Buy-and-Hold: Facing The Challenges Of Long-Term Investing

Table of Contents

Market Volatility and its Impact on Buy-and-Hold Strategies

Market volatility is an inherent characteristic of investing. Price fluctuations, both upward and downward, are unavoidable. For buy-and-hold investors, these swings can significantly impact investor confidence, especially during periods of market correction or downturn. The psychological toll of watching your portfolio value decline can be substantial, potentially leading to impulsive decisions like selling at a loss.

-

Illustrative examples of significant market downturns and their effect on buy-and-hold portfolios: The 2008 financial crisis and the COVID-19 market crash serve as stark reminders of the potential for dramatic market declines. Investors employing a buy-and-hold strategy during these periods experienced significant temporary losses, testing their commitment to their long-term plan.

-

Discussion of the psychological challenges of weathering market corrections: Fear and uncertainty are common emotional responses to market volatility. The temptation to sell low and buy high, driven by panic or fear of missing out (FOMO), is a major threat to the success of any buy-and-hold strategy. Developing a robust investment plan and sticking to it is crucial during these times.

-

The importance of a long-term perspective to mitigate short-term losses: The key to mitigating the impact of market volatility is maintaining a long-term perspective. The buy-and-hold strategy is designed to weather these storms, recognizing that market downturns are a normal part of the economic cycle, and focusing on the overall long-term growth potential. Remember that short-term losses don't negate the potential for long-term gains.

Inflation's Erosion of Purchasing Power and Buy-and-Hold Returns

Inflation, the gradual increase in the general price level of goods and services, is another significant challenge to buy-and-hold returns. Over extended periods, inflation erodes the purchasing power of your investment returns. A seemingly healthy return might not represent actual growth in real terms if inflation outpaces it.

-

Strategies for mitigating inflation risk, including investing in inflation-protected securities: To mitigate this risk, investors can diversify their portfolios to include assets that historically perform well during inflationary periods, such as inflation-protected securities (TIPS), real estate, and commodities.

-

The importance of regular portfolio rebalancing to adjust for inflation: Regular portfolio rebalancing is essential to maintain your desired asset allocation and counteract the effects of inflation. This involves periodically adjusting your portfolio to restore the original target allocation, potentially selling assets that have outperformed and buying assets that have underperformed.

-

Examples of assets that historically perform well during inflationary periods: Historically, real estate and commodities have often provided a hedge against inflation. However, it is important to remember that past performance is not indicative of future results.

The Importance of Diversification in a Buy-and-Hold Portfolio

Diversification is paramount in a buy-and-hold strategy. By spreading your investments across different asset classes, you reduce your overall portfolio risk. A well-diversified portfolio is less susceptible to significant losses from any single investment performing poorly.

-

Different asset classes (stocks, bonds, real estate, etc.) and their risk profiles: Stocks are generally considered higher risk, higher reward investments, while bonds are considered lower risk, lower reward. Real estate and alternative investments offer different risk-return profiles. A balanced portfolio often includes a mix of these asset classes.

-

The benefits of international diversification to mitigate geographic-specific risks: International diversification helps to mitigate risks associated with specific geographic regions or economic conditions. Investing in companies and assets in multiple countries reduces your dependence on the performance of a single economy.

-

The potential for sector-specific risk and the importance of broad diversification: Even within asset classes, sector-specific risks exist. Over-concentration in a single sector (e.g., technology) can leave your portfolio vulnerable to sector-specific downturns. Broad diversification across multiple sectors is crucial.

Unexpected Events and Black Swan Events impacting Buy and Hold

Unforeseen events, including so-called "black swan" events – highly improbable but potentially high-impact occurrences – can significantly disrupt even the most carefully planned long-term investment strategies. These events are difficult to predict and can create sudden, sharp market corrections.

-

Examples of black swan events (e.g., global pandemics, financial crises) and their impact on markets: The COVID-19 pandemic and the 2008 financial crisis are prime examples. These events caused unprecedented market volatility and significant losses for many investors.

-

Strategies for building resilience into a buy-and-hold portfolio to withstand unexpected shocks: Building portfolio resilience requires careful risk management, including appropriate diversification, and sufficient emergency funds to weather unexpected downturns.

-

The importance of having a robust financial plan that accounts for unforeseen circumstances: A well-defined financial plan, considering various scenarios and potential risks, is essential for navigating unexpected events. Regular reviews and adjustments to your plan are crucial in adapting to changing circumstances.

Tax Implications of Long-Term Buy-and-Hold Investing

The tax implications of long-term buy-and-hold investing are substantial and should be carefully considered. Capital gains taxes are levied on profits earned from the sale of assets, reducing your overall returns.

