Bitcoin's Future: Exploring A Potential 1,500% Price Increase

Table of Contents

Growing Institutional Adoption and Demand

The increasing acceptance of Bitcoin by large financial institutions is a significant factor potentially driving its price upwards. This shift signifies a move away from viewing Bitcoin solely as a speculative asset towards recognizing its potential as a valuable store of value and a diversifying asset within investment portfolios.

Increased Investment from Large Financial Institutions

- MicroStrategy's significant Bitcoin holdings: MicroStrategy, a business intelligence company, has made headlines for its aggressive Bitcoin accumulation strategy, holding billions of dollars worth of BTC. This demonstrates a growing confidence in Bitcoin's long-term value among established corporations.

- Tesla's Bitcoin investment and subsequent sale: While Tesla later sold a portion of its Bitcoin holdings, its initial investment signaled a willingness of major corporations to embrace cryptocurrency as a legitimate asset class. This action, while potentially impacting short-term price, still demonstrated the growing institutional interest.

- Growing number of hedge funds investing in Bitcoin: Many prominent hedge funds are now allocating a portion of their portfolios to Bitcoin, viewing it as a hedge against inflation and a potential source of high returns. This institutional interest significantly boosts Bitcoin's liquidity and price stability.

- Shift from speculative asset to store of value: The narrative surrounding Bitcoin is changing. Initially perceived as a highly speculative asset, it's increasingly seen as a potential store of value, similar to gold, but with superior portability and transaction efficiency. This fundamental shift in perception fuels further institutional investment.

Keywords: Institutional Bitcoin investment, Bitcoin adoption by corporations, hedge fund Bitcoin holdings, Bitcoin as a store of value, Bitcoin price prediction.

The Role of Bitcoin ETFs

The potential approval of Bitcoin Exchange Traded Funds (ETFs) in major markets could be a game-changer. ETFs make Bitcoin accessible to a much wider range of investors, including those who are less technically savvy or lack the infrastructure to invest directly in cryptocurrency.

- Increased market accessibility: ETFs lower the barrier to entry for institutional and retail investors, driving increased demand.

- Enhanced liquidity: ETFs generally offer increased liquidity compared to directly trading Bitcoin, making it easier to buy and sell. This increased liquidity can stabilize price volatility and attract more investors.

- Regulatory developments: The regulatory landscape surrounding Bitcoin ETFs is evolving. Approvals in major markets would signal a significant step towards mainstream acceptance and potentially unlock a massive influx of capital into the Bitcoin market.

Keywords: Bitcoin ETF, Bitcoin exchange-traded fund, Bitcoin ETF approval, Bitcoin liquidity, Bitcoin investment accessibility.

Scarcity and Limited Supply

Bitcoin's inherent scarcity is a cornerstone of its value proposition. Unlike fiat currencies, which can be printed indefinitely, Bitcoin has a fixed supply of 21 million coins. This scarcity is a crucial factor in its potential for long-term price appreciation.

Understanding Bitcoin's Fixed Supply

- 21 million coin limit: This hard cap on the total number of Bitcoins ensures that its supply will never exceed this limit. This inherent scarcity is a key differentiator compared to traditional currencies susceptible to inflation.

- Bitcoin's deflationary nature: Unlike inflationary currencies, Bitcoin’s fixed supply creates a deflationary pressure, meaning that its value theoretically tends to increase over time as demand rises.

- Comparison with fiat currencies: The unlimited supply of fiat currencies makes them susceptible to inflation, eroding their purchasing power. Bitcoin's fixed supply offers an attractive alternative for investors concerned about inflation.

Keywords: Bitcoin scarcity, Bitcoin supply limit, Bitcoin deflationary nature, 21 million Bitcoin, Bitcoin value proposition.

Halving Events and Their Impact

Bitcoin's protocol dictates halving events approximately every four years, where the rate of new Bitcoin creation is cut in half. This reduction in supply has historically correlated with significant price increases.

- Reduced supply: Each halving event significantly decreases the influx of new Bitcoins into circulation. This controlled supply reduction is a built-in deflationary mechanism.

- Historical impact: Past halving events have been followed by substantial price rallies, suggesting a strong correlation between reduced supply and increased demand.

- Anticipation of future halvings: The anticipation of future halving events can itself drive up demand and price in the lead-up to the event.

Keywords: Bitcoin halving, Bitcoin halving impact, Bitcoin supply reduction, Bitcoin price cycle.

Global Macroeconomic Factors and Inflation

Global macroeconomic conditions and inflationary pressures play a significant role in Bitcoin's price. Many investors see Bitcoin as a hedge against inflation and currency devaluation, further boosting its demand.

Bitcoin as a Hedge Against Inflation

- Protection against currency devaluation: In times of high inflation, Bitcoin's fixed supply makes it an attractive alternative to traditional currencies, whose value can be eroded by inflation.

