Bulldog Banker Takes On Canada's Resource Sector Challenges

Table of Contents

Navigating the Volatility of Commodity Prices

The Canadian resource sector's fortunes are intrinsically linked to global commodity prices. Fluctuations in the prices of oil, gas, minerals, and other resources create significant financial risks for Canadian resource companies. The Bulldog Banker plays a crucial role in mitigating these risks and securing the necessary funding for projects.

Hedging Strategies and Risk Management

Effective hedging is paramount to navigating price volatility. Various strategies are employed to protect against losses:

- Futures contracts: These agreements lock in a future price for a commodity, providing price certainty.

- Options: These provide the right, but not the obligation, to buy or sell a commodity at a specific price, offering flexibility.

- Swaps: These contracts allow companies to exchange cash flows based on commodity prices, transferring risk.

- Diversification strategies: Spreading investments across different commodities and geographic regions reduces exposure to single-market downturns.

- Portfolio optimization: Sophisticated models are used to balance risk and return, maximizing profitability while minimizing losses.

These strategies, expertly implemented by the Bulldog Banker, act as a crucial buffer against the unpredictable nature of commodity markets, ensuring the financial stability of resource projects.

Securing Long-Term Financing

Securing financing for resource projects, which often involve substantial upfront investment and long lead times, presents a significant challenge in a volatile market. The Bulldog Banker's expertise is vital in this area:

- Project finance: This involves structuring financing packages specific to the project's cash flows, reducing reliance on the company's overall financial health.

- Equity financing: Raising capital by selling ownership stakes in the company attracts investors who share the risk and reward.

- Debt financing: Securing loans from banks and other financial institutions provides crucial capital.

- Government incentives: Accessing government grants, tax breaks, and other incentives helps reduce project costs.

- Attracting foreign investment: Seeking capital from international investors diversifies funding sources and brings in valuable expertise.

The Bulldog Banker's ability to navigate these complex financing options is essential for bringing resource projects to fruition.

Addressing Environmental, Social, and Governance (ESG) Concerns

The growing importance of ESG factors is transforming the Canadian resource sector. Investors, consumers, and regulators increasingly demand environmentally and socially responsible practices.

Sustainable Resource Extraction

Minimizing environmental impact is no longer optional; it's a necessity. The Bulldog Banker understands this and works to integrate sustainability into project development:

- Carbon capture: Technologies are used to capture and store CO2 emissions, reducing the carbon footprint of operations.

- Renewable energy integration: Utilizing solar, wind, and other renewable energy sources reduces reliance on fossil fuels.

- Waste reduction: Implementing efficient processes to minimize waste and promote recycling.

- Biodiversity conservation: Protecting ecosystems and mitigating the impact on local flora and fauna.

- Stakeholder engagement: Building strong relationships with communities and ensuring transparency in project development.

Sustainable practices are not only ethically responsible but also crucial for securing project approvals and attracting investment.

Community Relations and Indigenous Partnerships

Building trust and strong relationships with local communities and Indigenous groups is paramount for social license to operate. The Bulldog Banker facilitates this process:

- Free, Prior, and Informed Consent (FPIC): Respecting Indigenous rights and obtaining consent for projects on their traditional territories.

- Benefit-sharing agreements: Ensuring that local communities and Indigenous groups share in the benefits of resource projects.

- Community investment: Supporting local infrastructure development and economic opportunities.

- Responsible land use: Minimizing the environmental impact on land and water resources.

Successful collaboration fosters social acceptance and reduces the risk of project delays or cancellations.

Leveraging Technological Advancements

The resource sector is undergoing a digital transformation, leveraging technology to enhance efficiency and productivity.

Digital Transformation in Resource Management

Technology plays a vital role in improving every stage of resource development:

- Artificial intelligence (AI): AI algorithms optimize exploration, improve resource extraction, and predict equipment failures.

- Machine learning (ML): ML models analyze vast datasets to enhance decision-making and predict market trends.

- Automation: Automating tasks reduces labor costs and improves safety.

- Remote sensing: Satellites and drones provide real-time data on resource locations and environmental conditions.

- Data analytics: Analyzing data from various sources improves operational efficiency and reduces waste.

Innovation in Resource Processing and Refining

Advancements in processing and refining are crucial for reducing environmental impacts and improving resource yields:

- Improved extraction techniques: More efficient methods minimize waste and reduce environmental damage.

- Cleaner refining processes: Reducing pollution and emissions throughout the refining process.