-

Capital gains taxes and their impact on overall returns: Understanding capital gains tax rates and how they apply to your specific investments is crucial for optimizing your overall returns.

-

Tax-efficient investment strategies, such as tax-advantaged accounts (e.g., 401(k), IRA): Utilizing tax-advantaged accounts like 401(k)s and IRAs can significantly reduce your tax burden on investment gains.

-

Importance of consulting with a financial advisor to develop a tax-efficient investment plan: A financial advisor can help you develop a tax-efficient investment strategy tailored to your specific circumstances and financial goals.

Conclusion

Buy-and-hold investing, while offering the potential for substantial long-term growth, requires a nuanced understanding of its inherent challenges. Successfully navigating market volatility, inflation, diversification needs, unexpected events, and tax implications is crucial for achieving your financial goals. By carefully considering these factors and implementing appropriate strategies, you can significantly increase your chances of success with your buy-and-hold investment approach. Remember to consult with a qualified financial advisor to create a personalized buy-and-hold strategy tailored to your individual risk tolerance and financial objectives. Start building your successful buy-and-hold portfolio today!

Featured Posts

-

Lewis Hamilton And Former Teammate A Touching Moment In F1 Testing

May 25, 2025

Lewis Hamilton And Former Teammate A Touching Moment In F1 Testing

May 25, 2025 -

Francis Sultana Designing The Interiors Of Robuchon Monaco Restaurants

May 25, 2025

Francis Sultana Designing The Interiors Of Robuchon Monaco Restaurants

May 25, 2025 -

Marks And Spencers 300 Million Cyber Security Breach Lessons Learned

May 25, 2025

Marks And Spencers 300 Million Cyber Security Breach Lessons Learned

May 25, 2025 -

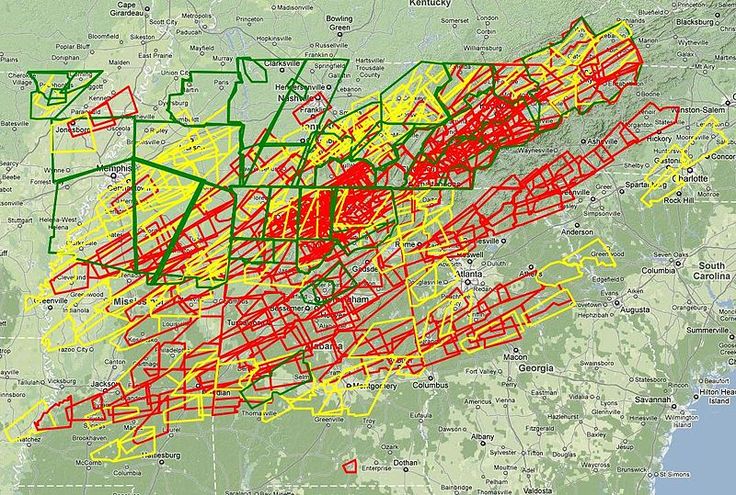

April 4th 2025 Severe Weather Update Flash Flood Warnings And Tornado Count

May 25, 2025

April 4th 2025 Severe Weather Update Flash Flood Warnings And Tornado Count

May 25, 2025 -

Tennis Participation Report 25 Million Players Projected Nationwide By August 2024

May 25, 2025

Tennis Participation Report 25 Million Players Projected Nationwide By August 2024

May 25, 2025

Latest Posts

-

Elever Une Famille Nombreuse Le Parcours De Melanie Thierry Et Raphael

May 25, 2025

Elever Une Famille Nombreuse Le Parcours De Melanie Thierry Et Raphael

May 25, 2025 -

Parenthood Challenges Melanie Thierry Et Raphaels Experience With Three Children

May 25, 2025

Parenthood Challenges Melanie Thierry Et Raphaels Experience With Three Children

May 25, 2025 -

Melanie Thierry Et Raphael Les Defis De La Parentalite Avec Des Enfants De Plusieurs Ages

May 25, 2025

Melanie Thierry Et Raphael Les Defis De La Parentalite Avec Des Enfants De Plusieurs Ages

May 25, 2025 -

Melanie Thierry Et Raphael Elever Trois Enfants Avec Un Grand Ecart D Age

May 25, 2025

Melanie Thierry Et Raphael Elever Trois Enfants Avec Un Grand Ecart D Age

May 25, 2025 -

Thierry Ardisson Prend La Defense De Laurent Baffie

May 25, 2025

Thierry Ardisson Prend La Defense De Laurent Baffie

May 25, 2025