Bond Market Reaction: Powell's Remarks Offset Rate Cut Anticipation

Table of Contents

The bond market experienced a significant shift this week, as Chairman Powell's latest remarks unexpectedly countered widespread anticipation of an imminent interest rate cut. The initial market sentiment, heavily weighted towards a rate reduction, underwent a dramatic reversal, leading to a notable bond market response. This article will dissect the bond market reaction, exploring the factors that contributed to this surprising turn of events and offering insights into the potential future trajectory of bond yields and the fixed-income market. We'll examine Powell's speech, the latest inflation data, investor sentiment, and the overall outlook for the bond market.

<h2>Powell's Hawkish Stance and its Impact on Bond Yields</h2>

Powell's recent statements surprised many market analysts, who had anticipated a more dovish approach given the recent economic slowdown. Instead, he adopted a hawkish stance, emphasizing the persistence of inflation and hinting at the possibility of further tightening monetary policy. This unexpected shift directly impacted bond yields.

The language Powell used, including phrases like "persistent inflation" and "further tightening," signaled a less accommodative monetary policy than the market had priced in. This led to a rise in bond yields, as investors adjusted their expectations for future interest rate hikes. The magnitude of the change was significant, with 10-year Treasury yields jumping noticeably within hours of his speech.

- Specific quotes: "Inflation remains too high," "We are prepared to raise rates further if necessary," "We are not yet seeing the kind of sustained decline in inflation that we would like to see."

- Market response: An immediate sell-off in the bond market, pushing yields higher. This reflected investors' revised expectations for higher interest rates in the future.

- Comparison to previous reactions: This reaction contrasts sharply with previous instances where similar hints at rate cuts had led to a rally in bond prices and lower yields. The market clearly interpreted this communication as a departure from the previous dovish sentiment.

<h2>Inflation Data and its Influence on the Bond Market Reaction</h2>

Recent inflation data played a crucial role in shaping the bond market reaction. While some indicators showed signs of easing, the overall picture remained one of persistent inflation. The Consumer Price Index (CPI) and Producer Price Index (PPI) figures, while showing a marginal slowdown, were still above the Federal Reserve's target.

This "sticky" inflation, as economists term it, reinforced Powell's concerns and justified his hawkish stance. The market interpreted the data as signaling a need for continued vigilance and potentially further interest rate increases, thus impacting bond yields.

- Key inflation figures: CPI remained above expectations, suggesting that price pressures were still substantial. PPI also remained elevated, indicating persistent upward pressure on producer prices.

- Inflation trend analysis: While the rate of inflation has slowed from its peak, the decline has been gradual, leading to concerns about the persistence of inflation.

- Market interpretation: The market viewed the inflation data as consistent with the Fed’s cautionary stance, diminishing the probability of an imminent rate cut.

<h2>Investor Sentiment and Flight to Safety (or Risk)</h2>

Following Powell's remarks, investor sentiment shifted noticeably. Instead of a "flight to safety," characterized by increased demand for government bonds, the market saw a degree of risk-off sentiment. Investors, apprehensive about the prospect of further interest rate hikes, reduced their holdings of bonds.

This shift is understandable considering the implications of sustained higher interest rates for bond returns. The higher yields, while attractive in the short term, increase the risk of capital losses if rates continue to rise.

- Investment strategy shifts: Data suggests a reduction in net buying of longer-term treasury bonds.

- Risk aversion/appetite: The prevailing sentiment leaned towards risk aversion, with investors preferring assets perceived as less sensitive to interest rate changes.

- Impact on other markets: The stock market also experienced volatility in response to Powell's comments, indicating a broader shift in investor sentiment across asset classes.

<h2>Future Outlook for the Bond Market</h2>

Predicting the future trajectory of bond yields is inherently challenging, but several potential scenarios are worth considering. Further rate hikes remain a possibility, particularly if inflation proves more persistent than anticipated. The Fed could also opt for a pause to assess the impact of previous increases. A rate cut currently appears less likely given Powell's recent statements and the persistence of inflation.

The future direction of bond yields will depend heavily on several factors, including upcoming economic data releases (especially inflation figures), the overall state of the economy, and the Fed's policy decisions.

- Likely scenarios: A range of scenarios exists – continued tightening, a pause in rate hikes, or even a surprise cut if inflation cools significantly. The probabilities are difficult to assign precisely.

- Influencing factors: Upcoming CPI and PPI reports, changes in employment data, and unexpected geopolitical events will all impact investor sentiment and consequently, bond yields.

- Recommendations: Investors should adopt a cautious approach, diversifying their portfolios and carefully considering the impact of potential interest rate changes on their investments. Conservative bond strategies might be more appropriate in the near term.

<h2>Conclusion</h2>

The bond market reaction to Chairman Powell's recent comments underscores the importance of closely monitoring central bank communications and economic data. The initial expectation of a rate cut was swiftly overturned by Powell's hawkish stance, highlighting the significant influence of Fed policy on the fixed-income market. The bond market response was dramatic, with yields rising significantly. Inflation data reinforced the Fed’s concerns, contributing to the shift in investor sentiment and impacting investment strategies. The future outlook remains uncertain but hinges upon upcoming economic data and the Fed's subsequent actions. Stay tuned for further updates on the bond market reaction as economic indicators and Fed policy continue to evolve. Understanding the dynamics of the bond market reaction is crucial for navigating the current economic landscape.

