Buffett Rejects Trump Tariff Claims: All Reports False

Table of Contents

Buffett's Direct Denial of Supporting Trump Tariffs

The claims suggesting Warren Buffett supported Trump's tariffs are demonstrably false. Buffett has consistently and publicly refuted any association with these policies. He has never explicitly endorsed the Trump administration's trade protectionism. His denials are easily verifiable through various reputable news sources and official statements.

- Specific date(s) of denial: While a precise date for a single, overarching denial is difficult to pinpoint, numerous interviews and statements over the years implicitly and explicitly contradict the false claims. Analyzing his public appearances and Berkshire Hathaway annual reports reveals a consistent rejection of the narrative linking him to support for the tariffs.

- Media outlet(s) where the denial was made: While not a single, unified statement, Buffett's consistent public commentary on trade and economic policy within major news outlets like CNBC, Bloomberg, and The Wall Street Journal, indirectly and directly refutes these false claims. The absence of any supportive statement from him speaks volumes.

- Key phrases used by Buffett in his refutation: While there’s no single quote explicitly debunking the specific rumor, his consistent emphasis on free trade, the benefits of globalization, and the potential downsides of protectionist policies implicitly refutes the notion of him supporting Trump's tariffs. A careful analysis of his interviews and written statements reveals this consistent position.

Analysis of the False Reports and Their Origin

The origin of these false Buffett Trump Tariff Claims remains unclear, but several factors could have contributed to their spread. It's possible the misinformation stemmed from:

- Identification of the original source(s) of the false claim: Pinpointing the initial source of the misinformation is challenging. It likely spread through a combination of social media, biased news outlets, and potentially deliberate attempts to misrepresent Buffett's position for political or other agendas.

- Analysis of the credibility of the source(s): Many of the sources propagating this narrative lack journalistic integrity or present a clear bias. This makes it crucial to critically evaluate information sources before accepting claims regarding prominent figures.

- Examination of any potential biases or agendas driving the spread of misinformation: Political motivations, intentional disinformation campaigns, or even simple errors and misunderstandings could have fueled the spread of these false claims. The lack of factual evidence makes such motivations highly suspect.

Buffett's Actual Stance on Tariffs: A Balanced Perspective

Buffett's position on tariffs is nuanced and consistent with his broader investment philosophy. He generally favors free trade and globalization, recognizing their positive impacts on economic growth. However, this doesn't preclude him from acknowledging potential downsides in specific instances.

- Buffett's general views on free trade versus protectionism: He has consistently emphasized the benefits of open markets and international trade. His investment portfolio includes numerous global companies, highlighting his belief in the advantages of global economic integration.

- Specific examples of his investments and business decisions related to global trade: Berkshire Hathaway's extensive global holdings demonstrate his commitment to international trade and economic collaboration.

- How his stance on tariffs aligns with his overall investment philosophy: His long-term investment strategy favors companies with strong global reach and competitive advantages, reflecting his belief in the benefits of open markets.

The Economic Impact of Trade Wars and Tariffs

Tariffs, as demonstrated by numerous economic studies, can lead to higher prices for consumers, reduced competitiveness for domestic industries, and retaliatory measures from other countries. Organizations like the IMF and World Bank have extensively documented the potential negative consequences of trade wars and protectionist policies. Understanding these consequences provides crucial context for evaluating claims related to individuals' stances on trade.

Conclusion

Reports linking Warren Buffett to support of Trump's tariffs are unequivocally false. Buffett has clearly and consistently rejected such claims. His actual stance on trade policies is nuanced but ultimately aligns with a belief in free and open markets. His vast global investments directly contradict any notion of support for protectionist measures. Understanding the difference between verifiable facts and misinformation is crucial in discerning accurate financial and economic reporting.

Call to Action: Stay informed about accurate financial news and rely on verified sources before accepting information regarding prominent figures like Warren Buffett and significant economic policy discussions. Avoid the spread of misinformation about Buffett Trump Tariff Claims and always consult reputable news sources for accurate reporting. Critical thinking and fact-checking are essential tools in navigating the complex landscape of financial news.

