Broadcom's VMware Acquisition: AT&T Exposes A 1,050% Price Hike

Table of Contents

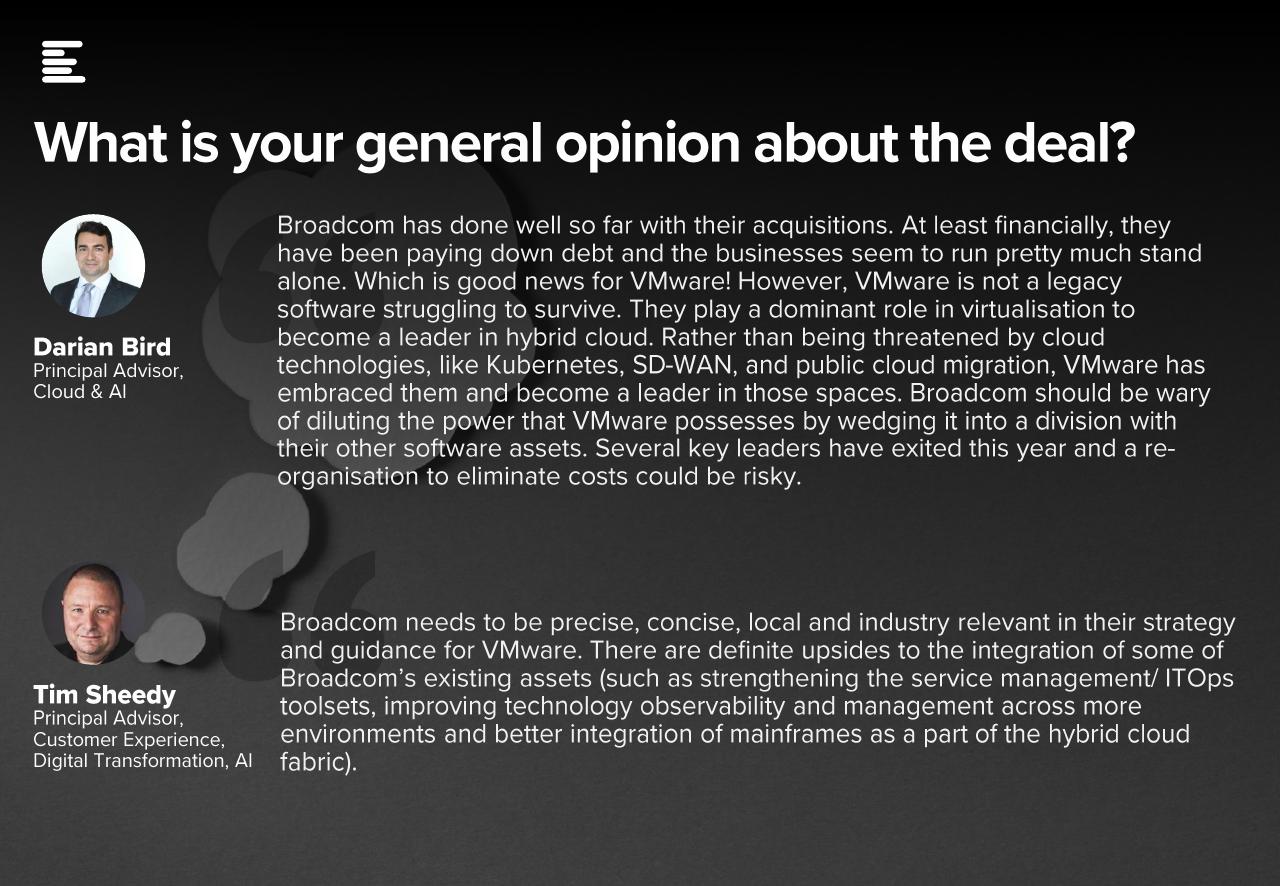

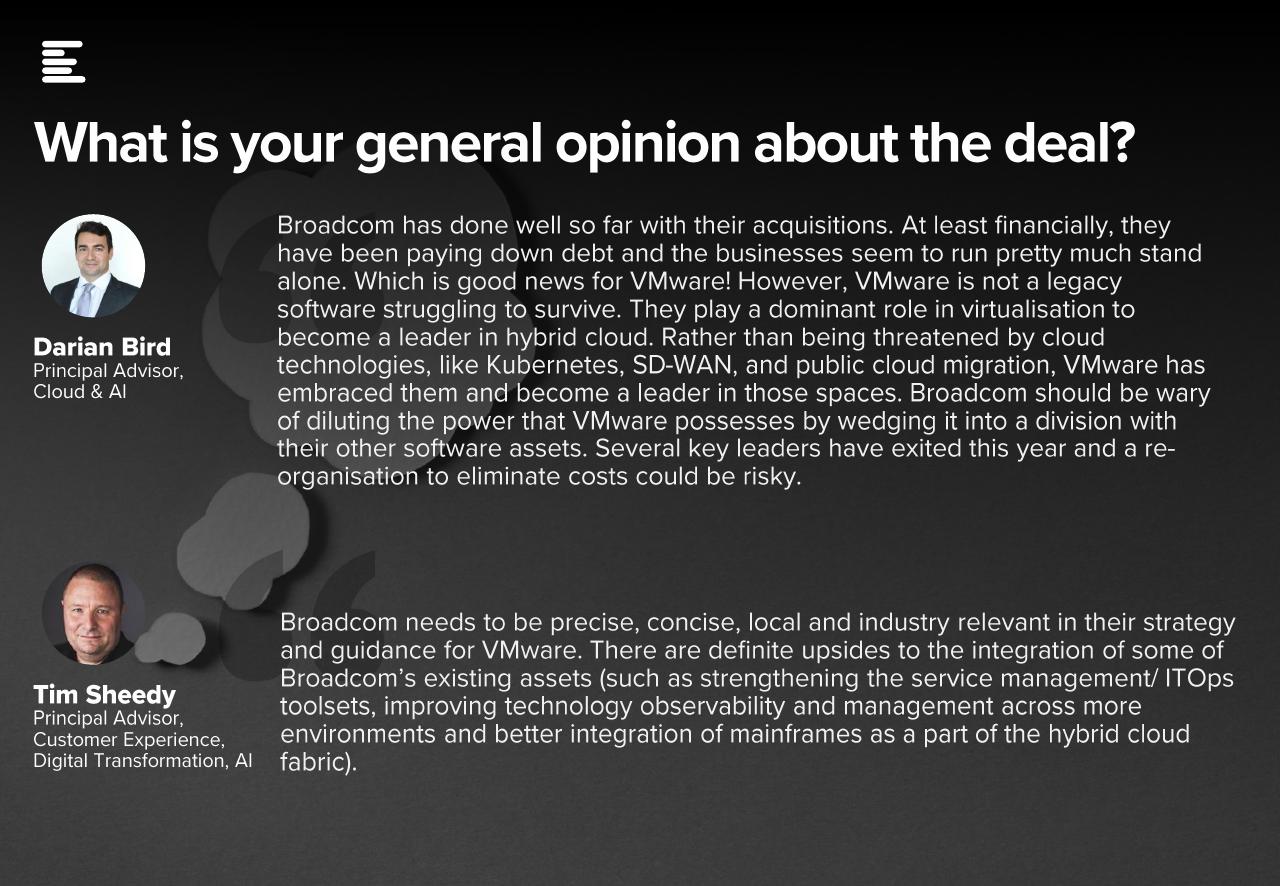

Understanding the Broadcom VMware Acquisition and its Market Implications

Broadcom's Strategic Goals

Broadcom's acquisition of VMware was a strategic move aimed at significantly expanding its footprint in the enterprise software and infrastructure market. The company sought to:

- Increase market dominance: Gain a leading position in the rapidly growing market for enterprise software and cloud infrastructure.

- Access new technologies: Acquire VMware's advanced virtualization and cloud technologies to bolster its existing portfolio.

- Achieve synergies: Leverage synergies between Broadcom's existing infrastructure solutions and VMware's software offerings, creating a more comprehensive and integrated product suite.

VMware's Market Position Before the Acquisition

Before the acquisition, VMware held a dominant position in the virtualization and cloud computing market. Its key strengths included:

- Significant market share: VMware was a market leader in virtualization technologies, holding a substantial share of the global market.

- Key product offerings: Its portfolio of products, including vSphere (server virtualization), vSAN (storage virtualization), and NSX (network virtualization), were widely adopted by businesses of all sizes.

- Extensive customer base: VMware boasted a vast and diverse customer base, including many Fortune 500 companies and major telecommunications providers like AT&T.

Antitrust Concerns and Regulatory Scrutiny

The Broadcom VMware acquisition naturally raised concerns about potential antitrust violations and monopolistic practices. The deal underwent (or is undergoing) thorough regulatory scrutiny, with regulators examining:

- Potential monopolies: Concerns were raised about the creation of a dominant player in the market, potentially stifling competition and innovation.