- Correlation with inflation: While the correlation between Bitcoin price and inflation isn't always direct, periods of high inflation have often led to increased demand for Bitcoin as a safe-haven asset.

- Increasing global inflation concerns: Growing concerns about global inflation are likely to fuel further demand for Bitcoin as investors seek to protect their wealth.

Keywords: Bitcoin inflation hedge, Bitcoin as a safe haven asset, inflation protection, Bitcoin vs fiat currency, Bitcoin price and inflation.

Geopolitical Instability and its Influence

Geopolitical uncertainty and global instability can significantly impact Bitcoin's price. Its decentralized and censorship-resistant nature makes it an attractive asset during times of political or economic turmoil.

- Safe haven asset: Investors may flock to Bitcoin during times of geopolitical uncertainty, viewing it as a store of value outside the control of governments or central banks.

- Censorship resistance: Bitcoin's decentralized nature makes it resilient to government controls or sanctions, increasing its appeal in unstable regions.

- Examples of geopolitical events: Events like wars, political instability, or economic sanctions can cause a flight to safety, pushing up demand for Bitcoin.

Keywords: Bitcoin geopolitical risk, Bitcoin as a decentralized asset, Bitcoin and global instability, Bitcoin safe haven.

Conclusion

A potential 1,500% price increase in Bitcoin is a bold prediction, but several factors suggest it’s not entirely impossible. The confluence of institutional adoption, inherent scarcity, and macroeconomic factors creates a unique environment for substantial price appreciation. However, it's crucial to remember that Bitcoin is highly volatile and investing involves significant risk. Before investing in Bitcoin, thoroughly research the market and understand the potential risks involved. Understanding the factors that could contribute to a potential surge in the price of Bitcoin is essential for navigating the exciting but unpredictable future of this revolutionary cryptocurrency. Are you ready to explore the potential of Bitcoin and its possible future price increase? Learn more about Bitcoin investment strategies and risk mitigation techniques today!

Featured Posts

-

Xrp Etf Launch Pro Shares Enters The Crypto Market No Spot Etfs

May 08, 2025

Xrp Etf Launch Pro Shares Enters The Crypto Market No Spot Etfs

May 08, 2025 -

Champions League Final Hargreaves Arsenal Psg Prediction

May 08, 2025

Champions League Final Hargreaves Arsenal Psg Prediction

May 08, 2025 -

Understanding Data Transfer Methods Best Practices And Security

May 08, 2025

Understanding Data Transfer Methods Best Practices And Security

May 08, 2025 -

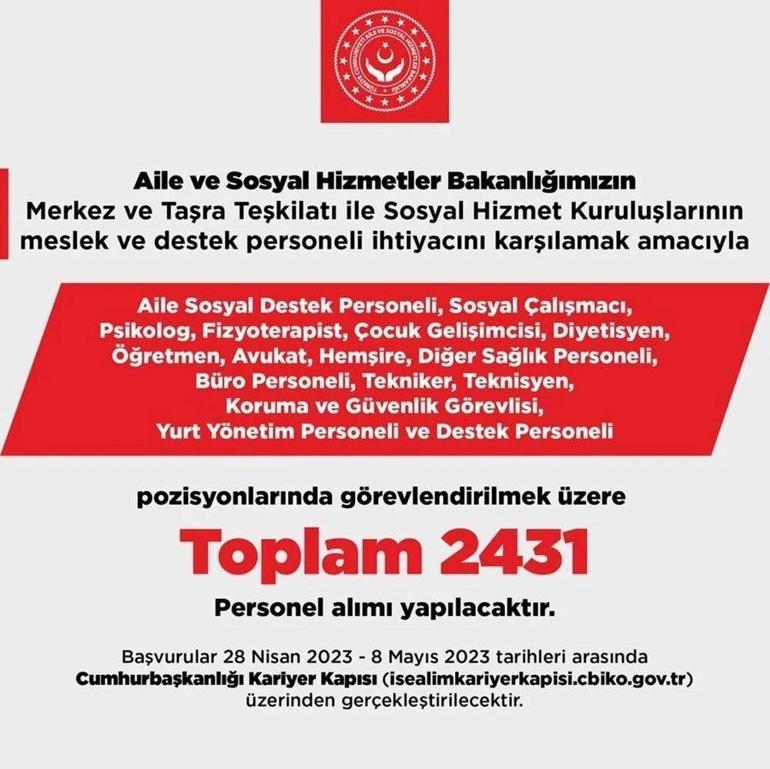

Saglik Bakanligi Personel Alimi Basvuru Sartlari Gereken Belgeler Ve Islem Adimlari

May 08, 2025

Saglik Bakanligi Personel Alimi Basvuru Sartlari Gereken Belgeler Ve Islem Adimlari

May 08, 2025 -

A Prudent Approach To Xrp Ripple Investment For Financial Stability

May 08, 2025

A Prudent Approach To Xrp Ripple Investment For Financial Stability

May 08, 2025