Featured Posts

-

Payton Pritchards Sixth Man Of The Year Candidacy A Deep Dive Into His Improved Performance

May 12, 2025

Payton Pritchards Sixth Man Of The Year Candidacy A Deep Dive Into His Improved Performance

May 12, 2025 -

Colombia Acoge A Ricardo Martinelli Detalles Del Caso

May 12, 2025

Colombia Acoge A Ricardo Martinelli Detalles Del Caso

May 12, 2025 -

Is Jessica Simpson Returning To Reality Tv Album Launch Sparks Speculation

May 12, 2025

Is Jessica Simpson Returning To Reality Tv Album Launch Sparks Speculation

May 12, 2025 -

The Graham Rahal Effect Highlighting The Porsche 911 Gt 3 Rs 4 0s Performance

May 12, 2025

The Graham Rahal Effect Highlighting The Porsche 911 Gt 3 Rs 4 0s Performance

May 12, 2025 -

Shane Lowry And Rory Mc Ilroy Friendship On Display After The Masters Tournament

May 12, 2025

Shane Lowry And Rory Mc Ilroy Friendship On Display After The Masters Tournament

May 12, 2025

Latest Posts

-

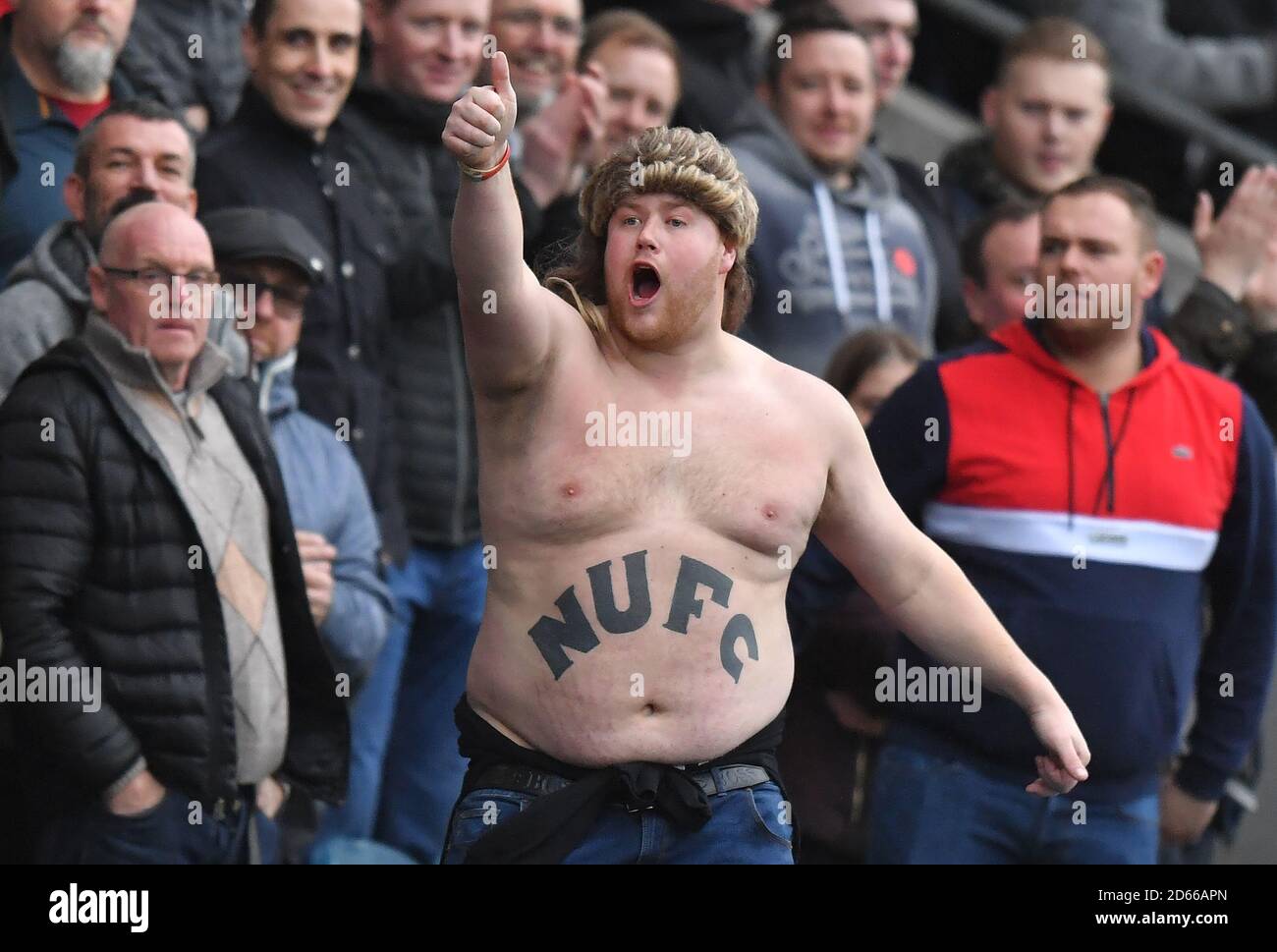

Newcastle United Supporters Championship Play Off Choices

May 13, 2025

Newcastle United Supporters Championship Play Off Choices

May 13, 2025 -

Championship Play Offs A Newcastle United Fan Perspective

May 13, 2025

Championship Play Offs A Newcastle United Fan Perspective

May 13, 2025 -

Newcastle Fans Championship Play Off Predictions Who Will Win

May 13, 2025

Newcastle Fans Championship Play Off Predictions Who Will Win

May 13, 2025 -

Newcastle United Fans Predict Championship Play Off Winners

May 13, 2025

Newcastle United Fans Predict Championship Play Off Winners

May 13, 2025 -

Sky Sports Premier League Hd Your Guide To Pl Retro Football

May 13, 2025

Sky Sports Premier League Hd Your Guide To Pl Retro Football

May 13, 2025