BofA's Reassurance: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Positive Market Outlook: A Deep Dive

BofA's market forecast for 2024 and beyond paints a relatively optimistic picture. Their analysis incorporates various economic indicators to form a comprehensive view of the market's trajectory.

-

Economic Growth Projections: BofA projects continued, albeit moderate, economic growth fueled by resilient consumer spending and ongoing technological advancements. They anticipate a gradual slowdown from the post-pandemic boom, but not a sharp recession. Their models suggest a [insert specific percentage] GDP growth rate for [insert year].

-

Inflation Outlook: While inflation remains a concern, BofA anticipates a continued decline toward the central bank's target rate. Their predictions suggest inflation will settle around [insert percentage] by [insert year], easing pressure on interest rates and supporting corporate profitability. This is supported by their analysis of [mention specific economic indicators like CPI or PPI].

-

Earnings Growth: BofA forecasts robust earnings growth for many sectors, particularly [mention specific high-growth sectors like technology or healthcare]. They cite factors such as increased productivity, technological innovation, and continued global demand as key drivers. Their projections indicate an average earnings growth rate of [insert percentage] for S&P 500 companies in [insert year].

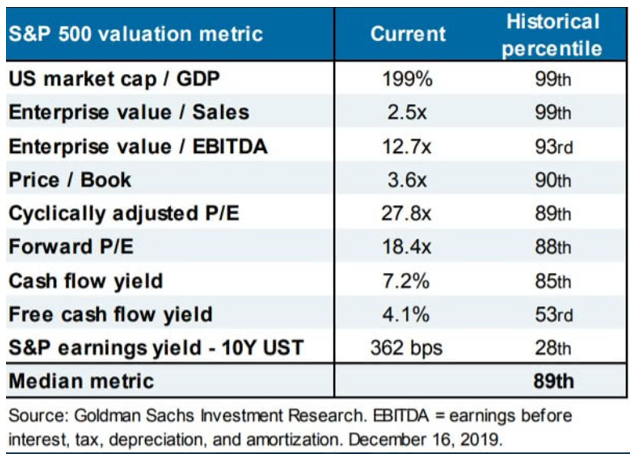

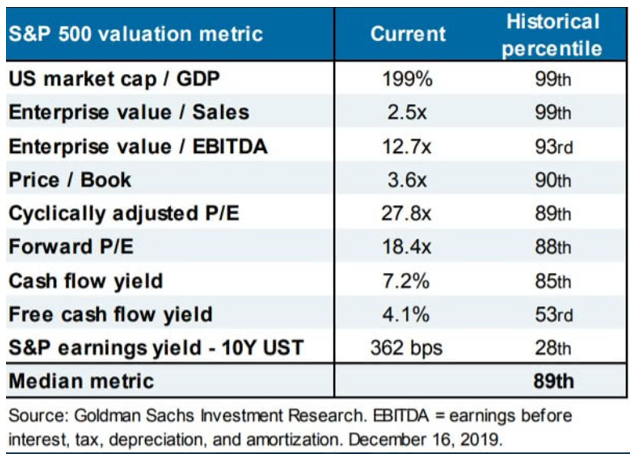

Addressing Concerns about Stretched Valuations

The undeniable reality is that many stocks currently trade at seemingly high valuation multiples. High P/E ratios and other valuation metrics raise legitimate concerns about potential overvaluation. However, BofA offers several counterarguments:

-

Future Earnings Growth: BofA emphasizes the importance of considering future earnings growth when evaluating valuations. Their analysts argue that current high valuations are justified by the anticipated growth trajectory of many companies, particularly in the technology and innovation sectors. Using discounted cash flow (DCF) analysis, they project [explain how DCF analysis justifies current valuations].

-

Interest Rate Expectations: BofA’s analysis incorporates the anticipated path of interest rate adjustments by central banks. While higher interest rates can impact valuations, BofA’s projections suggest a gradual decline in interest rates which will have a positive impact on stock valuations.

-

Alternative Valuation Methods: While P/E ratios are commonly used, BofA highlights the usefulness of other valuation metrics, such as price-to-sales ratios and enterprise value-to-EBITDA, to provide a more complete picture. These alternative methods, when considered alongside future earnings growth projections, might suggest valuations are less stretched than initially perceived. For example, [mention specific examples and data].

