BP Valuation Doubling: CEO's Plan And Rejection Of US Stock Market

Table of Contents

The CEO's Blueprint for BP Valuation Doubling

The CEO's plan to double BP's valuation is multifaceted and ambitious, focusing on a significant shift in investment strategy and operational efficiency. The blueprint hinges on several key pillars:

-

Increased Investment in Renewable Energy: BP is aggressively pursuing investments in renewable energy sources, including solar and wind power. This strategic move aims to capitalize on the growing global demand for clean energy and establish BP as a leader in the renewable energy sector. This represents a considerable shift in their traditional oil and gas focus, reflecting a broader industry trend towards diversification and sustainability.

-

Focus on Efficiency Improvements and Cost Reduction in Oil and Gas Operations: Simultaneously, BP is committed to optimizing its existing oil and gas operations. This includes streamlining processes, adopting advanced technologies, and implementing stringent cost-reduction measures. Improving efficiency within the existing infrastructure is crucial for maintaining profitability while transitioning towards renewable energy sources.

-

Strategic Acquisitions of Smaller Energy Companies: The CEO's plan involves identifying and acquiring smaller, innovative energy companies. These acquisitions will provide access to new technologies, expand BP's market reach, and accelerate the overall growth strategy. This active approach to mergers and acquisitions will be instrumental in achieving the ambitious valuation target.

-

Expansion into Emerging Markets with High Growth Potential: BP plans to leverage opportunities in rapidly developing economies. These emerging markets offer significant growth potential for both traditional and renewable energy sources. Careful risk management and strategic partnerships will be crucial for successful expansion into these regions.

-

Technology Advancements and Digital Transformation Initiatives: Embracing technological advancements and digital transformation is a critical aspect of the plan. Investing in cutting-edge technologies across all operations will boost efficiency, reduce costs, and enhance decision-making. This commitment to innovation is vital for navigating the complexities of the modern energy landscape.

Why the US Stock Market is Being Shunned

The decision to de-emphasize the US stock market as a primary focus is a surprising yet strategic one. Several factors likely contribute to this decision:

-

Higher Regulatory Scrutiny in the US: The US energy sector faces stringent regulatory oversight, which can impact investment decisions and profitability. Navigating complex regulatory landscapes can be resource-intensive and may slow down the pace of growth.

-

Preference for Faster Growth in Other Markets: Emerging markets often offer less saturated landscapes with faster growth trajectories, compared to the more mature US market. This allows for potentially quicker returns on investment and faster progress towards the valuation doubling goal.

-

Focus on Long-Term Value Creation over Short-Term Stock Gains: The CEO's vision prioritizes long-term sustainable growth and value creation over short-term stock market fluctuations. This longer-term perspective aligns with the complexities and substantial investment required in the energy transition.

-

Opportunities in Less Saturated Markets: By focusing on international markets, BP aims to capitalize on less competitive environments. This provides opportunities to secure strategic partnerships, acquire assets, and establish a stronger presence in high-growth regions.

Potential Challenges and Opportunities

While ambitious, BP's plan is not without challenges. Potential obstacles include:

-

Geopolitical Instability and Energy Price Volatility: Global geopolitical events and fluctuating energy prices pose significant risks to the company's investment strategy. Careful risk assessment and mitigation strategies are essential.

-

Competition from Other Energy Companies: BP faces intense competition from established players and emerging companies in both the traditional and renewable energy sectors. Differentiation and innovation will be key to maintaining a competitive edge.

-

Difficulties in Transitioning to Renewable Energy: The transition to renewable energy presents significant technological, logistical, and regulatory challenges. Successfully navigating these challenges will be crucial for the success of the plan.

-

Managing Risks Associated with Expansion into New Markets: Expansion into new markets presents unique risks, including political instability, regulatory hurdles, and logistical complexities. Effective risk management strategies are vital for minimizing potential setbacks.

However, substantial opportunities exist:

-

Growing Demand for Renewable Energy: The global demand for renewable energy is steadily increasing, presenting a vast market opportunity for companies like BP.

-

Technological Breakthroughs in Energy Production: Continuous technological advancements offer potential cost reductions and efficiency improvements in both traditional and renewable energy sectors.

-

Opportunities in Developing Economies: Developing economies present significant growth potential, allowing BP to tap into underserved energy markets.

Conclusion: BP Valuation Doubling - The Path Forward

BP's CEO has laid out a comprehensive plan to double the company's valuation, centered on a strategic shift towards renewable energy, operational efficiency improvements, and expansion into emerging markets. While significant challenges related to geopolitical instability, competition, and the energy transition exist, the growing demand for renewable energy and technological advancements offer substantial opportunities. The success or failure of this plan will have significant implications for investors and the global energy market. Stay informed about BP's progress in doubling its valuation and its impact on the global energy market. Follow our updates for the latest on BP's strategic moves and the unfolding story of their ambitious growth plan.

