Can America Meet The Challenge? China's Rise In The Electric Vehicle Market

Table of Contents

China's EV Dominance: A Deep Dive

China's success in the EV market isn't accidental; it's the result of a multi-pronged strategy. This dominance is fueled by a confluence of factors, creating a formidable challenge for competitors worldwide.

Massive Government Subsidies and Incentives

The Chinese government has poured billions into its EV sector through a combination of direct subsidies, tax breaks, and substantial investments in charging infrastructure. This proactive approach has fostered rapid growth and innovation.

- Direct subsidies: Significant cash payments to consumers purchasing EVs.

- Tax incentives: Reductions in purchase taxes and registration fees for EVs.

- Infrastructure development: Massive investment in building a nationwide network of charging stations, making EV ownership more convenient. This includes both fast-charging and slower-charging options, ensuring broad accessibility.

These policies have created a supportive ecosystem, accelerating EV adoption and giving Chinese manufacturers a significant competitive edge in the global market. This focus on Chinese EV subsidies and government incentives has been instrumental in establishing China as the EV leader.

A Robust Supply Chain and Battery Technology

China's dominance extends beyond consumer incentives. It boasts control over a significant portion of the global supply chain for critical EV components, particularly batteries. This control over raw materials like lithium and cobalt, coupled with advanced battery technology, provides a significant cost advantage.

- Lithium-ion battery production: China dominates the production of lithium-ion batteries, the core technology powering most EVs. Companies like CATL (Contemporary Amperex Technology Co. Limited) hold substantial global market share.

- Rare earth minerals: China also controls a large portion of the global supply of rare earth minerals crucial for EV motor production and other components. This control gives them leverage over pricing and supply.

- Vertical Integration: Many Chinese EV manufacturers have vertically integrated their supply chains, further reducing costs and ensuring reliable sourcing of components.

Securing these resources and technologies presents a substantial hurdle for US EV manufacturers striving to match China's scale and efficiency. This highlights the importance of EV battery technology and supply chain dominance in the EV race.

Scale and Domestic Market Size

The sheer size of China's domestic market allows its EV manufacturers to achieve economies of scale unattainable by smaller players. This massive consumer base fuels rapid technological advancements and cost reductions.

- Huge domestic sales: Millions of EVs are sold annually within China, creating a vast testing ground for new technologies and production processes.

- High growth rate: China's EV market consistently shows significant year-on-year growth, outpacing many other global markets.

- Economies of scale: Mass production allows for significant cost reductions, making Chinese EVs more price-competitive globally.

This Chinese EV market size and inherent economies of scale contribute significantly to their global competitiveness.

America's Response: Strengths and Weaknesses

While China's dominance is undeniable, the US possesses considerable strengths that could enable it to compete more effectively. However, significant challenges remain.

Technological Innovation and Private Sector Investment

The US boasts a strong track record of technological innovation, particularly in areas like battery technology and autonomous driving. Private sector investment also plays a vital role.

- Leading EV companies: Companies like Tesla, Rivian, and Lucid Motors are pushing the boundaries of EV technology, particularly in areas such as battery range and autonomous features.

- Venture capital: Significant venture capital funding is flowing into the US EV sector, fostering innovation and competition.

- Software and AI: American companies are strong in software and AI development, which is critical for features like autonomous driving and advanced driver-assistance systems.

This US EV technology and robust private sector investment provide a strong foundation for future growth.

Challenges: Infrastructure Gaps and Supply Chain Vulnerabilities

Despite its technological prowess, the US faces significant infrastructural challenges and supply chain vulnerabilities.

- Charging station network: The US charging station network lags significantly behind China's in terms of density and coverage, hindering wider EV adoption.

- Raw material sourcing: The US is heavily reliant on foreign sources for many critical EV raw materials, creating supply chain vulnerabilities.

- Manufacturing capacity: Building sufficient domestic manufacturing capacity to compete with China's scale will require significant investment and time.

Addressing these US EV infrastructure gaps and supply chain vulnerabilities is crucial for the US to remain competitive.

Government Policy and the Role of the Biden Administration

The Biden administration has introduced several initiatives to support the domestic EV industry, including substantial investments in charging infrastructure and tax credits for EV purchases.

