Broadcom's VMware Acquisition: A 1050% Price Hike For AT&T

Table of Contents

VMware's Crucial Role in AT&T's Network Infrastructure

VMware's virtualization technology forms the bedrock of many modern data centers, and AT&T is no exception. Before the Broadcom acquisition, AT&T heavily relied on VMware's suite of products for its network infrastructure, leveraging its capabilities for:

- Network Virtualization: VMware NSX provided AT&T with the ability to virtualize its network functions, improving agility and efficiency in managing its vast network.

- Server Virtualization: vSphere, VMware's flagship server virtualization platform, was crucial for consolidating and managing AT&T's server resources, optimizing utilization and reducing hardware costs.

- Cloud Computing Integration: VMware's solutions facilitated the integration of AT&T's on-premises infrastructure with its cloud deployments, enabling a hybrid cloud approach.

This significant dependency on VMware’s virtual infrastructure meant that any changes to VMware's pricing structure would directly and dramatically impact AT&T's operational costs. The sheer scale of AT&T's network amplified the effect of even a modest percentage increase in licensing fees.

The Broadcom Acquisition and its Immediate Impact on Pricing

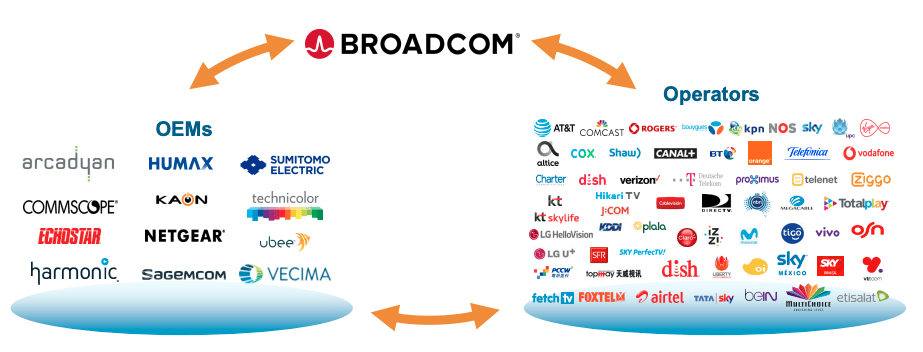

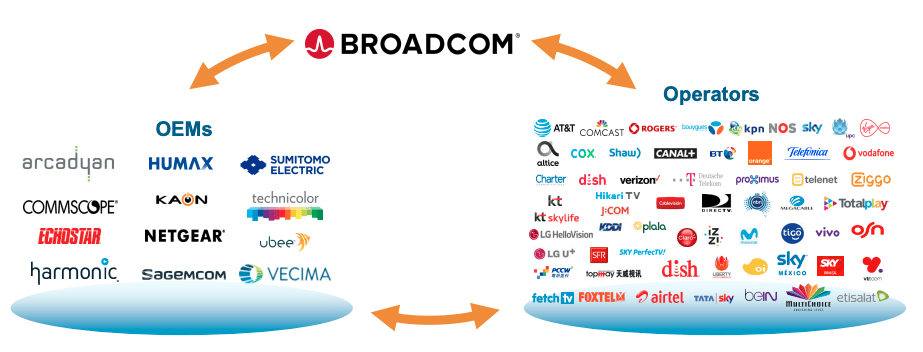

Broadcom's acquisition of VMware, a deal valued at approximately $61 billion, concluded in late 2022. This merger immediately raised concerns regarding potential anti-competitive practices and the likelihood of increased licensing costs for VMware customers. For AT&T, this concern rapidly became a reality. The 1050% price hike reflects the immediate fallout of the acquisition, suggesting a significant shift in VMware's pricing strategy following the change in ownership. Several contributing factors likely led to this drastic increase:

- Increased Market Dominance: The merger gave Broadcom considerable market power in the enterprise software space, potentially allowing for increased pricing leverage.

- Reduced Competition: The acquisition removed a significant competitor from the market, potentially reducing pressure to keep prices competitive.

- Increased Licensing Fees: Broadcom may have implemented new licensing models or increased existing fees to maximize profits post-acquisition.