Featured Posts

-

Legal Battle Over Banned Chemicals Sold On E Bay Section 230 Implications

May 05, 2025

Legal Battle Over Banned Chemicals Sold On E Bay Section 230 Implications

May 05, 2025 -

Panthers 3rd Period Comeback Johnston And Rantanens Rout Highlight Nhl Action

May 05, 2025

Panthers 3rd Period Comeback Johnston And Rantanens Rout Highlight Nhl Action

May 05, 2025 -

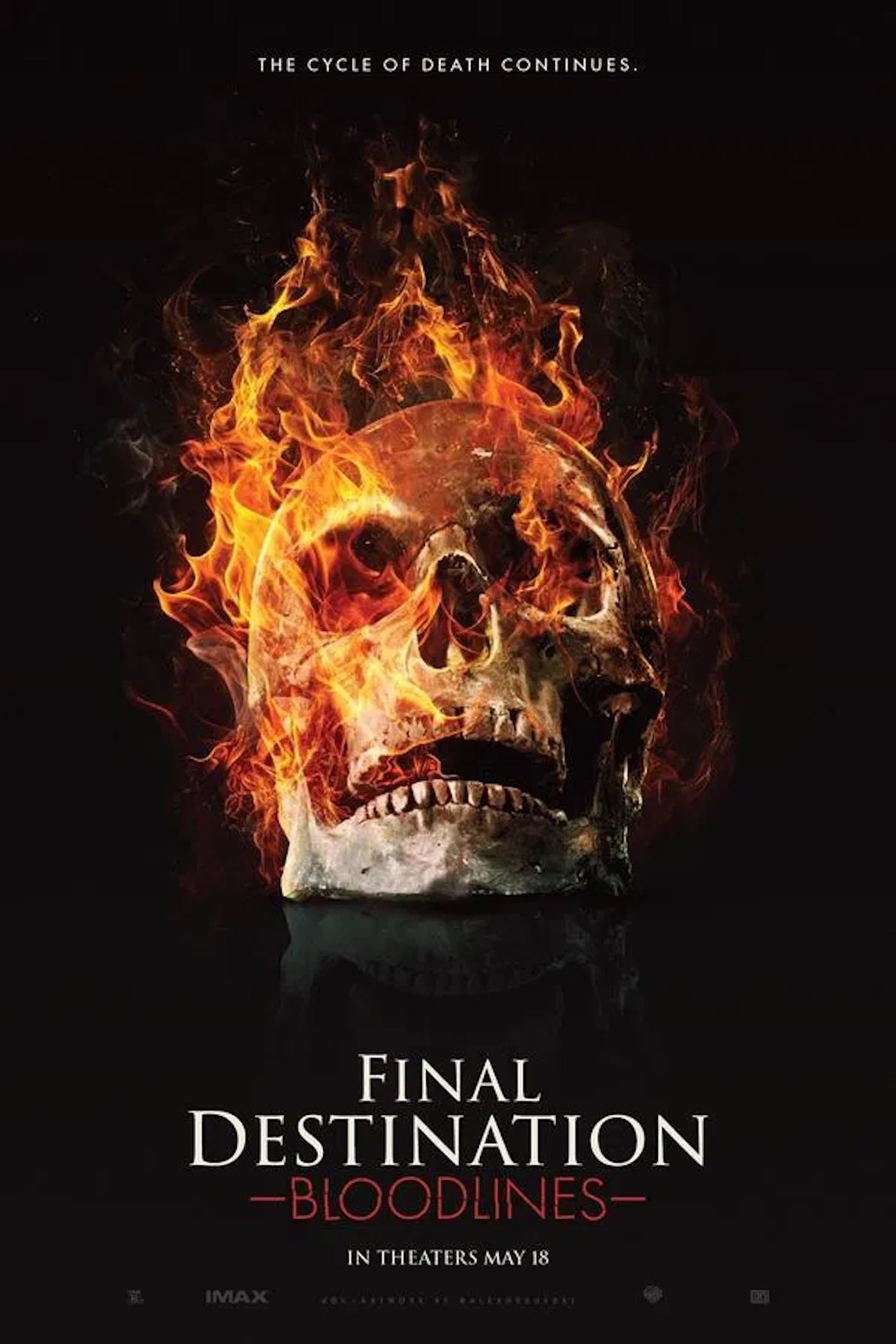

Revisiting The Most Iconic Final Destination Moment Why It Still Works

May 05, 2025

Revisiting The Most Iconic Final Destination Moment Why It Still Works

May 05, 2025 -

Verstappens New Role Horners Jocular Observation

May 05, 2025

Verstappens New Role Horners Jocular Observation

May 05, 2025 -

Ufc 314 Full Bout Order Revealed For Main Card And Prelims

May 05, 2025

Ufc 314 Full Bout Order Revealed For Main Card And Prelims

May 05, 2025

Latest Posts

-

