Buy-and-Hold Investing: The Long Game's Gut-Wrenching Truth

Table of Contents

The Allure and Illusion of Passive Investing

What is Buy-and-Hold?

Buy-and-hold investing is a long-term investment strategy centered on purchasing assets—like stocks, bonds, or real estate—and holding them for an extended period, typically years or even decades, regardless of short-term market fluctuations. It's often touted as a passive investing approach, a set-it-and-forget-it investing method that allows for significant growth over time. The core principles include a long-term investment horizon, minimal trading activity, and a diversified investment portfolio. This long-term investment strategy leverages the power of compounding returns to build wealth steadily.

The Myth of Effortless Returns

While buy-and-hold sounds simple, it’s far from effortless. The "passive" label is misleading. Successful buy-and-hold requires significant upfront effort. This includes thorough research to identify suitable investments aligned with your risk tolerance and financial goals, and creating a well-diversified investment portfolio. Furthermore, your portfolio management doesn't stop after the initial investment. Periodic rebalancing is necessary to maintain your desired asset allocation. Consistent risk management is key. It requires discipline and emotional resilience to withstand inevitable market downturns.

- Requires thorough initial research.

- Needs periodic rebalancing to maintain your desired investment portfolio diversification.

- Not entirely passive – requires discipline and emotional resilience to navigate market volatility.

Navigating the Gut-Wrenching Volatility

Market Corrections and Bear Markets

Market downturns are an inevitable part of investing. Market corrections and bear markets can be incredibly challenging for even the most seasoned investors. Witnessing your portfolio value decline significantly can trigger fear and anxiety, leading to impulsive decisions that undermine your long-term strategy. Understanding market volatility and developing a robust strategy to weather these storms is crucial for bear market survival. Your investment risk tolerance will heavily influence your ability to stay the course.

Fear and Greed – The Emotional Tug-of-War

Emotional investing is a significant threat to buy-and-hold success. Fear of further losses can lead to panic selling at the worst possible time, locking in losses and missing out on future gains. Conversely, greed can lead to overconfidence and chasing high-performing assets, creating an unbalanced and potentially risky portfolio. Understanding behavioral finance and investment psychology is crucial to mitigating these emotional biases.

- Develop a robust risk tolerance strategy before investing.

- Establish clear, realistic investment goals to maintain focus during market fluctuations.

- Avoid emotional reactions to short-term market fluctuations; focus on the long-term strategy.

Strategies for Successful Buy-and-Hold Investing

Diversification and Asset Allocation

A well-diversified portfolio is the cornerstone of successful buy-and-hold. Diversification across different asset classes—stocks, bonds, real estate, commodities—reduces the impact of any single asset's underperformance. Your asset allocation strategy should reflect your risk tolerance and time horizon. A proper risk tolerance assessment is critical before committing to a buy-and-hold strategy with a diversified portfolio.

Dollar-Cost Averaging (DCA)

Dollar cost averaging (DCA) is a powerful technique for mitigating risk and managing emotional impulses. Instead of investing a lump sum, DCA involves investing a fixed amount of money at regular intervals (e.g., monthly). This strategy helps to smooth out market volatility and reduces the risk of buying high and selling low.

The Power of Long-Term Vision

Buy-and-hold demands patience and a long-term perspective. Ignore the daily market noise and focus on your long-term financial goals. Develop a strategic investment plan with a clear long-term investment horizon that aligns with your financial aspirations. Patience in investing is a key characteristic of successful buy-and-hold investors. This strategic investing approach will allow your investments to ride out the market fluctuations and grow.

- Regularly review and rebalance your portfolio to maintain your asset allocation strategy.

- Consider seeking professional financial advice from a qualified advisor.

- Stay informed about market trends, but avoid overreacting to daily market news.

Conclusion

Buy-and-hold investing is a potent long-term strategy capable of generating significant wealth. However, it's far from passive and requires discipline, careful preparation, and emotional resilience to navigate the inevitable market volatility. Understanding your risk tolerance, diversifying your portfolio, employing strategies like DCA, and maintaining a long-term vision are crucial for success. Remember, while market fluctuations may create temporary anxieties, they don't change the fundamental value of a well-researched, diversified portfolio. Start your journey with buy-and-hold investing today! Learn more about effective buy-and-hold strategies now and embark on your path to long-term financial success.

