Brookfield Reconsiders US Manufacturing Expansion Amidst Tariff Concerns

Table of Contents

Brookfield, a prominent player in the manufacturing sector, had initially outlined plans for substantial investment in US manufacturing facilities. These plans, however, are now under review due to the significant headwinds created by ongoing tariff disputes and the resulting uncertainty surrounding future trade policies. This article will delve into the key factors prompting Brookfield's reconsideration, exploring the impact of tariffs, alternative investment strategies, and the broader implications for US manufacturing.

The Impact of Tariffs on Brookfield's Investment Decision

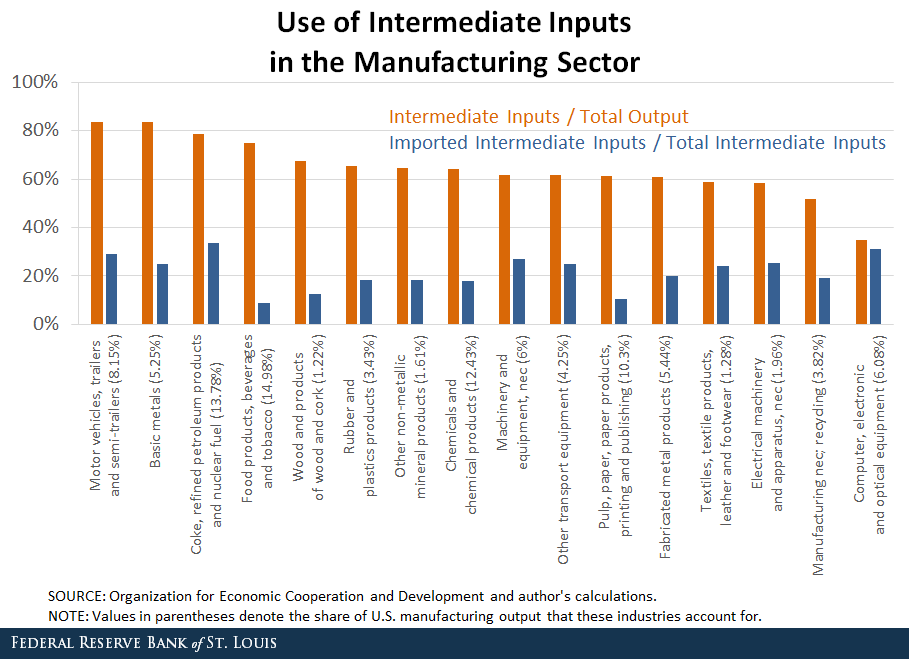

The imposition of various tariffs, particularly those affecting [Specify the relevant industry, e.g., steel, aluminum, or specific components], has significantly increased Brookfield's projected costs for its US manufacturing expansion. These increased costs directly impact the project's potential profitability, potentially reducing the return on investment to an unacceptable level. Estimates suggest that tariffs have added a [Quantify the percentage increase, e.g., 15-20%] increase in the cost of raw materials and finished goods.

- Increased raw material costs: Tariffs on imported raw materials, like [Specific examples relevant to Brookfield's industry], inflate the cost of production, squeezing profit margins.

- Higher import/export duties: The increased duties on both imported components and exported finished products further erode profitability.

- Potential loss of competitive advantage: Higher production costs due to tariffs reduce Brookfield's competitiveness against manufacturers in countries with more favorable trade agreements.

- Impact on supply chain logistics: Tariffs complicate supply chain management, leading to delays, increased administrative burden, and additional logistical expenses.

Alternative Investment Strategies and Geopolitical Considerations

Faced with the challenges posed by US tariffs, Brookfield is reportedly exploring alternative investment locations. Mexico and Canada, with their proximity to the US market and potentially more favorable trade agreements, are likely candidates. The current geopolitical climate, characterized by ongoing trade disputes and fluctuating political stability in various regions, significantly influences these investment decisions.

- Shifting manufacturing to lower-tariff countries: Relocating manufacturing operations to countries with more favorable trade agreements could mitigate the impact of US tariffs.

- Focusing on domestic sourcing of raw materials: Sourcing raw materials domestically, whenever feasible, reduces reliance on imports and minimizes tariff exposure.

- Exploring strategic partnerships: Collaborating with companies in other regions can help mitigate tariff impacts through diversification of supply chains and shared risk.

- Delaying expansion until greater tariff certainty emerges: A wait-and-see approach allows Brookfield to assess the evolving trade landscape before committing to large-scale investments.

Brookfield's Public Statements and Analyst Reactions

While Brookfield has not issued a formal statement explicitly confirming a halt to its US manufacturing expansion, [Cite any relevant press releases or news articles mentioning the situation]. Financial analysts have interpreted the situation as a direct response to the tariff uncertainty. [Quote an analyst or two with relevant expertise on the matter].

- Stock market response to the news: The news has [Describe the market response, e.g., led to a slight dip in Brookfield's stock price].

- Analyst predictions regarding future investment decisions: Analysts predict [Summarize predictions about Brookfield's future strategy, including potential geographic shifts in investment].

- Potential long-term implications for Brookfield's overall strategy: This decision could signal a broader shift in Brookfield's global investment strategy, potentially favoring regions with greater trade stability.

The Broader Context: US Manufacturing and Trade Policy Uncertainty

Brookfield's decision reflects a broader trend within the US manufacturing sector. The ongoing uncertainty surrounding US trade policy is making it increasingly difficult for companies to plan long-term investments. Many manufacturers are facing similar challenges, leading to delayed projects, reduced investment, and job security concerns.

- Job creation concerns: Reduced manufacturing investment directly impacts job creation potential in the US.

- Competitiveness of US manufacturers: Tariffs diminish the competitiveness of US manufacturers on the global stage.