Final Destination Bloodline A New Standard For The Franchises Length

May 05, 2025

Final Destination Bloodline A New Standard For The Franchises Length

May 05, 2025 -

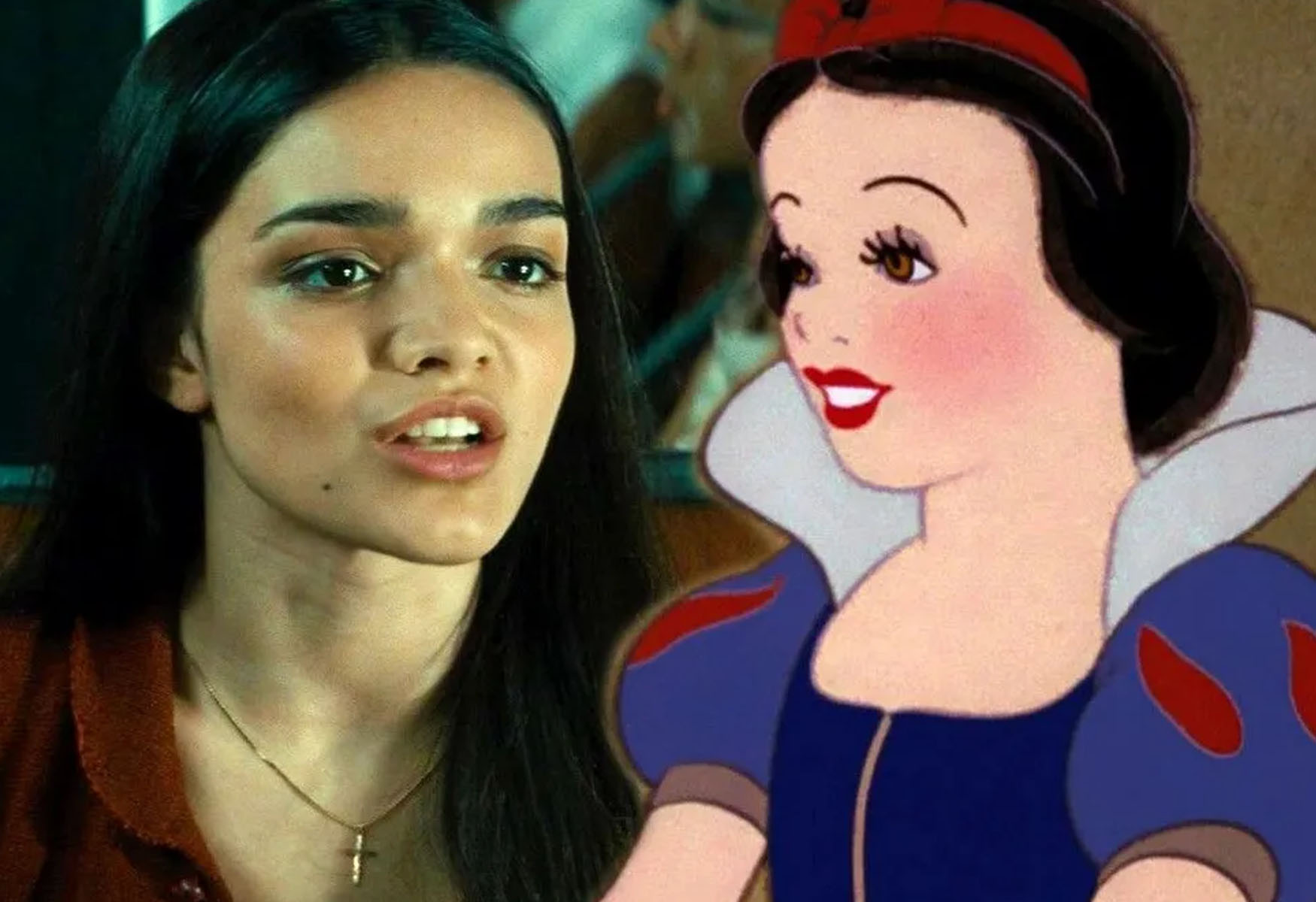

Can The Horror Franchise Reboot Top The Monkey A Look At The Upcoming Film

May 05, 2025

Can The Horror Franchise Reboot Top The Monkey A Look At The Upcoming Film

May 05, 2025 -

High Stakes The Upcoming 666 M Horror Franchise Reboot Faces A Monkey Sized Challenge

May 05, 2025

High Stakes The Upcoming 666 M Horror Franchise Reboot Faces A Monkey Sized Challenge

May 05, 2025 -

Monkey Business Can The Reboot Live Up To The 666 M Horror Franchises Legacy

May 05, 2025

Monkey Business Can The Reboot Live Up To The 666 M Horror Franchises Legacy

May 05, 2025 -

The Monkey Sets A High Bar Expectations For The 666 M Horror Franchise Reboot

May 05, 2025

The Monkey Sets A High Bar Expectations For The 666 M Horror Franchise Reboot

May 05, 2025