BofA's Analysis: Why Current Stock Market Valuations Aren't A Red Flag

Table of Contents

BofA's Methodology: A Deep Dive into Valuation Metrics

BofA's approach to evaluating market valuations is multifaceted, going beyond simple headline numbers. Their analysts utilize a range of sophisticated valuation metrics to paint a comprehensive picture. They don't rely solely on a single metric like the Price-to-Earnings ratio (P/E), but instead incorporate a broader toolkit. This includes:

-

Detailed explanation of the P/E ratio and its limitations in the current market: The P/E ratio, while widely used, can be misleading in periods of fluctuating interest rates and varying corporate earnings growth. BofA likely accounts for these factors in their analysis, adjusting the P/E interpretation based on industry-specific benchmarks and future earnings projections.

-

Discussion of other valuation metrics used by BofA and their interpretations: Beyond the P/E ratio, BofA likely employs other key metrics such as the Price-to-Sales ratio (P/S), which is particularly useful for evaluating companies with negative earnings, and Discounted Cash Flow (DCF) analysis, a more complex method that projects future cash flows to determine present value. The combination of these metrics provides a more robust valuation assessment.

-

Mention of any adjustments made by BofA to account for specific economic factors: BofA's analysts likely adjust their valuation models to account for current macroeconomic conditions, such as interest rate changes, inflation, and potential shifts in economic growth. These adjustments are crucial for providing a realistic assessment of market valuations.

Macroeconomic Factors Supporting Current Valuations

BofA's optimistic outlook isn't solely based on valuation metrics; they consider several significant macroeconomic factors. These factors contribute to their belief that current valuations, while perhaps elevated, aren't necessarily a cause for immediate concern. Key supporting factors include:

-

Analysis of the current interest rate environment and its impact on valuations: While higher interest rates can impact valuations, BofA’s analysis likely considers the current rate environment in the context of long-term projections. A controlled increase in rates may not signal an immediate economic downturn, particularly if accompanied by sustained economic growth.

-

Discussion of inflation's influence on corporate earnings and stock prices: Inflation, while a concern, can also drive corporate pricing power, potentially increasing profit margins. BofA’s analysis likely assesses the extent to which inflation is impacting corporate earnings and whether this impact is sustainable.

-

Exploration of projected economic growth and its effect on future market performance: Future economic growth projections play a crucial role. If BofA projects continued, albeit possibly moderated, economic growth, this would support current valuations and potentially justify higher price-to-earnings multiples.

The Role of Corporate Earnings in Justifying Valuations

Strong corporate earnings are a key pillar supporting BofA's positive outlook. Even with seemingly high valuations, robust earnings growth can justify current market levels. This analysis likely includes:

-

Analysis of current and projected corporate earnings growth: BofA likely examines not just current earnings, but also projections for future earnings growth across various sectors. Sustained earnings growth can offset concerns about high valuations.

-

Discussion of factors contributing to robust corporate profit margins: Factors like supply chain improvements, increased pricing power, and technological advancements can contribute to healthy profit margins, which bolster the case for current valuations.

-

Mention of any sectors showing particularly strong earnings growth: BofA's analysis may highlight specific sectors demonstrating exceptional earnings growth, potentially offsetting concerns about other less robust sectors.

Sector-Specific Analysis: Identifying Potential Risks and Opportunities

While BofA's overall outlook isn't bearish, their analysis likely doesn't paint a uniformly positive picture across all sectors. They likely identify specific areas of potential risk and opportunity:

-

Identification of overvalued or undervalued sectors according to BofA's analysis: Some sectors may be deemed overvalued based on their valuation metrics and growth prospects, while others may represent attractive investment opportunities due to undervaluation.

-

Discussion of the potential risks associated with investing in specific sectors: BofA's analysis likely highlights risks associated with certain sectors, such as increased competition, regulatory changes, or economic vulnerability.

-

Highlighting sectors with significant growth potential identified by BofA: Conversely, certain high-growth sectors may be highlighted as offering substantial investment potential despite higher valuations, due to their strong future growth prospects.

Addressing Investor Concerns: Why the "Red Flag" Narrative is Misleading

Many investors are wary of high valuations, fearing a market correction or even a crash. BofA likely addresses these concerns directly:

-

Rebuttal of common arguments suggesting an impending market downturn: BofA's analysis likely refutes common arguments associated with impending market downturns, such as over-inflated asset bubbles or unsustainable economic growth.

