Boosting Returns: CAAT Pension Plan Targets More Canadian Private Investments

Table of Contents

Why the Shift to Canadian Private Investments?

The CAAT Pension Plan's move towards increased Canadian private investment exposure is driven by two primary objectives: diversification and the pursuit of higher returns.

Diversification and Risk Mitigation

Private investments offer a compelling diversification benefit compared to traditional public market equities and bonds.

- Reduced Correlation: Private investments often exhibit lower correlation with public market fluctuations. This means that when public markets experience downturns, private investments may hold their value or even appreciate, thus smoothing overall portfolio performance.

- Market Risk Mitigation: Private investments are less susceptible to the daily volatility of the stock market, reducing exposure to short-term market swings and systematic risk.

- Interest Rate Risk Mitigation: Unlike bonds, many private investments are less sensitive to interest rate changes, providing a hedge against rising rates.

- Balanced Portfolio: Integrating private investments creates a more resilient and balanced portfolio, capable of weathering economic storms more effectively.

CAAT employs sophisticated risk mitigation strategies, including rigorous due diligence, diversification across various asset classes within private investments, and ongoing portfolio monitoring to ensure a well-balanced approach. The goal is to optimize the risk-return profile for the long-term benefit of its plan members.

Seeking Higher Returns

The Canadian private investment market presents the potential for significantly higher returns compared to traditional public market investments.

- Illiquidity Premium: Private investments often command a premium due to their inherent illiquidity. Investors are compensated for the reduced ability to quickly liquidate their holdings.

- Long-Term Growth: Pension plans, with their long-term investment horizons, are ideally suited to capitalize on the growth potential of private investments, which may take several years to fully materialize.

- Historical Performance: While past performance is not indicative of future results, historical data suggests that private equity and other alternative investments have often outperformed public markets over the long term. (Note: Specific data would be included here if available from CAAT's publicly released information.)

Successful private investment strategies often involve identifying undervalued assets, providing operational expertise to improve performance, and realizing value appreciation through eventual sale or IPO.

CAAT's Investment Strategy and Due Diligence

CAAT's success hinges on a rigorous and well-defined investment strategy underpinned by meticulous due diligence.

Selection Process for Private Investments

CAAT employs a rigorous multi-step process to select private investment opportunities:

- Thorough Research: Extensive research is conducted to assess market trends, competitive landscapes, and the potential for long-term growth.

- Risk Assessment: A comprehensive risk assessment is performed, identifying and quantifying potential risks associated with each investment.

- Ongoing Monitoring: Continuous monitoring and performance evaluation are key to ensuring investments remain aligned with CAAT's overall strategy.

- Specialized Teams: CAAT utilizes specialized teams and external advisors with extensive expertise in private investment markets.

The criteria for evaluating potential investments includes a thorough analysis of the management team's experience, the size and growth potential of the target market, robust financial projections, and alignment with CAAT's environmental, social, and governance (ESG) criteria. Conflict of interest protocols are strictly enforced to maintain transparency and objectivity.

Focus Areas within Canadian Private Investments

CAAT is strategically targeting several key sectors within the Canadian private investment market:

- Private Equity: Investing in established or emerging companies with high growth potential.

- Venture Capital: Funding innovative early-stage companies, often in technology and life sciences.

- Infrastructure: Investing in essential infrastructure projects, such as renewable energy, transportation, and utilities.

- Real Estate: Investing in income-producing properties or real estate development projects.

The rationale behind these choices stems from a combination of high growth projections, alignment with CAAT's long-term strategy, and the opportunity to contribute to the economic development of Canada. Geographic focus may include key provinces with strong economic growth and robust investment opportunities.

Potential Impact and Challenges

While the shift towards Canadian private investments offers significant potential, it's essential to acknowledge both the potential benefits and associated challenges.

Expected Return Enhancement

Increased allocations to private investments are projected to enhance CAAT's overall portfolio returns.

- Long-Term Growth: While the time horizon for realizing these benefits is longer than with public markets, the potential for significant long-term growth is considerable.

- Portfolio Diversification: The enhanced diversification reduces overall portfolio volatility, contributing to smoother returns and increased long-term sustainability.

Specific projections will depend on market conditions and investment performance, but the aim is to generate returns that exceed those achievable solely through traditional public market investments.

Challenges and Risks

Several challenges and risks are associated with increased private investment allocations:

- Liquidity Issues: Private investments are generally less liquid than public market securities, making it difficult to quickly sell assets if needed.

