Boston Celtics' New Ownership: Analyzing The $6.1 Billion Private Equity Deal

Table of Contents

The Deal's Key Players and Financial Details

The $6.1 billion sale of the Boston Celtics marks a significant milestone in NBA history and professional sports investment. Understanding the key players and financial specifics is crucial to comprehending the deal's impact.

-

Private Equity Firm(s) Involved: While the exact names of all participating private equity firms may not be publicly disclosed immediately, the deal's magnitude suggests involvement from major players with significant experience in sports investments. Further details will be available as the transaction progresses and official statements are released. Previous investments in sports franchises by these firms will be carefully scrutinized to gauge their approach to team management and strategic decision-making.

-

Purchase Price and Financing: The $6.1 billion purchase price represents a substantial increase in NBA franchise valuation. The financing mechanisms utilized likely involve a complex mix of equity contributions, debt financing, and potentially other financial instruments. This sophisticated structure reflects the high-stakes nature of such a significant transaction.

-

Ownership Structure: The ownership structure will likely involve a consortium of investors, creating a diversified ownership group. Clarification on the roles and responsibilities of key individuals within this group—including their experience and expertise in sports management—will be critical to assessing the team’s future trajectory.

-

Comparison to Other NBA Sales: The $6.1 billion valuation significantly surpasses previous NBA franchise sales, highlighting the increasing value of professional sports franchises. This reflects the league's growth, its global appeal, and the potential for significant revenue generation. Comparing this valuation to recent sales of other NBA teams will provide context and insight into the market forces at play.

-

Financial Implications for the Celtics: The influx of capital will allow the Celtics to strategically invest in several areas. This could include significant player acquisitions to bolster the team's on-court performance, upgrades to TD Garden to enhance the fan experience, and investments in community initiatives to strengthen the franchise's ties to the local community.

Impact on the Boston Celtics' Franchise

The change in ownership will undoubtedly have a profound impact on the Boston Celtics franchise, influencing various aspects of the team's operation.

-

On-Court Performance: The new ownership's influence could be felt immediately in the team's on-court performance. This could involve changes in coaching strategies, player recruitment based on a new long-term vision, and increased investment in player development programs.

-

Team Strategy (Short-Term and Long-Term): The new owners' strategic vision will play a pivotal role in shaping the Celtics’ future. Their short-term goals might involve immediate improvements to the team's performance and competitiveness, while long-term strategies might encompass ambitious plans for sustained success and franchise growth.

-

Fan Experience: The new ownership may seek to improve the fan experience at TD Garden through stadium renovations, modernized amenities, enhanced technological integration, and improved marketing efforts to increase fan engagement. This could lead to a more immersive and enjoyable experience for fans attending games.

-

Community Engagement and Social Responsibility: A new ownership group might bring a fresh perspective on community engagement and social responsibility initiatives. This could involve increased investment in local programs, charitable endeavors, and community outreach efforts.

Potential Changes in Team Management and Coaching

The shift in ownership could bring about substantial changes in the Celtics' management and coaching structures.

-

Coaching Staff and Front Office: Changes to the coaching staff and front office are possible. The new ownership may opt for personnel changes to align with their vision for the franchise, potentially bringing in individuals with different experience and expertise.

-

Organizational Structure: The organizational structure of the Celtics could also undergo restructuring to reflect the new ownership's preferences and management style. This might involve a streamlining of processes, redefining roles, and a focus on efficiency and effectiveness.

Broader Implications for the NBA and Private Equity in Sports

The $6.1 billion sale has far-reaching consequences for the NBA and the growing involvement of private equity in sports.

-

NBA Valuation: This record-breaking sale sets a new benchmark for NBA franchise valuations. It signals the league's continued growth and its attractiveness to investors, influencing the valuations of other NBA teams and potentially leading to further high-value transactions.

-

Private Equity in Sports: The deal underscores the increasing role of private equity in professional sports ownership. This trend is likely to continue as private equity firms recognize the potential for substantial returns on investments in high-profile sports franchises.

-

League Dynamics: The involvement of private equity could reshape the competitive landscape of the NBA. The influx of capital into certain teams could lead to increased spending on player salaries and infrastructure, potentially impacting the league's competitive balance.

-

Smaller Market Teams: This trend could pose challenges for smaller market teams that may not have access to the same level of investment capital. This disparity could exacerbate existing competitive imbalances within the league.

Conclusion

The $6.1 billion sale of the Boston Celtics marks a watershed moment in NBA history, highlighting the growing dominance of private equity in professional sports. The deal’s implications are vast, influencing the Celtics' on-court performance, financial stability, and long-term strategy. The shift in ownership will likely lead to significant transformations, not only shaping the future of the Celtics but also setting a precedent for future NBA franchise transactions.

