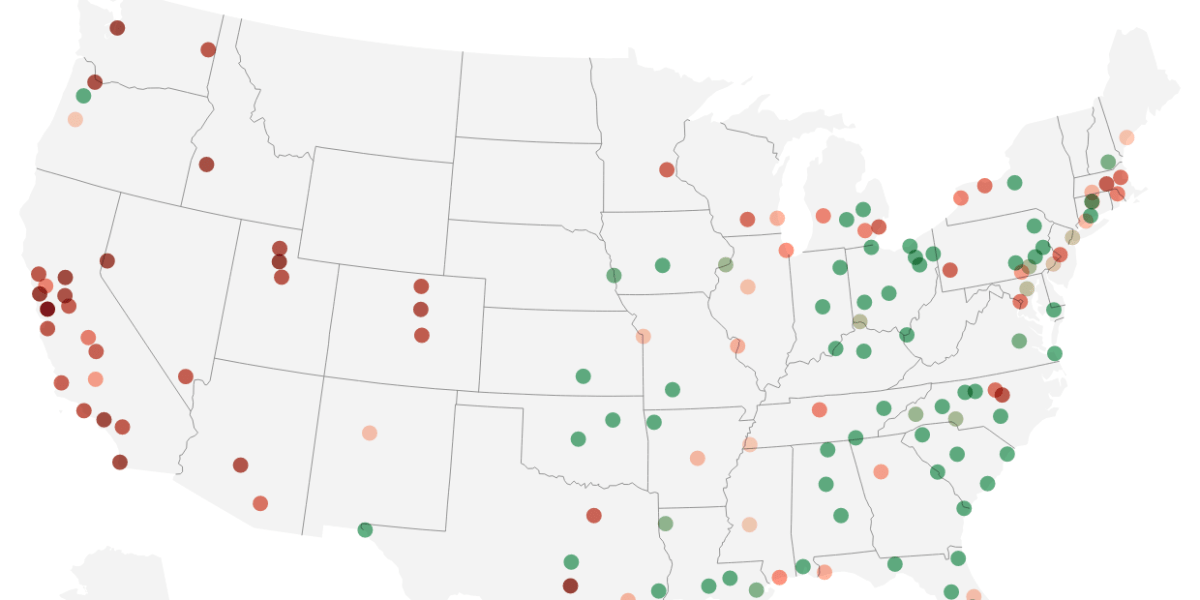

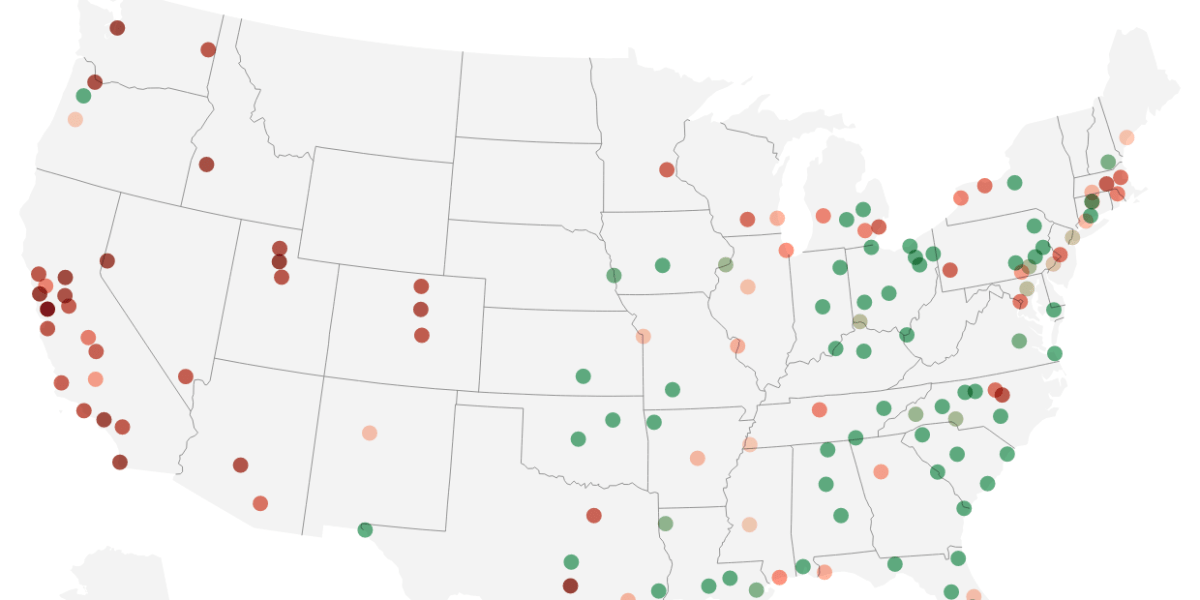

- Potential for Price Drops in Specific Regions: While not uniform across the country, certain regions are experiencing price reductions or a stagnation in price growth, particularly those previously experiencing the most rapid appreciation. Areas with higher than average home prices relative to average income are often seeing the biggest impacts.

Data from the Canadian Real Estate Association (CREA) shows a significant decrease in sales volume and a slowing of average home price growth across several major Canadian cities. Regional variations exist, however, with some markets remaining relatively robust compared to others.

