Bitcoin's Rebound: Potential For Further Growth And Investment Opportunities

Table of Contents

Factors Contributing to Bitcoin's Rebound

Several key factors have contributed to Bitcoin's recent price surge and positive market sentiment. Understanding these drivers is crucial for assessing the sustainability of this rebound and its implications for future Bitcoin growth.

Institutional Adoption

Institutional investors, including large corporations and financial institutions, are increasingly embracing Bitcoin. This growing acceptance is fueled by Bitcoin's potential as a store of value and a hedge against inflation, particularly in times of economic uncertainty.

- Examples: MicroStrategy's significant Bitcoin holdings, Tesla's adoption of Bitcoin as a payment method (although later reversed), and the growing number of publicly traded companies adding Bitcoin to their balance sheets demonstrate this trend. BlackRock, a global investment management giant, has also filed for a Bitcoin ETF, signaling a major shift in institutional interest.

- Impact: Large-scale institutional buying exerts significant upward pressure on Bitcoin's price, contributing to its rebound and increased market stability.

Regulatory Clarity (and Uncertainty)

The regulatory landscape surrounding Bitcoin is constantly evolving. While some regions have implemented clearer frameworks, others remain uncertain, creating a complex environment. This mix of clarity and uncertainty influences investor confidence and market behavior.

- Positive Regulatory Developments: Certain jurisdictions are developing clearer guidelines for cryptocurrency exchanges and Bitcoin transactions, increasing transparency and attracting institutional investment. The development of clear tax laws is a significant aspect of this.

- Ongoing Regulatory Uncertainty: In other regions, regulatory uncertainty persists, creating both risk and opportunity. This uncertainty can lead to volatility but also attracts speculators seeking higher returns.

Technological Advancements

Continuous technological advancements are improving Bitcoin's scalability, efficiency, and usability, thereby increasing its appeal to a wider range of users and investors.

- The Lightning Network: This layer-two scaling solution significantly improves transaction speeds and reduces fees, making Bitcoin more practical for everyday transactions.

- Mining Technology Improvements: Advancements in mining hardware and techniques increase Bitcoin's security and efficiency. This also helps to reduce the environmental impact of Bitcoin mining.

- Increased Accessibility: The development of user-friendly wallets and exchanges makes it easier for individuals to buy, sell, and store Bitcoin.

Assessing the Potential for Further Growth

Predicting Bitcoin's future price is challenging, but analyzing current trends and market sentiment offers valuable insights into its potential for further growth.

Market Sentiment and Price Analysis

Bitcoin's price is influenced by a complex interplay of factors, including supply and demand, macroeconomic conditions, and regulatory changes. Analyzing technical indicators, such as moving averages and relative strength index (RSI), can offer valuable insights into short-term price movements.

- Current Price Trends: Monitor Bitcoin's price action and volume to gauge investor sentiment and potential momentum.

- Price Predictions: While Bitcoin price predictions vary widely, understanding the range of potential outcomes can inform investment decisions. It's crucial to approach these predictions with caution, as they are highly speculative.

- Influencing Factors: Macroeconomic factors, such as inflation and interest rates, can significantly impact Bitcoin's price. Regulatory changes and major market events also play a crucial role.

Long-Term Growth Prospects

Despite its volatility, many analysts believe Bitcoin has significant long-term growth potential. Its decentralized nature, scarcity (limited supply of 21 million coins), and increasing adoption as a store of value contribute to its potential.

- Store of Value: Bitcoin's limited supply makes it an attractive alternative to traditional assets, especially in times of economic uncertainty or inflation.

- Portfolio Diversification: Many investors view Bitcoin as a valuable tool for diversifying their investment portfolios, reducing overall risk.

- Global Adoption: Growing acceptance in various countries and regions suggests a wider potential for adoption.

Investment Opportunities and Strategies

Investing in Bitcoin presents various opportunities, each with its own set of risks and rewards.

Direct Bitcoin Investment

The most straightforward approach is to buy and hold Bitcoin directly through cryptocurrency exchanges or digital wallets.

- Buying and Holding: This involves purchasing Bitcoin and holding it for the long term, aiming to benefit from potential price appreciation.