- Impact on competition: Regulators assessed the impact of the acquisition on the competitive landscape, analyzing whether it would lead to reduced choice and higher prices for consumers.

- Ongoing investigations: Depending on the jurisdiction, ongoing investigations may be examining the effects of the merger on market competitiveness.

AT&T's 1,050% Price Hike: A Case Study of Post-Acquisition Price Increases

The Specifics of AT&T's Price Increase

AT&T's reported 1,050% price increase following the Broadcom VMware acquisition shocked the industry. While the precise details may vary depending on the specific contracts, the increases affected:

- Specific products or services: [Insert specific VMware products or services affected by the price hike here. If possible, include specific examples and product codes].

- Old and new pricing: [Insert old and new pricing information for the affected services. Include sources if available].

- Supporting documentation: [If available, cite official statements from AT&T or other relevant documentation].

AT&T's Response and Industry Reaction

AT&T's official response to the criticism surrounding the price increase [insert AT&T's statement here if available]. The reaction from other telecommunication companies and industry experts has been mixed, with [insert quotes from relevant sources].

Potential Implications for Other VMware Customers

AT&T's experience serves as a cautionary tale for other VMware clients. The potential implications include:

- Concerns of other customers: Many VMware customers are expressing concerns about potential price increases on their own contracts.

- Impacts on budgets: Significant price hikes could severely impact IT budgets, forcing businesses to re-evaluate their spending priorities.

- Strategies for mitigating risks: Businesses are actively seeking strategies to mitigate the financial risks associated with the Broadcom VMware acquisition.

Analyzing the Long-Term Effects of the Broadcom VMware Acquisition on Pricing

Market Power and Pricing Dynamics

The Broadcom VMware acquisition resulted in a significant increase in market concentration. This concentration can lead to:

- Market power: Broadcom now possesses substantial market power, enabling it to potentially influence pricing to its advantage.

- Price gouging: Concerns exist about the potential for Broadcom to engage in price gouging, taking advantage of its market dominance.

- Impact on innovation: Reduced competition can stifle innovation, as there is less pressure to develop new and better products.

The Impact on Businesses and Consumers

The long-term effects of the acquisition on businesses and consumers are far-reaching:

- Increased operational costs: Businesses face potentially significant increases in their operational costs due to higher software licensing fees.

- Reduced choices: Less competition could limit the choices available to businesses when selecting virtualization and cloud solutions.

- Long-term economic consequences: The price hikes could ripple through the economy, affecting various industries and ultimately impacting consumers.

Potential Mitigation Strategies for Businesses

Businesses can take several steps to mitigate the risks of substantial price increases:

- Explore alternative solutions: Investigate and consider alternative virtualization and cloud platforms to reduce reliance on VMware products.

- Negotiate contracts effectively: Engage in robust negotiations with Broadcom to secure favorable pricing and contract terms.

- Monitor market trends closely: Stay informed about market developments and be prepared to adapt to changing pricing structures.

Conclusion: The Future of Pricing in the Post-Acquisition Landscape for Broadcom VMware

The Broadcom VMware acquisition has already resulted in significant price increases, as evidenced by AT&T's 1,050% hike. The long-term implications for businesses and consumers remain uncertain, but it’s crucial to monitor pricing changes and explore alternatives. Businesses need to proactively assess their dependence on VMware products and explore alternative options to protect themselves from potential future price hikes. Learn more about mitigating the risks associated with the Broadcom VMware acquisition and assess your vulnerability to Broadcom VMware price hikes now!

Featured Posts

-

Nba Playoffs Predicting The Outcome Of Celtics Vs Cavaliers

May 15, 2025

Nba Playoffs Predicting The Outcome Of Celtics Vs Cavaliers

May 15, 2025 -

Everton Vina Vs Coquimbo Unido 0 0 Reporte Del Partido

May 15, 2025

Everton Vina Vs Coquimbo Unido 0 0 Reporte Del Partido

May 15, 2025 -

Sensex Gains Momentum These Stocks Jumped Over 10 On Bse

May 15, 2025

Sensex Gains Momentum These Stocks Jumped Over 10 On Bse

May 15, 2025 -

Padres Vs Pirates Expert Mlb Predictions And Best Betting Odds

May 15, 2025

Padres Vs Pirates Expert Mlb Predictions And Best Betting Odds

May 15, 2025 -

Celtics Sale To Private Equity A 6 1 Billion Deal And Fan Uncertainty

May 15, 2025

Celtics Sale To Private Equity A 6 1 Billion Deal And Fan Uncertainty

May 15, 2025