BofA's Reassurance: Why High Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Positive Outlook and Rationale

BofA maintains a generally positive outlook on the current market, arguing that several factors justify the current, seemingly elevated, valuations. Their analysis points to a confluence of economic indicators and corporate performance that supports continued, albeit perhaps slower, growth.

Strong Corporate Earnings as a Foundation

- Robust Profitability: Many companies are reporting exceptionally strong earnings. This isn't limited to a single sector; we're seeing impressive results across various industries, from technology to consumer staples. For example, recent data shows a significant year-over-year increase in earnings for the S&P 500 companies, exceeding analysts' expectations. This strong performance, supported by solid revenue growth, provides a tangible foundation for the current valuation levels.

- Resilient Businesses: These strong earnings demonstrate the resilience of many businesses in the face of economic headwinds, proving their ability to adapt and thrive. This resilience is a key factor contributing to investor confidence and supporting higher stock prices.

- Sustained Growth Potential: Many companies are demonstrating sustained potential for growth, with forward-looking projections pointing towards continued expansion. This long-term perspective is critical for justifying current stock market valuations.

Low Interest Rates and Their Influence

- Increased Investment in Equities: Low interest rates make bonds less attractive, prompting investors to seek higher returns in the stock market. This increased demand drives up stock prices, contributing to higher valuations.

- Stimulus and Liquidity: The past period of low interest rates, coupled with government stimulus measures, injected significant liquidity into the market, further fueling investment in equities.

- Future Rate Adjustments: While interest rates are likely to rise, BofA's analysis suggests a gradual increase, mitigating the risk of a sudden market shock caused by an abrupt shift in monetary policy. This measured approach allows for a smoother transition for investors.

Long-Term Growth Projections

- Positive Economic Outlook: BofA's long-term projections for economic growth remain positive, anticipating sustained expansion in key sectors. This positive outlook fuels investor confidence and justifies higher valuations based on future earnings potential.

- Technological Innovation: Ongoing technological innovation across various sectors provides a significant driver for long-term growth, reinforcing the positive outlook.

- Global Economic Recovery: While challenges remain, the ongoing global economic recovery, albeit uneven, is expected to contribute to sustained market growth.