Strategies for Investors in a High-Valuation Market

Navigating a market with seemingly stretched valuations requires a strategic approach. Based on BofA's analysis, several strategies can help investors manage risk and potentially capitalize on growth opportunities:

-

Portfolio Diversification: Diversification across different asset classes (stocks, bonds, real estate) and sectors is crucial to mitigate risk. Investing across various sectors identified by BofA as high-growth areas can help balance potential losses in one area.

-

Long-Term Investing: Short-term market fluctuations are inevitable. BofA emphasizes the importance of a long-term investment horizon to weather these fluctuations and benefit from sustained growth.

-

Risk Management: Employing risk management strategies, such as setting stop-loss orders and diversifying investments, is vital. This approach helps limit potential losses and safeguards your capital.

-

Investment Styles: Both value and growth investing strategies can be appropriate, depending on individual risk tolerance and investment goals. BofA's analysis can help identify sectors where each strategy might be more effective.

The Role of Interest Rates and Inflation

BofA's market outlook is intrinsically linked to their projections for interest rates and inflation. The Federal Reserve's monetary policy plays a significant role in shaping market dynamics.

-

Interest Rate Hikes and Monetary Policy: BofA anticipates a measured approach to interest rate adjustments by the Federal Reserve. They believe that further rate hikes will be more measured, accounting for the potential impact on economic growth. Their analysis suggests a [explain BofA’s projection on future interest rate movements].

-

Inflation Rate and Its Impact: The projected decline in inflation is a key factor underpinning BofA's positive outlook. Lower inflation reduces pressure on interest rates and supports stronger corporate profitability, thus favorably impacting stock valuations.

Conclusion

BofA's analysis provides a reasoned counterpoint to anxieties surrounding stretched stock market valuations. Their positive market outlook, coupled with counterarguments to valuation concerns and suggested investment strategies, offers a framework for informed decision-making. Remember, while high P/E ratios are a valid concern, factors like future earnings growth and interest rate expectations must be considered. Don't let stretched stock market valuations deter you – understand the bigger picture and make informed decisions based on expert analysis like BofA's. Further research into BofA's reports and resources is encouraged for a deeper understanding of their market outlook and investment recommendations.

Featured Posts

-

Broadcoms Proposed V Mware Price Hike A 1050 Increase For At And T

May 16, 2025

Broadcoms Proposed V Mware Price Hike A 1050 Increase For At And T

May 16, 2025 -

40 50 Oil Goldman Sachs Examines Trumps Public Statements

May 16, 2025

40 50 Oil Goldman Sachs Examines Trumps Public Statements

May 16, 2025 -

Increased Alcohol Use In Women Health Risks And Potential Solutions

May 16, 2025

Increased Alcohol Use In Women Health Risks And Potential Solutions

May 16, 2025 -

Golden State Warriors Jimmy Butler A Superior Alternative To Kevin Durant

May 16, 2025

Golden State Warriors Jimmy Butler A Superior Alternative To Kevin Durant

May 16, 2025 -

Butlers Miami Exit Dwyane Wades Perspective

May 16, 2025

Butlers Miami Exit Dwyane Wades Perspective

May 16, 2025

Latest Posts

-

Analyse De La Decision De La Lnh De Decentraliser Son Repechage

May 16, 2025

Analyse De La Decision De La Lnh De Decentraliser Son Repechage

May 16, 2025 -

Decentralisation Du Repechage Lnh Un Succes Ou Un Echec

May 16, 2025

Decentralisation Du Repechage Lnh Un Succes Ou Un Echec

May 16, 2025 -

Mls Injury Report Roundup Game Changing Absences For Saturday

May 16, 2025

Mls Injury Report Roundup Game Changing Absences For Saturday

May 16, 2025 -

Saturdays Mls Games Key Injury Updates On Martinez And White

May 16, 2025

Saturdays Mls Games Key Injury Updates On Martinez And White

May 16, 2025 -

Josef Martinez Brian White Out Latest Mls Injury Report

May 16, 2025

Josef Martinez Brian White Out Latest Mls Injury Report

May 16, 2025