Bitcoin's 10-Week High: Implications For The $100,000 Target

Table of Contents

Analyzing Bitcoin's Recent Price Surge

The recent 10-week high in Bitcoin's price isn't a random event. Several factors have converged to propel its value upward. Let's examine some key contributors:

-

Increased Institutional Adoption: Large institutional investors, including hedge funds and corporations, are increasingly allocating capital to Bitcoin, viewing it as a hedge against inflation and a potential store of value. This influx of institutional money significantly impacts Bitcoin's price.

-

Positive Regulatory Developments: While regulatory uncertainty remains a concern, some jurisdictions have shown signs of embracing cryptocurrencies, leading to increased investor confidence. Clearer regulatory frameworks can stimulate greater adoption and investment.

-

Decreased Macroeconomic Uncertainty: While global economic conditions are still volatile, recent data in some key areas has eased concerns, potentially freeing up capital for riskier assets like Bitcoin. As fears of recession subside, investors are looking for higher-yielding alternatives.

-

Growing Retail Investor Interest: Despite market fluctuations, retail investor interest in Bitcoin remains strong. This sustained demand provides a solid foundation for continued price growth.

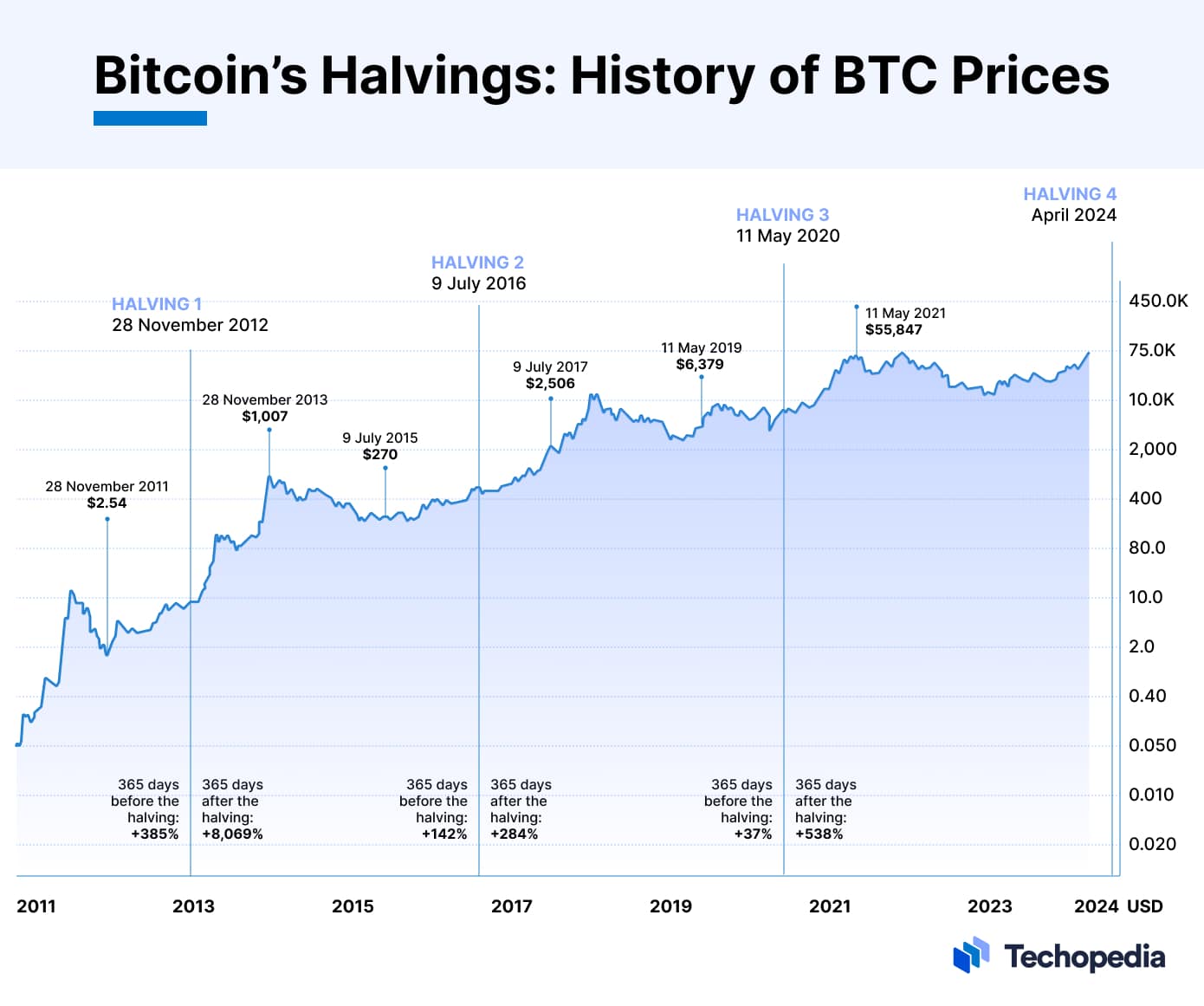

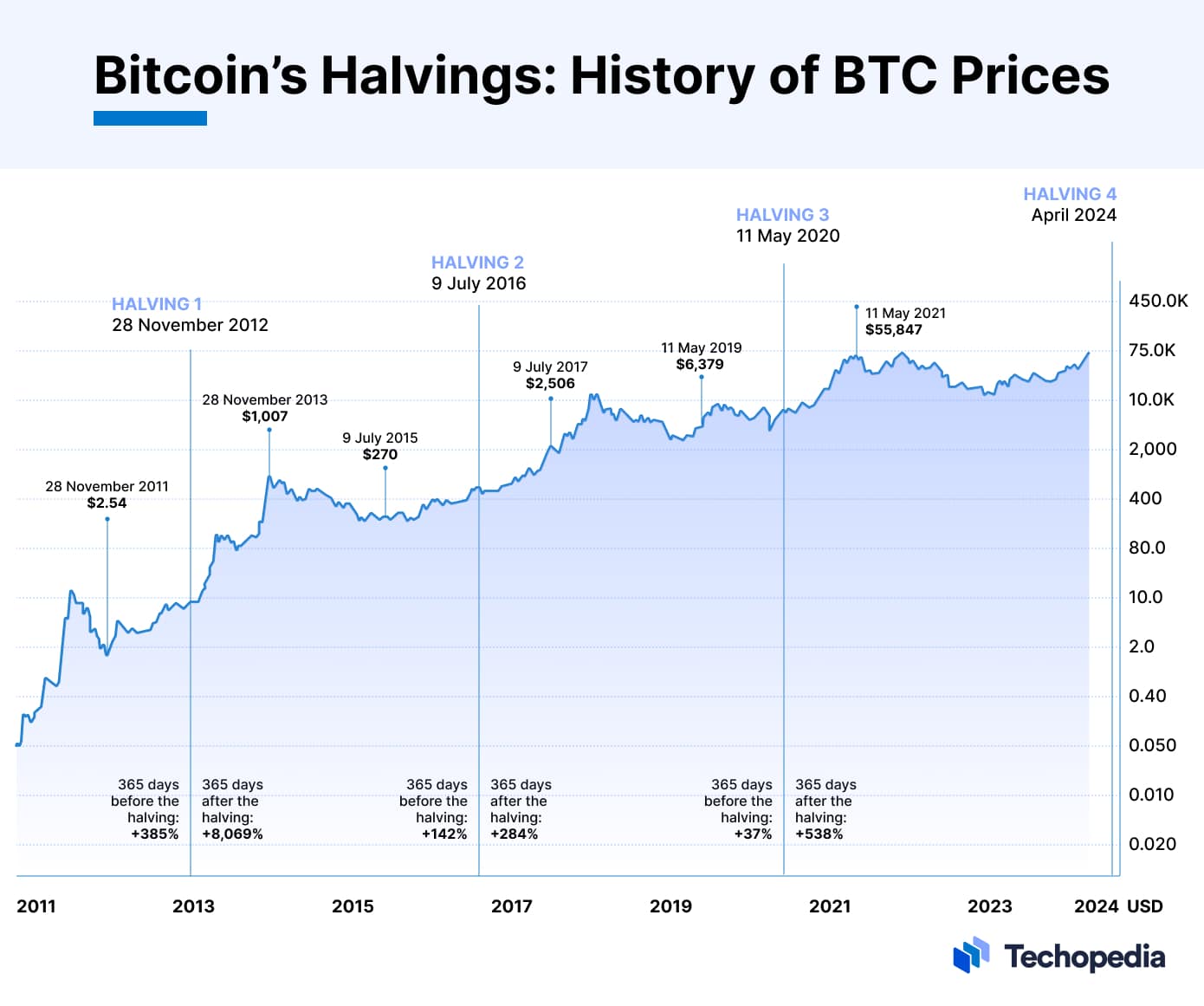

(Insert Chart/Graph here showing Bitcoin's price movement over the past 10 weeks, highlighting the 10-week high.)

For example, on [Date], Bitcoin reached a price of [Price], marking a significant increase from its low point of [Price] on [Date].