- Infrastructure Investment and Jobs Act: This legislation allocates significant funding for the expansion of the national EV charging network.

- EV tax credits: Tax credits incentivize consumers to purchase EVs, boosting domestic demand.

- Domestic manufacturing incentives: Policies aim to encourage domestic EV battery and component manufacturing.

The effectiveness of these US EV policy measures, under the Biden administration, will be critical in shaping the future of the US EV industry.

The Future of the EV Race: Can America Catch Up?

The future of the EV market will likely witness continued competition between the US and China, with the potential for both cooperation and rivalry. Geopolitical tensions and the global demand for EVs will be significant influencing factors. While China currently holds a commanding lead, the US possesses the potential to significantly increase its market share through targeted investment and strategic policy decisions.

Conclusion: Can America Meet the Challenge? The Future of Electric Vehicles

China’s dominance in the electric vehicle market is rooted in significant government subsidies, a robust supply chain, and a massive domestic market. The US, while possessing technological strengths and robust private sector investment, faces challenges in infrastructure development and supply chain resilience. Whether the US can successfully compete with China's rise in the electric vehicle market will depend on its ability to address these challenges, leverage its strengths, and implement effective policies to foster domestic growth and innovation. To learn more about this critical competition, delve deeper into the intricacies of government policy, technological advancements, and the ongoing race to dominate the future of EVs. Explore further resources on China's rise in the electric vehicle market to stay informed on this rapidly evolving landscape.

Featured Posts

-

The Truth About Lizzos Fitness Her Trainer Speaks Out

May 04, 2025

The Truth About Lizzos Fitness Her Trainer Speaks Out

May 04, 2025 -

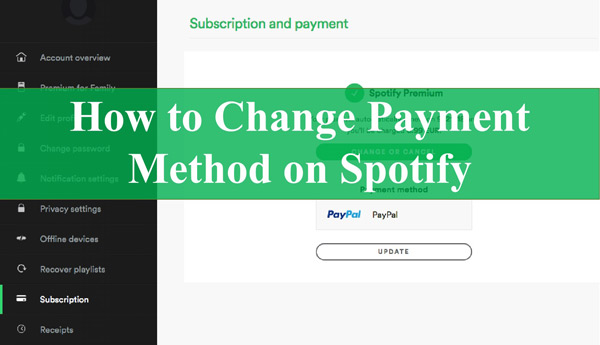

Spotify Updates I Phone App With Customizable Payment Options

May 04, 2025

Spotify Updates I Phone App With Customizable Payment Options

May 04, 2025 -

Gold Prices Fall Understanding The Two Week Trend In 2025

May 04, 2025

Gold Prices Fall Understanding The Two Week Trend In 2025

May 04, 2025 -

1 050 Price Hike At And T Details Broadcoms V Mware Cost Increase

May 04, 2025

1 050 Price Hike At And T Details Broadcoms V Mware Cost Increase

May 04, 2025 -

Nigel Farages Shrewsbury Visit Flat Cap Gin And Tonic And Attack On Conservative Road Plans

May 04, 2025

Nigel Farages Shrewsbury Visit Flat Cap Gin And Tonic And Attack On Conservative Road Plans

May 04, 2025

Latest Posts

-

Amidst Feud Rumors Blake Lively And Anna Kendrick Reunite At Premiere

May 04, 2025

Amidst Feud Rumors Blake Lively And Anna Kendrick Reunite At Premiere

May 04, 2025 -

Anna Kendrick Offers No Comment On Blake Livelys Legal Issues

May 04, 2025

Anna Kendrick Offers No Comment On Blake Livelys Legal Issues

May 04, 2025 -

Subtle Signals Decoding Anna Kendricks Body Language Beside Blake Lively

May 04, 2025

Subtle Signals Decoding Anna Kendricks Body Language Beside Blake Lively

May 04, 2025 -

Movie Premiere Anna Kendrick Avoids Questions On Blake Lively Lawsuit

May 04, 2025

Movie Premiere Anna Kendrick Avoids Questions On Blake Lively Lawsuit

May 04, 2025 -

Anna Kendrick And Rebel Wilsons Unusual Friendship Story

May 04, 2025

Anna Kendrick And Rebel Wilsons Unusual Friendship Story

May 04, 2025