BofA On High Stock Market Valuations: Why Investors Should Remain Calm

Table of Contents

BofA's Perspective on Current Market Conditions

Bank of America's research, often cited for its insightful market analysis, has recently addressed the issue of high stock market valuations. While acknowledging the elevated price levels, their assessment isn't uniformly bearish. Specific reports and analysts within BofA have considered factors beyond just price-to-earnings ratios (P/E ratios). They delve deeper, examining macroeconomic conditions and corporate fundamentals.

- Key data points from BofA's analysis: BofA's analysis frequently highlights metrics like forward P/E ratios, which account for projected earnings growth. They also consider factors like interest rate sensitivity and the potential impact of inflation.

- Specific sectors BofA highlights: BofA's reports often differentiate between sectors, identifying those potentially overvalued (e.g., certain technology sectors experiencing rapid growth) and those potentially undervalued (e.g., value stocks in cyclical industries).

- BofA's overall market outlook: While BofA acknowledges risks associated with high valuations, their overall outlook often leans towards a cautiously optimistic or neutral stance, emphasizing the need for selectivity and diversification rather than outright panic selling. They often emphasize the long-term growth potential of the market.

Understanding the Drivers of High Stock Market Valuations

Several interconnected factors contribute to the current environment of high stock market valuations. Understanding these drivers is crucial for informed investment decisions.

- Low interest rate environment and its impact on valuations: Historically low interest rates, a consequence of monetary policies implemented in recent years, make bonds less attractive relative to stocks. This pushes investors towards equities, driving up demand and valuations.

- The influence of technological innovation on growth expectations: Rapid advancements in technology, particularly in areas like artificial intelligence and cloud computing, fuel expectations of continued strong corporate earnings growth, supporting higher stock valuations.

- Impact of inflation and potential interest rate hikes: Inflation and the anticipated response from central banks in the form of interest rate hikes represent significant uncertainties. Higher interest rates could negatively impact valuations by increasing borrowing costs for companies and making bonds more competitive. BofA's analysis often incorporates these risks.

Why Investors Shouldn't Panic: Long-Term Growth Potential

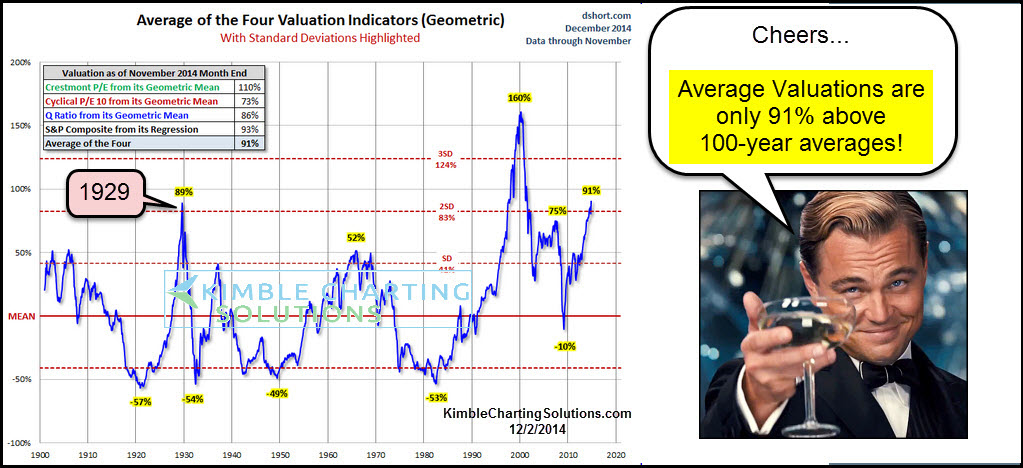

Despite the current high valuations, a long-term perspective is crucial. The stock market has historically experienced periods of high valuations followed by periods of consolidation or even correction, but long-term growth has ultimately prevailed.

- Historical data showing market recoveries: Analyzing historical data reveals that previous periods of high valuations have not always been followed by immediate and catastrophic market crashes. The market has, in most cases, recovered over the long term.