- Risk Management: Employ strategies like dollar-cost averaging (DCA) to mitigate risk by investing a fixed amount of money at regular intervals, regardless of price fluctuations. Diversification is also critical.

- Secure Storage: Safeguarding your Bitcoin investment through secure wallets is paramount. Hardware wallets offer superior security compared to software wallets.

Indirect Bitcoin Investment

Indirect investment options offer exposure to Bitcoin without directly owning the cryptocurrency.

- Bitcoin Mining Companies: Investing in publicly traded companies involved in Bitcoin mining provides indirect exposure to Bitcoin's price movements.

- Bitcoin ETFs (Exchange-Traded Funds): These funds allow investors to trade Bitcoin indirectly through a regulated exchange, offering convenience and diversification.

- Cryptocurrency Funds: Various investment funds focus on the broader cryptocurrency ecosystem, providing exposure to Bitcoin and other digital assets.

Conclusion

Bitcoin's recent rebound presents a potential window of opportunity for investors, fueled by institutional adoption, technological progress, and evolving market sentiment. However, the inherent volatility of the cryptocurrency market necessitates careful consideration. The potential for further Bitcoin growth is substantial, driven by its unique characteristics and growing global adoption. Thorough research and a well-defined investment strategy are essential before engaging in Bitcoin investments. Understanding the dynamics of this Bitcoin rebound is key to navigating this evolving asset class. Don't miss out on the potential of the Bitcoin rebound – start your research today!

Featured Posts

-

Elisabeth Borne Et La Fusion Renaissance Modem Une Ligne Politique Plus Claire

May 09, 2025

Elisabeth Borne Et La Fusion Renaissance Modem Une Ligne Politique Plus Claire

May 09, 2025 -

Nyt Spelling Bee Strands Today April 12 2025 Complete Guide

May 09, 2025

Nyt Spelling Bee Strands Today April 12 2025 Complete Guide

May 09, 2025 -

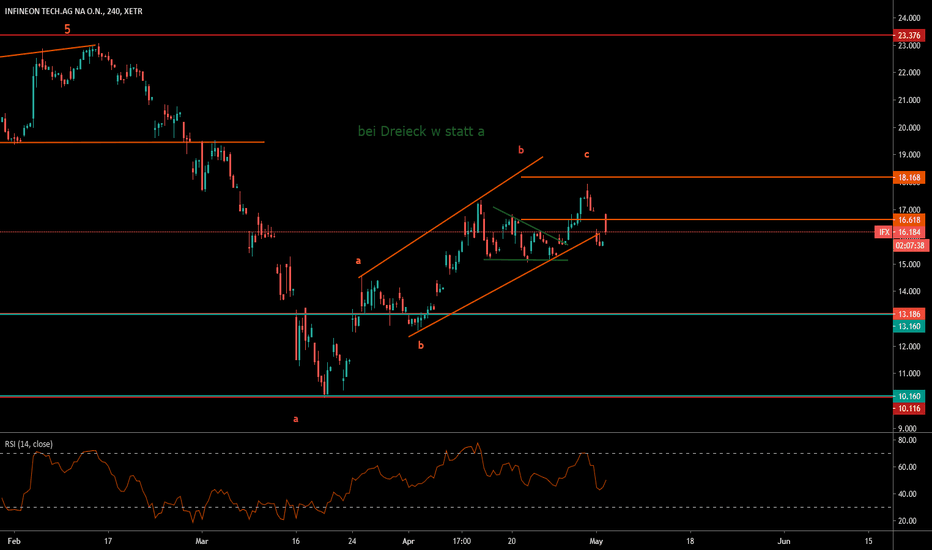

Infineon Ifx Q Quarter Earnings Lower Sales Guidance Due To Tariff Concerns

May 09, 2025

Infineon Ifx Q Quarter Earnings Lower Sales Guidance Due To Tariff Concerns

May 09, 2025 -

The China Factor Analyzing The Difficulties Faced By Luxury Car Brands

May 09, 2025

The China Factor Analyzing The Difficulties Faced By Luxury Car Brands

May 09, 2025 -

Lake Charles Easter Weekend Your Guide To Live Music And Events

May 09, 2025

Lake Charles Easter Weekend Your Guide To Live Music And Events

May 09, 2025