Featured Posts

-

Srbija Penzioneri Sa Milionskim Bogatstvom I Luksuznim Vilama

May 26, 2025

Srbija Penzioneri Sa Milionskim Bogatstvom I Luksuznim Vilama

May 26, 2025 -

Incidents Techniques Rtbf Solutions Et Prevention

May 26, 2025

Incidents Techniques Rtbf Solutions Et Prevention

May 26, 2025 -

Pogacars Second Tour Of Flanders Victory Denying Van Der Poels Historic Triumph

May 26, 2025

Pogacars Second Tour Of Flanders Victory Denying Van Der Poels Historic Triumph

May 26, 2025 -

Laurence Melys La Touche Feminine Du Cyclisme Sur Rtl

May 26, 2025

Laurence Melys La Touche Feminine Du Cyclisme Sur Rtl

May 26, 2025 -

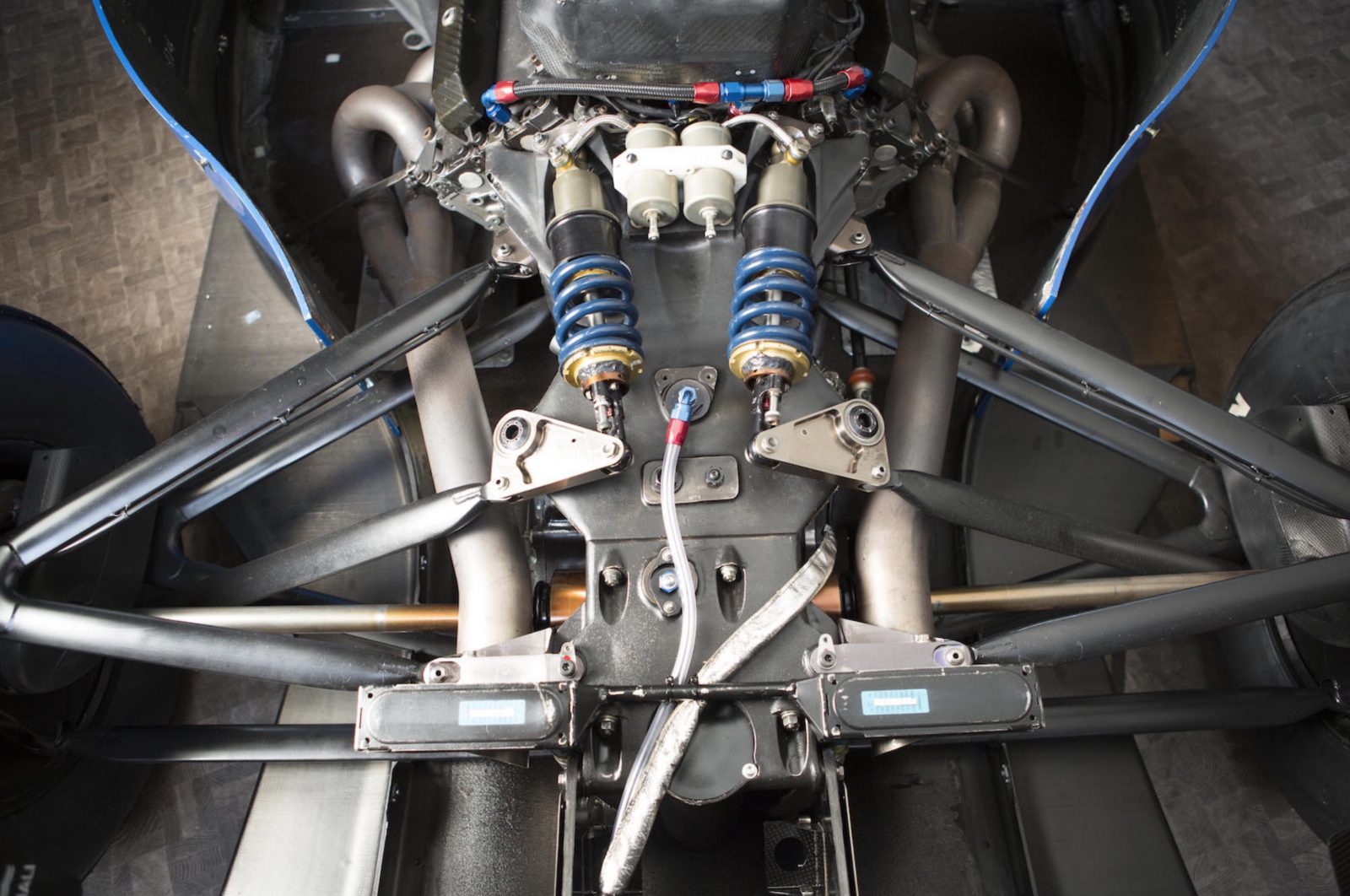

Rare Michael Schumacher Benetton F1 Show Car Up For Auction

May 26, 2025

Rare Michael Schumacher Benetton F1 Show Car Up For Auction

May 26, 2025

Latest Posts

-

Giannis Head Grab Sparks Controversy Pacers Game Aftermath

May 28, 2025

Giannis Head Grab Sparks Controversy Pacers Game Aftermath

May 28, 2025 -

Giannis Antetokounmpos Postgame Incident Head Grab During Handshakes After Bucks Loss

May 28, 2025

Giannis Antetokounmpos Postgame Incident Head Grab During Handshakes After Bucks Loss

May 28, 2025 -

Sacramento Kings Vs Indiana Pacers Injury Report And Game Preview

May 28, 2025

Sacramento Kings Vs Indiana Pacers Injury Report And Game Preview

May 28, 2025 -

Bennedict Mathurin Leads Pacers To Overtime Win Against Nets

May 28, 2025

Bennedict Mathurin Leads Pacers To Overtime Win Against Nets

May 28, 2025 -

Mathurins Heroics Pacers Edge Nets In Overtime Thriller

May 28, 2025

Mathurins Heroics Pacers Edge Nets In Overtime Thriller

May 28, 2025