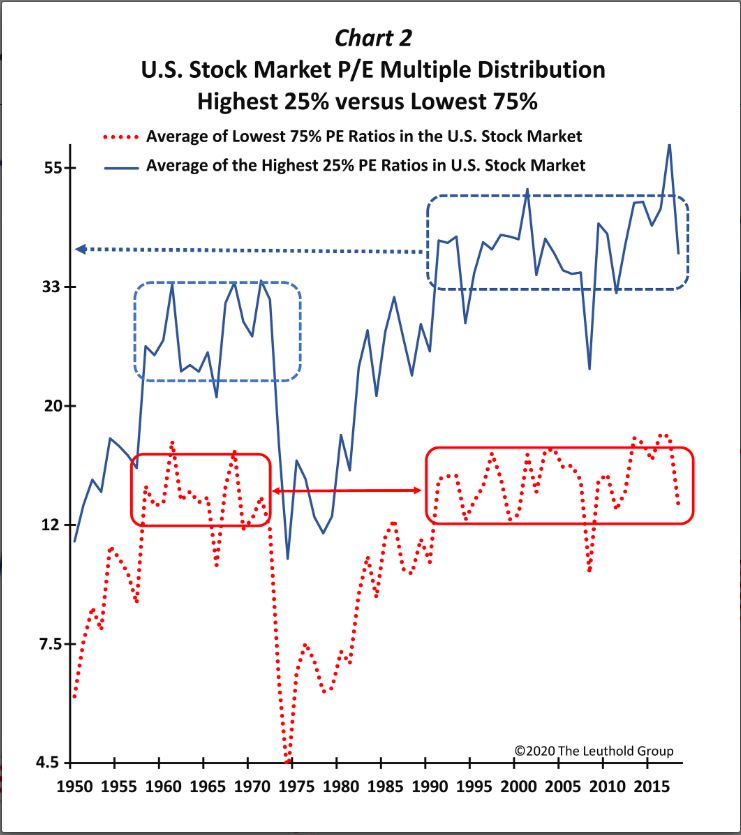

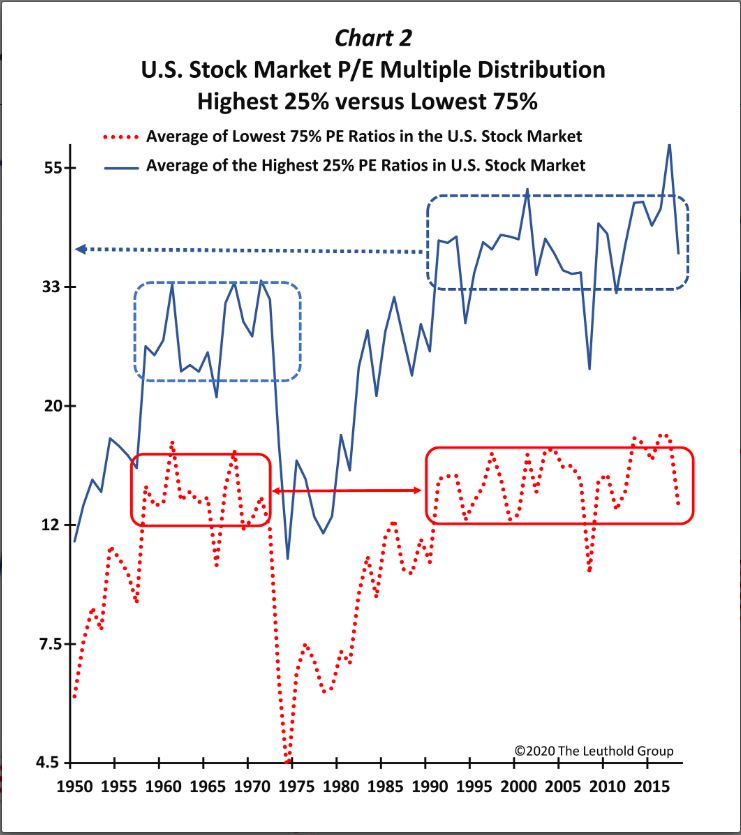

Addressing Common Investor Concerns about High Valuations

Many investors are understandably wary of high valuations, fearing a market crash. Let's address these concerns.

The Myth of an Imminent Market Crash

- High Valuations Don't Equal an Immediate Crash: High valuations alone don't predict an immediate market crash. History shows that markets can remain at elevated valuations for extended periods. BofA emphasizes the importance of considering long-term trends, not just short-term fluctuations.

- Market Corrections are Normal: Market corrections are a natural part of the investment cycle. While volatility is expected, a diversified portfolio can effectively mitigate the risks associated with market corrections.

- Long-Term Perspective is Crucial: A long-term investment horizon is key to weathering market fluctuations. Short-term anxieties about valuations often overshadow the potential for substantial long-term gains.

Diversification and Risk Management Strategies

- Diversify Your Portfolio: A well-diversified portfolio across different asset classes (stocks, bonds, real estate, etc.) reduces the impact of high valuations in any single sector.

- Strategic Asset Allocation: BofA recommends a strategic asset allocation approach tailored to individual risk tolerance and investment goals. This approach helps manage risk and maximize long-term returns.

- Regular Portfolio Review: Regularly reviewing and rebalancing your portfolio ensures it remains aligned with your investment objectives and risk tolerance.

The Role of Inflation and Its Impact

- Inflation's Influence on Valuations: Inflation can impact stock valuations, affecting both earnings and investor sentiment. BofA's analysis incorporates inflationary pressures into its market forecasts.

- Managing Inflationary Risks: Investors can manage inflationary risks through strategic asset allocation, including investments that tend to perform well during inflationary periods, like real estate or commodities.

- Inflationary Expectations: Understanding and managing expectations about future inflation is crucial for making informed investment decisions.

Conclusion

BofA's optimistic outlook on the market, despite high stock market valuations, is supported by strong corporate earnings, low interest rates stimulating equity investment, and positive long-term growth projections. While anxieties about high valuations are understandable, focusing on long-term investment strategies, diversification, and effective risk management can help mitigate these concerns. Don't let concerns about high stock market valuations deter you. Learn more about BofA's investment strategies and plan your long-term investment approach today! [Link to relevant BofA resources (if permitted)]

Featured Posts

-

Stuttgart In Bueyuek Capli Atff Futbol Altyapi Secmeleri

Apr 30, 2025

Stuttgart In Bueyuek Capli Atff Futbol Altyapi Secmeleri

Apr 30, 2025 -

Remember Mondays Eurovision Song A Response To Online Hate

Apr 30, 2025

Remember Mondays Eurovision Song A Response To Online Hate

Apr 30, 2025 -

Our Yorkshire Farm What Reuben Owen Disliked Most About The Show

Apr 30, 2025

Our Yorkshire Farm What Reuben Owen Disliked Most About The Show

Apr 30, 2025 -

Louisville Restaurant Owners Face Financial Hardship Due To River Road Project

Apr 30, 2025

Louisville Restaurant Owners Face Financial Hardship Due To River Road Project

Apr 30, 2025 -

Eurovision 2024 Sbs Hosts Courtney Act And Tony Armstrong

Apr 30, 2025

Eurovision 2024 Sbs Hosts Courtney Act And Tony Armstrong

Apr 30, 2025