Broadcom's VMware Acquisition: A 1,050% Price Increase For AT&T?

Table of Contents

Background: In a deal valued at approximately $61 billion, Broadcom, a leading semiconductor company, finalized its acquisition of VMware, a virtualization giant. This merger unites two industry powerhouses, creating a behemoth with significant influence over enterprise software and hardware. The deal's sheer size and the combined market power of the entities involved raise significant concerns regarding potential monopolistic practices and pricing strategies.

AT&T's Reliance on VMware Technology

VMware's Current Role in AT&T's Infrastructure

AT&T, a telecommunications giant, heavily relies on VMware's virtualization technologies for its vast network infrastructure. VMware's solutions, including vSphere, vCloud, and NSX, are integral to AT&T's data centers, powering a significant portion of its virtualized servers and network operations.

- vSphere: Forms the backbone of AT&T's server virtualization, enabling efficient resource utilization and scalability.

- vCloud: Provides a cloud computing platform for AT&T, supporting various applications and services.

- NSX: Plays a critical role in virtualizing AT&T's network, enabling agility and flexibility.

While precise figures aren't publicly available, it's safe to assume VMware powers a substantial percentage of AT&T's virtualized infrastructure. Further research into AT&T's investor reports and press releases may reveal more concrete data on the extent of their VMware deployment. [Insert links to relevant reports if available].

Potential for Vendor Lock-in

AT&T's significant investment in VMware's ecosystem creates a substantial risk of vendor lock-in. Migrating away from VMware's solutions after such a large-scale deployment would be incredibly complex, expensive, and time-consuming. This dependence significantly weakens AT&T's negotiating power with Broadcom, potentially leaving them vulnerable to substantial price hikes.

- Limited alternatives: The cost and complexity of switching to competing virtualization platforms limit AT&T's options.

- Price gouging potential: Broadcom's increased market share, following the acquisition, could enable them to exert significant pricing pressure.

- Monopolistic concerns: The merger raises concerns regarding potential monopolistic practices and reduced competition in the virtualization market. Regulatory bodies may investigate potential anti-competitive behavior.

Broadcom's Acquisition Strategy and Pricing Power

Broadcom's Track Record of Acquisitions

Broadcom has a history of acquiring companies and subsequently adjusting pricing strategies for their products and services. Analyzing their past acquisitions reveals a pattern of increased pricing after integrating acquired entities. A thorough examination of these past acquisitions is crucial to understanding the potential price implications for AT&T.

- [Example 1: Briefly describe a past acquisition and the subsequent price changes, citing sources.]

- [Example 2: Briefly describe another acquisition and its impact on customer pricing, citing sources.]

- [Example 3: Another acquisition and price impact analysis, including sources.]

Anticipated Pricing Changes Post-Acquisition

Given Broadcom's acquisition history and the newly consolidated market power, it's reasonable to anticipate price increases for VMware's products and services. Several scenarios are possible:

- Across-the-board price increases: A uniform increase across all VMware products could directly impact AT&T's operational costs.

- Tiered pricing: Broadcom might introduce a tiered pricing system, potentially penalizing large clients like AT&T with higher prices.

- Selective price hikes: Specific VMware products crucial to AT&T's operations could face disproportionately larger price increases.

Industry analysts predict significant price hikes, further fueling concerns about the impact on AT&T. [Include quotes or links to analyst reports if available].

Impact on AT&T's Bottom Line and Competitive Landscape

Financial Implications for AT&T

Increased VMware licensing costs directly translate to higher operational expenses for AT&T. This could significantly impact their profit margins and potentially necessitate cost-cutting measures in other areas.

- Reduced profitability: Higher licensing fees will directly eat into AT&T's profits.

- Impact on investment: Increased costs may force AT&T to reduce investments in research and development, network upgrades, or other crucial areas.

- Cost-cutting measures: AT&T may be forced to implement cost-cutting measures, potentially impacting service quality or workforce.

