Can Words Solve The Trade War? Markets Weigh The Outcome Of US-China Talks

Table of Contents

The Current State of US-China Trade Relations

The US-China trade war didn't erupt overnight. It's the culmination of years of simmering tensions over trade imbalances, intellectual property theft, and technology transfer. Key events include the imposition of tariffs on billions of dollars worth of goods by both countries, beginning in 2018. These tariffs have steadily increased, creating a cycle of retaliation and further escalation.

Current negotiations are focused on several sticking points:

- Intellectual Property Rights (IPR): The US accuses China of forcing technology transfer from American companies and insufficient protection of intellectual property.

- Technology Transfer: Concerns persist over China's policies that compel foreign companies to share their technology in exchange for market access.

- Agricultural Subsidies: Disputes over agricultural subsidies and market access for American agricultural products remain a major hurdle.

The impact of this trade war is far-reaching:

- Decreased Exports: Both countries have experienced significant declines in exports to each other.

- Supply Chain Disruptions: Global supply chains have been severely disrupted, leading to increased production costs and delays.

- Increased Consumer Prices: Tariffs have led to increased prices for consumers in both the US and China.

- Industry-Specific Impacts: The agricultural sector in the US, and technology companies in both countries, have been particularly hard hit.

The political climate adds another layer of complexity. Domestic political pressures in both countries could hinder the progress of negotiations and limit the scope of potential compromises.

The Potential for Diplomatic Solutions

Despite the considerable challenges, the potential for diplomatic solutions remains. A phased approach to tariff reductions could offer a pathway towards de-escalation. Increased market access for both countries, particularly in areas like agriculture and technology, could foster mutual benefits.

Progress is possible in several areas:

- Phased Tariff Reductions: Gradually reducing tariffs could build trust and demonstrate goodwill from both sides.

- Increased Market Access: Expanding market access in specific sectors could lead to increased trade and economic growth.

The feasibility of different solutions varies:

- Partial Agreements: Reaching partial agreements on specific issues could be a more achievable initial step.

- Role of International Organizations: The World Trade Organization (WTO) could play a mediating role in resolving disputes.

- Domestic Political Influence: The influence of domestic politics in both countries significantly impacts the potential for successful negotiations.

Alternative dispute resolution mechanisms, such as mediation or arbitration, could offer alternative avenues if direct negotiations stall.

Market Reactions and Economic Impacts

Global markets are highly sensitive to the ongoing trade negotiations. Stock markets experience volatility based on the perceived progress or setbacks. Commodity prices, particularly those affected by tariffs, fluctuate significantly. Currency exchange rates also reflect the uncertainty surrounding the trade war.

The economic consequences of different outcomes are substantial:

- Successful Resolution: A successful resolution could boost investor confidence, increase foreign direct investment, and stimulate job creation.

- Further Escalation: Continued escalation would likely lead to further economic downturn, decreased investor confidence, job losses, and depressed consumer sentiment.

Specific sectors are disproportionately affected:

- Technology: The technology sector faces significant challenges due to restrictions on technology transfer and intellectual property protection.

- Manufacturing: Manufacturing industries in both countries are impacted by supply chain disruptions and increased production costs.

- Agriculture: The agricultural sector is particularly vulnerable due to trade restrictions and retaliatory tariffs.

Long-term economic consequences depend heavily on the final resolution. A prolonged trade war could lead to significant structural changes in global supply chains and trade patterns.

Beyond Trade: The Broader Geopolitical Implications

The US-China trade war extends far beyond simple economic issues. It has significant geopolitical implications:

- Global Alliances: The trade war has strained relationships between the US and China and impacted alliances with other nations.

- Power Dynamics: The trade conflict is part of a broader struggle for global economic and technological dominance.

- Impact on Other Countries: Countries around the world are affected by the disruptions to global trade and supply chains.

Spillover effects are significant:

- Multilateral Trade Agreements: The trade war undermines the principles of multilateral trade agreements and weakens international cooperation.

- Regional Trade Blocs: The conflict could accelerate the formation of regional trade blocs as countries seek alternative trading partners.

- Global Supply Chains: Businesses are forced to reconsider their global supply chains to reduce dependence on either the US or China.

Conclusion

The question of whether words alone can solve the US-China trade war remains open. While diplomatic solutions offer a pathway to de-escalation and economic stability, the deeply entrenched issues and complex political landscape present considerable challenges. The outcome of these trade talks will have profound and long-lasting consequences for global markets and the international order. Closely monitoring the progress of US-China trade relations and understanding the potential impact on various sectors is crucial for businesses and investors. Staying informed about developments in US-China trade relations is paramount for navigating the ever-evolving economic landscape.