Featured Posts

-

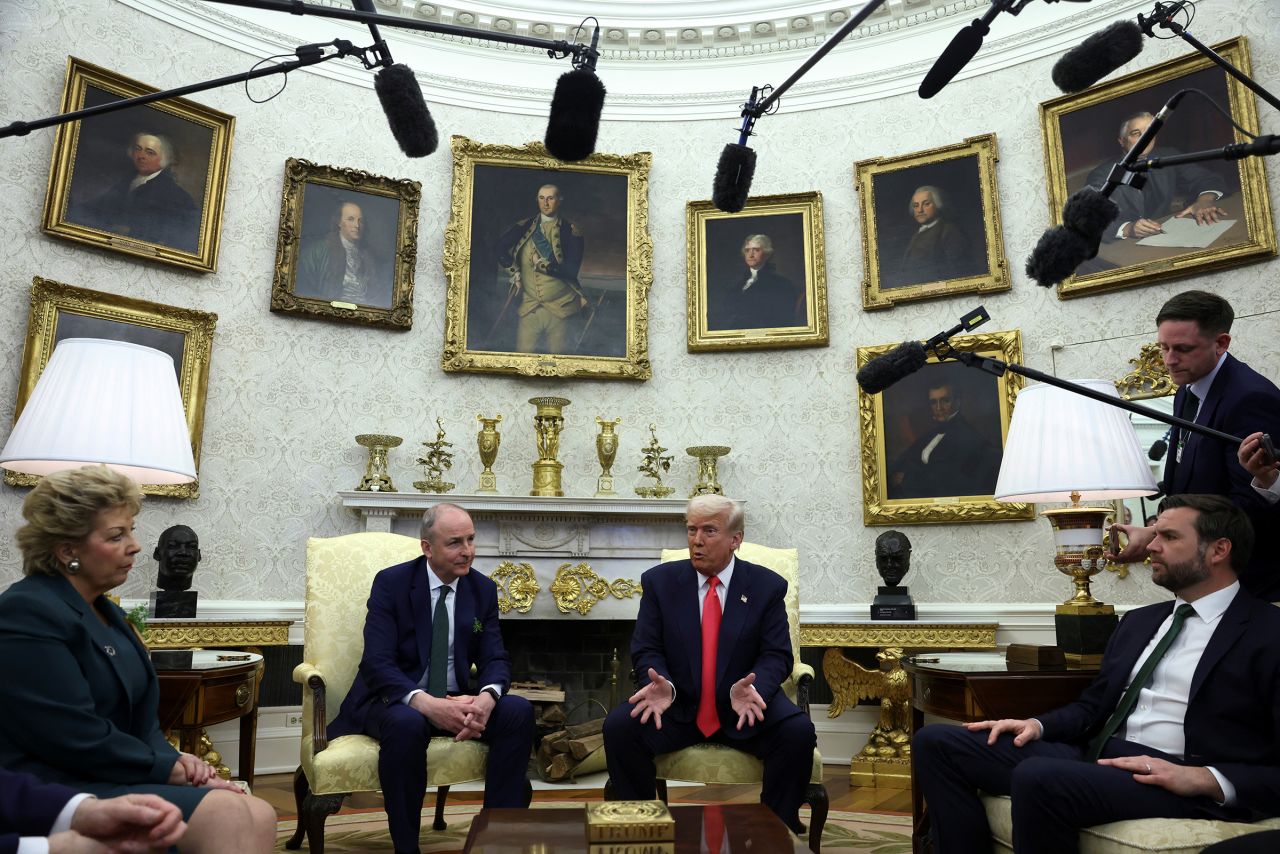

White House Humor Unforgettable Moments With Trump The Irish Pm And Jd Vance

May 21, 2025

White House Humor Unforgettable Moments With Trump The Irish Pm And Jd Vance

May 21, 2025 -

Breaking Free Strategies To Overcome A Lack Of Funds

May 21, 2025

Breaking Free Strategies To Overcome A Lack Of Funds

May 21, 2025 -

Discover Provence A Self Guided Walk From Mountains To Mediterranean

May 21, 2025

Discover Provence A Self Guided Walk From Mountains To Mediterranean

May 21, 2025 -

The Original Sin Finale And Dexters Biggest Regret Debra Morgans Fate

May 21, 2025

The Original Sin Finale And Dexters Biggest Regret Debra Morgans Fate

May 21, 2025 -

Analyzing Arne Slots Tactics How Liverpools Goalkeeper Secured Victory Against Psg

May 21, 2025

Analyzing Arne Slots Tactics How Liverpools Goalkeeper Secured Victory Against Psg

May 21, 2025

Latest Posts

-

Vanja Mijatovic O Razvodu Nije Me Ostavio Zbog Kilograma

May 21, 2025

Vanja Mijatovic O Razvodu Nije Me Ostavio Zbog Kilograma

May 21, 2025 -

Naybilshi Finansovi Kompaniyi Ukrayini Za Obsyagom Poslug U 2024 Analiz Rinku

May 21, 2025

Naybilshi Finansovi Kompaniyi Ukrayini Za Obsyagom Poslug U 2024 Analiz Rinku

May 21, 2025 -

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi

May 21, 2025

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi

May 21, 2025 -

Reyting Finkompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 21, 2025

Reyting Finkompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 21, 2025 -

Ing Groups 2024 Annual Report Form 20 F What Investors Need To Know

May 21, 2025

Ing Groups 2024 Annual Report Form 20 F What Investors Need To Know

May 21, 2025