-

Explanation of BofA’s risk management strategies and perspectives: Understanding BofA’s risk management approach provides context to their analysis. They may highlight their assessment of systemic risks and opportunities.

-

Discussion of historical market data to support their arguments: Historical data can help illustrate that periods of high valuations haven't always resulted in immediate market crashes. This perspective offers a more nuanced view of market dynamics.

Conclusion

BofA's comprehensive analysis suggests that while specific sectors warrant close monitoring, current stock market valuations, when considered alongside macroeconomic factors and strong corporate earnings, don't automatically signal an impending market crash. Their detailed methodology and sector-specific insights offer a nuanced perspective, encouraging a more measured approach to investment strategies. The "red flag" narrative might be overblown.

Call to Action: Understanding BofA's analysis of stock market valuations is crucial for informed investment decisions. Learn more about their findings and how to adjust your portfolio accordingly. Don't let the "red flag" narrative scare you; instead, use BofA's insights to navigate the current market effectively. Conduct your own thorough research and consult with a financial advisor before making any investment decisions based on this analysis. Remember, this is just one perspective, and individual investment strategies should be tailored to personal risk tolerance and financial goals.

Featured Posts

-

Los Angeles Wildfires And The Growing Market For Disaster Related Bets

Apr 27, 2025

Los Angeles Wildfires And The Growing Market For Disaster Related Bets

Apr 27, 2025 -

Cdcs Vaccine Study Hire A Discredited Misinformation Agent

Apr 27, 2025

Cdcs Vaccine Study Hire A Discredited Misinformation Agent

Apr 27, 2025 -

La Garantia De Gol De Alberto Ardila Olivares Una Guia Completa

Apr 27, 2025

La Garantia De Gol De Alberto Ardila Olivares Una Guia Completa

Apr 27, 2025 -

Possession Zulawski Exploring The Dynamic Between Sister Faith And Sister Chance

Apr 27, 2025

Possession Zulawski Exploring The Dynamic Between Sister Faith And Sister Chance

Apr 27, 2025 -

The Complex Relationship Of Sister Faith And Sister Chance In Andrzej Zulawskis Film Possession

Apr 27, 2025

The Complex Relationship Of Sister Faith And Sister Chance In Andrzej Zulawskis Film Possession

Apr 27, 2025

Latest Posts

-

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 28, 2025

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 28, 2025 -

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

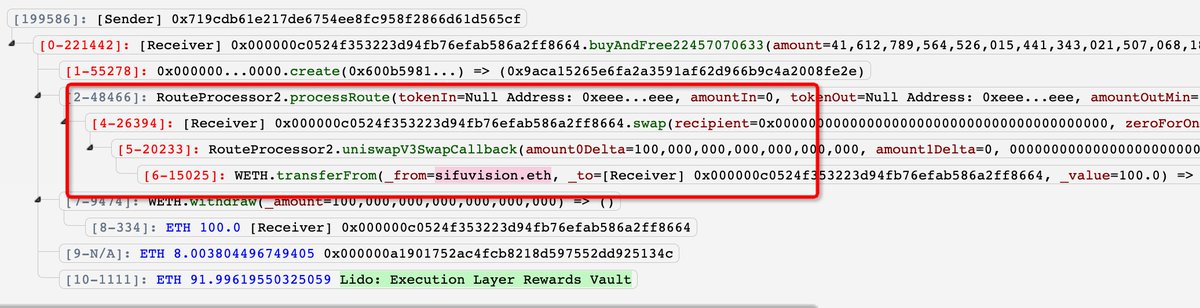

Massive Office 365 Data Breach Exposes Millions In Losses

Apr 28, 2025

Massive Office 365 Data Breach Exposes Millions In Losses

Apr 28, 2025 -

Crooks Office 365 Exploit Millions In Losses For Executives

Apr 28, 2025

Crooks Office 365 Exploit Millions In Losses For Executives

Apr 28, 2025 -

Federal Authorities Uncover Multi Million Dollar Office 365 Hacking Scheme

Apr 28, 2025

Federal Authorities Uncover Multi Million Dollar Office 365 Hacking Scheme

Apr 28, 2025