Competitive Implications

Higher costs related to VMware licensing could negatively impact AT&T's competitiveness. This could force them to increase service prices for consumers, potentially leading to a loss of market share to competitors.

- Increased service prices: Higher operational costs may necessitate increases in service pricing for AT&T's customers.

- Market share erosion: Competitors offering similar services at lower prices could gain a significant advantage.

- Innovation hampered: Reduced investment in R&D due to higher VMware costs could stifle innovation and the development of new services.

Conclusion

Broadcom's acquisition of VMware presents a significant challenge for AT&T. The company's heavy reliance on VMware's technology, combined with Broadcom's history of post-acquisition price increases, creates a real potential for a substantial, perhaps 1,050%, increase in licensing costs. This could have far-reaching consequences for AT&T's financial performance, operational efficiency, and competitive position in the telecommunications market. Stay updated on the Broadcom VMware acquisition and its implications for the future of the telecom industry; follow the impact of the Broadcom deal on VMware pricing and learn more about the potential for price increases related to the Broadcom VMware deal.

Featured Posts

-

The Underestimated Power Of Middle Managers Key To Organizational Success

May 12, 2025

The Underestimated Power Of Middle Managers Key To Organizational Success

May 12, 2025 -

Kya 62 Salh Tam Krwz Ne 36 Salh Adakarh Kw Dl De Dya

May 12, 2025

Kya 62 Salh Tam Krwz Ne 36 Salh Adakarh Kw Dl De Dya

May 12, 2025 -

The Masters Shane Lowrys Perspective On Rory Mc Ilroys Finish

May 12, 2025

The Masters Shane Lowrys Perspective On Rory Mc Ilroys Finish

May 12, 2025 -

Canada Tariffs Partial Removal Possible Says Us Ambassador

May 12, 2025

Canada Tariffs Partial Removal Possible Says Us Ambassador

May 12, 2025 -

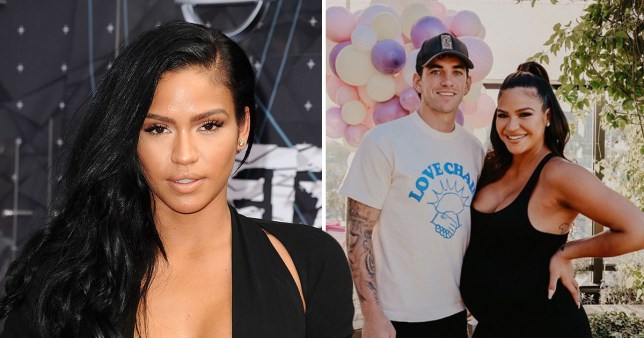

Eric Antoine Un Bebe Avec Sa Nouvelle Compagne Apres Son Divorce

May 12, 2025

Eric Antoine Un Bebe Avec Sa Nouvelle Compagne Apres Son Divorce

May 12, 2025

Latest Posts

-

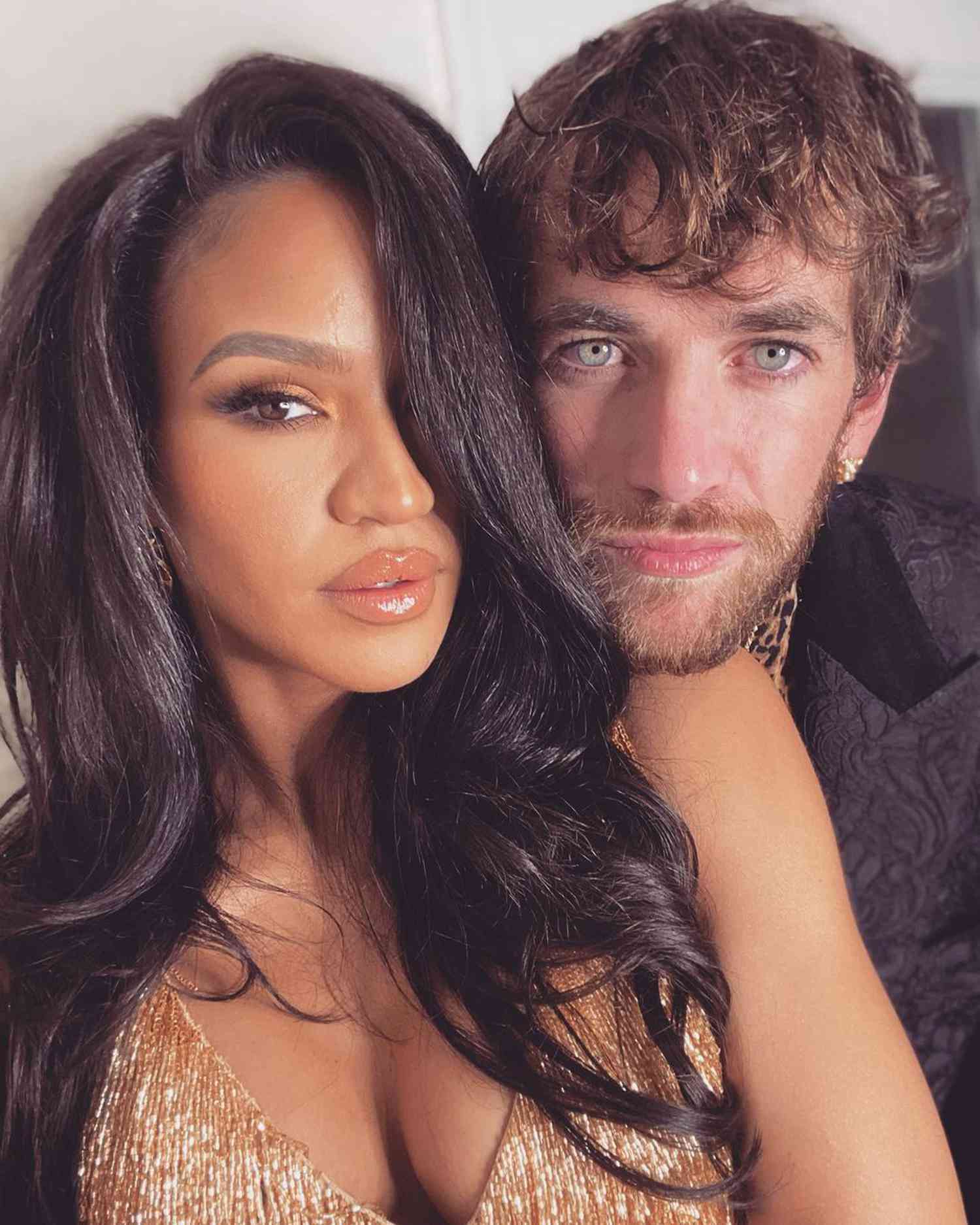

Cassie And Alex Fine First Red Carpet Appearance Since Pregnancy Announcement

May 13, 2025

Cassie And Alex Fine First Red Carpet Appearance Since Pregnancy Announcement

May 13, 2025 -

Cassie Ventura And Alex Fines Red Carpet Appearance Pregnant Cassies Debut

May 13, 2025

Cassie Ventura And Alex Fines Red Carpet Appearance Pregnant Cassies Debut

May 13, 2025 -

Mob Land Premiere Cassie Venturas Stunning Red Carpet Look While Pregnant

May 13, 2025

Mob Land Premiere Cassie Venturas Stunning Red Carpet Look While Pregnant

May 13, 2025 -

Pregnant Cassie Venturas Red Carpet Debut With Husband Alex Fine

May 13, 2025

Pregnant Cassie Venturas Red Carpet Debut With Husband Alex Fine

May 13, 2025 -

Celebrity Couple Cassie And Alex Fine Red Carpet Debut While Expecting

May 13, 2025

Celebrity Couple Cassie And Alex Fine Red Carpet Debut While Expecting

May 13, 2025