Boosting Sustainability: Funding Resources For Small And Medium Enterprises

Table of Contents

Government Grants and Subsidies for Sustainable Initiatives

Government grants and subsidies offer a low-risk, potentially lucrative avenue for SMEs to finance their sustainability projects. These funds are often specifically designed to encourage environmentally responsible practices and can significantly reduce the financial burden of adopting greener technologies or implementing sustainable initiatives. The benefits are clear: reduced upfront costs, increased affordability of sustainable upgrades, and a chance to significantly improve your environmental footprint.

Several national and regional programs exist, depending on your location. For instance, in [Insert Country/Region], the [Insert Specific Government Program Name and Link] provides funding for SMEs focused on energy efficiency improvements, renewable energy integration, and waste reduction strategies. Similarly, the [Insert Another Specific Government Program Name and Link, if applicable] offers grants for businesses implementing sustainable supply chain management.

- Eligibility Criteria: These vary greatly depending on the grant program. Common criteria include business size, location, the type of sustainable project, and the potential environmental impact. Check individual program guidelines carefully.

- Application Processes and Deadlines: Application procedures typically involve submitting a detailed project proposal outlining the planned activities, budget, and expected outcomes. Deadlines are usually specified and should be met meticulously.

- Types of Sustainable Projects Funded: These often include energy-efficient equipment upgrades (e.g., LED lighting, energy-efficient HVAC systems), renewable energy installations (solar panels, wind turbines), waste reduction and recycling programs, and sustainable packaging initiatives.

- Examples of Successful Grant Applications: Research successful case studies to understand what makes a compelling application. Look for examples relevant to your industry and project.

Green Loans and Financing Options for SMEs

Green loans are specifically designed to finance environmentally friendly projects. While they share similarities with traditional business loans, they often come with unique advantages and considerations.

Advantages: Green loans can offer competitive interest rates, potentially lower than conventional loans, reflecting the reduced risk associated with sustainable investments. Moreover, they can unlock access to capital specifically earmarked for environmental improvements.

Disadvantages: The eligibility criteria might be stricter than traditional loans, requiring a robust business plan and evidence of the project's environmental benefits. The application process may also be more complex.

Different types of green financing are available:

-

Lines of Credit: Provide flexible access to funds as needed.

-

Term Loans: Offer fixed repayment schedules over a set period.

-

Banks and Financial Institutions Offering Green Loans: Several financial institutions now actively promote green lending. Research local and national banks known for their commitment to sustainable financing.

-

Requirements for Securing a Green Loan: These typically include a comprehensive business plan detailing the sustainable project, a sustainability report outlining environmental benefits, and proof of financial stability.

-

Incentives and Benefits: Some jurisdictions offer tax incentives or other benefits for businesses securing green loans.

Impact Investing and Sustainable Venture Capital

Impact investing focuses on generating both financial returns and positive social and environmental impact. Impact investors and sustainable venture capitalists actively seek out SMEs committed to sustainability. While it offers significant potential, it also presents challenges.

- Types of Investors Interested in Sustainable SMEs: ESG (Environmental, Social, and Governance) funds, social enterprises, and philanthropic organizations are key players in this space.

- How to Create a Compelling Investment Pitch: Emphasize the environmental and social benefits of your project, as well as its potential for financial returns. A clear, concise business plan is crucial.

- Due Diligence Process for Impact Investors: Be prepared for rigorous due diligence, which will assess the environmental and social impact of your business as well as its financial viability.

Crowdfunding Platforms for Sustainable Projects

Crowdfunding offers an alternative funding avenue for SMEs. Platforms like Kickstarter and Indiegogo allow businesses to raise capital directly from the public.

- Advantages: Direct engagement with potential customers and a built-in marketing opportunity.

- Disadvantages: Success depends heavily on marketing and campaign management.

- Tips for a Successful Crowdfunding Campaign: Create compelling visuals, videos, and campaign materials that highlight the project’s value and sustainability impact.

- Marketing and Promotion Strategies: Utilize social media, email marketing, and public relations to reach a wider audience.

Securing Funding for a Sustainable Future

This article explored key funding resources for small and medium enterprises – government grants, green loans, impact investing, and crowdfunding – all vital tools for SMEs committed to sustainability. Embracing sustainable practices isn't just environmentally responsible; it's increasingly crucial for long-term business success and competitiveness. Consumers are increasingly demanding sustainable products and services, and businesses demonstrating a commitment to environmental responsibility often gain a competitive edge.

Start exploring the various funding resources for small and medium enterprises detailed in this article to begin your journey towards a more sustainable business model. Don't let financial limitations hinder your progress towards environmental responsibility. Find the right funding opportunity for your sustainable goals today! [Insert links to relevant government programs and funding resources mentioned throughout the article].

Featured Posts

-

The Uber Stock Recession Question What Analysts Say

May 19, 2025

The Uber Stock Recession Question What Analysts Say

May 19, 2025 -

Stefanos Stefanu Kibris Sorununda Yeni Bir Girisim

May 19, 2025

Stefanos Stefanu Kibris Sorununda Yeni Bir Girisim

May 19, 2025 -

The Future Of London Festivals Concerns Over Regulatory Control

May 19, 2025

The Future Of London Festivals Concerns Over Regulatory Control

May 19, 2025 -

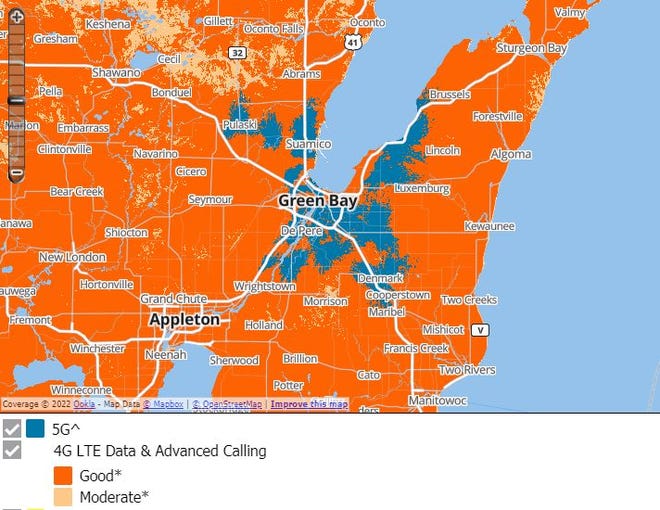

Cellcom Network Down Extended Recovery Time For Call And Text Services

May 19, 2025

Cellcom Network Down Extended Recovery Time For Call And Text Services

May 19, 2025 -

89 Year Old Johnny Mathis Retires Impact Of Memory Issues On Musical Legends Career

May 19, 2025

89 Year Old Johnny Mathis Retires Impact Of Memory Issues On Musical Legends Career

May 19, 2025