- The impact on the overall US economy: The uncertainty surrounding trade policy creates instability that affects the overall health of the US economy.

Conclusion: Navigating Tariff Uncertainty: The Future of Brookfield's US Manufacturing Plans

Brookfield's reconsideration of its US manufacturing expansion underscores the significant impact of tariff uncertainty on investment decisions. The increased costs, logistical challenges, and reduced competitiveness associated with tariffs have prompted the company to explore alternative strategies, potentially delaying or shifting its US investment plans. The evolving trade landscape will play a crucial role in shaping Brookfield's future investment in the US manufacturing sector. To stay updated on Brookfield's future announcements concerning US manufacturing expansion plans and to follow further analyses on the impact of tariffs on US manufacturing investment, continue to monitor industry news and expert opinions related to "Brookfield US manufacturing," "tariff impact on investment," and "US manufacturing expansion."

Featured Posts

-

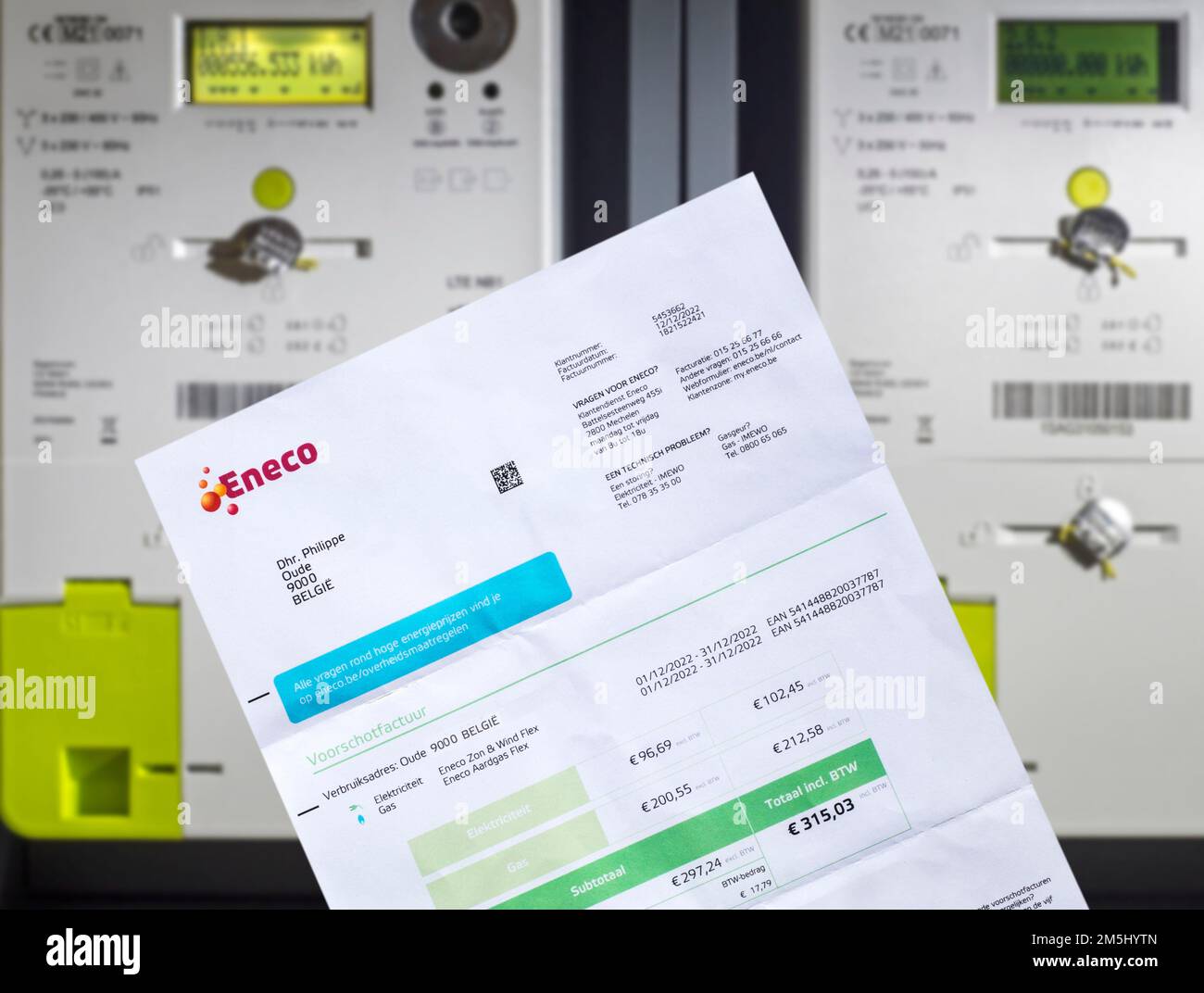

Energie Renouvelable Eneco Inaugure Un Megaparc De Batteries A Au Roeulx

May 03, 2025

Energie Renouvelable Eneco Inaugure Un Megaparc De Batteries A Au Roeulx

May 03, 2025 -

Farages New Reform Slogan A Controversial Jimmy Savile Reference

May 03, 2025

Farages New Reform Slogan A Controversial Jimmy Savile Reference

May 03, 2025 -

Analysis Has Labour Earned The Nasty Party Label

May 03, 2025

Analysis Has Labour Earned The Nasty Party Label

May 03, 2025 -

Strong Mental Health Policies A Foundation For A Productive Workforce

May 03, 2025

Strong Mental Health Policies A Foundation For A Productive Workforce

May 03, 2025 -

Lotto Plus 1 And Lotto Plus 2 Results Check The Latest Winning Numbers

May 03, 2025

Lotto Plus 1 And Lotto Plus 2 Results Check The Latest Winning Numbers

May 03, 2025