BofA's View: Why Current Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Understanding the Nuances of Current Valuations

BofA's methodology for assessing stock market valuations goes beyond simple Price-to-Earnings (P/E) ratios. They take a holistic approach, considering a multitude of factors to create a more nuanced and accurate picture of the market's health. Their analysis is far from a simple snapshot; it's a sophisticated model that incorporates forward-looking data, economic projections, and a deep understanding of market dynamics.

-

Forward-Looking Earnings: BofA's analysis considers forward-looking earnings estimates, not just trailing twelve months. This means they account for projected future growth, a crucial aspect often overlooked in simpler valuation methods. Predicting future earnings requires sophisticated modelling and understanding of economic indicators.

-

Economic Growth Impact: They account for the impact of potential economic growth on corporate profits. A strong economy generally leads to higher corporate earnings, justifying higher valuations. BofA's economists provide crucial input to this assessment, considering factors like GDP growth, employment rates and consumer spending.

-

Beyond P/E Ratios: Their valuation model incorporates factors beyond simple Price-to-Earnings ratios. They utilize a range of valuation metrics, including the Price-to-Sales (P/S) ratio, the Price-to-Book (P/B) ratio, and the PEG ratio (Price/Earnings to Growth ratio), creating a more comprehensive assessment of value. By using multiple metrics, BofA aims to mitigate the limitations of relying on a single valuation tool.

These factors collectively mitigate concerns about seemingly high P/E ratios. By considering future growth and incorporating a broader range of valuation metrics, BofA presents a more optimistic view of the current market.

The Influence of Low Interest Rates and Inflation on Stock Market Valuations

Low interest rates play a significant role in justifying current stock market valuations. Lower interest rates reduce the discount rate used in present value calculations. This means that future earnings are worth more today, supporting higher valuations. This is a key aspect of BofA's analysis, showcasing how macroeconomic factors directly affect market valuations.

Inflation expectations are another critical component. While inflation erodes purchasing power, its impact on discount rates is factored into BofA’s analysis. High inflation could increase discount rates, lowering present values; however, BofA likely incorporates various inflation scenarios and their potential impact, showing a balanced perspective that goes beyond simplistic conclusions.

-

Lower Interest Rates Increase Present Value: Lower interest rates make future earnings more valuable in present terms. This is a fundamental principle of finance, directly impacting how investors assess the intrinsic value of stocks.

-

Inflation and Earnings Growth: Inflation, while a concern, can be offset by strong corporate earnings growth. If companies can increase their earnings at a rate exceeding inflation, the real value of their earnings remains protected.

-

Scenario Planning: BofA's analysis likely incorporates various inflation scenarios and their potential impact. This shows a rigorous and comprehensive approach to risk assessment, creating more robust conclusions.

Long-Term Growth Prospects and Technological Innovation: A Foundation for Future Value

BofA's assessment of long-term market growth is optimistic, focusing on technological advancements and sector-specific opportunities. They highlight the transformative potential of technology across various industries, driving productivity gains and creating entirely new markets. This long-term perspective helps mitigate concerns about short-term market volatility.

BofA likely identifies specific sectors poised for significant growth. For example, renewable energy, artificial intelligence, and biotechnology are likely considered promising areas, offering high growth potential and contributing to their overall positive market outlook.

-

Technological Innovation: Technological innovation driving productivity gains and new market opportunities significantly impacts long-term growth projections.

-

Sector-Specific Growth: Growth in specific sectors (e.g., renewable energy, technology) outweighs concerns in other sectors, providing a balanced view of future market performance.

-

Long-Term Earnings Growth: BofA's projections for long-term earnings growth support current valuations. This long-term focus helps justify seemingly high valuations based on short-term metrics.

Addressing Specific Investor Concerns: Managing Risk in the Current Market

Market volatility and recessionary fears are valid investor concerns. BofA addresses these by emphasizing the importance of diversification and a long-term investment horizon. They likely advocate for a well-diversified portfolio across various asset classes to mitigate risk.

-

Diversification: Diversification strategies recommended by BofA reduce exposure to any single sector or asset class, minimizing potential losses during market downturns.

-

Long-Term Horizon: The importance of a long-term investment horizon is crucial for weathering short-term market fluctuations. Long-term investors are better positioned to withstand market volatility.

-

Risk Tolerance Assessment: Risk tolerance assessment and its relevance to investment choices are vital. Investors should understand their own risk profile and align their investment strategy accordingly.

Conclusion

BofA's analysis suggests that current stock market valuations, while seemingly high, shouldn't be a cause for significant investor concern. Their sophisticated methodology, incorporating forward-looking earnings, economic growth projections, and a broad range of valuation metrics, paints a picture of a market supported by strong long-term growth prospects and technological innovation. While acknowledging the valid concerns about market volatility and inflation, BofA emphasizes the importance of a long-term perspective and a diversified investment strategy.

While BofA's analysis offers a positive outlook, thorough due diligence is still crucial. Consult with a financial advisor to understand your own risk tolerance and develop a well-informed investment strategy considering current stock market valuations and BofA's perspective. Don't let unfounded fears about stock market valuations dictate your investment decisions; instead, use this information to build a robust and resilient investment portfolio.