- Circular economy principles: Designing processes to minimize waste and maximize resource reuse.

- Waste recycling: Developing methods to recover valuable materials from waste streams.

These innovations are vital for the long-term sustainability of the Canadian resource sector.

The Future of Canada's Resource Sector

The future of Canada's resource sector is bright, despite the challenges. The Bulldog Banker is instrumental in shaping this future.

Growth Opportunities and Emerging Markets

Canada possesses a wealth of natural resources crucial for a sustainable future:

- Critical minerals: Minerals essential for electric vehicles, renewable energy technologies, and other emerging sectors.

- Rare earth elements: These elements are vital for various high-tech applications.

- Green energy technologies: Canada is well-positioned to become a leader in the production of green energy resources.

- Global demand: The global demand for critical minerals and sustainable resources is expected to grow exponentially.

Canadian resource companies are poised to capitalize on these growth opportunities.

Attracting and Retaining Talent

A skilled workforce is essential for the continued success of the sector:

- Investment in education and training: Providing education and training programs to develop a skilled workforce.

- Promoting career opportunities: Highlighting the rewarding careers available in the resource sector.

- Improving working conditions: Creating a safe and attractive work environment.

Addressing skills shortages is vital for attracting and retaining the best talent.

Conclusion

The "Bulldog Banker" plays a pivotal role in navigating the complex landscape of Canada's resource sector. By employing robust risk management strategies, prioritizing ESG considerations, and embracing technological innovation, these tenacious financial professionals are helping to ensure the long-term success and sustainability of this vital industry. The future of Canada's resource sector hinges on continued adaptation and innovation. To learn more about how "Bulldog Bankers" are shaping the future of Canada's resource sector, explore further resources and connect with industry experts. Investing in a strong and resilient Canadian resource sector is investing in Canada's future.

Featured Posts

-

Colorado Rapids Win Harris And Bassett Goals Steffens 12 Save Performance

May 16, 2025

Colorado Rapids Win Harris And Bassett Goals Steffens 12 Save Performance

May 16, 2025 -

Breaking The Deadlock A Comprehensive Look At The Us China Trade Agreement

May 16, 2025

Breaking The Deadlock A Comprehensive Look At The Us China Trade Agreement

May 16, 2025 -

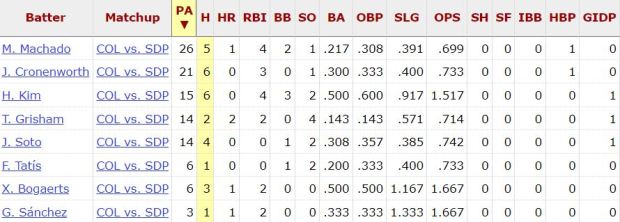

San Diego Padres Pregame Report Rain Delay And Roster Moves

May 16, 2025

San Diego Padres Pregame Report Rain Delay And Roster Moves

May 16, 2025 -

Ai Therapy Privacy Risks And The Erosion Of Civil Liberties

May 16, 2025

Ai Therapy Privacy Risks And The Erosion Of Civil Liberties

May 16, 2025 -

Nba Playoffs Jimmy Butlers Game 6 Predictions For Rockets Vs Warriors

May 16, 2025

Nba Playoffs Jimmy Butlers Game 6 Predictions For Rockets Vs Warriors

May 16, 2025

Latest Posts

-

Kogda Ovechkin Pobet Rekord Grettski Obnovlenniy Prognoz Ot N Kh L

May 16, 2025

Kogda Ovechkin Pobet Rekord Grettski Obnovlenniy Prognoz Ot N Kh L

May 16, 2025 -

Lane Hutson Un Futur Numero 1 En Defense Dans La Lnh

May 16, 2025

Lane Hutson Un Futur Numero 1 En Defense Dans La Lnh

May 16, 2025 -

Critiques Du Marche Famelique Pour Les Gardiens Realites Et Defis

May 16, 2025

Critiques Du Marche Famelique Pour Les Gardiens Realites Et Defis

May 16, 2025 -

Profession De Gardien Comment Naviguer Sur Un Marche Famelique

May 16, 2025

Profession De Gardien Comment Naviguer Sur Un Marche Famelique

May 16, 2025 -

Le Marche Famelique Des Gardiens Solutions Et Perspectives

May 16, 2025

Le Marche Famelique Des Gardiens Solutions Et Perspectives

May 16, 2025