- Valuation Difficulties: Valuing private investments can be challenging, especially for illiquid assets, requiring specialized expertise and valuation methodologies.

- Active Management: Private investments require active management and ongoing monitoring to maximize returns and mitigate potential risks.

CAAT is actively mitigating these risks through rigorous due diligence, diversification across various asset classes, and a robust risk management framework. Ongoing monitoring and portfolio adjustments are crucial to adapt to changing market conditions and ensure optimal performance.

Conclusion

CAAT Pension Plan's strategic increase in Canadian private investments reflects a forward-thinking approach to maximizing long-term returns for its members. The pursuit of diversification and higher returns, coupled with a rigorous due diligence process and proactive risk management, positions CAAT for sustained success in this evolving investment landscape. This strategic move highlights the increasing importance of Canadian private investments as a vital component of a robust and high-performing pension portfolio. Learn more about CAAT's investment strategy and explore the exciting opportunities within the Canadian private investment market. Consider how diversifying your own portfolio with carefully selected Canadian private investments can help you achieve your financial goals.

Featured Posts

-

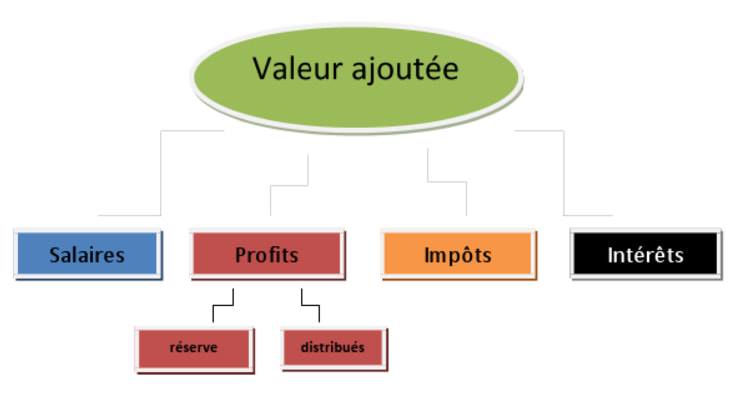

Infotel Demonstration De Valeur Ajoutee Le 17 Fevrier

Apr 23, 2025

Infotel Demonstration De Valeur Ajoutee Le 17 Fevrier

Apr 23, 2025 -

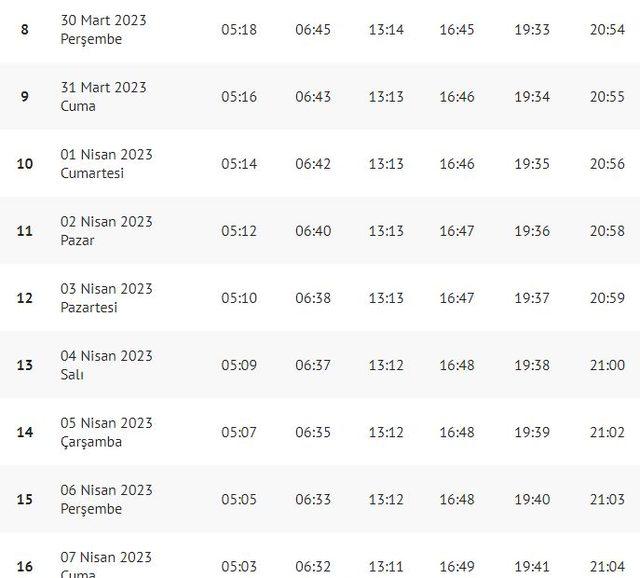

Istanbul 3 Mart Pazartesi Iftar Ve Sahur Saatleri

Apr 23, 2025

Istanbul 3 Mart Pazartesi Iftar Ve Sahur Saatleri

Apr 23, 2025 -

Die 50 2025 Komplette Teilnehmerliste Sendeplan And Streaming Moeglichkeiten

Apr 23, 2025

Die 50 2025 Komplette Teilnehmerliste Sendeplan And Streaming Moeglichkeiten

Apr 23, 2025 -

Resultats Fdj Du 17 Fevrier Hausse En Bourse

Apr 23, 2025

Resultats Fdj Du 17 Fevrier Hausse En Bourse

Apr 23, 2025 -

Thdyth Asear Alktakyt Alywm Alathnyn 14 Abryl 2025 Bmsr

Apr 23, 2025

Thdyth Asear Alktakyt Alywm Alathnyn 14 Abryl 2025 Bmsr

Apr 23, 2025