BP CEO Aims To Double Company Valuation, Rejects US Listing

Table of Contents

The Target: Doubling BP's Market Capitalization

BP's current market capitalization (as of [Insert Current Date and Market Cap]) represents a substantial figure. However, the CEO's ambition to double this valuation signifies a massive undertaking, requiring significant growth and strategic execution. Achieving this target would require navigating a complex energy market, characterized by intense competition, the ongoing energy transition, and persistent geopolitical instability.

- Current market cap of BP: [Insert Current Market Cap]

- Target market cap after doubling: [Double the Current Market Cap]

- Growth percentage required: 100%

- Challenges:

- Intense competition from other major oil and gas companies.

- The rapid shift towards renewable energy sources and the pressure to reduce carbon emissions.

- Geopolitical risks and uncertainties impacting global energy markets.

- Fluctuations in oil and gas prices.

Reasons Behind the Rejection of a US Listing

The decision to forgo a US listing for BP is a significant strategic choice. While a US listing offers access to a vast pool of capital and investors, it also comes with certain complexities and potential drawbacks. Several factors likely contributed to this decision:

- Regulatory hurdles in the US market: Navigating the intricate regulatory landscape of the US securities market can be complex and costly.

- Tax implications of a US listing: A US listing may lead to increased tax liabilities for BP.

- Differences in investor sentiment: Investor preferences and expectations can vary significantly between US and other major markets. BP's existing listing location may already provide access to investors who align more closely with their current strategy.

- Potential impact on shareholder value: The CEO might have concluded that maintaining the current listing structure will ultimately deliver higher value for existing shareholders in the long run.

BP's Strategic Plan for Achieving the Valuation Target

To achieve its ambitious valuation target, BP plans to implement several key strategic initiatives and operational changes. This involves a multi-faceted approach that encompasses significant investments in renewable energy, operational efficiency improvements, and potential mergers and acquisitions.

- Investment in renewable energy sources: BP is actively investing in solar, wind, and other renewable energy technologies to diversify its portfolio and cater to the growing demand for sustainable energy solutions.

- Operational efficiency improvements: The company is focusing on reducing its carbon footprint, optimizing production processes, and enhancing overall operational efficiency. This includes exploring and implementing new technologies to improve output and reduce costs.

- Technological advancements and innovation: Investing in research and development to explore and implement cutting-edge technologies across its operations is key to remaining competitive.

- Mergers and acquisitions strategy: Strategic acquisitions of smaller companies in the renewable energy or related sectors could provide quick access to new technologies and market share.

- Cost-cutting measures: Reducing operational expenses and streamlining processes will free up capital for investment in growth opportunities.

Market Reaction and Analyst Opinions on BP's Strategy

The market's initial reaction to the CEO's announcement was mixed. Some analysts expressed optimism about the potential for growth, highlighting BP's strong position in the energy sector and its commitment to transitioning to a lower-carbon future. Others remained cautious, citing the significant challenges involved in doubling the company's valuation in a volatile energy market.

- Stock price fluctuations following the announcement: [Insert details on stock price changes after the announcement]

- Analyst ratings and predictions: A range of analyst opinions, from cautiously optimistic to more skeptical, reflects the market uncertainty.

- Positive viewpoints from market analysts: Some analysts see BP's strategy as a bold and necessary step for long-term survival and success in the evolving energy landscape.

- Negative viewpoints from market analysts: Others highlight the ambitious nature of the goal and the inherent risks associated with the plan, particularly in the context of geopolitical instability and competition.

- Impact on investor confidence: The announcement has likely increased investor interest in BP, both positively and negatively, resulting in heightened market volatility.

Conclusion: Assessing BP's Ambitious Plan to Double Company Valuation

BP's CEO has set an ambitious goal: doubling the company's valuation while simultaneously rejecting a US listing. This bold strategy involves significant investments in renewable energy, operational improvements, and potentially mergers and acquisitions. The plan faces numerous challenges, including intense competition, the rapid energy transition, and geopolitical uncertainties. However, successful execution could significantly increase shareholder value. The market reaction has been varied, with analysts expressing a range of opinions on the feasibility and ultimate success of this ambitious undertaking. Staying informed about BP's progress in doubling its company valuation will be crucial for understanding its long-term implications for both the company and the energy sector. Stay tuned for updates and further analysis of this transformative strategy.

Featured Posts

-

96 1 1

May 21, 2025

96 1 1

May 21, 2025 -

Juergen Klopp Mu Carlo Ancelotti Mi Teknik Direktoer Karsilastirmasi

May 21, 2025

Juergen Klopp Mu Carlo Ancelotti Mi Teknik Direktoer Karsilastirmasi

May 21, 2025 -

New York City To Witness Vybz Kartels Historic Performance

May 21, 2025

New York City To Witness Vybz Kartels Historic Performance

May 21, 2025 -

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 21, 2025

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 21, 2025 -

Whats Next For Gumball A Teaser

May 21, 2025

Whats Next For Gumball A Teaser

May 21, 2025

Latest Posts

-

Vanja Mijatovic O Razvodu Nije Me Ostavio Zbog Kilograma

May 21, 2025

Vanja Mijatovic O Razvodu Nije Me Ostavio Zbog Kilograma

May 21, 2025 -

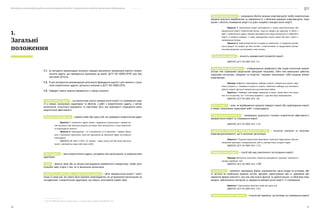

Naybilshi Finansovi Kompaniyi Ukrayini Za Obsyagom Poslug U 2024 Analiz Rinku

May 21, 2025

Naybilshi Finansovi Kompaniyi Ukrayini Za Obsyagom Poslug U 2024 Analiz Rinku

May 21, 2025 -

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi

May 21, 2025

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi

May 21, 2025 -

Reyting Finkompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 21, 2025

Reyting Finkompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 21, 2025 -

Ing Groups 2024 Annual Report Form 20 F What Investors Need To Know

May 21, 2025

Ing Groups 2024 Annual Report Form 20 F What Investors Need To Know

May 21, 2025