Assessing the Path to $100,000 Bitcoin

Reaching the $100,000 Bitcoin price target requires sustained upward momentum and overcoming several obstacles. Let's examine both supporting and opposing factors:

-

Technical Analysis: Technical indicators like moving averages and the Relative Strength Index (RSI) can offer insights into potential price trends. However, it's crucial to remember that technical analysis is not foolproof and should be considered alongside other factors.

-

On-Chain Analysis: Examining on-chain metrics, such as transaction volume and mining difficulty, provides valuable insights into the underlying activity and health of the Bitcoin network. High transaction volume often correlates with increased demand.

-

Potential Resistance Levels: Bitcoin's price history reveals various resistance levels where price increases tend to stall. Overcoming these levels will be crucial for reaching the $100,000 mark.

-

Market Sentiment Analysis: Positive news and increasing adoption generally lead to a more bullish market sentiment, contributing to price increases. Conversely, negative news can trigger sell-offs.

Risk Factors and Potential Downsides

While the $100,000 Bitcoin target is exciting, it's essential to acknowledge the inherent risks:

-

Market Volatility: The cryptocurrency market is notoriously volatile. Sharp price corrections are a common occurrence, and investors should be prepared for potential downturns.

-

Regulatory Risks: Government regulations can significantly impact the cryptocurrency market. Unfavorable regulations could lead to price declines.

-

Security Risks: Holding Bitcoin requires robust security measures. Losses due to hacking or theft are a real possibility.

-

Competition from Other Cryptocurrencies: The cryptocurrency landscape is constantly evolving, with new altcoins emerging and competing for investor attention.

Long-Term Implications and Investment Strategies

Despite the risks, Bitcoin's long-term potential as a store of value and an investment asset remains significant. However, investment strategies should align with individual risk tolerance:

-

Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals helps mitigate the risk of buying high and selling low.

-

Long-Term Holding (HODLing): Holding Bitcoin for an extended period, weathering market fluctuations, can potentially yield significant returns in the long run.

-

Diversification: Diversifying investments across different cryptocurrencies and asset classes reduces overall portfolio risk.

-

Risk Management: Employing stop-loss orders and other risk management techniques can protect against significant losses.

Conclusion: Bitcoin's Journey to $100,000: A Realistic Outlook

Bitcoin's recent 10-week high is a positive development, fueled by several factors including increased institutional investment and positive regulatory developments. However, reaching the $100,000 target is not guaranteed and involves considerable risk. Market volatility, regulatory uncertainties, and competition from other cryptocurrencies pose significant challenges. Thorough research, careful risk assessment, and a diversified investment strategy are crucial for navigating this dynamic market. Stay informed about Bitcoin price movements and continue your research into the potential for Bitcoin to reach $100,000. Make informed investment decisions based on your risk tolerance and financial goals.

Featured Posts

-

Zendayas Sheer Dress Stuns In The South Of France

May 07, 2025

Zendayas Sheer Dress Stuns In The South Of France

May 07, 2025 -

Biles Celebra Una Gimnasta Repite Su Iconico Salto

May 07, 2025

Biles Celebra Una Gimnasta Repite Su Iconico Salto

May 07, 2025 -

How The Pope Is Elected A Guide To The Conclave Process

May 07, 2025

How The Pope Is Elected A Guide To The Conclave Process

May 07, 2025 -

Rihannas Third Pregnancy Announcement At The Met Gala

May 07, 2025

Rihannas Third Pregnancy Announcement At The Met Gala

May 07, 2025 -

Royal Air Maroc Extends Partnership With Ouagadougou Pan African Film Festival

May 07, 2025

Royal Air Maroc Extends Partnership With Ouagadougou Pan African Film Festival

May 07, 2025

Latest Posts

-

Bitcoin In Gelecegi Guencel Durum Ve Uzun Vadeli Tahminler

May 08, 2025

Bitcoin In Gelecegi Guencel Durum Ve Uzun Vadeli Tahminler

May 08, 2025 -

Trump Medias Crypto Com Etf Partnership A Detailed Analysis

May 08, 2025

Trump Medias Crypto Com Etf Partnership A Detailed Analysis

May 08, 2025 -

Investment Insights Examining The Performance Of Dogecoin Shiba Inu And Sui

May 08, 2025

Investment Insights Examining The Performance Of Dogecoin Shiba Inu And Sui

May 08, 2025 -

Bitcoin De Son Gelismeler Fiyat Analizi Ve Uzman Goeruesleri

May 08, 2025

Bitcoin De Son Gelismeler Fiyat Analizi Ve Uzman Goeruesleri

May 08, 2025 -

Trump Media And Crypto Coms Etf Partnership Impact On Cro

May 08, 2025

Trump Media And Crypto Coms Etf Partnership Impact On Cro

May 08, 2025