- The significance of long-term investment horizons: A longer investment timeframe allows for weathering market fluctuations. Short-term volatility should be viewed as an opportunity for strategic adjustments rather than a cause for panic.

- Strategies for mitigating risk: Diversifying investments across various asset classes, sectors, and geographies helps reduce overall portfolio risk. Dollar-cost averaging, a strategy involving regular investments regardless of market fluctuations, is another effective risk mitigation technique.

BofA's Recommendations for Investors

BofA's recommendations for investors typically center on a cautious but proactive approach.

- Specific actions investors should consider: BofA generally advises investors to maintain a well-diversified portfolio, focus on quality companies with strong fundamentals, and consider dollar-cost averaging. They often suggest re-evaluating risk tolerance in light of higher valuations.

- Sectors BofA suggests focusing on or avoiding: BofA's specific recommendations vary depending on the market conditions and their analysts' predictions, and therefore this advice should be interpreted within the specific context of the current report. Generally, however, they advise caution in sectors exhibiting excessive valuations and exploration of opportunities in potentially undervalued sectors.

- Importance of professional financial advice: Given the complexity of current market conditions, BofA frequently emphasizes the importance of consulting with a qualified financial advisor to tailor investment strategies to individual needs and risk tolerance.

Conclusion: Maintaining Calm Amidst High Stock Market Valuations

Despite high stock market valuations, as highlighted by BofA's analysis, investors should remain calm and adopt a long-term perspective. BofA's cautious optimism, focused on selectivity and diversification, underscores the importance of a strategic, rather than reactive, approach. Key takeaways include understanding the drivers of high valuations, the potential for long-term growth, and the benefits of risk mitigation strategies. Review your investment strategies in light of BofA's view on high stock market valuations and consider seeking professional financial advice to navigate the complexities of this environment. Understanding BofA's analysis of high stock market valuations is crucial for making informed investment decisions.

Featured Posts

-

How To Watch The Monaco Grand Prix 2025 Timing Streaming And More

May 26, 2025

How To Watch The Monaco Grand Prix 2025 Timing Streaming And More

May 26, 2025 -

5 Excellent Shrimp Restaurants In The Hudson Valley

May 26, 2025

5 Excellent Shrimp Restaurants In The Hudson Valley

May 26, 2025 -

2025s Best Office Chairs A Comprehensive Guide

May 26, 2025

2025s Best Office Chairs A Comprehensive Guide

May 26, 2025 -

Dads Desperate Row Raising 2 2 Million For Sons Treatment

May 26, 2025

Dads Desperate Row Raising 2 2 Million For Sons Treatment

May 26, 2025 -

Planning Your Trip To Dr Terrors House Of Horrors

May 26, 2025

Planning Your Trip To Dr Terrors House Of Horrors

May 26, 2025

Latest Posts

-

Illegal Caribou Hunt At Remote Lodge Rcmp Investigation Underway Near Manitoba Nunavut Border

May 30, 2025

Illegal Caribou Hunt At Remote Lodge Rcmp Investigation Underway Near Manitoba Nunavut Border

May 30, 2025 -

Rcmp Investigate Illegal Caribou Hunting Near Manitoba Nunavut Border

May 30, 2025

Rcmp Investigate Illegal Caribou Hunting Near Manitoba Nunavut Border

May 30, 2025 -

Snowfall Warning Issued For Parts Of Western Manitoba

May 30, 2025

Snowfall Warning Issued For Parts Of Western Manitoba

May 30, 2025 -

Enhanced Emergency Care Advanced Paramedics Arrive In Rural And Northern Manitoba

May 30, 2025

Enhanced Emergency Care Advanced Paramedics Arrive In Rural And Northern Manitoba

May 30, 2025 -

Joy Smith Foundation Launching A Media And Photo Advisory

May 30, 2025

Joy Smith Foundation Launching A Media And Photo Advisory

May 30, 2025