Featured Posts

-

Truckies Realistic Plea For Key Road In Tasman

May 12, 2025

Truckies Realistic Plea For Key Road In Tasman

May 12, 2025 -

Win Big At The B And W Trailer Hitches Heavy Hitters Bass Fishing Tournament

May 12, 2025

Win Big At The B And W Trailer Hitches Heavy Hitters Bass Fishing Tournament

May 12, 2025 -

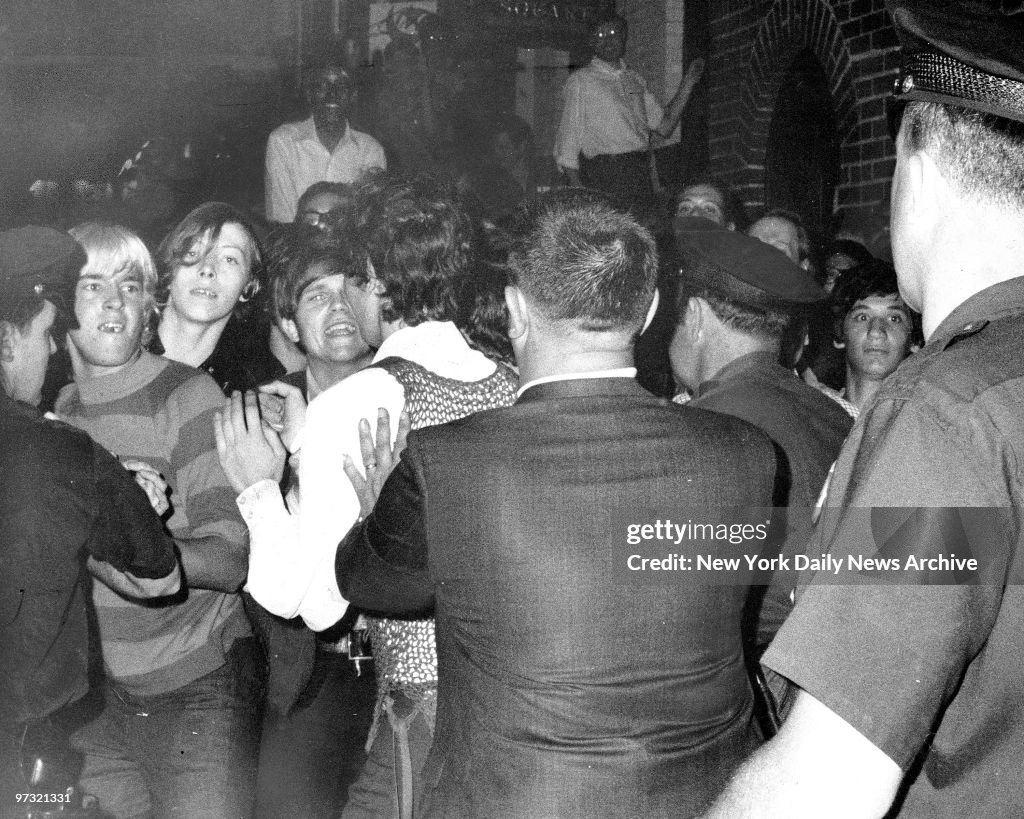

Ice Raid Sparks Chaos Crowd Attempts To Intervene

May 12, 2025

Ice Raid Sparks Chaos Crowd Attempts To Intervene

May 12, 2025 -

Okikj I Khart Virusna Iz Ava I Smea

May 12, 2025

Okikj I Khart Virusna Iz Ava I Smea

May 12, 2025 -

Alex Winters Early Comedy Unearthing His Pre Freaked Mtv Series

May 12, 2025

Alex Winters Early Comedy Unearthing His Pre Freaked Mtv Series

May 12, 2025

Latest Posts

-

Kamala Harriss Gen Z Influencer Now Seeks Congressional Seat

May 13, 2025

Kamala Harriss Gen Z Influencer Now Seeks Congressional Seat

May 13, 2025 -

Gen Z Influencers Unexpected Path Running For Congress After Kamala Harris Campaign

May 13, 2025

Gen Z Influencers Unexpected Path Running For Congress After Kamala Harris Campaign

May 13, 2025 -

From Kamala Harris Influencer To Congressional Candidate A Gen Z Story

May 13, 2025

From Kamala Harris Influencer To Congressional Candidate A Gen Z Story

May 13, 2025 -

No 10 Oregon Edges No 7 Vanderbilt In Overtime Ncaa Tournament Highlights

May 13, 2025

No 10 Oregon Edges No 7 Vanderbilt In Overtime Ncaa Tournament Highlights

May 13, 2025 -

Ncaa Womens Basketball Oregons Dramatic Comeback Triumph Over Vanderbilt

May 13, 2025

Ncaa Womens Basketball Oregons Dramatic Comeback Triumph Over Vanderbilt

May 13, 2025