Analyzing the 1050% Price Increase: A Case Study in Market Power

The 1050% price increase is not just a number; it represents a substantial financial burden for AT&T. This translates to millions, if not billions, of dollars in additional annual expenditure. This dramatic increase has significant implications:

- Impact on Profitability: The higher costs directly impact AT&T's profitability, potentially forcing them to reconsider pricing strategies for their own services or reduce investments in other areas.

- Competitive Disadvantage: The increased costs could put AT&T at a competitive disadvantage compared to other telecommunications companies that may have secured better licensing agreements or opted for alternative virtualization technologies.

- Broader Market Implications: This case serves as a stark warning to other businesses relying on VMware products, highlighting the potential for similar price increases and the vulnerability of companies heavily reliant on a single vendor's technology. This raises serious concerns regarding monopolistic practices and the need for regulatory oversight.

Future Implications and Potential Mitigation Strategies

The long-term consequences of this price hike are still unfolding. For AT&T and other businesses, the need for strategic adaptation is clear. Potential responses include:

- Negotiating New Licensing Agreements: AT&T might renegotiate its contracts with Broadcom, attempting to secure more favorable pricing terms.

- Exploring Alternative Virtualization Solutions: Migrating to alternative virtualization platforms, such as OpenStack or Red Hat Virtualization, could offer a pathway to reduce reliance on Broadcom's VMware solutions.

- Implementing Cost-Cutting Measures: Optimizing resource utilization and implementing other cost-cutting measures within their IT infrastructure will be necessary to offset the increased expenses.

Regulatory scrutiny and potential antitrust investigations are also likely to play a role in shaping the future landscape. The impact of this acquisition on the competitive landscape will likely be felt for years to come.

Conclusion: Navigating the Post-Acquisition Landscape of VMware and Broadcom

Broadcom's acquisition of VMware has resulted in a substantial price hike for AT&T, demonstrating the far-reaching implications of mergers and acquisitions in the enterprise software market. The 1050% price increase serves as a stark example of the potential power of these mergers and the risks for businesses heavily reliant on specific technologies. The long-term effects on AT&T and the broader telecommunications industry remain to be seen, but the case underscores the need for businesses to actively manage their enterprise software costs and diversify their technology dependencies. Stay informed about the evolving landscape of enterprise software and the impact of mergers and acquisitions on your business, actively managing your Broadcom VMware acquisition costs and implementing effective enterprise software cost management strategies.

Featured Posts

-

Alkhtwt Aljwyt Aljnwbyt Alsynyt W Laram Shrakt Jdydt Lrbt Ifryqya Balsyn

May 07, 2025

Alkhtwt Aljwyt Aljnwbyt Alsynyt W Laram Shrakt Jdydt Lrbt Ifryqya Balsyn

May 07, 2025 -

Stansted Airports New Casablanca Connection Everything You Need To Know

May 07, 2025

Stansted Airports New Casablanca Connection Everything You Need To Know

May 07, 2025 -

Understanding Greg Abel The Canadian Leading Berkshire Hathaway

May 07, 2025

Understanding Greg Abel The Canadian Leading Berkshire Hathaway

May 07, 2025 -

Negative Inflation In Thailand A Boon For The Economy

May 07, 2025

Negative Inflation In Thailand A Boon For The Economy

May 07, 2025 -

Cavaliers Defeat Grizzlies Extend Win Streak To Franchise Record 16 Games With Mobleys Help

May 07, 2025

Cavaliers Defeat Grizzlies Extend Win Streak To Franchise Record 16 Games With Mobleys Help

May 07, 2025

Latest Posts

-

76

May 08, 2025

76

May 08, 2025 -

2 0 76

May 08, 2025

2 0 76

May 08, 2025 -

76 2 0

May 08, 2025

76 2 0

May 08, 2025 -

The Night Inter Milan Beat Barcelona To Reach The Champions League Final

May 08, 2025

The Night Inter Milan Beat Barcelona To Reach The Champions League Final

May 08, 2025 -

Inters All Time Victory Reaching The Champions League Final By Defeating Barcelona

May 08, 2025

Inters All Time Victory Reaching The Champions League Final By Defeating Barcelona

May 08, 2025