Call to Action: Stay informed about the evolving story of the Boston Celtics' new ownership. Follow our blog for in-depth analysis and insights into the implications of this $6.1 billion private equity deal and its impact on the future of the Celtics franchise. Learn more about the evolving landscape of Boston Celtics ownership and private equity's role in professional sports.

Featured Posts

-

Reports Confirm Dodgers Inf Hyeseong Kim Receives Promotion

May 16, 2025

Reports Confirm Dodgers Inf Hyeseong Kim Receives Promotion

May 16, 2025 -

Ex Cnn Reporter Breaks Silence On Alleged Biden Health Cover Up

May 16, 2025

Ex Cnn Reporter Breaks Silence On Alleged Biden Health Cover Up

May 16, 2025 -

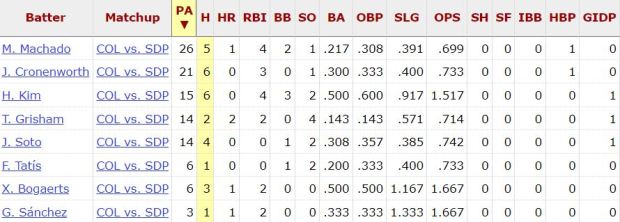

San Diego Padres Pregame Report Rain Delay And Roster Moves

May 16, 2025

San Diego Padres Pregame Report Rain Delay And Roster Moves

May 16, 2025 -

Grizzlie Jaylen Wells Stretcher After Scary Fall

May 16, 2025

Grizzlie Jaylen Wells Stretcher After Scary Fall

May 16, 2025 -

Jeremy Arndts Crucial Negotiation Role In Bvg Discussions

May 16, 2025

Jeremy Arndts Crucial Negotiation Role In Bvg Discussions

May 16, 2025

Latest Posts

-

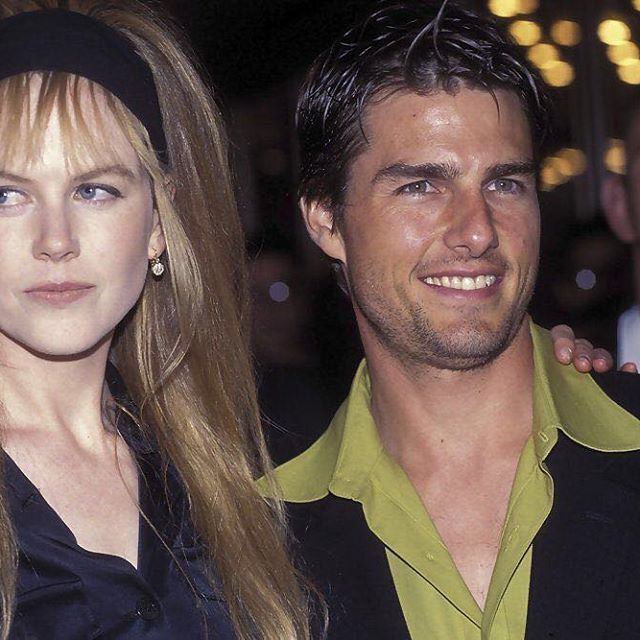

Fjwt Emryt 26 Eama Twm Krwz Wana Dy Armas Qst Hb Am Mjrd Shayet

May 16, 2025

Fjwt Emryt 26 Eama Twm Krwz Wana Dy Armas Qst Hb Am Mjrd Shayet

May 16, 2025 -

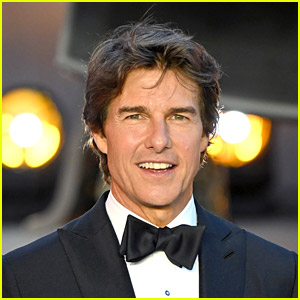

Tom Cruises Dating History A Comprehensive Look At His Relationships

May 16, 2025

Tom Cruises Dating History A Comprehensive Look At His Relationships

May 16, 2025 -

Hl Yjme Twm Krwz Wana Dy Armas Elaqt Eatfyt Farq Alsn Ythyr Aljdl

May 16, 2025

Hl Yjme Twm Krwz Wana Dy Armas Elaqt Eatfyt Farq Alsn Ythyr Aljdl

May 16, 2025 -

Ataka Na Ukrainu Otsenka Uscherba Posle Obstrela Bolee Chem 200 Raketami I Dronami

May 16, 2025

Ataka Na Ukrainu Otsenka Uscherba Posle Obstrela Bolee Chem 200 Raketami I Dronami

May 16, 2025 -

Tom Cruise And Ana De Armas New Pictures Spark Dating Rumors In England

May 16, 2025

Tom Cruise And Ana De Armas New Pictures Spark Dating Rumors In England

May 16, 2025