Featured Posts

-

Thousands Of Zebra Mussels Found On Casper Boat Lift

May 22, 2025

Thousands Of Zebra Mussels Found On Casper Boat Lift

May 22, 2025 -

Hellfest A Mulhouse Concert Au Noumatrouff

May 22, 2025

Hellfest A Mulhouse Concert Au Noumatrouff

May 22, 2025 -

The Traverso Family A Cannes Photography Legacy

May 22, 2025

The Traverso Family A Cannes Photography Legacy

May 22, 2025 -

Half Dome Secures Abn Group Victorias Media Account

May 22, 2025

Half Dome Secures Abn Group Victorias Media Account

May 22, 2025 -

Zayavlenie Evrokomissara O Perspektivakh Chlenstva Ukrainy V Nato

May 22, 2025

Zayavlenie Evrokomissara O Perspektivakh Chlenstva Ukrainy V Nato

May 22, 2025

Latest Posts

-

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025 -

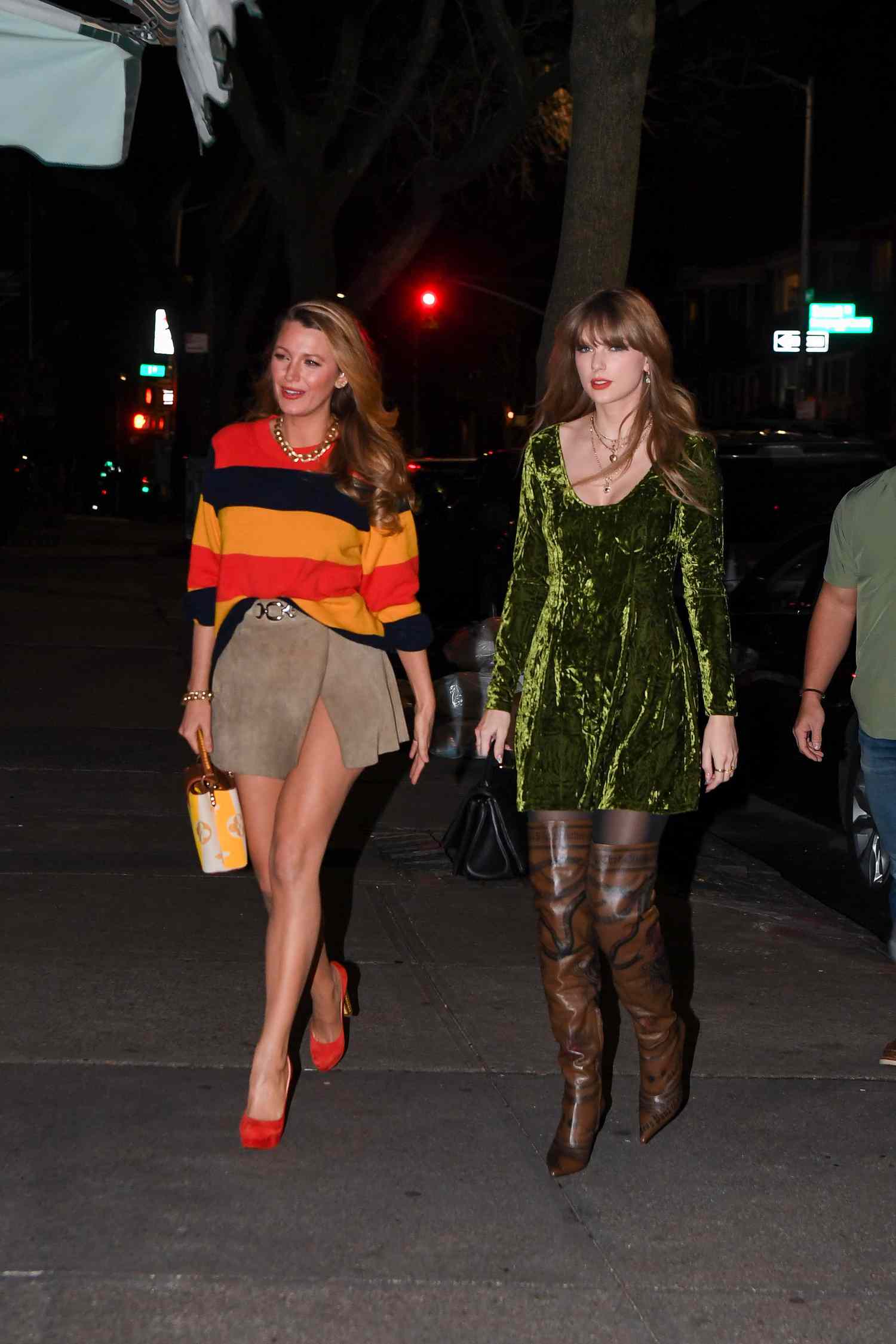

Did A Subpoena Damage Blake Lively And Taylor Swifts Friendship

May 22, 2025

Did A Subpoena Damage Blake Lively And Taylor Swifts Friendship

May 22, 2025 -

Blake Lively And Taylor Swift Subpoena Allegations Strain Close Bond

May 22, 2025

Blake Lively And Taylor Swift Subpoena Allegations Strain Close Bond

May 22, 2025 -

The Rift Between Taylor Swift And Blake Lively A Legal Battles Fallout

May 22, 2025

The Rift Between Taylor Swift And Blake Lively A Legal Battles Fallout

May 22, 2025 -

Subpoena Report Casts Shadow On Blake Lively And Taylor Swifts Friendship

May 22, 2025

Subpoena Report Casts Shadow On Blake Lively And Taylor Swifts Friendship

May 22, 2025