Reduced Buyer Demand and Increased Inventory

The Canadian housing market is experiencing a fundamental shift in the relationship between supply and demand. This shift is a key indicator of a potential price correction.

Shifting Market Dynamics

The combination of higher interest rates and economic uncertainty is leading to a significant reduction in buyer demand.

- Fewer Buyers Entering the Market: Higher borrowing costs and concerns about future economic conditions are discouraging many potential buyers from entering the market.

- Increased Housing Inventory in Some Areas: The reduced demand is leading to a rise in housing inventory in certain regions, which increases the supply and creates a more balanced market.

- Impact on Seller's Market Dominance: The seller's market dominance of recent years is waning, giving buyers more negotiating power and potentially leading to lower sale prices.

Statistics from CREA and other real estate boards show a clear shift in the buyer-to-seller ratio, indicating a growing imbalance in favor of buyers in many parts of the country.

The Impact of New Housing Construction

The increased construction of new homes is also playing a role in influencing market supply.

- Impact of New Builds on Existing Home Prices: Increased new housing supply can put downward pressure on prices for existing homes, particularly in areas with significant new construction.

- Discussion of Supply Chain Issues and Their Effect: Supply chain disruptions and material costs continue to affect new housing construction, impacting the pace of supply growth.

- Regional Differences in New Construction: The rate of new housing construction varies significantly across different regions of Canada, influencing the local market dynamics.

Data on housing starts and building permits provides further insight into the impact of new construction on the overall housing supply and its effect on price.

Other Indicators of a Potential Price Correction

Beyond interest rates and reduced demand, other indicators suggest a potential price correction in the Canadian housing market.

Decreasing Home Price Growth

Data from various sources is showing a clear slowing in home price growth, and in some cases, outright declines.

- Statistics on Year-Over-Year Price Changes: Year-over-year price increases are significantly lower than the double-digit growth seen in previous years.

- Regional Comparisons: The pace of price change varies across the country, with some regions showing significant slowdowns or declines while others remain more resilient.

- Identification of Cooling Markets: Specific markets are identified as cooling, exhibiting clear signs of a slowdown in price growth or even price reductions.

The difference between a price decline and stagnation in price growth is important. Stagnation suggests a plateauing of the market, while a decline represents an actual decrease in prices.

Increased Number of Unsold Properties

The increasing number of unsold properties after a reasonable time on the market is another significant indicator.

- Data on Days-On-Market: Properties are staying on the market for longer periods, suggesting reduced buyer interest.

- Increased Inventory in Specific Regions: Certain areas are seeing a notable buildup of unsold inventory, exerting downward pressure on prices.

- Impact on Pricing Strategies by Sellers: Sellers are increasingly adjusting their pricing strategies to account for the changing market dynamics.

The link between unsold properties and potential price adjustments is clear: an increase in inventory typically leads to a need for price reductions to attract buyers.

Conclusion

While the Canadian housing market remains robust, several significant indicators point towards a potential price correction. Rising interest rates, reduced buyer demand, increased inventory, and slowing price growth are all contributing factors. Understanding these trends is crucial for both buyers and sellers navigating this evolving market. Whether you're looking to purchase your dream home or strategically sell your existing property, staying informed about the ongoing adjustments in Canada's housing market is essential. Stay tuned for further updates on Canada's housing market and its potential price correction. Continue to monitor key indicators and consult with real estate professionals for personalized advice as you navigate this dynamic landscape.

Featured Posts

-

Malaysias Najib Razak Implicated In French Submarine Bribery Case

May 22, 2025

Malaysias Najib Razak Implicated In French Submarine Bribery Case

May 22, 2025 -

Emergency Response To Box Truck Crash On Route 581

May 22, 2025

Emergency Response To Box Truck Crash On Route 581

May 22, 2025 -

Close Call Oh Jun Sungs Win At Wtt Star Contender Chennai

May 22, 2025

Close Call Oh Jun Sungs Win At Wtt Star Contender Chennai

May 22, 2025 -

Love Monster Practical Strategies For Improving Relationships

May 22, 2025

Love Monster Practical Strategies For Improving Relationships

May 22, 2025 -

Appeal Hearing For Tory Councillors Wife After Migrant Rant Conviction

May 22, 2025

Appeal Hearing For Tory Councillors Wife After Migrant Rant Conviction

May 22, 2025

Latest Posts

-

Investigation Launched After Massive Chicken Barn Fire In Franklin County Pa

May 22, 2025

Investigation Launched After Massive Chicken Barn Fire In Franklin County Pa

May 22, 2025 -

Factors Affecting Gas Prices In Southeast Wisconsin

May 22, 2025

Factors Affecting Gas Prices In Southeast Wisconsin

May 22, 2025 -

Lower Gas Prices In Illinois Reflecting National Average

May 22, 2025

Lower Gas Prices In Illinois Reflecting National Average

May 22, 2025 -

Lower Gas Prices In Toledo A Week Over Week Comparison

May 22, 2025

Lower Gas Prices In Toledo A Week Over Week Comparison

May 22, 2025 -

Falling Gas Prices In Illinois A Nationwide Decline

May 22, 2025

Falling Gas Prices In Illinois A Nationwide Decline

May 22, 2025